In this article, I will talk about How To Track Business Expenses Online. Using a digital tool helps companies automatically keep track of their expenses, categorize their transactions, and create up-to-the-minute financial statements.

These features improve the business’s bookkeeping, make tax preparation easy, and enhance budgeting to control expenses and cash flow better.

What Are Business Expenses?

Business expenses refer to the expenditures that a company incurs during its operations. These expenses, often called business deductions, are necessary and ordinary costs that must be taken out of revenue.

Some common ones include marketing expenses, software subscriptions, office supplies, banking fees, printing, postage, and traveling such as mileage.

Tracking business expenses and monitoring costs allows for accurate budgeting, identification of trends, and profit and loss analysis. Businesses are enabled to make smarter decisions regarding their finances and forecast growth by understanding where their money is being utilized.

The IRS also permits premiums to be deducted from gross income when proper documentation is fulfilled. Proper business expenses documentation reduces the net income which ultimately decreases tax liability.

To record and track your business expenses online, a software such as QuickBooks Online can be helpful. Here is how you can do it:

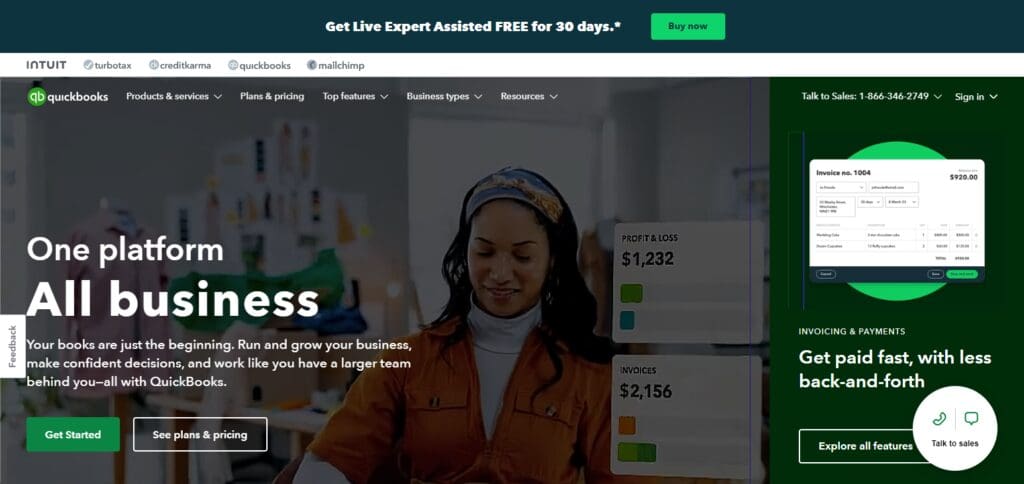

How To Track Business Expenses With QuickBooks Online

Register Quickly On QuickBooks Online

Head to the QuickBooks Online homepage, register for a new account and select the plan that fits your business.

Create Your Business Account:

Enter the business information, link your bank and credit card accounts so that QuickBooks can securely import transactions automatically.

Add Expenses

Use your mobile device to capture receipts and categorize various expenses on the mobile app, or typing them in manually is also an option.

Establish Expense Groups

For more efficient financial management, set up expense groups, which are customizable.

Monitor Regular Expenses

use QuickBooks to log in recurring expenses such as rent, utility bills, subscriptions, etc.

Build Reports

To analyze how much you spend, run a report. This is extremely helpful come tax season and when you want to make bigger financial decisions.

Link To Other Platforms

link QuickBooks with other software you use for business like payroll so that your financial management systems are cohesive and your work is simplified.

5 Best Business Expense Tracker Apps in 2025

1. QuickBooks Online

QuickBooks Online is an advanced accounting system that streamlines global expense management by tracking expenses automatically, offering reports in real time, and preparing taxes.

It helps businesses by connecting bank accounts and credit cards, which categorizes transactions to save time. Users can upload receipts through the mobile app to ensure proper documentation.

Additionally, QuickBooks integrates with payroll, invoicing, and tax software, making it a comprehensive tool for managing finances. Businesses have access to cash flow management, budget setting, and expense report generation instantly.

With the help of AI, all information is ready to go in mere seconds. Freelancers, small businesses, or enterprises can all appreciate the smooth tax filing process that is possible with integration of TurboTax, third-party apps, decision-making made easier with cash flow management.

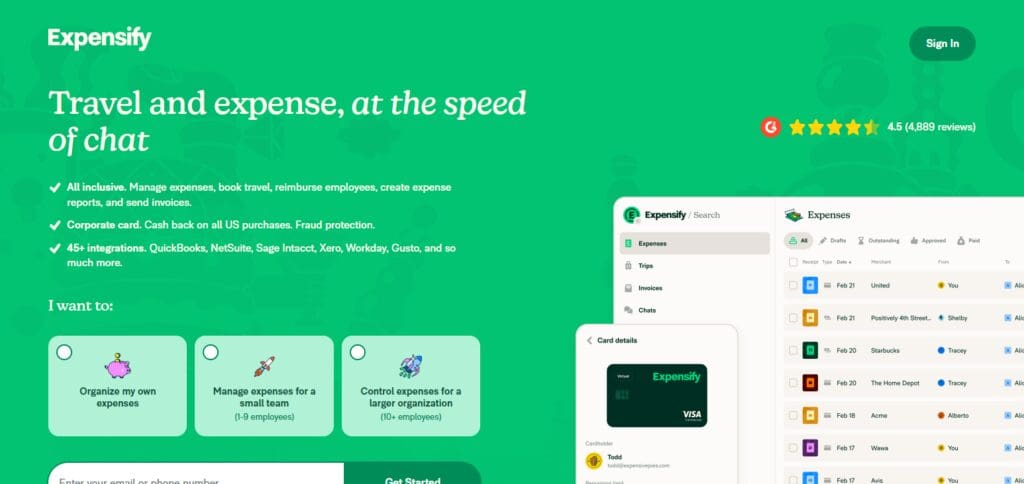

2. Expensify

Expense reporting and approval processes are easier with Expensify because of its receipt scanning technology. Expensify helps in capturing expenses by taking a photo of receipts.

