I will discuss the multi-bridge routing protocols uniquely applied within decentralized finance (DeFi). The examination delineates mechanisms by which these protocols improve inter-chain interoperability and operational efficiency.

Through the aggregation of numerous blockchain bridges, asset transfers occur with increased velocity, reduced cost, and heightened security.

Routes are consolidated and liquidity concurrently optimized, precipitating the transition of multi-bridge solutions from experimental frameworks to critical infrastructure requisite for the sustained expansion of DeFi ecosystems.

Key Point & Multi-bridge routing protocols for DeFi List

| Name | Keypoint (Unique Strength) |

|---|---|

| Rango Exchange | Multi-chain DEX aggregator with support for 60+ blockchains and advanced routing for cross-chain swaps. |

| Jumper Exchange | User-friendly bridge aggregator focusing on best rates and minimal slippage across multiple chains. |

| Chainspot | Multi-bridge routing hub offering fast transactions with built-in monitoring for bridge reliability. |

| Bungee Exchange | Optimized for low-cost, efficient cross-chain transfers with advanced pathfinding algorithms. |

| LI.FI Protocol | Developer-focused multi-bridge API aggregator integrating multiple bridges and DEXs for DeFi apps. |

| Across Protocol | Liquidity-based bridge with instant cross-chain transfers and low fees powered by relayers. |

| Hop Protocol | Rollup-to-rollup bridge specializing in scaling Ethereum with quick and low-fee transactions. |

| Stargate Finance | Omnichain liquidity protocol enabling native asset swaps with deep liquidity pools. |

| Synapse Protocol | Cross-chain DEX and bridge offering interoperability, stablecoin swaps, and multi-chain liquidity. |

| Celer cBridge | Scalable cross-chain bridge supporting 40+ blockchains with low fees and fast finality. |

1.Rango Exchange

Rango Exchange distinguishes itself within the DeFi sector through the deployment of an advanced multi-bridge routing architecture, facilitating frictionless asset transfers among an extensive array of blockchains.

By aggregating numerous bridges and decentralized exchanges into a consolidated routing engine, the protocol guarantees superior liquidity, diminutive slippage, and the optimal trajectory for cross-chain transactions—capabilities that single-bridge counterparts cannot match.

Its compelling advantage resides in the capability to accommodate in excess of sixty networks, employing an on-the-fly, algorithmic evaluation to select the most resource-efficient corridor. Such sophistication positions Rango Exchange as an indispensable instrument for advancing interoperability across the decentralized finance landscape.

| Feature | Details |

|---|---|

| Type | Multi-bridge routing protocol & cross-chain DEX aggregator |

| KYC Requirement | Minimal to none for most swaps |

| Supported Chains | 60+ blockchains including EVM and non-EVM networks |

| Key Function | Aggregates multiple bridges & DEXs to find best cross-chain routes |

| Unique Strength | Optimized liquidity, low slippage, and seamless cross-chain swaps |

| Target Users | DeFi traders seeking interoperability without heavy compliance barriers |

2.Jumper Exchange

Jumper Exchange is an optimized multi-bridge routing protocol tailored for decentralized finance, purpose-built to facilitate rapid, cross-chain asset transfers while upholding operational efficiency.

Departing from the cumbersome mechanics of traditional aggregators, the protocol curates the most advantageous routing pathways through a diverse set of bridges, deliberately curbing both slippage and overall transaction expenditure. Its principal innovation resides in a deceptively simple graphical interface that autonomously calibrates optimal trajectories, thus obviating the need for any specialized blockchain acumen.

By consolidating a heterogeneous array of bridges within a unified environment, Jumper Exchange not only guarantees seamless interoperability, but also democratizes access to DeFi, rendering complex cross-chain interactions instinctive for the average participant.

| Feature | Details |

|---|---|

| Type | Multi-bridge routing protocol & cross-chain swap aggregator |

| KYC Requirement | Minimal to none for most transfers |

| Supported Chains | Multiple EVM-compatible and major non-EVM chains |

| Key Function | Finds best routes across multiple bridges with optimized costs |

| Unique Strength | Simple, user-friendly interface with automatic path optimization |

| Target Users | Everyday DeFi users seeking fast, low-cost, cross-chain swaps without heavy compliance |

3.Chainspot

Chainspot constitutes a cross-chain routing protocol leveraging a multi-bridge architecture, specifically designed to enhance reliability and transparency for decentralized finance (DeFi) transactions. Rather than directing transfers through a single bridge, it synthesizes several bridge alternatives, aggregating live performance data to furnish users with instantaneous updates on asset location and status throughout the transfer process.

