This article outlines the Low-Risk Stablecoin Staking Platforms that permit investors to earn predictable returns without the risk of extreme market fluctuations.

Platforms like Binance Earn, Coinbase Staking, and Kraken, offer safe staking opportunities for leading stablecoins — USDT, USDC, and BUSD. With an emphasis on customer safety and security, these platforms ensure transparent and liquid processes to earn steady growth on crypto holdings.

What is Stablecoin ?

A stablecoin has value but it tries to maintain it by pegging to other assets such as the US dollar or gold. Unlike other altcoins such as Bitcoin and Ethereum, stablecoins try to at least maintain some form of security and stability.

Because of their predictability, stablecoins can be used in savings, spending, and trading. With stablecoins, you can earn the same features as a crypto currency, but without the drastic risk of losing value. stablecoins are used in decentralized finances a lot and some examples are USDT, USDC, and DAI.

How To choose Low-risk Stablecoin Staking Platforms

Regulation & Licensing – Make sure they are regulated by reputable authorities in order to cover yourself against fraud.

Security Measures – Pick platforms that have sound protocols like multi-signature wallets, cold storage, and insurance.

Transparency – Analyze the platform’s practices to evaluate if they publish audit reports on a periodic basis and are transparent about interest rates, reserve backing, and lock-up periods.

Reputation & Reviews – Assess the level of trust and reliability by checking the user reviews, ratings, and reviews published by industry stakeholders.

Liquidity & Withdrawal Options – Make sure the platform is not the sort that charges penalties for late withdrawals, and that they have ample liquidity to allow speedy withdrawals.

Interest Rates vs Risk – Stay away from platforms that offer very high interest rates, as these are most likely to be riskier and offer unsustainable returns.

Stablecoin Backing – Backed stablecoins that are less likely to be de-pegged are the ones that are strongly collateralized or have fiat backing.

Key Point & Low-risk Stablecoin Staking Platforms List

| Platform | Key Points |

|---|---|

| Binance Earn | Regulated exchange, high liquidity, supports multiple stablecoins, flexible and locked staking options, strong security protocols. |

| Coinbase Staking | US-based regulated platform, insured custodial wallets, simple interface, transparent rewards, reliable reputation. |

| StableHodl | Focused on stablecoin staking, competitive interest rates, audited smart contracts, moderate lock-up periods. |

| Crypto.com Earn | Regulated exchange, multiple stablecoins supported, flexible and fixed-term staking, security via cold storage, user-friendly app. |

| Kraken Staking | Regulated US exchange, high security, transparent rewards, instant withdrawal on some coins, strong customer support. |

| Lido Finance | DeFi staking platform, decentralized, audited smart contracts, liquid staking tokens for flexibility, risk from smart contract vulnerabilities. |

| WhiteBit | Regulated exchange, stablecoin support, flexible staking plans, moderate rewards, strong security measures. |

| Storm Trade | Emerging platform, offers competitive rates, multiple stablecoins, moderate transparency, check audits before staking. |

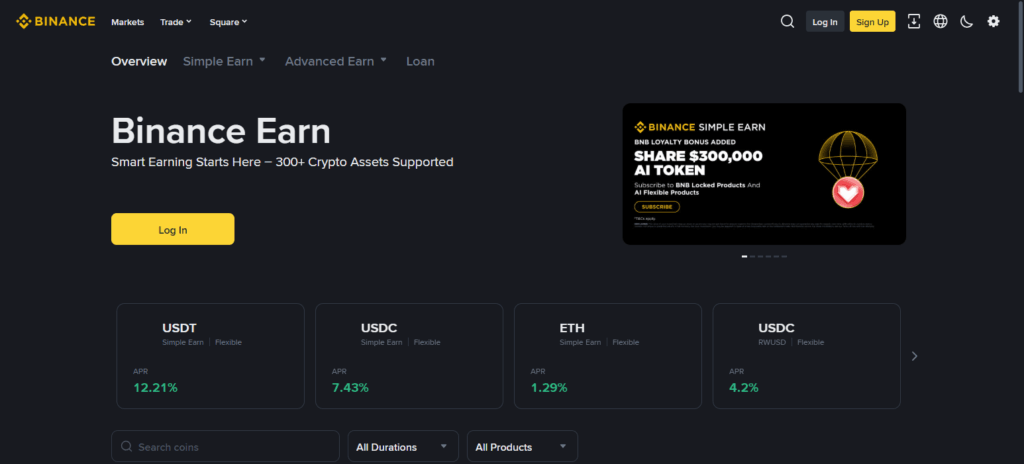

1. Binance Earn

Binance Earn takes a low-risk approach to stablecoin staking which is why it is sought after. This is made possible because it is a minimalist rigor exchange which is trusted globally.

Binance Earn offers high security measures such as cold storage and multi-sig wallets. Binance Earn also provides stablecoin holders a stable and predictable yield because it supports multiple stablecoins ranging from BUSD to USDT and even USDC.

