In this article, I will explain Zilliqa (ZIL) staking mechanisms for passive income, as well as the detailed approaches for safe reward earning.

You will come across selecting the appropriate wallet, delegating ZILs to trustworthy validators, and other techniques to maximise the benefits and minimise the risks of staking. This is a comprehensive guide for novice and seasoned crypto investors alike.

What is Zilliqa (ZIL)?

Zilliqa achieves unprecedented performance benchmarks among blockchain and crypto networks because of its unique approach to sharding technology, which allows it to process thousands of transactions in a fraction of a second.

Smart Zilliqa blockchain with its own cryptocurrency ZIL allows for execution of transactions and smart contracts on the blockchain while maintaining a network of dApps and contracts.

Investors are able to stake Zilliqa for passive income while also contributing to the security of the Zilliqa network. This balanced approach to earning through advanced crypto technologies has made Zilliqa popular for best practices in secure passive income generation.

What is Staking and How It Works

Staking is the term used for the process of locking up cryptocurrency, for example, Zilliqa (ZIL), to facilitate the operations and enhance the security of a blockchain network. Validators get selected to confirm transactions based on the amount of cryptocurrency they stake in a proof-of-stake (PoS) system.

You help maintain the network consensus and security by delegating your ZIL to a validator or staking pool. In staking, rewards are earned that are proportional to the stake. Staking Zilliqa, in particular, allows investors to earn income passively and helps the network stabilise and grow, as illustrated in Best Practices for Secure, Passive Income with ZIL.

How to Stake Zilliqa (ZIL) for Passive Income

Step 1: Choose a Staking Platform

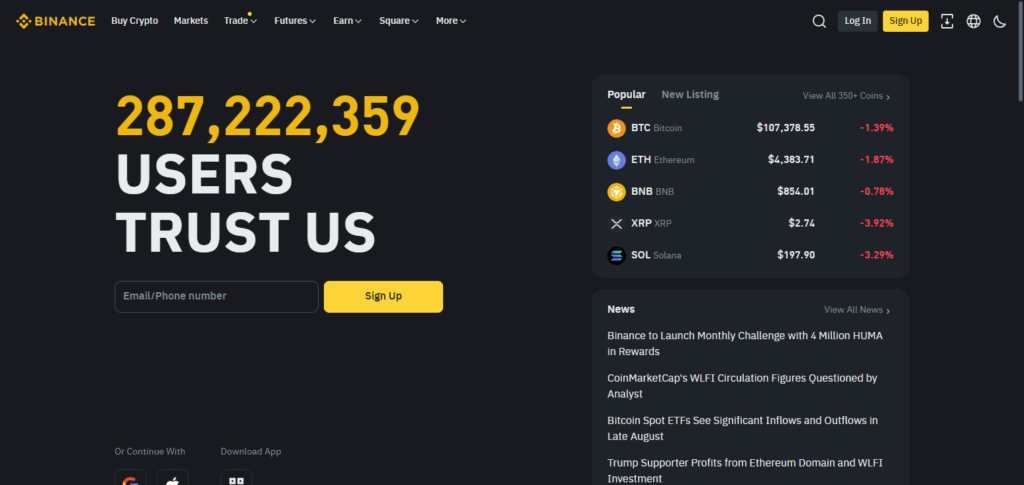

Make sure to select a legitimate platform that permits ZIL staking and withdraws. The platform can be a crypto exchange like Binance, or even a Zilliqa wallet that allows delegation.

Step 2: Set Up a ZIL Wallet

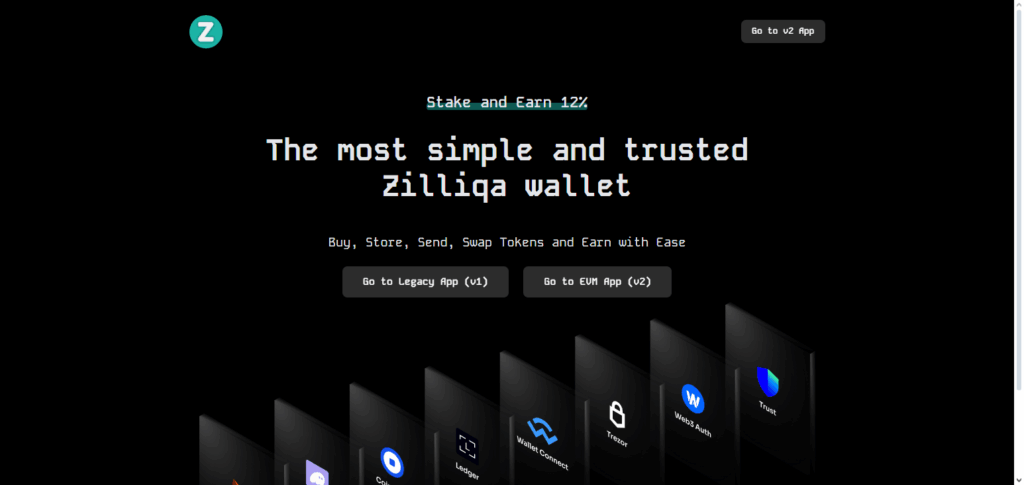

Set up a wallet compatible with Zilliqa like Zillet, Moonlet, or even a hardware wallet like Ledger. Do make sure to privately store your seed phrase written down, as it is your only backup.

Step 3: Buy or Transfer ZIL

You can buy ZIL from any exchange, or else you can transfer ZIL tokens to your staking wallet. Make sure the tokens are in your purse before staking.

