Prop firms that accept traders from Poland are giving Poles the chance to access large amounts of money without putting their own money at risk.

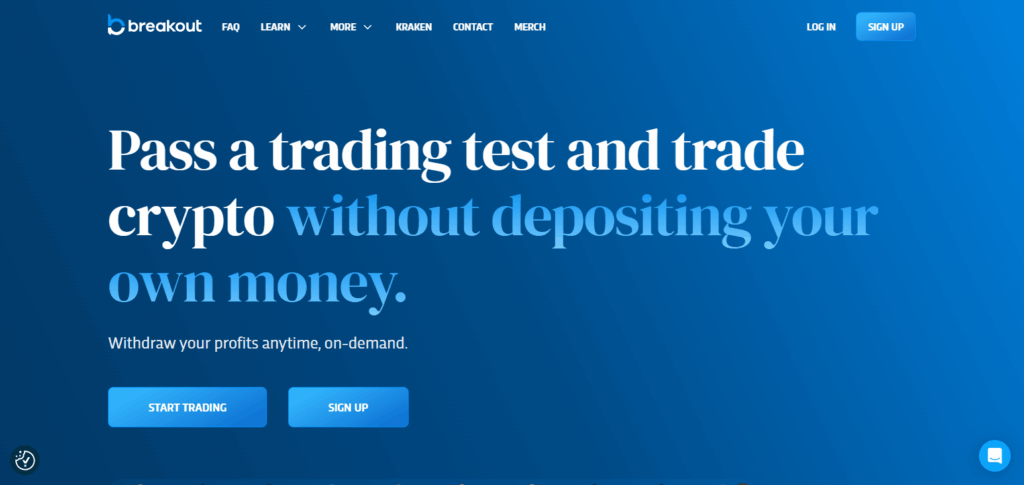

Leading firms like FTMO, Breakout, and Topstep are giving traders structured assessments, safe trading platforms, and reasonable profit split.

By applying their discipline and risk management skills, Poles can advance their trading careers in global markets. Opportunities for obtaining funds are more available and empowering than ever before.

What is Prop Firms?

A prop firm, short for proprietary trading firm, is an institution that offers traders its own capital to trade different financial markets including forex, derivatives, cryptocurrency, equities and futures.

They offer traders the opportunity to trade without risking personal capital, although, requires passing an evaluation to demonstrate their trading skill, discipline and risk management. In return, these traders keep 70% to 90% of the profits made.

Prop trading firms provide highly regulated trading practices, safe account management and trading infrastructure, and account scaling which makes them a great option for new and advanced traders looking for funded trading accounts.

Key-Point

| Prop Firm | Key Points / Highlights |

|---|---|

| FTMO | Reputable global prop firm, offers forex/indices/commodities, two-step evaluation, scaling up to $2M, clear trading objectives |

| Topstep | Focused on futures, two-step evaluation, strict risk management, coaching & community, weekly payouts |

| Funded Next | Multiple account sizes, flexible trading rules, low evaluation fees, quick funding, supports forex/crypto/indices |

| Traddoo | Emerging firm, remote evaluation, forex & crypto focus, transparent profit split, beginner support |

| FTUK | UK-based, specializes in forex, evaluation like FTMO, scaling plan, risk management tools |

| FundingPips | Security-focused, strong KYC & fraud prevention, multiple account options, clear profit split, forex & crypto markets |

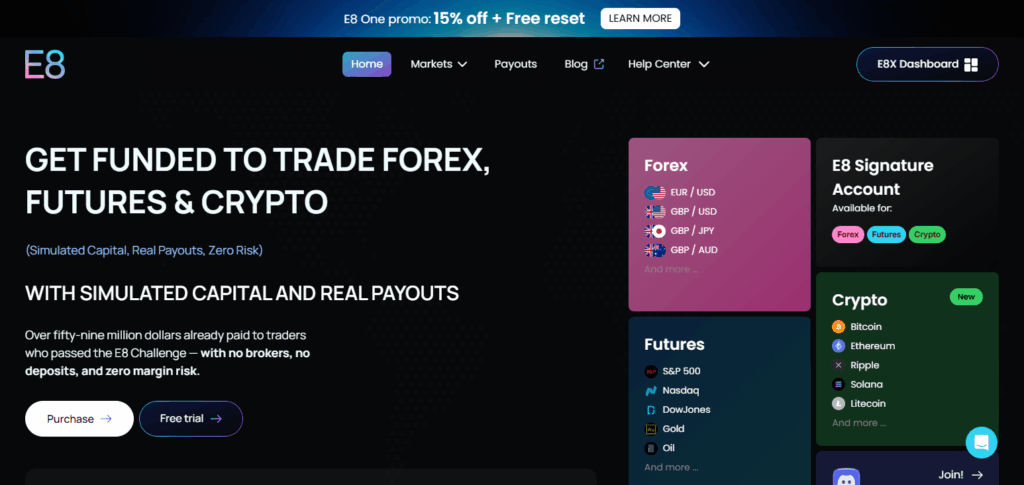

| E8 Markets | Instant funding, forex & indices, flexible rules, multi-platform support, community guidance |