Security and visibility—two core design principles—i.e., are baked directly into the routing logic, thereby mitigating the vulnerabilities common to inter-network asset movements. By delivering optimized pathways anchored in demonstrable trust and operational efficiency, Chainspot contributes to a more cohesive and robust environment for DeFi interoperability.

| Feature | Details |

|---|---|

| Type | Multi-bridge routing hub for cross-chain transfers |

| KYC Requirement | Minimal to none for standard swaps |

| Supported Chains | Multiple blockchains with broad interoperability |

| Key Function | Aggregates bridges and tracks transactions in real time |

| Unique Strength | Emphasis on transparency and reliability through monitoring tools |

| Target Users | DeFi users prioritizing secure, visible, and efficient cross-chain transfers |

4.Bungee Exchange

Bungee Exchange is a multi-bridge, cross-chain routing protocol specifically engineered for decentralized finance (DeFi) applications. Unlike standard solutions that merely aggregate available bridges, Bungee Exchange leverages cutting-edge pathfinding algorithms to objectively assess and rank each prospective route, selecting the path that minimizes both latency and total expense.

Security is assured through a cryptographically guarded environment that verifies each intermediary hop while preserving user privacy. Traders executing multiple cross-chain swaps benefit substantially from the protocol’s capacity to estimate real-time gas costs and latency, transmitting near-optimal instructions to the originating wallet.

In sum, Bungee Exchange enhances the overall coherence and user-friendliness of the DeFi landscape by embedding economically rational, cryptographically assured multi-chain routing within a single command.

| Feature | Details |

|---|---|

| Type | Multi-bridge routing protocol & cross-chain swap optimizer |

| KYC Requirement | Minimal to none for most swaps |

| Supported Chains | Multiple EVM and major non-EVM blockchains |

| Key Function | Optimizes routes for lowest fees and fastest cross-chain transfers |

| Unique Strength | Advanced pathfinding algorithms for cost-efficient and reliable swaps |

| Target Users | DeFi users seeking fast, low-cost, and secure multi-chain transactions without heavy compliance |

5.LI.FI Protocol

LI.FI Protocol constitutes a developer-centric multi-bridge routing standard engineered explicitly for decentralized finance, synthesizing diverse bridging and decentralized-exchange components into a singular, cohesive layer.

Rather than serving merely as a token-swapping solution, it exposes comprehensive APIs and software development kits that enable custodial and non-custodial wallets, decentralized applications, and trading venues to effortlessly facilitate cross-chain asset movements on behalf of end users.

Its distinguishing capability resides in an infrastructure-first philosophy, furnishing builders with the tools to embed multi-chain interoperability natively and unobtrusively within their core offerings. By marrying extensive configurability, granular customization, and thorough, low-level integration, LI.FI Protocol cultivates an elastic yet performant substrate that underpins scalable cross-chain connectivity within the broader DeFi ecosystem.

| Feature | Details |

|---|---|

| Type | Multi-bridge routing protocol & cross-chain infrastructure API |

| KYC Requirement | Minimal to none for most users |

| Supported Chains | Multiple EVM and non-EVM blockchains |

| Key Function | Aggregates bridges and DEXs for seamless cross-chain transfers |

| Unique Strength | Developer-focused, enabling dApps and wallets to integrate multi-chain interoperability |

| Target Users | DeFi builders and users seeking efficient, customizable, and secure cross-chain solutions |

6.Across Protocol

Across Protocol presents an innovative multi-bridge routing mechanism engineered specifically for decentralized finance, transforming the dynamics of cross-chain asset movement through a novel liquidity-oriented architecture.

Departing from conventional asset locking, the protocol orchestrates a federated network of authenticated relayers alongside decentralized liquidity suppliers, thereby enabling instantaneous asset exchanges while imposing only negligible transfer costs to users. The principal operational advantage of the protocol resides in enhanced capital efficiency; liquidity is selectively concentrated, enabling prompt finality and skeletal surplus charges.

By orchestrating accelerated finality, cryptographic security, and rigorous economic rationality, Across Protocol underpins frictionless interoperability and is positioned as a strategic cornerstone for the expansion of cohesive multi-chain ecosystems in the decentralized finance sphere.

| Feature | Details |

|---|---|

| Type | Multi-bridge routing protocol & liquidity-based cross-chain bridge |

| KYC Requirement | Minimal to none for standard transfers |

| Supported Chains | Major EVM-compatible chains and select non-EVM networks |

| Key Function | Uses liquidity providers and relayers for near-instant cross-chain swaps |

| Unique Strength | Efficient capital use, low fees, and fast settlement across chains |

| Target Users | DeFi users seeking secure, fast, and cost-effective multi-chain transfers |

7.Hop Protocol

Hop Protocol represents a sophisticated multi-bridge routing architecture tailored to the decentralized finance (DeFi) landscape, with particular emphasis on optimizing transfers across Ethereum rollups and sidechains. It circumvents the latency typically imposed by conventional bridging mechanisms by employing liquidity-backed hTokens and purpose-built automated market makers, thereby facilitating immediate, cost-effective cross-chain swaps.