Step 4: Choose a Staking Node or Pool

You should be able to see a list of validators or staking pools in your wallet. Analyse their performance, commission fees, and their overall reliability and select one to delegate your tokens.

Step 5: Delegate Your ZIL

Choose the amount of ZIL you want to stake and delegate it to the respective validator or pool of your choice. The transaction will be pending until it is confirmed that the network has processed it.

Step 6: Start Earning Rewards

You will begin earning staking rewards once your delegation is active. Most platforms show what is expected as rewards, which are usually distributed periodically.

Step 7: Monitor and Manage Your Stake

Staking rewards should be checked and assessed along with validator performance regularly. It is possible to increase your stake, withdraw, or redelegate as you wish.

Benefits of Staking Zilliqa (ZIL)

Earn Passive Income – One can most certainly earn rewards whilst staking Zilliqa. This makes it possible to earn passive income. There is no need to trade Zilliqa to earn rewards.

Support Network Security – Supporting Zilliqa by staking helps to verify transactions as well as the blockchain’s security and stability.

Predictable Passive Income – Effort is minimal once delegated. There is no need to go out and trade or even mine.

Compounding rewards – The staking rewards can be reinvested thereby increasing one’s assets over time.

Ecosystem Contribution – Development stakers have a direct impacted on Zilliqa’s blockchain network development and growth.

Decentralised Governance – Some staking mechanisms enable ZIL stakers to partake in network governance.

Transparent Returns Mechanism – Passive income becomes possible when staking mechanisms and rewards are transparent. There are no hidden agendas.

Tips for Safe Staking Zilliqa (ZIL)

Use Secure Wallets – Hardware wallets like Ledger and other software wallets are preferable for ZIL staking.

Avoid Unknown Platforms – Most scams happen because a user stakes ZIL on random platforms instead of the authorised exchanges.

Enable Two-Factor Authentication (2FA) – Attacks on wallets and accounts are common, and losing funds because of unprotected accounts is disastrous.

Delegate to Reliable Validators – Validators and pools that have a good reputation and low downtime with fair commission fees should be selected.

Keep a Backup of Seed Phrases – Losing funds because of a lack of security phrases is a common misstep.

Monitor Your Staking Rewards – Validators are required to give rewards that should be regularly checked.

Don’t Stake All Tokens at Once – With ZIL kept in a liquid wallet, counting on emergencies is better.

Stay Updated on Network Changes – Follow Zilliqa to know more about changes and updates that might come with protocol changes.

Best Practices for Staking Zilliqa

Staking Zilliqa (ZIL) while adhering to industry practices saves time and guarantees security and steady earnings. To protect private keys, always use secure wallets, preferably hardware wallets like Ledger. Delegate ZIL tokens with reputable validators that have strong records, low commission fees, and low risk; avoid novice validators and unknown platforms.

Store copies of seed phrases off the grid and enable 2-factor authentication (2FA) on your accounts. Monitor staking rewards, validator performance, and liquidity: do not stake all tokens at once. Understanding Zilliqa network changes will help improve staking. All of the above stances will ensure ZIL staking remains a safe and profitable passive income.

Risk & considerations

Validator Risk

Selecting an unreliable validator may result in lower rewards and higher penalties.

Slashing Risk

Some networks may penalise ‘misbehaving’ validators. The staked assets may be subject to the penalised amount.

Liquidity Risk

Staked tokens come with lock-up provisions and can restrict access to funds.

Market Price Fluctuation

Volume may change dynamically, and the value of ZIL and staking rewards may be influenced.

Continue Risk

Staking ZIL on crypto exchanges and other third-party platforms is prone to a lack of governance and cyber attacks.

Upgrading the Network

Staking rewards and the protocol’s rules may change with any protocol change.

Staking Opportunity Cost

Staking prevents holders from accessing other Zilliqa-based projects.

Staking Issues

Issues like network or wallet breakdowns may delay the staked rewards.

Pros & Cons

| Pros | Cons |

|---|---|

| Earn passive income through regular staking rewards | Tokens may be locked, limiting liquidity |

| Supports network security and stability | Validator or staking pool failure may reduce rewards |

| Low maintenance compared to active trading | Market volatility can affect the value of rewards |

| Opportunity to compound rewards over time | Potential platform or exchange risks, including hacks |

| Contribute to Zilliqa ecosystem growth | Protocol updates or network changes may affect staking terms |

| Access to governance in some cases | Staking all tokens at once increases exposure to risk |

| Transparent and predictable reward mechanism | Technical issues with wallets or validators may disrupt staking |

Conclusion

Staking Zilliqa (ZIL) is a straightforward method to earn passive income while earning from the network and helping to secure and support its expansion. By proper selection of trustworthy validators, secure wallet allocation, and practising security measures, risks can be minimised and rewards maximised.

Staking performance regularly and staying current with the network is essential. Staking ZIL for any user is a hassle-free method of investing in the crypto space while maintaining a set-and-forget approach. Start practising responsible staking today and reap the Zilliqa rewards effortlessly.

FAQs

What are the risks of staking ZIL?

Risks include validator downtime, slashing penalties, market volatility, and potential platform security issues.

Is staking ZIL safe?

Yes, if you follow best practices such as using secure wallets, reliable validators, and enabling 2FA for accounts.

Can I increase my staking rewards?

Yes, by delegating more tokens, choosing high-performing validators, or compounding your earned rewards.