In this article, I will discuss the Best Bridging Aggregators for Easiest Stablecoin Transfers with a focus on the best cross-chain transaction platforms.

These aggregators improve the speed of the transfer, minimize the costs, and further strengthen the security of users moving stablecoins across numerous blockchain networks. Let’s look at the most advanced solutions for multichain interoperability.

Key Point & Top Bridging Aggregator For Fast Stable Coin Transfers List

| Platform | Key Point |

|---|---|

| Rango Exchange | Multi-chain DEX and bridge aggregator supporting various networks. |

| Swing | Cross-chain liquidity transfer platform for fast asset movement. |

| ChainArq | Focuses on secure and efficient blockchain interoperability. |

| Synapse Protocol | Offers cross-chain swaps, messaging, and liquidity pools. |

| Across Protocol | Optimized for fast and low-cost bridging between Ethereum L2s. |

| Stargate Finance | Uses LayerZero technology for seamless native asset transfers. |

| Celer cBridge | Provides fast and low-fee cross-chain liquidity bridging. |

| Hop Protocol | Specializes in scaling Ethereum with quick L2-to-L2 transfers. |

| Multichain (Anyswap) | One of the largest cross-chain routers for various assets. |

| Portal Token Bridge | Wormhole-powered bridge for token transfers across blockchains. |

1. Rango Exhange

Rango Exchange, a Rango branded Fast Multi-Chain DEX, allows users to move and trade assets, including stablecoins, throughout various blockchains.

Rango automatically integrates many bridges and liquidity sources, ensuring optimal routes for transactions and decreasing fees while also speeding up transaction times.

Its user-friendly interface with multiple network capabilities makes it a go to platform for fast and cost effective transfers of stablecoins.

Rango Exchange Features

- Multi-Bridge Aggregation – Combines several bridges to locate the lowest and quickest transfers.

- Wide Blockchain Support – Several Layer 1 and Layer 2 networks are supported.

- Stablecoin Optimization – Effortlessly secures stablecoin transfers at low rates.

- Smart Routing – A smart algorithm designed to improve transactions on a user’s behalf.

- User Friendly Interface – Cross-chain transfer process is enhanced at large.

2. SWING

Swing is an aggregator across chains for bridges focusing on developers and users interested in seamless movement of assets in different blockchain ecosystems.

It specializes in delivering fast and secure transactions while minimizing slippage. Swing’s protocol targets traders and liquidity providers stressed out in need of fast transactions.

It provides optimization to Stablecoin transfers by utilizing best routes through integrated bridges across Layer 1 and Layer 2 networks.

Swing Features

- Cross-Chain Liquidity Aggregation – Bestowers the finest stablecoin liquidity pools within differing networks.

- Fast and Low-Cost Transfers – Transfers and gas charges are minimal.

- Seamless Integration for Developers – Simple integration for dApps using the API and SDK.

- Multi-Network Support – The application works on more than one blockchain and most of the L2 solutions.

- Secure Transactions – Centralized verification is replaced with advanced security measures.

3. ChainARQ

ChainARQ is a trusted blockchain interoperability platform with an emphasis on security and efficiency for minimal supervision. It enables cross-chain stablecoin transfers while focusing on limiting the risk of impermanent loss as well as transaction failures.

ChainArq utilizes routing mechanisms and helps ensure that the trades he/she does want to make can be acted on through the smooth moving of assets between different ecosystems.

ChainArq Features

- High-Security Interoperability – Employs encryption and decentralized validation for enhanced security.

- Fast Settlement Times – High speed transactions and low latency on stablecoin transfers.

- Multi-Chain Compatibility – Assets are bridged across major blockchain ecosystems.

- Low Slippage Transfers – Secures predictable prices for stablecoin swaps.

- Reliable Liquidity Management – Ensures consistent smooth cross-chain liquidity.

