In this article, I will explain Most Advanced Defi Protocols that are changing the entire landscape of decentralized finance. Some of these protocols provide services like Automated Market Makers (AMM), Liquid Staking yields, optimization, and even the creation of synthetic assets.

These innovations still aid in making financial services secure, efficient, and easily accessible; they remain a leader in FinTech based on Blockchain technology, striving with continuous advances.

Key Point & Most Advanced Defi Protocols List

| Platform | Key Point |

|---|---|

| Uniswap | Leading decentralized exchange (DEX) enabling automated token swaps via AMM. |

| Aave | Non-custodial liquidity protocol allowing users to lend and borrow crypto. |

| Lido Finance | Liquid staking protocol supporting Ethereum and other PoS assets. |

| EigenLayer | Restaking protocol that enhances Ethereum security via decentralized services. |

| Curve Finance | Optimized DEX for stablecoin and like-asset swaps with low slippage. |

| Synthetix | Protocol for trading synthetic assets representing real-world or crypto assets. |

| Balancer | Decentralized portfolio manager and AMM allowing custom token pools. |

| Yearn Finance | Yield optimizer that automatically allocates assets across DeFi strategies. |

| SushiSwap | Community-run DEX offering swaps, yield farming, and token launchpad tools. |

1.Uniswap

Uniswap DeFi protocols at the forefront of technology with its automated market makers (AMMs) which brought new opportunities for trading. Unilke other systems, it supports P2P trades through liquidity pools which are easier and faster to work with than traditional methods.

Innovations like concentrated liquidity that allows users to adjust capital in a more rational way demonstrate why Uiniswap is so successful. As for other advantages, the protocol offers no custody services protection withdrawal restrictions, a deep ecosystem background interoperability and free access gives him the right to act as infrastructure supporting entire DeFi.

| Feature | Details |

|---|---|

| Protocol Name | Uniswap |

| Category | Decentralized Exchange (DEX) |

| Blockchain | Ethereum (Also supports Layer 2s like Arbitrum, Optimism, and Polygon) |

| KYC Requirement | No mandatory KYC for users |

| Core Mechanism | Automated Market Maker (AMM) |

| Token | UNI (Governance Token) |

| Launch Year | 2018 |

| Key Advantage | Permissionless trading & deep liquidity |

| Notable Feature | Concentrated liquidity (Uniswap v3) for capital efficiency |

| Use Case | Swap tokens, earn fees as liquidity provider, DAO governance |

2.Aave

Aave is a leader in DeFi because it automated innovation within the ecosystem with features like flash loans and switching interest rates. These innovations brought new standards to decentralized lending. Aave supports multi-collateral overwithdrawal borrowing, these means having many assets under one loan which increases security in the system while also adding flexibility.

Real-time updates on the protocol are possible because of user governance and risk-adjusted parameters integrated by Aave. Along with meeting their own priorities for centralization, multi-market deployment, and risk management, Aave also stands out among competitors for scalable solutions for secure DeFi lending.

| Feature | Details |

|---|---|

| Protocol Name | Aave |

| Category | Decentralized Lending & Borrowing |

| Blockchain | Ethereum (Also supports Polygon, Avalanche, Arbitrum, Optimism) |

| KYC Requirement | No mandatory KYC for standard DeFi usage |

| Core Mechanism | Liquidity Pool-Based Lending |

| Token | AAVE (Governance & staking token) |

| Launch Year | 2020 (Rebranded from ETHLend) |

| Key Advantage | Flash loans & collateral swapping |

| Notable Feature | Aave V3 supports cross-chain liquidity & gas optimizations |

| Use Case | Deposit to earn interest or borrow assets without intermediaries |

3.Lido Finance

Lido Finance is well-known for its innovative liquid staking approach, making it one of the most sophisticated DeFi protocols. It enables users to stake Ethereum with derivative tokens such as stETH. This creates capital efficiency since participants can earn staking rewards while using their assets in DeFi activities.

Lido is integrated across most major DeFi platforms and has a decentralized validator network which improves usability and helps instill trust within the system, making Lido a cornerstone of the Ethereum Staking Ecosystem.

| Feature | Details |

|---|---|

| Protocol Name | Lido Finance |

| Category | Liquid Staking |

| Blockchain | Ethereum (Also supports Solana, Polygon, Polkadot, Kusama) |

| KYC Requirement | No mandatory KYC for staking users |

| Core Mechanism | Liquid staking via stTokens (e.g., stETH) |

| Token | LDO (Governance Token) |

| Launch Year | 2020 |

| Key Advantage | Earn staking rewards while maintaining token liquidity |

| Notable Feature | Integrated with multiple DeFi apps for yield strategies |

| Use Case | Stake ETH and receive stETH to use across DeFi ecosystems |

4.EigenLayer

EigenLayer is one of the most sophisticated DeFi protocols by introducing the concept of restaking whereby users can utilize their staked ETH to secure other decentralized services outside Ethereum.