| QT Funded | Quick evaluation, forex & crypto, multiple account tiers, competitive profit split, beginner-friendly |

| Breakout |

1. FTMO

FTMO is one of the most Prop Firms That Allow Traders From Poland, specializing in forex, indices, commodities, and cryptocurrencies. Traders must pass a two-step evaluation, including the Challenge and Verification phases, testing risk management, discipline, and consistency.

FTMO offers competitive profit splits, typically 80-90%, with scaling opportunities up to $2 million for consistent performers. Traders can use popular platforms like MetaTrader 4, MetaTrader 5, and cTrader, with robust account security, including two-factor authentication and encryption.

The firm provides detailed performance analytics, clear trading objectives, and quick payouts. Mid-paragraph mention: FTMO’s structured evaluation and strong support system make it a benchmark in the prop trading industry.

FTMO Features

- One of the most well-known prop trading firms.

- Trades forex, indices, commodities, and crypto.

- Two step evaluation consisting of the Challenge & the Verification.

- 80–90% profit split.

- Scaling plan up to 2 million for consistent traders.

- Uses MetaTrader 4, MetaTrader 5, and cTrader.

- Good account security and comprehensive account analytics.

2. Topstep

Topstep Prop Firms That Allow Traders From Poland. After completing their two-step evaluation, they allow traders to fund trading accounts. There is an 80% profit split and profits can be accessed on a weekly basis, which means traders can make spending money every week. Topstep works with NinjaTrader, Tradovate, and CQG trading platforms.

They have security measures in place that include account verification and secure data protocols. They have strict active loss management with daily and maximum loss limits in place which means they will be in close contact with you while you are trading.

They provide risk coaching webinars, and community support. Mid-paragraph mention: They are also the only traders who have been given a profit-shared evaluation process and transparency approach likened to FTMO which is because of the discipline seen in their techniques.

Topstep Features

- Focuses primarily on futures trading.

- Two step evaluation.

- Has strict risk management (daily and max loss limit).

- Funded traders receive weekly pay.

- Has coaching and provides community support.

- Uses NinjaTrader, Tradovate, and CQG.

3. Funded Next

Funded Next Prop Firms That Allow Traders From Poland has different account sizes that fit the needs of different professional levels which are also good for forex, crypto, and indices. The profit split on these accounts is 70-85% and is determined by the account size.

They provide accounts based on MetaTrader 4, MetaTrader 5, and cTrader. Funded Next accounts also have security protocols which include 2-factor authentication. Funded Next offers fast funding after the evaluation which is critical in having flexible trading rules.

They also provide clear guidelines and active performance tracking to make it easy for traders to remain profitable while moving along the predetermined profit path.

Mid-paragraph mention: They have a similar approach to FTMO in that they also emphasize consistency in trading and discipline in risk management.

Funded Next Features

- Offers different account sizes to support traders of different levels.

- Forex, crypto, and indices have relaxed trading rule.

- Has low evaluation cost.

- Quick to fund after evaluation completion.

- 70–85% profit split.

- Uses MetaTrader 4, MetaTrader 5, and cTrader.

- Has secure accounts with performance tools.

4. Traddoo

Traddoo Prop Firms That Allow Traders From Poland is a new proprietary trading firm servicing forex and crypto markets. Traders are subjected to a remote assessment and are able to receive accounts with a 70-80% profit split.

Traders can use MetaTrader 4, MetaTrader 5 and web based accounts. KYC regulatory compliance and KYC encryption are used to ensure account safety. For transparency, Traddoo offers fixed trading objectives, flexible and clearly defined risk rules.

As a new comer, support and community collaboration are critical to your trading. Mid paragraph is: Similar to FTMO, Traddoo places a great emphasis on evaluation and performance monitoring to guarantee traders gain access to consistent funding and profits.

Traddoo Features

- New prop firm with a focus on forex and crypto.

- Evaluations can be done remotely.

- Clear and transparent 70–80% profit split.

- New traders receive support with community mentoring.

- Loose trading rules.

- Uses MetaTrader 4, MetaTrader 5, and a web-based platform.

5. FTUK

FTUK Prop Firms That Allow Traders From Poland is a UK based proprietary trading firm that is primarily focused on the forex market. For traders, the evaluation is structured in a similar format to FTMO, with each trader having clearly defined daily and maximum loss limits.

