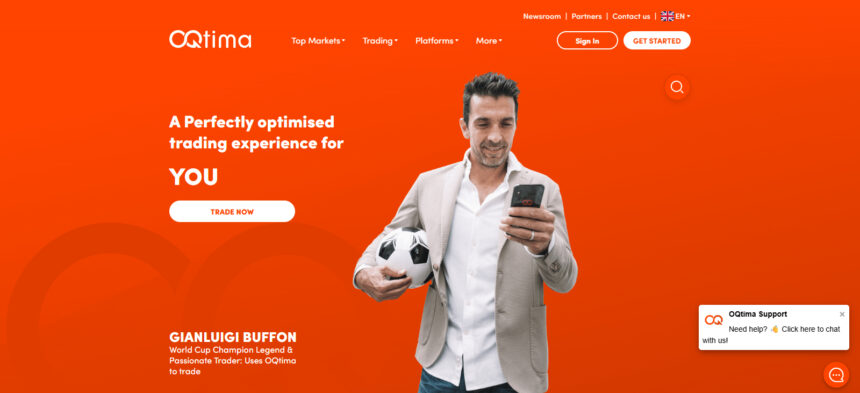

OQtima is a new company for financial derivatives broker based in Cyprus, where we started our operations in 2022, which focuses on financial derivatives and accommodating all types of traders, be they beginner or pro.

OQtima has more than 940 instruments available for trading in the forex and crypto markets, as well as in commodities, indices, and stocks.

OQtima has sophisticated trading environment proprietary OQtima Trader, as well as the industry leaders, MetaTrader 4 and 5. OQtima delivers efficient and flexible trading experience with low spreads, free VPS hosting, and dependable market analyses.

Oqtima Overview

OQtima which has its headquarters in Limassol, Cyprus opened in 2022 as a broker for financial derivatives working with over 940 tradable assets via the MetaTrader 4 and MetaTrader 5 platforms.

The broker is remarkable due to its ultra-low spreads and the exceptional offered value. The offered value is the free VPS hosting for seamless low-latency trading and the expert analysis offered through Trading Central for every customer.

The OQtima ECN+ account is remarkable for the industry as the account offers a low round-turn commission of $3.

Key Details

| Feature | Details |

|---|---|

| Regulations | CySEC (Cyprus), FSA (Seychelles) |

| Supported Languages | English, Italian, Spanish, Portuguese, Chinese, Korean, French, Indonesian, Bahasa, Vietnamese, Japanese |

| Products Offered | Currencies, Stocks, Crypto, Indices, Commodities |

| Minimum Deposit | $20 |

| Maximum Leverage | 1:30 (CySEC), 1:500 (FSA) |

| Trading Desk Type | STP (Straight Through Processing) |

| Trading Platforms | MetaTrader 4 (MT4), cTrader |

| Deposit Methods | Wire Transfer, Skrill, Neteller, Credit Card, Debit Card |

| Withdrawal Methods | Credit Card, Debit Card, Wire Transfer, Skrill, Neteller |

| Demo Account Availability | Yes |

| Foundation Year | 2022 |

| Headquarters | Cyprus |

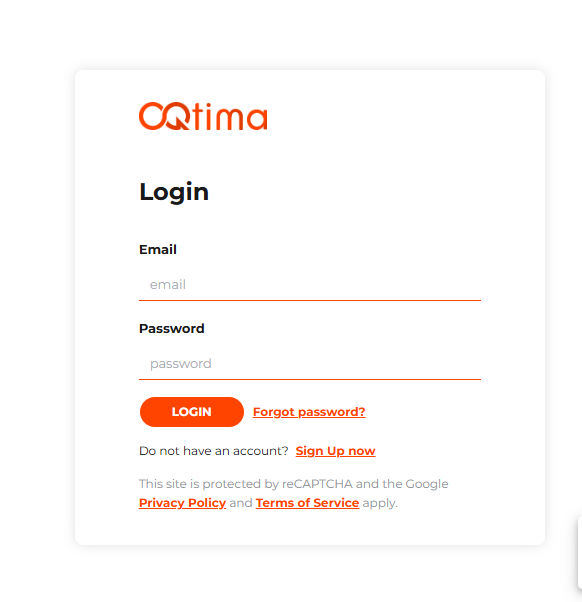

How To Open Oqtima Account?