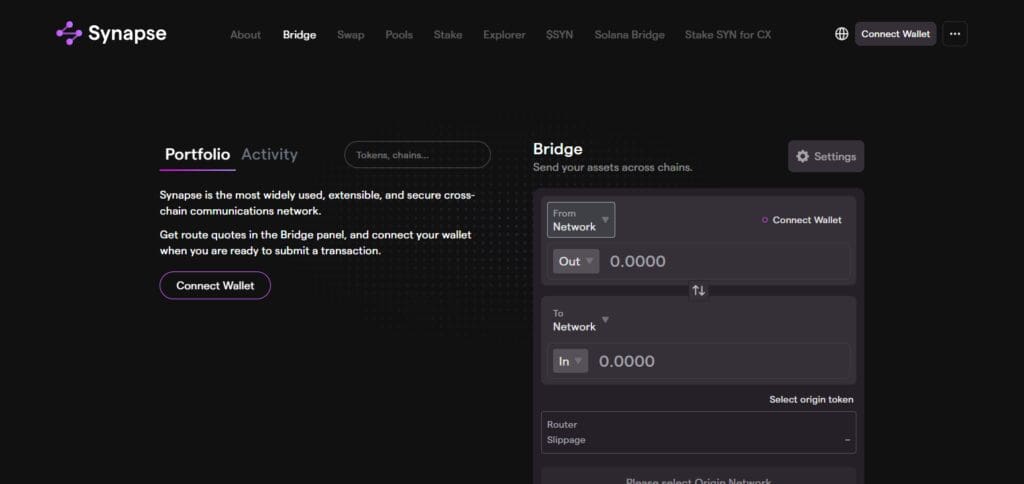

4. Synapse Protocol

Synapse Protocol helps perform seamless, cross-chain movements of digital assets and to implement transactions on chain without the extra hassle of specially tailored token bridges.

The Synapse Protocol will interoperate with native woody chains to combine the best from both worlds.By utilizing its liquidity pools, it enables users to perform stablecoin swaps at extremely low fees with lightning-fast speed.

Synapse also supports Ethereum, Binance Smart Chain, and several other Layer 2 blockchains, making it very popular among DeFi proponents and enthusiasts.

Synapse Protocol Features

- Deep Liquidity Pools – Allows for easy liquidity when swapping stablecoins.

- Minimal Transaction Fees – Cost-effective Transfers due to an efficient fee structure.

- Multi-Chain Bridging – Available on Ethereum, Avalanche, Binance Smart Chain, and others.

- Cross-Chain Messaging – Supports advanced cross-chain functionality beyond simple transfers.

- Fast Confirmation Times – Speeds up waiting times for specific transactions.

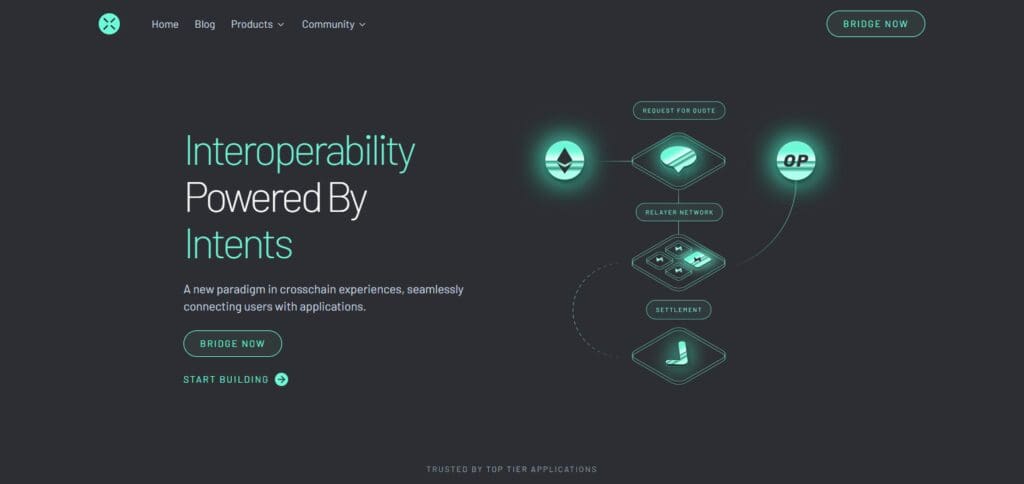

5. Across Protocol

Across Protocol is specialized for bridging stablecoins and other assets transfer between Ethereum Layer 2s (L2s) with perfection. It combines relay mechanism and liquidity mining to increase adoption while decreasing the costs and time associated with crossing boundaries.

This protocol holds the reputation for one of the quickest and least expensive ways to transfer stablecoins between rollups and Ethereum mainnet, so it is mostly used by DeFi asset managers who work with many chains.

Across Protocol Features

- Optimized for Layer 2 Transfers – Focuses on bridging from rollup to rollup in Ethereum.

- Low Cost Transactions – Lowers gas fees associated with stablecoin transfers.

- Fast and Secure Relayers – Uses an advanced relayer system for high-speed settlement.

