In this article, I will examine the prop firm that suffered the most significant drawdown, which is a kind of trading firm that enables traders to take more risk while keeping a tight leash on the market’s swings.

These firms offer great leeway, accommodating different types of trading and providing a path to increase capital consistently. Traders can take advantage of disciplined risk management techniques by learning the unique characteristics of these firms.

What is prop firm?

A prop firm, or proprietary trading firm, is a type of business which gives traders access to capital to trade in financial markets, including stocks, forex, or crypto, for the firm’s benefit. Rather than relying on personal capital, traders use the firm’s funds, and financial returns are usually distributed between the firm and the trader.

Prop firms also offer training, advanced trading tools, as well as risk management support. While the potential can be a boon to business, the firm enforces strict performance and risk limits, requiring discipline to succeed.

How To choose prop firm with the largest drawdown

Paying attention to all aspects is critical when selecting a prop firm that offers the highest drawdown limit. Here are some of the most important aspects to consider:

Maximum Drawdown Limit: Prioritize businesses that have a higher drawdown limit, as this increases flexibility before a stop-loss is triggered.

Profit Split: Ensure the profit-sharing ratio remains favorable even when drawdown limits are larger.

Trading Rules: Verify if the firm accepts your preferred style of swing or high-risk trades.

Funding and Scaling: Establish if the firm offers the ability to scale up the capital after achieving consistent results.

Reputation and Support: Look into the reviews, training, and risk management offered to ensure safer trading.

Key Point & prop firm with the largest drawdown List

| Prop Firm | Key Points |

|---|---|

| FundingPips | Within the realm of proprietary trading, Fundingpips is noted for providing some of the most accommodating funding programs available |

| PipFarm | Flexible funding, supports swing trading, moderate drawdown |

| E8 Markets | Forex & crypto trading, strong risk management, fair drawdown |

| FundedNext | Multiple account sizes, scaling plan, flexible trading rules |

| Alpha Capital Group | High-volume trading allowed, clear rules, larger drawdown |

| Fintokei | Beginner-friendly, demo account available, standard drawdown |

| FunderPro | Fast approval, daily risk monitoring, limited drawdown |

| Funded Trading Plus | Daily & overall drawdown limits, good customer support |

| Top One Trader | Multiple funding levels, flexible trading styles |

| MyFundedFutures | Futures-focused, high leverage, larger drawdown |

| Smart Prop Trader | Funded accounts with training, moderate drawdown |

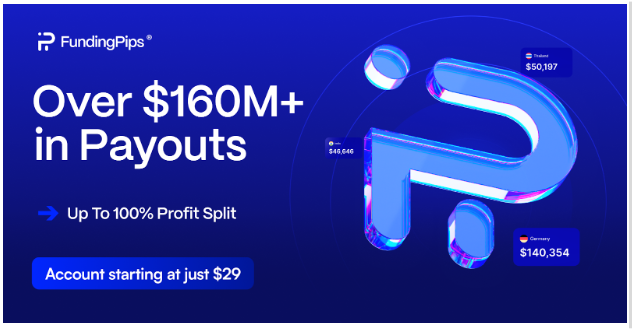

1. FundingPips

Within the realm of proprietary trading, Fundingpips is noted for providing some of the most accommodating funding programs available, while simultaneously ensuring it is one of the largest drawdowns in the industry.

The drawdown limits at Fundingpips necessitate risk management on the trader’s part to avoid account loss,. However, the drawdown policy is what attracts experienced traders.

The comprehensive trading policies, rapid withdrawal systems, and overall functional design of risk management at Fundingpips makes it one of the most sought after prop trading firms for risk-disciplined traders looking for large amounts of capital to trade in high-risk environments.

Payouts: Over $160 Million

Payout cycles: Total 6 Payout Cycles.