It offers flexible and locked staking options and also provides transparency about rewards and lock-up periods. High liquidity ensures easy access to free capital which is a bonus. These features make Binance Earn a go to option for low risk stablecoin staking.

Binance Earn Features

- Multiple stablecoin support: Allows staking of USDT, USDC, BUSD, among others which provides diversified low-risk options.

- Flexible & locked staking: Both flexible and fixed-term plans are offered.

- High security & liquidity: Proactive measures with cold storage and multi-signature wallets are used and with high liquidity, easy access is available to the funds.

2. Coinbase Staking

Coinbase Staking is a stablecoin staking platform with low risk because of its strong regulatory compliance and its reputation as a US-based exchange. Lots of users keep insured custodial wallets with them, confident that they would be protected from any loss or risks.

Coinbase’s rewards are transparent, staking is straightforward, and Coinbase’s interface is user-friendly enough for novices. It also supports the most popular stablecoins like USDC and DAI so users are stablecoin yields without high, or any, risk. It is a great Coinbase staking platform for crypto investors.

Coinbase Staking Features

- Regulated & insured: Controlled under US provisions and wallets are insured which means funds are protected.

- Clear rewards: Users are provided easy to understand APY’s and staking terms to understand the maximum returns expected.

- Easy to use: Users, even novice ones, are provided a simplified dashboard to easily stake stablecoins such as USDC and DAI.

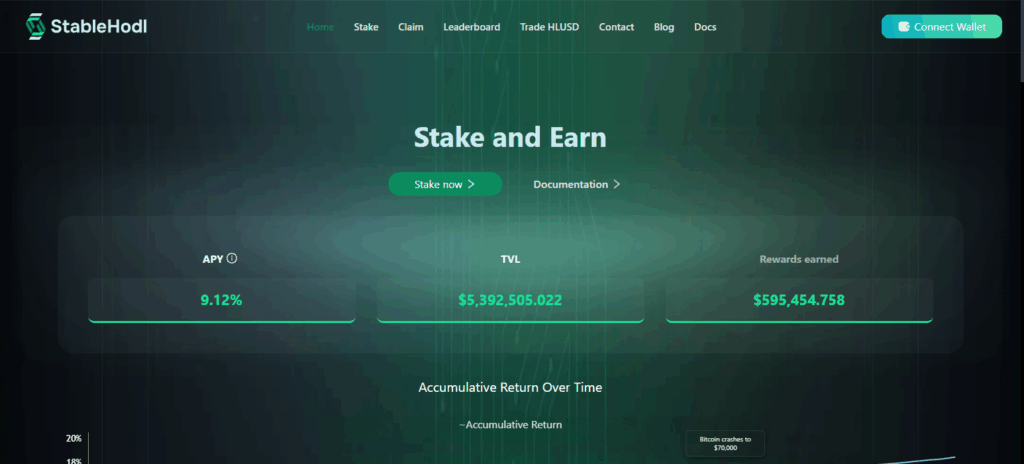

3. StableHodl

StableHodl is a special coin staking service which has been positioned for low risk investors. It has easily accessible proof contracts while paying competitive interest rates on easily manageable payment stablecoins.

Hodl has a reputation for offering low borrower’s interest rates while regularly distributing project stablecoins. With regular bonus structure adjustments and withheld stablecoin staking periods, stake holders have nothing to worry about, even with extreme market volatility.

Stake investors looking for considerable stable risk payment earnings can confidently turn to Hodl Stable for peace of mind and predictability which is rarely offered in the market.

StableHodl Features

- Major stablecoin focused: The only focus is staking major stablecoins with predictable returns.

- Smart contracts with audits: All staking protocols are secure and easily verifiable which is transparent and reliable.

- Moderate to defined lock-up periods: Balanced lock-up options to yield and liquidity are available.

4. Crypto.com Earn

Crypto.com Earn gives its users the chance to stake multiple coins, including USDC, USDT, and DAI, while still providing both flexible and fixed-term contracts.

It is one of the only platforms that offers low to no risk while still providing users with transparent reward structures, defined lock-up periods, and multiple options.

Crypto.com Earn is complaint with regulations and ensures that its securities are met with cold storage and multi-factor authentication, providing users with further peace of mind. Users further benefit from the high liquidity and low risk involved thanks to the transparent reward system and Crypto.com Earn’s unmatched reliability.

Crypto.com Earn Features

- Flexible & fixed-term options: Users are given the option of staking periods which match their risk preference.

- Multiple stablecoins supported: USDT, USDC or DAI can all be staked with provided transparent APY rates.

- Building Security Funds are kept secure with cold storage and multi-signature wallets.

5. Kraken Staking

Kraken Staking is known to be a low risk and stablecoin staking platform given its regulatory standing and its long-time trust as a leading exchange on cryptocurrency.

