I will explain the Pendle Finance Airdrop, a great chance for DeFi fans to grab some free $PENDLE tokens. Pendle Finance comes with exciting innovations like tokenizing and trading future yields.

Which makes it an incredible addition to the decentralized finance space. This is a step-by-step guide on how to partake and increase your potential earnings.

What Is Pendle Finance Airdrop?

The Pendle Finance airdrop is a marketing campaign that allows Pendle’s users to get free PENDLE tokens which serves as an incentive towards engaging in community activities and onboard new users.

Pendle Finance is a DeFi (decentralized finance) platform that enables users to trade tokenized future yield. Through these airdrop campaigns, users can receive.

The Pendle tokens by participating in tasks like being part of the community, interacting with the platform, or by having particular assets. Such airdrops help the awareness and adoption of the protocol.

Users can keep track of upcoming Pendle airdrops by actively following Pendle Finance social media pages.

How to Participate in the Pendle Airdrop?

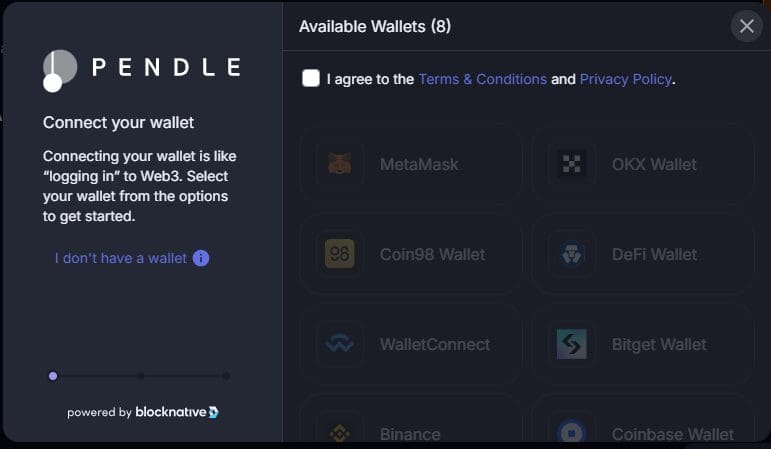

To take part in the Pendle Airdrop, execute the following actions:

Sign Up for an Account: Set up an account on an exchange that participates in the Pendle Airdrop, like Binance.

Identity Verification: Get verified using the KYC (Know Your Customer) procedure.

Token Staking: Stake your TUSD or BNB tokens in the Launchpool.

PENDLE Token Distribution: The quantity of tokens PENDLE you receive is proportional to tokens put in stake.

Token Claiming: After the airdrop time frame is over, collect the PENDLE tokens from the given exchange.

Core Technology

Yield Tokenisation

Split any yield-bearing asset into separate yield and principal components for maximum control

Pendle AMM

Designed for yield trading with concentrated liquidity, dual fee-structure, and negligible IL concerns

vePENDLE

Lock $PENDLE for a stake in the protocol.

Pendle Finance Airdrop Features

Really Easy Future Yield Tokenization

Pendle allows users to tokenize assets and trade them which, in turn, provides liquidity and helps them manage their investments.

Easy Token Principal & Yield Separation

The platform allows ownership of the underlying asset and the separation of the future yield, which means users can trade the yield tokens freely.

Optimization of Yield Markets

With Pendle, users are able to trade tokenized yield in both “yield markets” created by Pendle, enabling users to partake in speculative trade while also being able to manage risks.

Integration with Numerous Protocols

Pendle connects with various other DEFI protocols, thus allowing everyone to harness different sources of yield and boosting diversification.

Improvement of Integrated Advanced Yield Optimization

The platform provides tools for advanced yield optimization, thus enabling users to shift their investment strategy based on market conditions and changes in interest rates.

“ Educational Resources”

Pendle has recommended reading material to make navigating through the platform effortless and pertaining to understanding yield tokenization simple.

User-friendly interface

The platform comes with a plain yet advanced interface that makes complicated processes straightforward and easy for novice traders.