- For 1 step and 2 Step (Monthly 100%, Bi-weekly 80%, Tuesday 60%, On-demand 90%)

- 2 Step Pro (Daily 80%, Weekly 80%)

- FundingPips Zero/Instant (Bi-weekly 95%)\

USPs:

- No payout denial (Track record of 0 payout denial)

- 29,900 Reviews on Trustpilot (4.5 stars)

- Up to100% Profit split

- Account starting at just $29

- Over 100K+ traders

- Flexible Payout Cycles

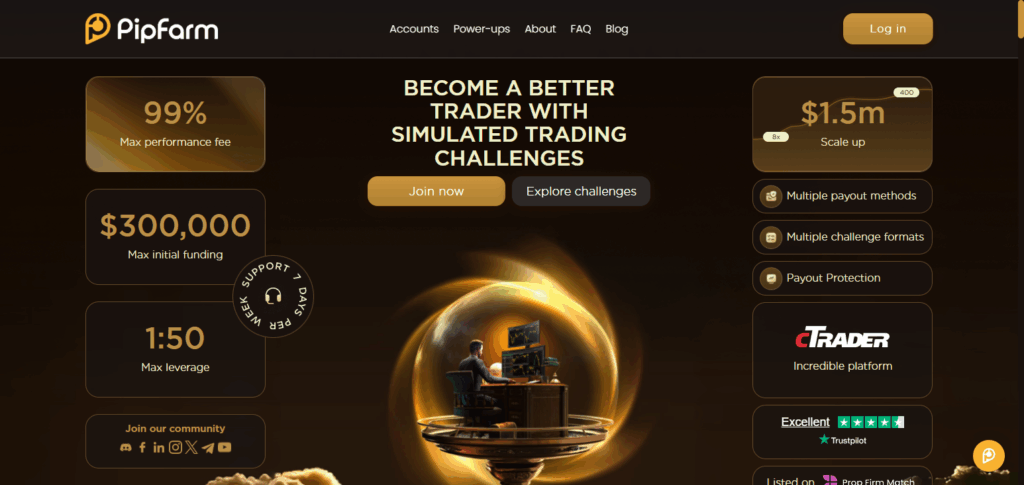

1.PipFarm

PipFarm is a proprietary trading firm recognized for having one of the largest drawdown limits in the industry. This is beneficial for traders with more complex and flexible strategies. Unlike firms with strict low drawdown limits, PipFarm permits greater manged market movement with delayed account suspension, lending itself to more calculated risk-taking.

A blend of ample funding, flexible trading conditions, and allowance of swing and intraday trading make PipFarm a go to firm for traders looking for discipline alongside freedom in proprietary trading.