For profit splits, the firm offers 75-85%, additional scaling is available for high achieving traders. FTUK offers MetaTrader 4 and 5 and account safety is protected by encryption. Fast payouts risk management tools, and guidance in clear trading rules are offered to traders in all funded accounts.

Mid paragraph is: FTUK imitates the structured method of FTMO in a way that strives to equally balance strict evaluation criteria with the opportunity for traders to scale account and profit.

FTUK Features

- UK-based proprietary trading firm with a focus on forex.

- Evaluation process follows the same standards as FTMO.

- Scaling plans for traders who perform well.

- Profit split: 75–85%.

- Use MetaTrader 4, MetaTrader 5, and risk management tools.

6. FundingPips

FundingPips emphasizes safety and clarity, implementing rigorous KYC and anti-fraud measures. It caters to forex and crypto traders, offering 75-85% profit splits. Traders utilize MetaTrader 4, MetaTrader 5, and cTrader and receive detailed guidelines, along with risk management and funding procedures.

Fast evaluations and multiple account options 도움. Mid paragraph mention: Like FTMO, FundingPips underscores accountability, disciplined trading, and protecting both the traders and the firm with clear profit-sharing structures.

FundingPips Features

- Extremely devoted to safety with robust KYC and fraud prevention.

- Account options for both crypto and forex.

- Profit split: 75–85% with trading rules that are easy to adjust.

- Use MetaTrader 4, MetaTrader 5, and cTrader.

- Evaluation rules are simple and funding is fast.

7. E8 Markets

E8 Markets services forex and indices. They provide instant funding to qualifying traders after which profit splits are 70-85% based on performance. Accounts are secured with encryption and verification.

They also support MetaTrader 4, MetaTrader 5, and cTrader. E8 Markets provides flexible trading rules, scalable accounts, and peer support.

Mid paragraph mention: E8 Markets, like FTMO, promotes the philosophy of structured evaluations and transparency, enabling traders to securely build profit-productive funded accounts.

E8 Markets Features

- After evaluation, provides instant funding.

- Profit split: 70–85%.

- Community guidance with account scaling.

- Use MetaTrader 4, MetaTrader 5, cTrader to trade forex and indices.

- Values transparency on trader growth.

8. QT Funded

QT Funded Prop Firms That Allow Traders From Poland executes fast and simple evaluations for forex and crypto traders, with various account levels to choose from. The account profit splits are 70% to 85% which is favorable for the traders.

The accounts are compatible with MetaTrader 4, MetaTrader 5, and online trading applications. KYC and account encryption means that traders’ accounts will uphold the highest safety standards.

The firm emphasizes the importance of discipline in trading and risk management and places a high priority on safely instructing rules. QT Funded resembles FTMO in incorporating a structured evaluation system along with clear rules and transparent profit sharing, enabling trader success.

9. Breakout

Breakout Prop Firms That Allow Traders From Poland that gives traders the chance to manage large amounts of capital without risking their own money. Traders can receive funded capital of up to $200,000 simply by passing a performance evaluation. Being backed by one of the largest crypto exchanges, Kraken, ensures the firm’s liquidity and trustworthiness.

Breakout Prop Trading is geographically inclusive so traders from Poland can also participate in the firm’s evaluation and receive a funded account once they pass. The firm’s evaluation system provides Polish traders access to the international crypto trading markets at an unprecedented scale.

Breakout Features

- Trading firm focused on crypto that is prop backed by Kraken.

- Choose between a 1-step or 2-step evaluation.

- Profit split: 80–90%.

- Trade and track performance on the mobile app.

- KYC accounts are secure, and payments are in crypto.

- Deep liquidity through Kraken exchange.

Conclusion

What is a prop trading firm?

A prop trading firm provides traders with access to company capital to trade forex, crypto, indices, or futures. Traders do not risk their own money but must pass an evaluation to manage funded accounts.

Can traders from Poland join prop trading firms?

Yes. Many prop firms, including FTMO, Topstep, Funded Next, Traddoo, FTUK, FundingPips, E8 Markets, Breakout, and QT Funded, accept traders from Poland. These firms ensure compliance with regional regulations and allow Polish traders to participate in global markets.

How do I get funded?

Traders must pass an evaluation process, usually consisting of one or two steps (Challenge & Verification). The evaluation tests trading skills, risk management, and consistency before granting access to a funded account.

What profit split can I expect?

Most prop firms offer profit splits between 70% and 90%, depending on the account type and performance. For example, FTMO and Breakout provide up to 90% profit share, while newer firms like Traddoo and QT Funded offer 70–85%.

Which trading platforms are supported?

Common platforms include MetaTrader 4, MetaTrader 5, cTrader, NinjaTrader (for futures), and web or mobile apps like Breakout’s app. Polish traders can choose the platform they are most comfortable with.