This forms a new layer of programmable trust, which allows distributed systems to be constructed on top of other distributed systems without needing fresh investments. Eigenlayer further enhances capital efficiency, decentralization and innovation by extending Ethereums security to new emerging networks and applications, thus positioning itself as a primitive in the growing moduler blockchain industry.

| Feature | Details |

|---|---|

| Protocol Name | EigenLayer |

| Category | Restaking & Modular Security Layer |

| Blockchain | Ethereum |

| KYC Requirement | No mandatory KYC for restakers |

| Core Mechanism | Restaking ETH or LSTs (like stETH) to secure other services |

| Token | Not launched yet (as of mid-2025) |

| Launch Year | 2023 (Mainnet phased rollout) |

| Key Advantage | Enables shared security for new protocols via ETH restaking |

| Notable Feature | Supports Actively Validated Services (AVSs) |

| Use Case | Enhance security of new networks while earning additional rewards |

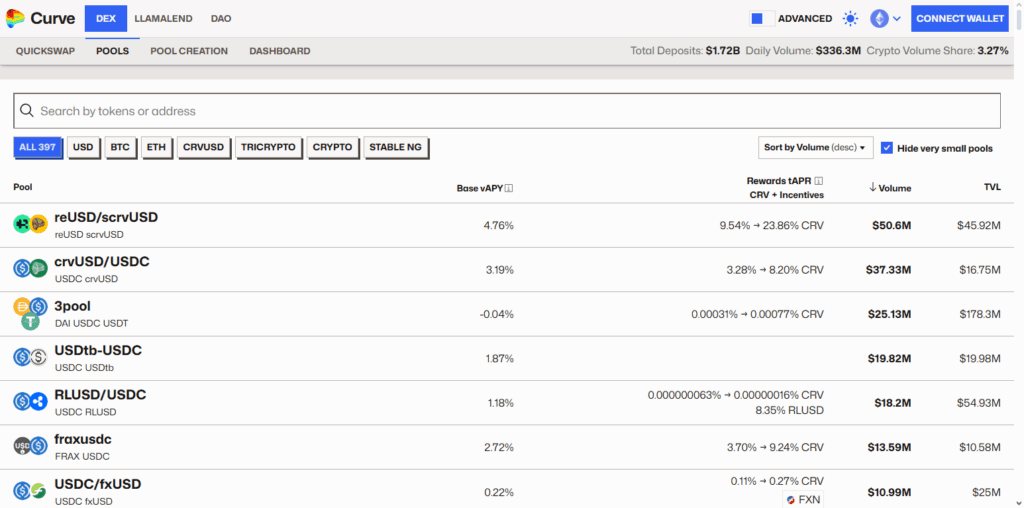

5.Curve Finance

Curve Finance boasts some of the most sophisticated tools in DeFi, focusing on trading stablecoins and correlated assets with low slippage and minimal fees. The AMM Algorithm employed by Curve is specifically tailored for closely valued assets, achieving better capital efficiency and execution across trades.

In addition, Curve has one of the most effective DAO governance systems alongside tokenomics that incentivize liquidity provisioning among providers. It also serves as an essential source of liquidity for stablecoin volume due to its integration throughout the DeFi ecosystem. This makes it a critical building block in the DeFi architecture.

| Feature | Details |

|---|---|

| Protocol Name | Curve Finance |

| Category | Decentralized Exchange (Stablecoin & Liquidity Optimization) |

| Blockchain | Ethereum (Also deployed on Arbitrum, Avalanche, Optimism, Polygon) |

| KYC Requirement | No mandatory KYC for users |

| Core Mechanism | Automated Market Maker (optimized for low-slippage stable swaps) |

| Token | CRV (Governance & rewards token) |

| Launch Year | 2020 |

| Key Advantage | Efficient stablecoin trading with low fees and slippage |

| Notable Feature | Curve Wars: veCRV tokenomics influence reward distribution |

| Use Case | Swap stablecoins, provide liquidity, earn trading fees & incentives |

6.Synthetix

Synthetix is one of the more advanced protocols in DeFi for its ability to create and trade synthetic assets which track real world and digital assets without requiring custody. It utilizes a collateralized debt model backed by SNX, its native token, allowing users to mint synths pegged to fiat currencies, commodities, or even crypto.