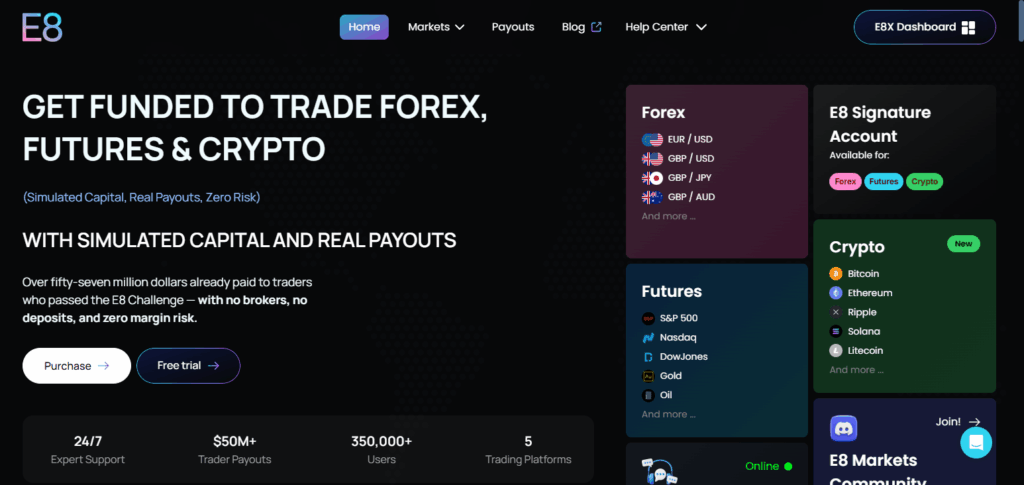

2.E8 Markets

E8 Markets is a prop firm well-known for its generous drawdown limit which allows traders to implement more sophisticated trading strategies without the risk of hitting limits. It’s unique strength comes from the integration of strong risk management features alongside flexible account configurations that enable traders to mitigate the impact of market turbulence.

With its support for both forex and crypto trading alongside its generous drawdown limits, E8 Markets is, without a doubt, a forex traders dream, as profits can be maximized while risk exposure is controlled.

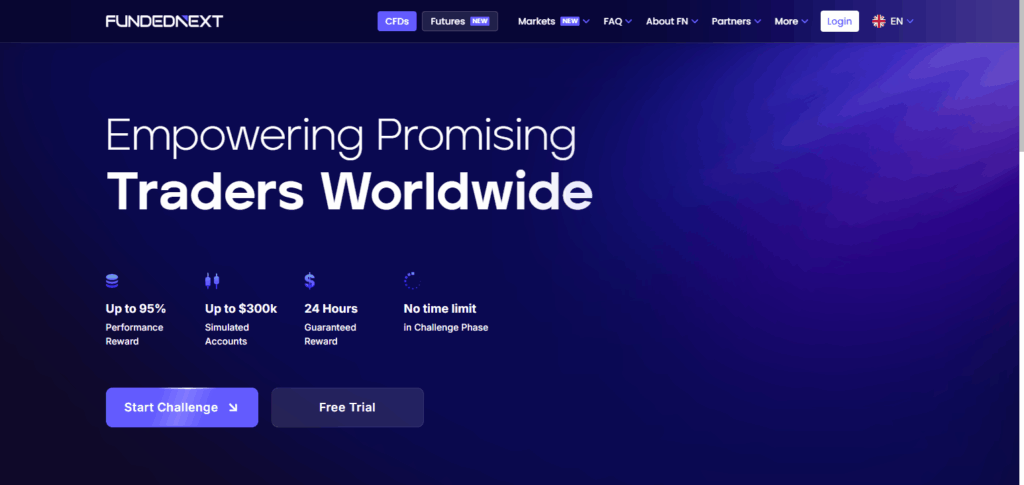

3.FundedNext

FundedNext differentiates itself from others with one of the largest drawdown limits offered in the industry, providing considerable breathing room for traders during volatile market conditions. Its distinct edge lies in the combination of multiple account sizes provided along with a proper scaling plan, enabling traders to increase their capital in a stepwise manner while sustaining considerable losses without outright account termination.

FundedNext’s clear rules and strong protective risk management features allow traders to implement multiple strategies and thus makes FundedNext a go-to firm for traders who are drawn to a lot of the freedom, growth potential, and lenient environment.