Future of Pendle Finance and $PENDLE Token

Pendle Finance: Its Future Looks Promising

Pendle Finance is changing the game by allowing users to tokenize and trade their assets’ future yields in the DeFi space. Its future looks promising with some key aspects listed below:

Distinct Methods of Trading Pendle Assets

Yield trading is no longer YET to be used independently, the principal along with the investment can also be used Pendle farming and trading can be altered with this innovation, and the way DeFi yield farming and yield trading is done is surely going to change.

Integration of Other Protocols

Users are now able to obtain several sources of yields thanks to Pendle’s integration with several protocols which allows for better earning opportunities.

Greater Yield Investing

Advanced Pendle users are provided tools that enable them to modify their optimization strategies and interest rates that are active in the market at the time.

Instructive Materials

Instructing materials are available on the platform making sure users are well prepared for yield tokenization processes.

Highly Accessible

The sophisticated processes are streamlined through the interfaces which makes the platform highly accessible to novice traders looking to try their hands in Pendle crypto, whilst not alienating advanced users.

Looking Ahead to The $PENDLE Token’s Future

The Pendle Finance ecosystem relies heavily on the $PENDLE token’s ecosystem, which focuses on the economy of yield. In the following, we shall try to analyze the important points regarding its future :

Future Yield Trading

The tokenization and future yield trading features provided by the $PENDLE token gives the users a greater degree of autonomy over their investment.

Pricing and Trading Approach

The creation of distinct markets for both the principal and yield tokens helps market participants trade with better price and increases overall liquidity and eficiency.

Investing for the Best Return

The token $PENDLE enables participants to use different risk management techniques for their returns through multiple yield optimization tactics.

Long-Term Demand and Market Value

The expansion of the DeFi ecosystem is expected to enhance the demand for advanced trading solutions like Pendle Finance, which could, in turn, increase the value of the $PENDLE token.

Ecosystem Development:

The $PENDLE token can also be used to govern the Pendle Finance platform, which allows holders of the token to influence the operational decisions and the overall direction of the platform.

Pendle together with the $PENDLE token will undoubtedly add new tools for yield trading and optimization in the DeFi Ecosystem.

Considerations and Risks

Regulatory Risk: Owing to changing regulations, the value or legality of value Pendle Finance, and by extension, $PENDLE token, may be affected. Always be vigilant about the pertinent regulations.

Technological Risks: The underlying blockchain of Pendle Finance is susceptible to bugs, vulnerabilities, and technical failures. These risks may affect the platform’s performance and investment holdings.

Market Sentiment: Investor behavior and market sentiments can have an impact on $PENDLE’s value. Bad news, market trends, and several other factors can lead to a downward price change for the token.

Security: Be sure to store your $PENDLE tokens in a secure location. Use trusted wallets, enable two-factor authentication, and be aware of phishing attacks and scams.

Volatility: $PENDLE is subject to the same drastic fluctuations that define the crypto space so be ready to weather losses along with the wins.

Liquidity: Even though Pendle Finance confirms it seeks to facilitate liquidity via yield markets there are periods where liquidity is shallow which restricts users from buying and selling $PENDLE tokens under favorable conditions.

Integration Risks: Pendle Finance is connected to various other DeFi protocols. The downside of this multifaceted integration is the added risk involved with these protocols, as any issue or vulnerability within them can affect the entire system.

Yield Volatility: The revenue from staking or liquidity provision comes with expected yield but is subject to market conditions and interest rate changes. Investments in this sphere should be anticipated with volatility in earnings.

Investment Focus: Make sure to focus your investment strategy on looking at one specific area. No matter if you decide on dollar-cost averaging, a lump sum investment or diversification, all approaches come with their own pros and cons.

Doing Your Homework: Before attempting to partake in the airdrop or even spend funds on investing in $PENDLE, make sure to do your homework. Get to know the fundamentals of the project’s team and understand all associated risks.

Conclusion

Engaging in Pendle Finance’s airdrop offers the chance to receive new tokens while learning novel DeFi strategies. Pendle Finance’s methods for Yield tokenization and future yield trading ensures liquidity and flexibility for the investors.

Knowing how to participate, what the airdrop features are, and what risks accompany the airdrop will help you make the right decisions and gain the most from this exciting initiative.

The growth of the DeFi ecosystem will greatly benefit Pendle Finance and the $PENDLE token. It is also important to analyze thouroughly, monitor the market, or get professional help in order to successfully maneuver the intricacies of the cryptocurrency world.