Manual entry is obsolete thanks to the SmartScan feature. Businesses with operations in multiple countries will benefit from this service due to multi-currency support. Users on QuickBooks, Xero, and NetSuite will be able to integrate as well.

Employers can approve expenses through a mobile application and pay out reimbursements right there. Travel booking along with corporate card reconciliation makes Expensify an ideal option for companies that deal with business travel expenses quite often.

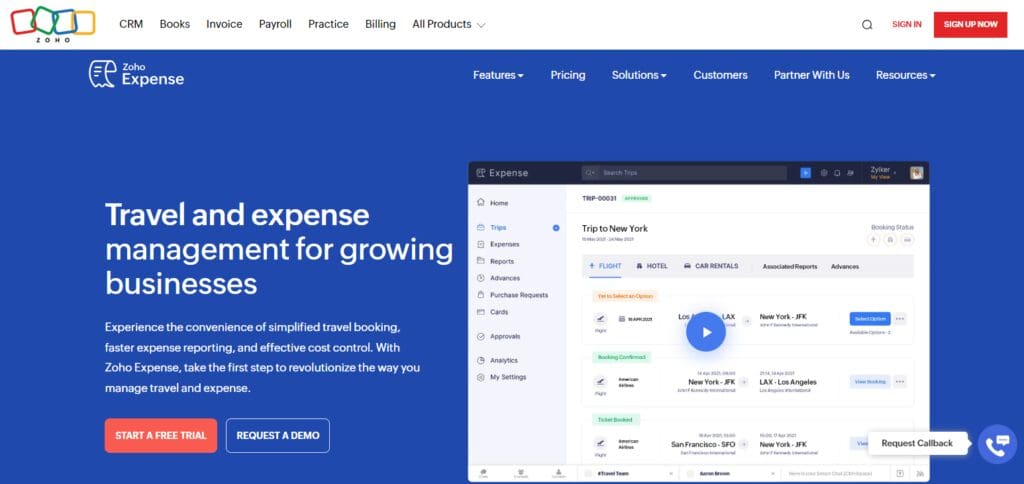

3. Zoho Expense

Zoho Expense is an expense reporting only program with a specialized focus on small and medium businesses. The tool automates fetching, approval, and reimbursement workflows.

Users can connect credit cards for import transactions, mobile capture receipts, and set employee card spending limits. Its industry-leading apps integration, such as Zoho Books, Zoho CRM, and even Slack and Quickbooks, makes it so every organization has a place to put it in their finance tech stack.

It is also great for larger companies with staff in different locations thanks to advanced features like tracking mileage, calculating per diem, and multi-currency options. To top it all off, expense policy compliance and audit trails are also taken care of.

4. ExpenseIn

ExpenseIn streamlines the consolidation of employee’s expense claims, expense summaries, approvals, and reimbursements. Companies can take pictures using a mobile app that pulls out transaction details from the document’s text.

Managers who use the system will find custom approval workflows helpful to make expense review and approval easier.

ExpenseIn easily reconciles with Sage, Quickbooks, and Xero which makes financial accounting much easier. Alongside VAT tracking for tax refund claims, GPS mileage tracking is also included along with per diem and corporate card reconciliation. ExpenseIn is a great solution for businesses looking to simplify their expense reporting while also ensuring compliance.

5. Freshbooks

Freshbooks is an expense tracking app that functions as an all encompassing invoicing and accounting service provider. Businesses are able to categorize their expenses, link their bank accounts, and generate tax ready reports through a simple interface.

Receipts can be taken through their mobile app and uploaded to ensure a business’s financial records are accurate. Freelancers and other small businesses can also benefit from new project expense and time tracking features.

Payments and account management is made easier through integration with Stripe, PayPal, Gusto, and Quickbooks. Financial reports are automated, allowing the business to manage their cash flow efficiently and be better prepared for when tax season comes around.

Impacts of Monitoring Business Expenditures Efficiently

Tracking business expenses is vital for the growth and financial health of a business. In this modern age, companies need agile and effective techniques to track expenses and ensure that the business grows.

The Benefits of Monitoring Expenditures Efficiently

Enhances Financial Planning – Accurate expenditure tracking improves financial planning by using the funds allocated in travel, office supplies, and even employee benefits wisely.

Creates Efficiency in Claiming Tax Exemptions – An organized tracking system reduces hustle in filing tax as it accounts for all business expenses and could be easily claimed.

Improves Tracking and Bookkeeping – As expenses are accurately tracked, they ensure that the financial records are also valid, thereby, improving bookkeeping.

Conclusion

Online tracking of business expenses is vital for accuracy in finances, tax payments, and budgeting. Using digital tools like QuickBooks Online, Expensify, Zoho Expense, ExpenseIn, and FreshBooks enables expense categorization, automation of transaction tracking, and creation of real-time financial reports.

The integration of bank accounts, receipt uploads, and approval workflows simplifies and automates the process reducing manual over sight and errors.

Accurate expense tracking provides businesses with valuable financial analysis, improved cash flow, and effortless tax season preparations. Adopting modern technology in expense management greatly improves efficiency, accuracy, and financial sustainability in the long term.