- Decentralized Governance – Members of the community can enhance the protocol’s features.

- Efficient Liquidity Management – Smooth transfers are guaranteed by rewarding liquidity providers.

6. Stargate Finance

Stargate Finance is a fully fledged cross-chain liquidity protocol based on the innovative and pioneering Layer Zero number technology that supports swift cross-chain transfers of non-natively supported assets.

Instead of having to convert coins into wrapped assets like most standard bridges, Stargate makes it possible to move stablecoins without incurring a loss because of low liquidity.

Stargate’s liquidity pools ensure sufficient liquidity for ideal swapping rates. Their bridge operates using “single transaction” mode, allowing the stablecoins to be sent directly from Ethereum, Avalanche, Binance Smart Chain networks and others seamlessly.

Stargate Finance Features

- Native Asset Transfers – Transfers of stablecoins don’t require wrapped tokens.

- Single Transaction Bridging – A transfer that takes place in one step, reducing hassle.

- Omnichain Support – Interoperability of multiple blockchains is possible since it is built on LayerZero.

- Instant Finality – Transactions are quickly confirmed, leaving no opportunity for alteration.

- High Liquidity Reserves – A large amount of stablecoin transfers are supported by plentiful liquidity.

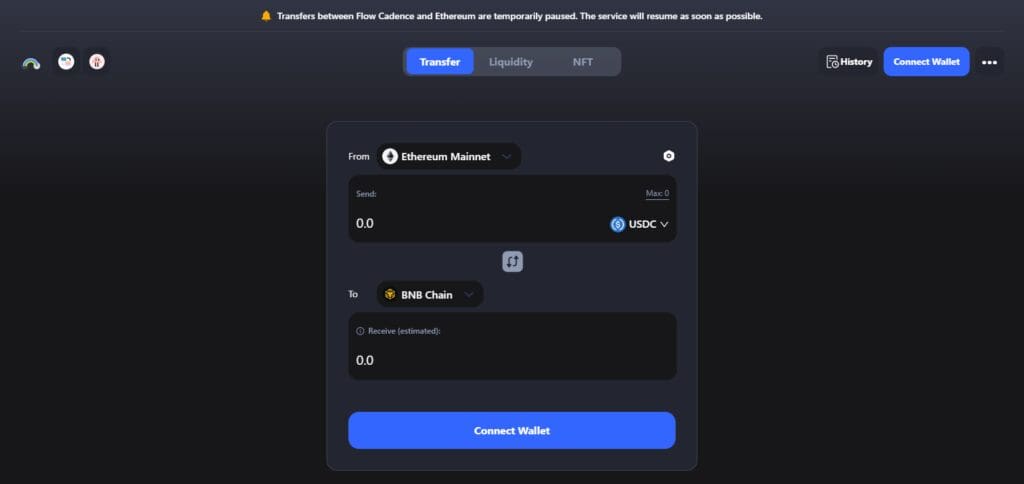

7. Celer cBridge Features

Celer cBridge is a multi-chain bridging solution for speedy and affordable tokens and stablecoin transfers.

It uses the Celer State Guardian Network (SGN) for data supervision to improve transaction velocities and reduce gas charges.

For example, Celer cBridge tends to work with numerous Layer 1 and Layer 2 networks, which makes it easier for users in different ecosystems to shift stable coins instantly.

Celer cBridge Features

- Low-Fee Transfers – Great for low cost, cross-chain stablecoin swapping.

- Multi-Chain and Layer 2 Support – Bridges between Ethereum, BSC, Polygon, Optimism and more.

- Instantneous Conclusion – employs a state channel method for rapid confirmations.

- Smart Contract Infrastructure Secured – Lessens the chances of bridge exploitations.

- Integration Of DeFi – Links with lending and yield farming systems.