It has highly-sophisticated security protocols, including cold storage and regular audits, to make certain that user funds are properly secured. Kraken has stablecoins such USDT and USDC, guaranteeing predictable yields at transparent rewards with a flexible withdrawal schedule.

Its attentive customer support and straightforward staking conditions are much appreciated, as it is a safe option for investors looking for reasonable low risk return on stablecoin staking.

Kraken Staking Features

- Regulated And Trusted Exchange: Low-risk, long standing rep.

- Rewards are Clear And Flexible: Staking is done with defined periods and easy withdrawal.

- High Security Standards: Staking is done with cold wallets, open audits, and effective support.

6. Lido Finance

Lido Finance operates as a low risk stablecoin staking platform inside the DeFi ecosystem. It provides users a truly unique staking experience no other platform provides.

Users earn rewards via staking while keeping the underlying staked liquidity as well. Users can trade or utilize staked tokens freely in other DeFi protocols.

Lido utilizes industry-grade audited smart contracts that integrates transparent governance, thus minimizing the risk of losing capital. Lido combines stablecoin yields with DeFi liquid security, letting investors earn flexible low risk returns in crypto staking.

Lido Finance Features

- Liquid Staking Tokens: Staking with liquidity is done with representation as tokenized.

- Audited Smart Contracts: Contract failures are smartened.

- Decentralized Governance: Community governance within a platform that is open and clear.

7. WhiteBit

According to reports, the Whitebit Stablecoin Staking is low risk monetization form because Whitebit is exchange with cold wallets, 2FA, and cold wallets which help secure the exchange.

Whitebit is also able to target many investors with stabilized plans, such as USDT, USDC, and BUSD while offering both flexible and flexible term plans with clear and easy to understand associate reward plans.

Whitebit goes on to offer moderate periods and higher liquidity which allows for high retention of low funds. Because Whitebit is directly drained to the monitoring authority, funds and platform functions guarantee the investors on low risk income returns.

WhiteBit Features

- Regulated Exchange: User safety is guaranteed with compliance.

- Variable And Fixed Staking Contracts: Transparent rewards with flexible lock-up periods are offered for stablecoin staking.

- High Security Measures: Funds are secure with cold wallets and 2FA authentication.

8. Storm Trade

The Storm Trade platform offers low-risk staking on stablecoins and delivers competitive interest rates and optimal security. It covers stablecoins and offers very low risk.

It supports multiple stablecoins and offers competitive interest rates. without any hidden or unclear terms or conditions on rewards or staking. Storm Trade protects investors from losses by segregating user funds into secure wallets and by conducting audits on vaults/smart contracts.

The smart contracts are configured to allow simple staking with incorporated low to moderate lock-up periods that guarantee returns. It has very low exposure to volatility and risk, making it a platform to consider for investors looking for stablecoin staking.

Storm Trade Features

- Consistent Yields: Focused on staking stablecoins for consistent gains with low risk.

- Audited And Secure: Protected losses with risk-limited wallets and protocol audits.

- Staking Options Are User Friendly: Easy to understand and flexible staking strategies with clear terms on rewards.

Pros & Cons

| Pros | Cons |

|---|---|

| Predictable and stable returns | Lower yields compared to high-risk crypto staking |

| Minimal exposure to market volatility | Some platforms have lock-up periods limiting liquidity |

| High security with regulated exchanges | Occasional platform fees may reduce net returns |

| Transparent reward structures | Limited selection of stablecoins on some platforms |

| Easy access to funds with high liquidity | Risk of depegging for less established stablecoins |

| Beginner-friendly interfaces | DeFi platforms may carry smart contract risks |

| Insured custodial options (on some platforms) | Regulatory changes could affect staking conditions |

Conclusion

To summarize, low-volatility stablecoin staking platforms afford peace of mind and assurance for capital preservation to investors who want to earn staking rewards without the principal risk of market fluctuations.

The balance of security, regulatory compliance, and transparent rewards systems earned Binance Earn, Coinbase Staking, StableHodl, and Kraken platforms notable reputations for placing user funds above risk.

Although the yields offered by these platforms do not compare to high-risk offerings and there is no capital appreciation, the liquidity, platform stability, ease of use, and low risk tailored to the crypto market makes these platforms the best choice for investors wanting to grow their assets without paying for excessive risk.

FAQ

What is low-risk stablecoin staking?

Low-risk stablecoin staking involves earning rewards by locking stablecoins on secure platforms that minimize volatility and protect user funds.

Which stablecoins are commonly used for low-risk staking?

Popular options include USDT, USDC, BUSD, and DAI, as they are pegged to fiat currencies and maintain stable value.

Are low-risk staking platforms safe?

Yes, regulated exchanges like Binance, Coinbase, and Kraken provide strong security measures, insured custodial wallets, and transparent operations.

Do I need to lock my stablecoins for staking?

Some platforms offer flexible staking, while others require fixed-term lock-ups. Terms vary depending on the platform.