In this article, I will discuss the How to Track Monthly Expenses Easily. Being aware of how you spend money is important to focus on better financial management.

Simple methods and tools are available for you to take control of your budget, analyze spending patterns, and work towards your financial goals. Here are some ways you can track your monthly expenses easily.

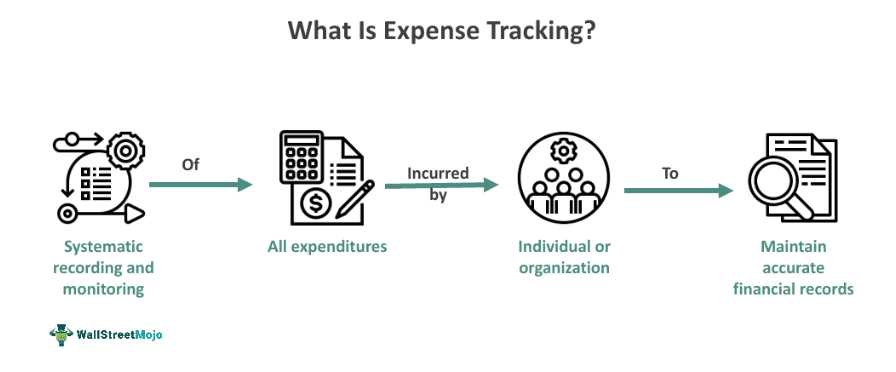

What is Expense Tracking?

Expense tracking is simply keeping track of every monetary transaction that happens, your fixed and variable expenses. It involves spending records that are organized by category to see how money is spent.

Expense tracking helps achieve the budget goals, notice wasteful spending, and make modifications for better financial management.

Expense tracking is crucial for managing finances as it ensures improved savings and makes debts easier to avoid.

How to Track Monthly Expenses Easily

Downloading and Installing the App

Head to App Store (iOS) or Google Play Store (Android).

Search for “Mint” and download the app.

Install the app on your mobile device.

Creating an Account

Launch the Mint app

Register a new account using your email address or any social media account.

If prompted, verify your email address.

Linking Your Bank Accounts

Go to the “Accounts” tab.

Click on “Add Account”, then select your bank or other relevant financial institution.

Input your login details, then link your bank account to the Mint app.

Classifying Your Expenses

Your expenses will be automatically categorized by Mint.

Review whether there are any categorizations that need to be altered in order to reflect the correct categories.

Establishing Your Budget

Visit the Budgets section.

Establish a budget for every expense category depending on your income and expenditure.

Mint will monitor your spending against your budget and will notify you if you surpass your budget.

Monitor Your Expenses

In the “Transactions” section”, you can see all your spending in one place.

Understand your spending activity and look for opportunities to reduce expenses.

Evaluate Your Finances

Go to “Trends” and check the graphs that track your spending over a given period.

Make use of the information to adjust your finances and spending habits for better budgeting.

Let Yourself Be Notified

You can set notifications for anything related to spending, budget, or balance in accounts.

Get tips and suggestions using Mint to improve your finances.

Important Mint Features For Tracking Spending

Automatic Categorization: All credits and debits are automatically categorized for easier tracking.

Budgeting Tools: Track your budget using different expenditure categories that you create.

Spending Alerts: Notifications are sent when predestined budgets are exceeded or when there are exceptional expenses.

Financial Insights: View and analyze your expenses in detailed charts and graphs.

Account Aggregation: Multiple bank accounts can be linked so that all your finances can be viewed in one place.

What are the Top Methods to Track Monthly Expenses?

Pen and Paper Recording

Demonstrably one of the most effective techniques is journaling. The positive thing about this strategy is that it actively engages your brain which is a critical aspect of effective expense management. Additionally, no technology is needed, thus giving you control over the entire process.

Transaction SMS Alarms

Almost all banks emit SMS alerts for each transaction. With spending to manage, that is really helpful as you can track your expenses in real-time. These notifications keep you informed of all transactions in real-time so staying on top of your finances gets easier than ever.

Manual Digital Budgets

Unlike paper, spreadsheets don’t leave you at risk of losing your information so they are an amazing tool to manually balance your budget with. Speaking of spreadsheets, they also allow you to save information without requiring tons of paper.

But the most time-saving feature would have to be that they add up all expenses automatically, leaving you with significantly less work.

Budgeting Apps

Many budgeting apps available today allow for monthly spending limits to be set based on your income and expenses. Most of these apps are mobile-friendly, allowing you to track your purchases on the go. If you plan to stay within budget, these apps can be extremely helpful for managing your finances.

Benefits of Tracking Monthly Expenses?

Improved Financial Organization

Your organization gives you the opportunity to increase or decrease your spending and savings. Implementation of the information provided earlier will help you achieve a greater level of financial control.

Spotting Spending Patterns

Frequent checkups of expenses usually help in identifying the challenging areas of one’s spending habits. This information reveals the basic spending patterns which show your financial discipline and identify areas that need improvement.

Gaining Greater Financial Control

A detailed understanding of finances helps in making sound decisions regarding future spending. Keeping track of financial exchanges with family or friends is essential for allocating expenses in the future.

Achieving Goals Faster

Almost everyone has financial goals, and most require consistent funding. Seeing how close you are to your targets or how far you need to go to fulfill them is in sight with tracking your expenses.

Promoting Savings and Less Impulsive Purchases

Encouraging savings alongside less impulse buying can be done by regularly tracking your expenses as well as your income. With this method, you may be provided with ample opportunities to set and achieve your savings goals.

Steering Away From Debt

A whole lot of financial deformation stems from ignorance of one’s spending and income. Tracking your finances is critical in issues of avoiding debt accumulation and keeping your repayments manageable. Being in control of your earnings and expenses helps to keep the debt at bay.

Worth it of Tracking Monthly Expenses?

Better Financial Awareness: Once you know how much you are spending, the critical areas to focus on saving becomes more clearer. When you fully grasp where your money is going, spending, saving, and investing becomes very easy for you.

Improved Budgeting: If you have a budget, you can stick to it easily with tracking. You will be able to make sure that you are not spending too much on certain aspects in such a way that affects your financial condition too much.

Financial Goal Achievement: For those people who want to meet specific financial goals, tracking your expnese records helps make sure you stay on top of them. It becomes easier for you to save for big purchases or build an emergency fund.

Preventing Debt: Tracking your expenses mostly helps with knowing when and how much you can spend, greatly reducing the likelihood of falling into debt or spending outside your means. This habit prevents you from relying on credit cards, reducing debt.

Identifying Spending Habits: Sticking to a budget helps pinpoint areas that constantly overspend. By looking at your previous expenses, you create a better financial strategy and decision to improve on شدهتا your goal.

Savings Boost: Paying closer attention to your expenses can help you identify areas to save in, whether that means reducing disposable spending or looking for cheaper options.

Conclusion

Ultimately, Monitoring how you spend your money monthly is an uncomplicated, yet effective approach toward financial stability and success. Digital tools like budgeting apps, and spreadsheets alongside classic pen and paper methods work incredibly well as long as you remain consistent.

By routinely tracking your spending, you will remain anchored, notice patterns that require change, and make wiser financial decisions. This approach not only ensures you remain within budget but also motivates you to save, while avoiding needless debt.

Take charge of your finances and work towards your goals with confidence by tracking your expenses today.