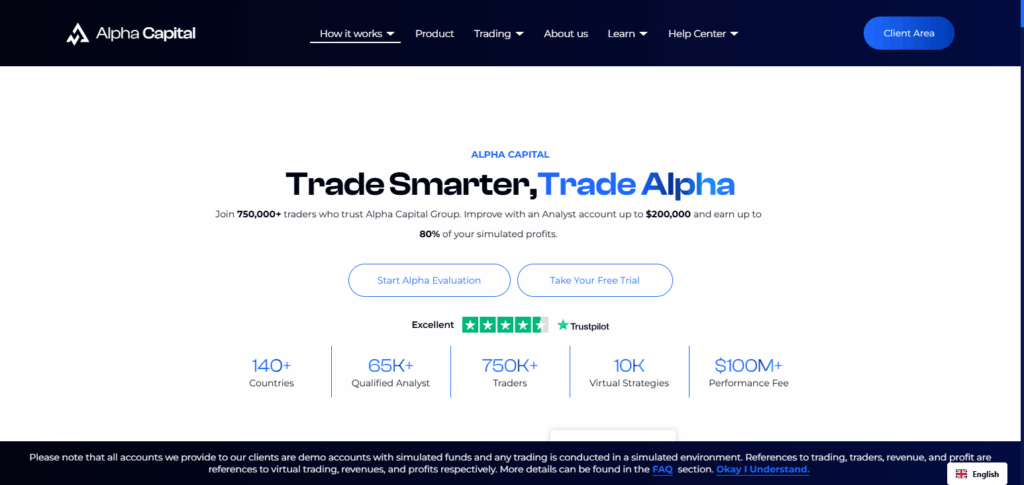

4.Alpha Capital Group

Alpha Capital Group is a prop company famous for its high drawdown limits, which enables traders to accommodate greater market fluctuations without suffering immediate damage. Its unique advantage comes from permitting high-frequency trading as well as transparent and trustworthy policies which allows traders to operate freely.

Alpha Capital Group enhances disciplined trading by offering high drawdown limits coupled with comprehensive trading flexibility, professional assistance, and high volume trading, which empowers traders to navigate volatility and maximize profit potential. This company is ideal for traders who value a blend of autonomy alongside discipline.

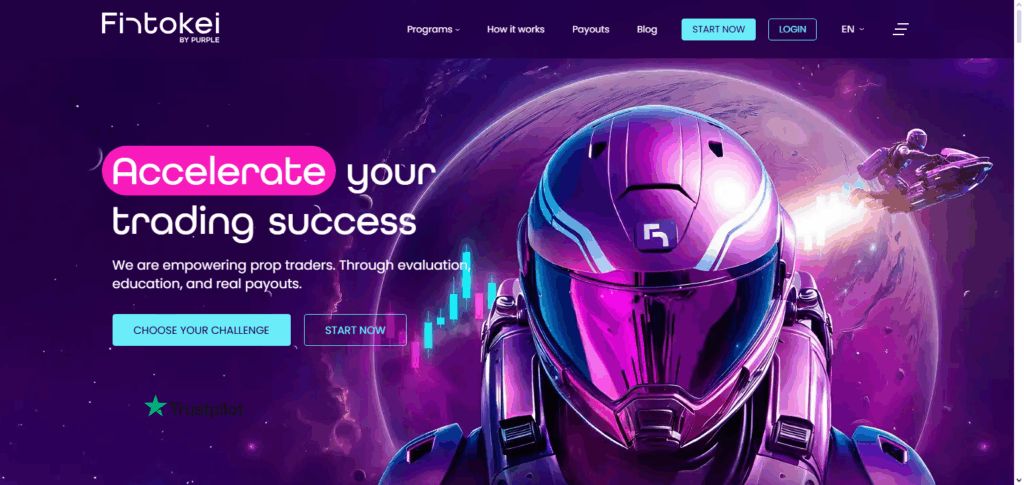

5.Fintokei

Fintokei is a prop firm known for having one of the largest drawdown limits which gives its traders more room to maneuver during trading. Fintokei’s unique strength is its easy entry for novice traders while still catering to seasoned traders who prefer to employ advanced strategies like swings and intraday trading.

With high drawdown limits on the demo accounts and well-defined trading policies, Fintokei helps traders to practice, learn, and develop with confidence. This equilibrium of leniency and guidance is most appealing to traders looking for both independence and a nurturing trading atmosphere.

6.FunderPro

FunderPro prop firm is well-known for its generous drawdown limits which allows its traders to maneuver through the market volatility without being on a constant edge. Its distinguishing trait is the rapid approval system in combination with real-time risk assessment, which enhances the safety of traders while giving them the freedom to start trading immediately.

