In this article, I will discuss the How to Track NFT Floor Prices. Knowing how to track them is crucial towards making sound decisions in the NFT ecosystem.

Be it purchase, sale, or simply observing movements in the space, accurate measures will assure you stay ahead. Discover optimum ploys to make the most out of this guide and learn what to sidestep.

What is an NFT Floor Price?

An NFT floor price is the lowest price at which any NFT belonging to a collection can be purchased on the market. It serves as a primary valuation NFT’s from that collection.

The demand and supply determine the floor price, and it changes with the market factor such as recent transactions, popularity, and scarcity. Monitoring the floor price assists prospective buyers and sellers understand the general perceived worth of the collection.

How to Track NFT Floor Prices

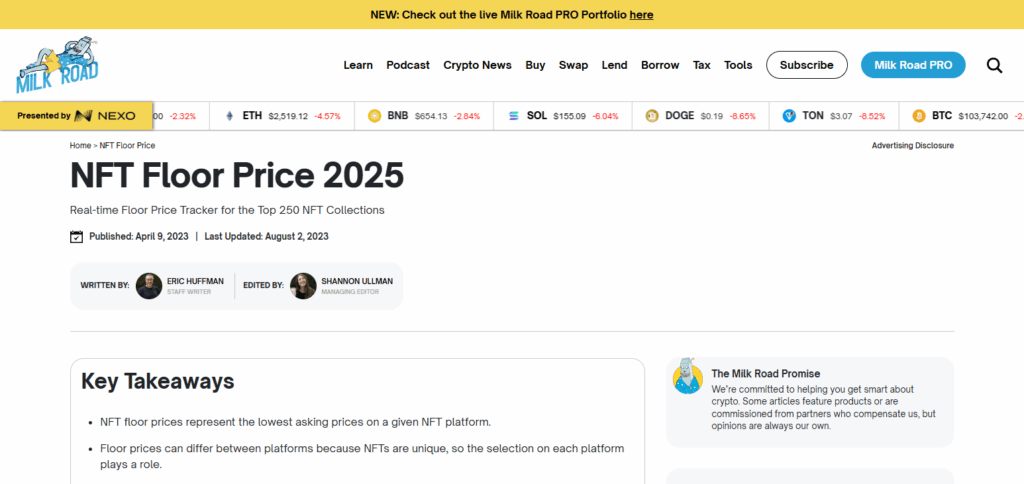

Tracking the floor prices of NFTs is crucial for understanding market dynamics and making informed investment choices. Let me show you how to track floor prices of NFTs using Milk Road’s NFT Floor Price Tracker.

Example: Using Milk Road’s NFT Floor Price Tracker

Visit the Tracker

Access real-time floor price data on Milk Road’s NFT Floor Price Tracker .

Select an NFT Collection

View the floor price of a specific collection, for instance, Bored Ape Yacht Club.

Analyze Floor Price Trends

The tracker helps users pinpoint price volatility by offering them historical and real-time data on the floor prices.

Compare Across Marketplaces

Mintables, Rarible, and OpenSea are some of the marketplaces where floor prices may differ. Milk Road helps you notice these discrepancies.

Monitor Price Concentration

The tracker calculates Floor Price Concentration, which indicates how many NFTs from the collection are listed around the floor price.

Make Informed Decisions

You can accurately decide whether it’s a good time to buy, sell, or hold NFTs based on the data provided.

Other Place Where to Track NFT Floor Prices

CoinGecko

CoinGecko is very useful for tracking the floor prices of NFTs since it compiles and displays data from different NFT marketplaces in one place. What makes CoinGecko exceptional is the synthesis of NFT data with other relevant crypto information, enabling users not only to see floor prices but also gauge them against the market value of other tokens.

This aids in assessing the worth of an NFT in addition to the competitiveness of the surrounding ecosystem, and thus proves advantageous for investors wanting to analyze the financial dimensions of NFT collections more deeply.

OpenSea

OpenSea is one of the best places to track NFT floor prices since its marketplace literally gives live listings. A primary draw is the ability to filter collections by traits, price, and even listing time.