The protocol’s defining advantage resides in its rollup-to-rollup interoperability, which notably curtails the latency associated with asset withdrawals without sacrificing rigorously defined security predicates. In addressing the prevailing scalability constraints that afflict Ethereum’s broader ecosystem, Hop Protocol thus assumes a central function in accelerating the execution and viability of multi-chain DeFi operations.

| Feature | Details |

|---|---|

| Type | Multi-bridge routing protocol & rollup-to-rollup bridge |

| KYC Requirement | Minimal to none for most transfers |

| Supported Chains | Ethereum rollups and major sidechains |

| Key Function | Enables fast and low-cost cross-chain transfers between rollups |

| Unique Strength | Optimized for rollup-to-rollup interoperability with instant finality |

| Target Users | DeFi users seeking scalable, secure, and efficient cross-chain swaps |

8.Stargate Finance

Stargate Finance constitutes a cross-chain multi-bridge routing architecture specifically designed for DeFi, facilitating the movement of native assets amongst heterogeneous blockchains via a consolidated liquidity pool framework.

Distinct from conventional wrapping bridges, the protocol effects atomic transfers of non-custodial tokens, thereby enhancing effective liquidity depth and mitigating fragmentation commonly observed in consumer and liquidity-provider behaviours.

The protocol’s salient architectural characteristic is instant guaranteed finality: settlement, state manifestation, and observability occur concurrently across participant ledgers, eliminating latency and arbitrage opportunities. By synthesising native asset transport with unified liquidity access, Stargate Finance materially reduces the complexity of inter-chain operations and fortifies the requisite infrastructural undergirding for a multi-chain decentralized finance landscape.

| Feature | Details |

|---|---|

| Type | Multi-bridge routing protocol & omnichain liquidity protocol |

| KYC Requirement | Minimal to none for standard transfers |

| Supported Chains | Major EVM and selected non-EVM blockchains |

| Key Function | Enables native asset swaps across chains using unified liquidity pools |

| Unique Strength | Instant guaranteed finality with deep liquidity for cross-chain transactions |

| Target Users | DeFi users seeking secure, fast, and seamless multi-chain asset transfers |

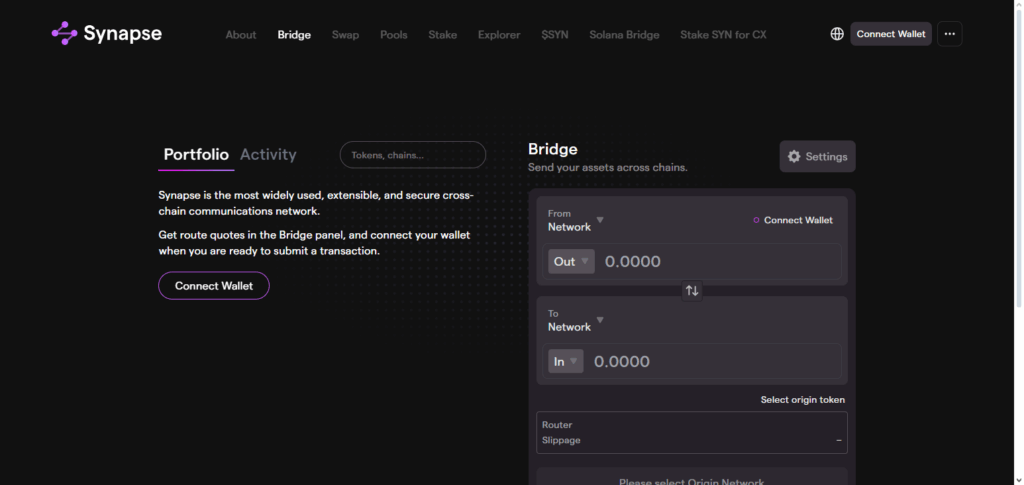

9.Synapse Protocol

Synapse Protocol constitutes a routing framework for multi-bridge applications within decentralized finance, synthesizing cross-chain interoperability and sophisticated liquidity mechanisms.

Beyond the mere transfer of fungible tokens, the protocol facilitates stablecoin pair swaps and permits the transmission of arbitrary application-defined messages across heterogeneous chains.