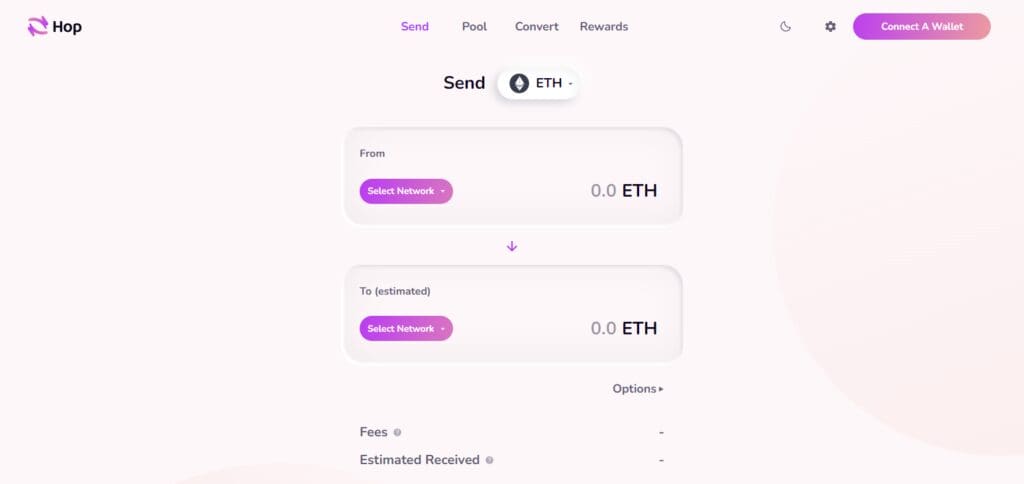

8. Hop Protocol

Hop Protocol is known for bridging stablecoins alongside other assets with Ethereum and Layer 2 like Polygon, Optimism, Arbitrum, etc. It leverages slippage and delays in transactions through automated Market makers (AMM) and stablecoin liquidity pools.

Hop has an exclusive roll-up-to-roll-up transfer technique which allows users to transfer funds in and out of various Ethereum scaling solutions faster.

Hop Protocol Features

- Rollup-to-Rollup Transfers – Focuses on stablecoin transfers for Ethereum Layer 2s.

- Fast Transfers – Shortens time for transactions by using AMM based pools.

- Low Slippage Transfers – Enables smooth and quick exchanges between assets.

- Support for DeFi Concentrators – Maintains liquidity pools for fee-generating activities.

- Bridge Network Coverage – Provides distributed security through multi-party governance.

9. Multichain (formerly Anyswap) Features

Multichain, unlike other cross chain router protocols, is one of the biggest when it comes to seamless stablecoin transfers between multiple networks.

It offers support to a large number of assets while partnering with several bridges to improve the transferable token range.

With the decentralized and secure nature of Multichain, users can transfer stablecoin with little to no restriction at high speeds and low fees, making it one of the leaders in interoperability.

Multichain (formerly Anyswap) Features

- Most Important Cross-Chain Router – Employs a large variety of blockchains and many other virtual assets.

- Decentralized Infrastructure – Employs secure multi-party computation (MPC).

- Rapid Transactions Across States – Sends stablecoins to people with different states instantaneously.

- Anytime Connectivity WIFI/DApps/DeFi – Fuses all kinds of applications with stronger Zero-Knowledge Proofs, Making it easier for DeFi Apps to access.

10. Portal Token Bridge

Bridge your favorite tokens within different ecosystems with Snapshots using Portal Token Bridge.

Using Portal Token Bridge, users will be able to transfer stable coins in between major blockchains, enabling a secured mode of switching is put in place with the Wormhole protocol.

With a variety of supported assets proficient users can get tokens bridged within Solana, Ethereum, and Binance Smart Chain ecosystems.

Portal Token Bridge Features

- Wormhole-Powered Transfers – Powered by the Wormhole Protocol for secure sending and receiving.

- Multiple Chain Networks Support – Bridges assets across Solana, Ethereum, BSC, and others.

- Transactions Made Easy and Secure – Safety provided through decentralized verification nodes.

- Direct Transfers From One Asset To Another – Transfers between native and wrapped assets for various stablecoins.

- APIs for Developers – wALLET and dApp integrations are supported.

Conclusion

Cross-chain interoperability has started to play a pivotal role within the DeFi ecosystem where bridging aggregators are incredibly effective to make stablecoin transfers seamless and efficient. Rango Exchange, Swing, Multichain and similar others aggregate multiple bridges and look for the fastest and cheapest routes.

Others like Synapse Protocol, Stargate Finance, and Celer cBridge take care of deep liquidity pools and infrastructure security in order to optimize the transfers. Specializing in cost effective and rapid transfers across Ethereum Layer 2 solutions are Across Protocol, Hop Protocol, and ChainArq.

The protocol that is ideal for the user depends on liquidity availability, transaction speed, network compatability, and security measures.

Through these bridging solutions users can effectively move stablecoins between different blockchain networks and bear low fees, quicker transaction times, and greater security.

Bridging aggregators will always be important to the smooth operation of blockchain systems and their evolution towards an interconnected multi-chain system.