This gives users pinpoint control over their analysis vis-a-vis floor prices. Unlike many other tools, OpenSea displays in real time the changes in price and sales for each NFT collection which helps users to identify trends almost instantly and thus, make fast decisions based on market activity.

NFTfolio

NFTfolio is a unique tool for tracking NFT floor prices since it blends portfolio management with up-to-the-minute market information. Its distinctive advantage is allowing users to link their wallets for automated tracking of floor price changes for the NFTs in their possession.

Such tailored monitoring makes unnecessary manual appraisal effortless and provides automated intel on portfolio appraisal shifts around market activity. For collectors, NFTfolio’s uncluttered design, combined with real-time updates, ensures precise monitoring of asset value at any given moment.

Why Tracking NFT Floor Prices is Important

Spot potential acquisitions: Tracking floor prices identifies NFTs that are currently below market value, so they can be acquired prior to price appreciation.

Identify Demand Trends: Consistent tracking of floor prices indicates their attractiveness and popularity across collections.

Control Portfolio Valuation: Current floor price information provides NFT holders with real time assessments of their portfolio.

Optimize selling and buying tactics: Insights from floor price data can be used to identify suitable selling”

Pay lesser price for NFTs: Floor price monitoring prevents over-purchasing by ensuring no NFTs are bought at a premium.

How to Use These Tools Effectively

Set Floor Price Alerts

Platforms such as OpenSea and NFTFloor allow you to create alerts for price changes in your preferred collections.

Different Source Verification

Utilize different sources such as DappRadar and Rarity.tools to check the information for accuracy.

Examine the Past

Assess the movements of the past floor price to know how it behaves and what it would do next.

Monitor Activity

Assess the actual market activity by analyzing the floor price with volume of trade.

Watch Rarity and Traits

Evaluate how some specific traits affect the value of an NFT by applying filters to the floor price.

Tips for Accurate NFT Floor Price Tracking

Tools of Choice: For accurate information, stick to Opensea, DappRadar, and NFTFloor for real-time floor data.

Update Intervals: Floor prices update frequently, so update your data at least daily to keep up with any changes.

Data Verification: Always confirm prices on other websites as well to ensure you are not depending on outdated listings.

Avoid Wash Trades: Avoid prices that appear to be inflated due to fake “buying and selling” of assets.

Take External Data into Account: News about communities, project announcements, or shoutouts from influencers can greatly affect floor price.

Common Mistakes to Avoid When Tracking Floor Prices

Using One Source Only

Using a single source can lead to incomplete or stale information.

Ignoring the Market Ecosystem

Think beyond just listing the floor price; trading volume, listing activity, community sentiment, and whether they are bullish or bearish should all play into consideration.

Focusing on the Cheapest NFTs

NFTs with prices tagged as the lowest could be facing devaluation for a reason, so make sure to conduct a quality check in addition to checking the price.

Being Too Reactive to Short-Term Movements

Look at the longer side when analyzing the data as sudden spikes and drops can be sustained only in the short-term.

Not Looking for Wash Trades

Some numbers may be too good to be true and could be the outcome of sham trades, so be vigilant for curious occurrences.

Pros & Cons

| Pros | Cons |

|---|---|

| Helps identify buying and selling opportunities | Floor prices can be influenced by wash trading |

| Keeps you informed about market trends | Data may vary across platforms |

| Assists in accurate NFT portfolio valuation | Short-term fluctuations can be misleading |

| Supports better decision-making in trading | Lowest-priced NFTs may not represent overall collection quality |

| Enables real-time alerts for price movements | Requires regular monitoring and tool usage |

Conclusion

To sum up, Monitoring and tracking NFT floor prices is crucial for all market participants, be it an NFT collector, investor or even a trader. Leveraging technology ensures that you stay updated.

It allows for setting alerts, following trends, and making analyses, thus allowing for smarter decisions. As a rule of thumb, always crosscheck data, monitor market signals, exercise due diligence to avoid misinformation with respect to NFT analytics, and common pitfalls that come along as a trader to ensure you receive reliable information.