Go to www.oqtima.com

To set up a demo or live trading account, click “Open Account” or “Get Started” on the official OQtima site.

Enter Your Information

Provide your name, email address, phone number, country, and a secure password. Specify your preferred trading platform, account type, and base currency.

Complete KYC

To secure your account as well as comply with regulations, and to complete the KYC process, upload a government-issued ID and proof of address documentation.

Account Preferences

Once your account is set up, pick the account type that you want, your trading leverage, and platform choice between MetaTrader 4 or MetaTrader 5.

Fund Your Account

Before going live, add money to your account using any of the allowed payment options which are bank transfers, debit/credit cards, e-wallets, and cryptocurrency.

Go Live

Once your account has been funded, you are free to use MetaTrader 4 or 5 to analyze the market and start trading the 940+ financial instruments available on your OQtima account.

Account Types

OQtima maintains a strict focus on flexibility and accessibility. There are three core account types to choose from, each designed to accommodate different trading patterns and experience levels.

OQtima ONE is the account with no commission. It is aimed at earning customers who prefer keeping things simple with no added commissions, and somewhat wider spreads beginning around 1.0 pip. It is most suitable for beginners or infrequent traders who appreciate unambiguous pricing.

OQtima ECN+ is aimed at more experienced and active traders. This account delivers raw spreads starting at 0.0 pips, with a commission of $6 on each order round trip. It is designed for the traders who are willing to take control of their own order execution and risk, while still appreciating tight spreads.

They also offer a Swap-Free Account for traders who need trading without earning interest. It is structured similarly to the ONE account in terms of pricing, but it has no overnight fees, in line with Islamic finance standards.

This account is vital for swing traders or those with religious observances as it allows users to keep positions open without incurring rollover fees.

Fees and Spreads

OQtima aims to make itself distinct in this location. Here are the specifics.

ECN+ account, spreads are 0.0 pips and a $3 commission per side traded. Well set up for cost-sensitive traders.

ONE account, commission-free, but spreads widen slightly to cover the cost to the broker.

Leverage is up to 1: 1000 for forex and metals. This is extremely high and would pose significant risks especially for under-capitalised accounts.

It is good to see that OQtima does not impose any deposit or withdrawal fees.

Trading Platforms: Great Proprietary and MetaTrader Options

Whether you are a novice or an experienced trader, OQtima offers several trading platforms to suit your needs, including OQtima’s web and mobile proprietary OQtima Trader as well as MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

MetaTrader 4 (MT4) is among the most prominent platforms in the forex trading ecosystem. Due to MT4’s straightforward design, it is perfect for beginners, who, in fact, constitute the majority of the platform’s users.

Also, the platform has a strong online community and a wealth of training materials. MT4 has established reliability. For 15 years, users have documented exceptional platform dependability.

However, MT4’s age also means limited capabilities. Compared to MT5, it has fewer built-in indicators, timeframes, and other analytical tools. Further, MT4’s proprietary language, MQL4, has limited customization capabilities because it is less sophisticated than MQL5.

MetaTrader 5 (MT5) is targeted at experienced traders who seek high order execution speeds and advanced trading capabilities. MT5 outperforms MT4 in backtesting and has a wider array of trading instruments. Also, automation and order customization is far greater in MT5, which uses the more advanced MQL5.

Advanced platform capabilities can be a double-edged sword. For beginners, MT5’s sophisticated environment may pose challenges, particularly because some older MT4 Expert Advisors (EAs) will be inoperable.

OQtima Trader (Web & Mobile) was designed as the broker’s proprietary platform to give customers the best possible trading experience. For customers’ convenience, it’s available as a mobile app or a web browser, which is a great option for customers who want to trade anywhere.