Its primary advantage emerges from the dual optimization of cross-chain reach and the provisioning of deep liquidity reserves, thereby minimizing slippage and settlement risk for users. By converging bridging capabilities and decentralized-exchange functionalities within a single architecture, Synapse Protocol substantially improves the speed, security, and composability of multi-chain asset movement, thereby reinforcing the broader DeFi commerce.

| Feature | Details |

|---|---|

| Type | Multi-bridge routing protocol & cross-chain DEX and bridge |

| KYC Requirement | Minimal to none for standard transfers |

| Supported Chains | Major EVM-compatible and select non-EVM blockchains |

| Key Function | Enables cross-chain swaps, stablecoin transfers, and messaging between chains |

| Unique Strength | Combines bridging and decentralized exchange features for smooth multi-chain liquidity |

| Target Users | DeFi users seeking versatile, secure, and efficient cross-chain transactions |

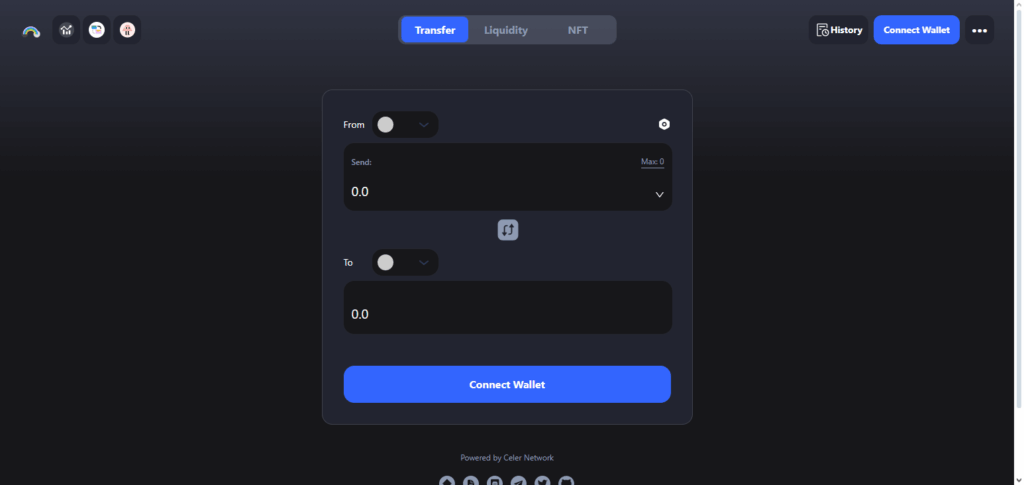

10.Celer cBridge

Celer cBridge represents an advanced multi-bridge routing protocol tailored for decentralized finance, enabling rapid, cost-efficient, and secure cross-chain transfers across an extensive network of more than forty blockchain protocols.

Distinct from conventional bridges, which tether themselves to individual chains, cBridge capitalizes on the Celer State Channel architecture and Layer-2 scaling, thereby achieving immediate finality and significantly diminished transaction fees.

The protocol’s architectural design embodies exceptional scalability, permitting extremely high throughput without the latency typically associated with network congestion. By integrating speed, low-cost access, and extensive multi-chain compatibility, Celer cBridge serves as a cornerstone for the evolution of seamless interoperability within the DeFi ecosystem.

| Feature | Details |

|---|---|

| Type | Multi-bridge routing protocol & scalable cross-chain bridge |

| KYC Requirement | Minimal to none for most transfers |

| Supported Chains | 40+ blockchains including EVM and non-EVM networks |

| Key Function | Enables fast, low-cost, and secure cross-chain asset transfers |

| Unique Strength | High scalability with instant finality and low transaction fees |

| Target Users | DeFi users seeking reliable, efficient, and broad multi-chain interoperability |

Conclusion

Emergent multi-bridge routing protocols in decentralized finance (DeFi) are reshaping user engagement with inter-chain assets by optimizing speed, cost, and security in cross-chain transactions.

In contrast to traditional single-bridge models, these innovations consolidate liquidity from numerous bridges, systematically routing trades along paths that minimize slippage and transaction fees, thereby delivering notably streamlined user experiences.

Their core advantage resides in fostering pervasive interoperability, permitting DeFi protocols to transcend otherwise siloed ledgers and to scale seamlessly across heterogeneous environments.

As DeFi maturation progresses, multi-bridge routing protocols will constitute the backbone of a continuously integrated multi-chain infrastructure, furnishing the connective tissue required for a truly interconnected decentralized economy.

FAQ

What are multi-bridge routing protocols in DeFi?

Multi-bridge routing protocols are systems that connect multiple blockchain bridges and liquidity sources, enabling users to transfer assets seamlessly across different networks with optimized speed, cost, and security.

How do they improve cross-chain transactions?

They analyze multiple bridges and automatically select the best route, reducing slippage, minimizing fees, and ensuring faster settlements compared to single-bridge solutions.

Why are multi-bridge routing protocols important for DeFi?

They enhance interoperability, allowing users and dApps to access liquidity across many blockchains, which strengthens the efficiency and scalability of decentralized finance.