In this article, I will cover how to track Bridging Tokens in Portfolio Apps and provide guidance on doing it effectively. As you know, bridging tokens travel through multiple blockchains, making it difficult to track your progress.

I will outline the most powerful strategies, tools, and tips to help you maintain accuracy in your multi-chain portfolio, real-time transactions, and limit mistakes that end in balance inaccuracies.

What Are Bridging Tokens?

Bridged tokens are cryptocurrencies that utilise cross-chain bridges to travel across different blockchains. They are typically wrapped or pegged copies of the original tokens, like pegged tokens such as WBTC (wrapped Bitcoin) on Ethereum or bridged ETH on other chains.

Such tokens enable users to retain their original tokens, as they can use the bridged version to interact with different protocols, access liquidity, and utilise DeFi services across various chains. Bridged tokens increase the interoperability of blockchains, but they also add complexity to a user’s crypto portfolio, as users must track the balances of each chain to maintain an accurate summary.

How to Track Bridging Tokens in Portfolio Apps

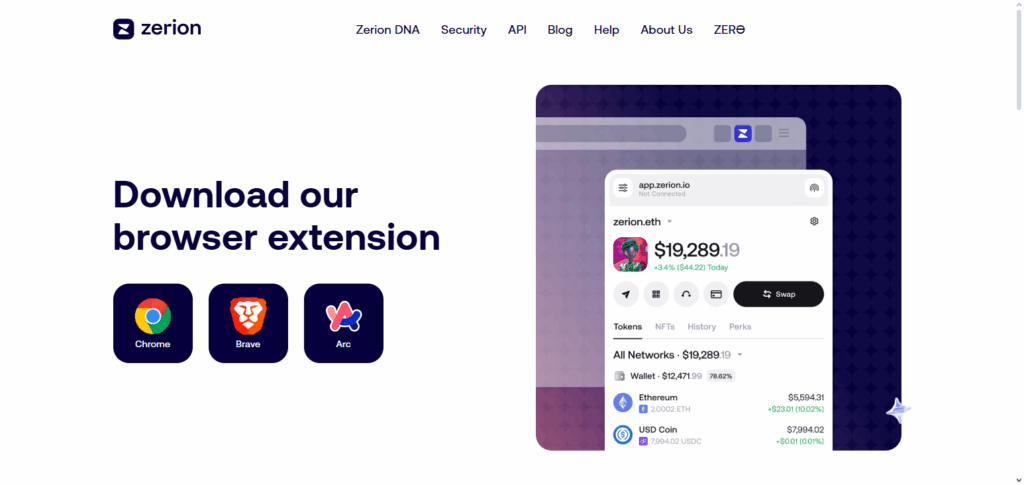

Tracking Bridging Tokens On Portfolio Apps: A Case Study On Zerion

Step 1: Getting Started With Zerion

- Download the Zerion mobile software app or access it online.

- Once the app has loaded, create a Zerion account or log in via Web3 wallet.

Step 2: Connecting Wallets

- Connect cross-chain wallets like Ethereum, Binance Smart Chain, Polygon, etc.

- Ensure that the wallet has the required bridging tokens you want to keep track of.

Step 3: Tracking Multi-Chain Assets

- App settings should be adjusted to show assets within all connected chains.

- Ensure that balances of chains are visible.

Step 4: Finding Bridging Tokens

- In your wallet finder, type bridged tokens like WBTC, or other bridged tokens like bridged ETH.

- Make sure that the token balance is in alignment with your wallets ‘ on-chain data.

Step 5: Observing Transactions

- Make sure to review the transaction history for the bridge to track all transfers.

- Ensure to track the inflow and outflow of bridging tokens for accurate updates to the portfolio.

Step 6: Setting Cross-chain Notification Alerts

- Customise notifications to alert you of cross-chain movements so you can track all notified changes.

- This is effective for reporting missed transactions and discrepancies.

Choosing the Right Portfolio App

Multi-Chain Support: It should allow you to manage and track assets across a network of blockchains such as Ethereum, Binance Smart Chain, and Polygon, among others.

Automatic Token Detection: The app should detect and classify bridged tokens, like wrapped BTC and bridged ETH, so you don’t have to spend time tracking them.

Real-Time Portfolio Updates: Your portfolio should be updated in real-time, and the dollar value and performance should reflect the most recent trades and market changes.