It is also possible that certain exclusive features made especially for OQtima’s trading environment are available. Customization is possible, but OQtima doesn’t provide as much of it as is provided by MetaTrader, which also has a much larger community. Moreover, OQtima is the platform customers expect to improve and innovate most regularly.

Overview of Trading Fees At OQtima

OQtima provides good trading fees for various asset classes, particularly for share CFDs and cryptocurrencies. Based on testing carried out on January 16, 2025, across both London and New York trading sessions, OQtima had lower spreads for some trading instruments although for others, OQtima spreads were somewhat higher.

Spreads

OQtima had lower spreads on share CFDs during testing, spreads for Apple were 0.06 points and for Tesla 0.11 points. OQtima also had lower spreads for Bitcoin, $13 as compared to the industry average of $34.

For the currency pair, EUR/USD, the average spread was 1.2 pips which is close to the industry average, and for commodities, Gold and Oil, OQtima had average spreads.

However, for major indices, Dow Jones 30 and Germany 40, OQtima had higher spreads compared to the competition.

Swaps

OQtima does have overnight holding fees. For EUR/USD, a long position has a $6.21 fee which the trader has to pay and for the short position, the trader receives a $2.28 fee which is a credit.

For GBP/JPY, long positions have $14.32 credits and for short positions, the trader has to pay $33.60 which is considered average to slightly high. Swap fees do depend on current market interest rates and these rates do change.

Non-Trading Fees:

OQtima does not impose any fees for the handling of deposits and withdrawals, although third-party services might charge some. For inactivity, the broker charges a $20 monthly inactivity fee after an account has been dormant for six months. This fee will continue to accrue until the account has a positive balance or until trading activity resumes.

Account Fee Comparison:

OQtima’s two account types are ONE and ECN+. Each of these accounts also has a minimum deposit of $100. The ONE account has a 1.2-pip spread with no commission, which means that the account holder pays $12 for a full lot.

This indicates that the account holder will pay $12 in commission for a full lot in trading, which pays for a complete lot to be traded.

The ECN+ account has a 0.1 pip spread and charges $6 commission for a full lot in trading which means lent to the trader that total of $7 will be paid for the complete lot in trading which is ECN accounts are priced at the minimum of $8 for lots to be traded.

Competitiveness Assessment

OQtima’s trading fees are not only low in the market, but also offer benefits to the traders who work with share CFDs and cryptocurrencies.

Although spreads for commodities and indices are a bit higher compared to the market, the lack of withdrawal and deposit fees, predictable pricing, and affordable ECN+ account create a friendly atmosphere for traders.

OQtima Deposit and Withdrawal Options: Convenient and Flexible

OQtima offers several deposit and withdrawal methods: traditional banking, e-wallets, cards, and cryptocurrency, which gives traders multiple convenient options for funding their accounts.

Bank Transfer: Depending on your bank, processing might take between 1 to 5 business days. Transfer fees are different for each bank, so checking on your bank is a good idea. Accepted currencies include the USD, EUR, GBP and others.

Credit/Debit Cards (Visa, Mastercard): Deposit and withdrawal transactions are processed instantly or can take up to 24 hours. Fees are usually $0, but it is good to confirm with OQtima and your card provider. Supported currencies are the USD, EUR, and GBP.

E-Wallets (Skrill & Neteller): Transactions are instant and supported currencies are USD and EUR. There are small fees to be paid which are service fees and it is good to confirm those.

Cryptocurrencies: OQtima processes and accepts the major digital currencies: Bitcoin (BTC), Ethereum (ETH), and Tether (USDT). There are processing times which are set by the blockchain and there are network fees also.

These different options make the funding and withdrawal processes simple and easy. OQtima recommends their payment options page for the latest on processing times, fees, and supported currencies.