With the drawdown limits set very high alongside various trading conditions, it becomes very easy for even novice traders to learn while risk is minimized, and for seasoned traders to refine their trading techniques which is precisely why FunderPro is many traders’ saw choice to seek flexibility alongside safety.

7.Funded Trading Plus

Funded Trading Plus is a proprietary trading firm (prop firm) distinguished by its high drawdown limits. This gives its traders the ability to track and manage larger market fluctuations. What sets the firm apart is its combination of daily and overall drawdown limits, a hybrid system that provides traders both flexibility and controlled risk.

Funded Trading Plus offers multiple account types, adept customer support, and clear trading policies, which empowers traders to formulate diverse strategies and steadily increase their account balances. This ideal balances both autonomy and risk control; bearing enhanced accountability is perfect for determined and disciplined traders.

8.Top One Trader

Top One Trader is a prop trading firm noted for offering some of the largest drawdown limits available, affording traders remarkable latitude to navigate volatility. Its distinct advantage is the offering of different funding tiers, accommodating diverse trading approaches from intraday to swing trading.

Top One Trader stands out as the prop firm that best enables measured risk-taking through disciplined trading with a well-crafted account structure, reasonable rules, and good drawdown limits, making steady capital growth possible and the firm ideal for disciplined traders looking to advance.

9.MyFundedFutures

MyFundedFutures is a proprietary trading firm noted for its generous drawdown limits which is ideal for traders dealing with volatile instruments such as futures. Its best feature is its focus on futures trading with high leverage which enables traders to take substantial positions while minimizing risk.

By offering high drawdown limits, varied account types, and professional assistance, MyFundedFutures allows traders to refine sophisticated strategies, maintain a steady bslance between risk and reward, and grow their funded trading accounts in a challenging and highly rewarding environment.

10.Smart Prop Trader

Smart Prop Trader is a prop trading company that is well known for one of the largest drawdown limits offered among prop firms, enabling traders to implement a broad range of strategies without the constant threat of account termination.

The company uniquely integrates funded accounts with training programs, making it possible for both novice and professional traders to learn and enhance their trading skills while enjoying considerable freedom.

Smart Prop Trader allows disciplined traders to navigate through market volatility with confidence and steadily build their accounts with generous drawdown limits, professional instruction, well-defined trading parameters, and sound professional support.

Pros & Cons

| Pros | Cons |

|---|---|

| Greater Flexibility: Traders can take larger positions and handle market swings without hitting limits immediately. | Higher Risk Exposure: Larger drawdowns can lead to bigger losses if risk is not managed properly. |

| Supports Diverse Strategies: Suitable for swing, intraday, and high-risk trading styles. | Discipline Required: Traders must maintain strict risk management to avoid account blowouts. |

| Better Learning Opportunity: Allows traders to test strategies in real market conditions with more room for error. | Potential Emotional Stress: Larger drawdowns can create psychological pressure during losing streaks. |

| Increased Growth Potential: Traders have more opportunity to scale accounts over time. | Not Beginner-Friendly for Some: Traders without experience may struggle despite larger drawdown limits. |

Conclusion

Proprietary firms with the highest drawdown limits offer traders unparalleled freedom to maneuver through market fluctuations, test different strategies, and optimize profit potential without facing immediate consequences.

Such firms are most suitable for traders who are risk-averse and possess high self-discipline. Although higher drawdown limits expose traders to greater potential losses which requires solid emotional management, the potential for personal and professional development is significantly higher. In long-term trading, selecting the right prop firm with generous drawdown limits may be the most important factor for success.

FAQ

What is a prop firm with a large drawdown?

A prop firm with a large drawdown allows traders to lose a higher percentage of their funded account before hitting risk limits, giving more flexibility in trading.

Who should choose these firms?

Traders with experience, discipline, and risk management skills who want freedom to test strategies and handle market swings.

What are the advantages?

Larger drawdowns offer flexibility, growth potential, and the ability to implement diverse trading strategies.