Cross-Chain Transaction History: Useful for tracking. It lets you see and manage the transaction histories over different chains.

User-Friendly Interface: It should be easy to learn. Crypto portfolio management should be streamlined to facilitate rapid management and tracking of assets for the customer.

Challenges in Tracking Bridging Tokens

Multiple Blockchains: Bridged tokens span across numerous networks, making it strenuous to track token balances in a single portfolio.

Delayed Updates: Certain portfolio apps suffer from latency, which affects their ability to track cross-chain transactions in real time.

Unrecognised Tokens: Certain apps fail to recognise new bridged or wrapped tokens automatically and hence need to be added manually.

Complex Transaction History: Cross-chain transfers are very complicated and include numerous fragmented transactions which makes token movement very difficult to track.

Security Concerns: Inaccurate tracking and linking of multiple wallets increases the chances of either phishing or handling wallets with weak security policies.

Inconsistent Pricing Data: Retrieved bridged tokens with cross-chain market access will have different prices, leading to portfolio value discrepancies.

Tips for Accurate Tracking

Choose Multi-chain Portfolio Applications

Select application software that works with several blockchains and can automatically identify bridged tokens participating in cross-chain token transfer activities.

Periodically Reconcile with Blockchain Explorers

Affirm token balances and activities by cross-checking on-chain records to enforce the integrity of accounts.

Log Notifications

Track movements for alerts set on cross-chain transfers and wallet access to understand the context of the changes.

Automatically Recognised Tokens

Bridged tokens that are not automatically recognised can be added manually to reinforce a clear perspective of the portfolio.

Oversee Transaction Confirmations

Transaction discrepancies occur when submitting ether to a bridge token without waiting for the bridge transactions to be fully confirmed.

Oversee Uncompleted or Unsuccessful Transfers

First, review the ledger for uncompleted and unsuccessful transactions to ensure accurate cross-checking of portfolio balances.

Common Mistakes to Avoid

Ignoring Tokens of Incomplete Recognition: Not adding new or wrapped tokens can result in skewed portfolio data.

Dependent on a Single Platform: Some apps do not cover all chains or bridging protocols which results to absent or inaccurate data.

Lack of Confirmation Negligence: If a bridging transfer is assumed to be complete, balance discrepancies might be encountered.

Ignoring Fees Associated With Account Transfers: Not including gas or bridging fees can be damaging to portfolio evaluations.

Failing to Cross Check: Closely, not checking app data against blockchain explorers can result in overlooked discrepancies.

Ignoring Transfers That Are Pending or Have Failed: These include portfolio trackers that are inaccurate due to pending transfers and are ignored.

Pros & Cons

| Pros | Cons |

|---|---|

| Allows users to monitor assets across multiple blockchains in one place | Some apps may not support all chains, causing incomplete tracking |

| Provides real-time updates on portfolio value | Delays in cross-chain transaction updates can cause temporary discrepancies |

| Helps prevent losses by tracking pending or failed transactions | Certain bridged or wrapped tokens may not be automatically recognized |

| Improves decision-making with a comprehensive overview of holdings | Cross-chain fees and price variations can complicate accurate valuation |

| Enables alerts and notifications for transfers | Manual addition of tokens may be required for full accuracy |

| Facilitates tax reporting and portfolio reconciliation | Security risks increase when connecting multiple wallets across apps |

Conclusion

Tokens bridge on crypto portfolio apps for accurate multi-chain crypto portfolio tracking. Take any portfolio tracking apps that can support real-time updates. Users can manually add any tokens that are not recognised. Users can get a complete overview of their holdings and check blockchain explorers for any Pending transactions.

Alerts and check notifications. Frequent transaction confirmations lessen the errors and discrepancies. Don’t make the same errors every time. Pending Transfers, single apps, and old balances are common mistakes people make, which are the soft targets.

FAQ

Which portfolio apps are best for tracking bridging tokens?

Apps like Zerion, CoinStats, Delta, and CoinTracker are ideal because they support multi-chain tracking and detect bridged tokens automatically.

How can I ensure accurate tracking?

Regularly reconcile app balances with blockchain explorers, manually add unrecognized tokens, and monitor pending or failed transactions.

Why do my bridging token balances sometimes differ?

Delays in updates, cross-chain fees, or inconsistent pricing across networks can cause temporary discrepancies.