Regulation OQtima

Two different entities regulate OQtima. For Nordskov Capital Ltd, which is located in Cyprus, there is regulation by CySEC. This provides strong safeguards, including segregated accounts, negative balance protection, and an additional layer of deposit insurance of up to €20,000. For retail traders, leverage is capped at 30:1, which is quite common and considered safe.

For CDE Global Markets Ltd, there is regulation by Seychelles FSA. This provides higher leverage of up to 500:1, but the protections are less compared to the first entity. Hence, there is a greater onus on clients to consider the implications of the different levels of regulation for whichever entity they choose to trade under.

Pros and Cons of OQtima

Pros:

- Affordability: OQtima presents attractive pricing for economically sensible traders, providing low fees and commission costs. On its ECN+ account, traders receive 0.0 pip spreads and are charged only $3 for a round trip.

- Range of Tradeable Markets: OQtima caters for different customer needs by providing access to a multitude of different markets including forex, commodity, indices, stock, ETF and crypto trading.

- Free VPS: The offer of free VPS as a low-latency trading option for OQtima users is a perk, and particularly for traders who indulge in scalping and trading algorithms.

- Developed Trading Interfaces: OQtima users can access both MetaTrader 4 and 5 systems and can utilize the systems efficient automatic trading strategy features.

- Free Deposit and Withdrawal: OQtima offers cost efficiency to traders by not charging fees for deposit and or withdrawal.

Cons:

- Few Education Materials: Providing minimal educational content is a disadvantage for clients, specifically novice traders seeking orderly educational resources.

- Risky High Leverage: Leverage of 1:1000 may not be the best for less experienced traders as it will likely lead to huge losses.

- Weak Investor Protection: OQtima is regulated by CySEC and the Seychelles FSA which offer a lower standard of protection.

- Unproven Track Record: OQtima is relatively new as it was founded in 2023, meaning it hasn’t built a history which may decrease concerns about its dependability and vouchability.

- Mixed User Reviews: In addition, user experiences have been fairly reported, but concerns about accounts, access, and withdrawals have been reported which possibly demonstrate a lack of service reliability.

Conclusion

Conclusion – OQtima Review

OQtima is a modern derivatives broker that provides a range of tradable instruments that consist of assets from forex to cryptocurrencies, commodities, stocks, and even indices. What is worth mentioning about OQtima is that they offer some of the most competitive spreads and low commisions––especially on the ECN+ account, free VPS hosting which allows for low-latency trading, and the ability to use OQtima Trader along with all the other MT platforms.

Having been established in 2022, OQtima is a relatively new player in the industry having basic investor protection from CySEC and Seychelles FSA. OQtima has no limit on the transaction fees and handling fees, and their deposit and withdrawal options which includes cryptocurrencies.

OQtima is the best value for money on trading share CFDs, forex pairs, cryptocurrencies, and even CFDs, however, the spreads on indices and commodities are on the high side. Also, the high leverage comes with great risk and the lack of educational material for beginners may prove to be a disadvantage.

OQtima is a great option for new and more experienced traders that want advanced, flexible low-cost trading tools.

FAQ

What is OQtima?

OQtima is a financial derivatives broker founded in 2022, headquartered in Limassol, Cyprus. It offers over 940 tradable instruments, including forex, cryptocurrencies, commodities, stocks, and indices.

Is OQtima regulated?

Yes, OQtima is regulated by CySEC (Cyprus) and the FSA (Seychelles), providing basic investor protection, although it operates in multiple jurisdictions.

What trading platforms does OQtima offer?

OQtima supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary OQtima Trader platform (web and mobile), suitable for both beginner and advanced traders.

What are OQtima’s spreads and fees like?

OQtima provides low spreads on share CFDs and cryptocurrencies, average spreads on currency pairs and commodities, and higher spreads on indices. Swap fees are average to high, and there are no deposit or withdrawal handling fees.

What deposit and withdrawal methods are available?

Traders can fund accounts via bank transfer, credit/debit cards, Skrill, Neteller, and cryptocurrencies like BTC, ETH, and USDT. Processing times vary by method, with most e-wallets and cards being instant……….09