This allows for decentralized derivatives trading with deep liquidity and no slippage. Synthetix oracle integration alongside SNX composability enables CFI markets with no restrictions.

| Feature | Details |

|---|---|

| Protocol Name | Synthetix |

| Category | Synthetic Asset Issuance & Derivatives Trading |

| Blockchain | Ethereum & Optimism |

| KYC Requirement | No mandatory KYC for users |

| Core Mechanism | Collateralized debt pool enabling synthetic asset minting |

| Token | SNX (Used for staking & governance) |

| Launch Year | 2018 (Originally Havven) |

| Key Advantage | Exposure to crypto, fiat, and commodities without holding actual assets |

| Notable Feature | Powering platforms like Kwenta for decentralized perpetuals trading |

| Use Case | Mint & trade synthetic assets, stake SNX for rewards |

7.Balancer

Balancer remains one of the most sophisticated DeFi protocols owing to its self-balancing portfolio manager automated market maker (AMM). Liquidity pools on Balancer are not restricted to two tokens like DEX. Users can construct pools with upto eight tokens achieving maximum exposure and controlling fee structures which are advantageous for liquidity providers.

Through smart order routing, reduced slippage, better trading efficiency and improved liquidity depth, composability with other protocols enhances Balancer’s strength.

| Feature | Details |

|---|---|

| Protocol Name | Balancer |

| Category | Decentralized Exchange & Automated Portfolio Manager |

| Blockchain | Ethereum (Also on Polygon, Arbitrum, Optimism, Gnosis Chain) |

| KYC Requirement | No mandatory KYC for standard users |

| Core Mechanism | Customizable Automated Market Maker (AMM) pools |

| Token | BAL (Governance & rewards token) |

| Launch Year | 2020 |

| Key Advantage | Multi-token pools with adjustable weights for portfolio-like exposure |

| Notable Feature | Boosted pools and integration with asset managers for yield |

| Use Case | Swap tokens, create liquidity pools, earn fees & BAL incentives |

8.Yearn Finance

Yearn Finance is among the best DeFi protocols because it automates yield optimization across several platforms which allows all users to take advantage of sophisticated strategies. Its unique vault system consolidates user funds, deploying them via algorithmically optimized strategies to maximize returns with minimal user effort.

Automation cuts gas costs and removes the need for continuous manual work. Yearn Finance integrates with different protocols and adapts in real-time, acting as a smart layer for automated yield generation on top of them.

| Feature | Details |

|---|---|

| Protocol Name | Yearn Finance |

| Category | Yield Aggregator |

| Blockchain | Ethereum (Also supports Fantom, Arbitrum, Optimism) |

| KYC Requirement | No mandatory KYC for users |

| Core Mechanism | Automated yield farming via smart contract strategies |

| Token | YFI (Governance token) |

| Launch Year | 2020 |

| Key Advantage | Auto-optimizes yield across multiple protocols |

| Notable Feature | Vaults that execute complex strategies to maximize user returns |

| Use Case | Deposit crypto assets to earn optimized passive yield |

9.SushiSwap

SushiSwap is one of the more sophisticated DeFi protocols stemming from a simple DEX and has evolved into a multifunctional suite. Aside from token swaps, SushiSwap offers yield farming, lending, launchpads and cross-chain interoperability.

Its most distinguishing attribute is the community-based development model which allows for swift innovations and improvements. Other features such as Onsen for incentivized pools and Trident for modular AMMs showcase how flexible the infrastructure is in meeting diverse DeFi needs that make the platform dynamic and advanced in the decentralized economy.

| Feature | Details |

|---|---|

| Protocol Name | SushiSwap |

| Category | Decentralized Exchange (DEX) & DeFi Suite |

| Blockchain | Multi-chain (Ethereum, Arbitrum, Polygon, BNB Chain, Avalanche & more) |

| KYC Requirement | No mandatory KYC for core features |

| Core Mechanism | AMM-based token swaps and liquidity pools |

| Token | SUSHI (Governance & reward token) |

| Launch Year | 2020 |

| Key Advantage | Full DeFi suite: swapping, yield farming, lending, and launchpad |

| Notable Feature | Trident AMM framework for advanced liquidity customization |

| Use Case | Trade tokens, earn yield, participate in governance and staking |

Conclusion

To summarize, the most sophisticated protocols in DeFi which include Uniswap, Aave, Lido Finance, EigenLayer, Curve, Synthetix, Balancer, Yearn Finance, and SushiSwap are at the forefront of decentralized innovation finance technology.

These all offer some form of automated liquidity provision and synthetic asset creation as well as restaking and yield optimization. In addition to these features enhanced capital efficiency , decentralization is also achieved while providing a lean infrastructure for programmable finances that are more open and secure, thus facilitating further groundbreaking advancements in global finance.