In this article, I will discuss the mistakes traders make in the crypto and forex markets. Lack of planning, poor risk management, and emotion-driven decision-making often cause issues for beginners.

A trader needs to be aware of and avoid these mistakes for the sake of longevity in the market. Eradicating these mistakes will help traders achieve consistency, safeguard their capital and develop a disciplined strategy in the effective management of volatile markets.

key Points & Top Common Mistakes Traders Make in Crypto & Forex Markets

| Mistake | Key Point |

|---|---|

| Lack of a Trading Plan | Trading without a clear strategy leads to impulsive and emotional decisions. |

| Overleveraging | Using excessive leverage increases risk and can wipe out accounts quickly. |

| Ignoring Risk Management | Failing to set stop-loss or manage position size exposes traders to big losses. |

| Chasing the Market | Jumping into trades late due to FOMO often results in poor entries. |

| Overtrading | Trading too frequently can lead to burnout and unnecessary losses. |

| Neglecting Fundamental Analysis | Ignoring news, economic indicators, or blockchain updates can skew decisions. |

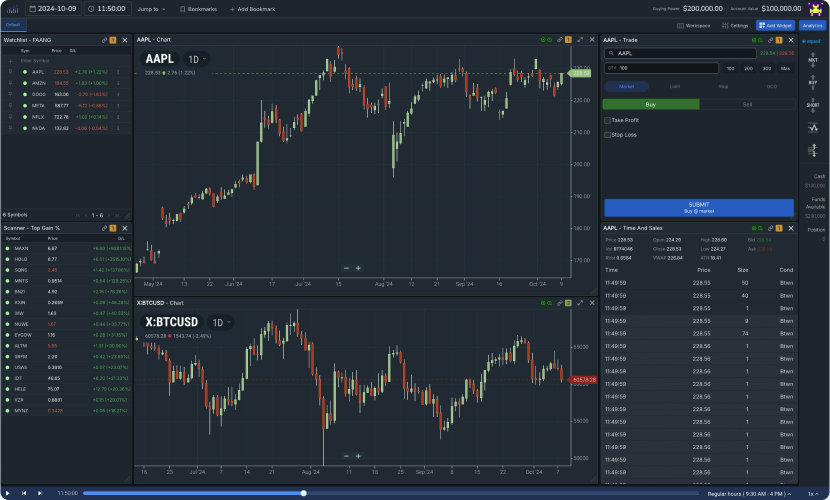

| Poor Technical Analysis | Misreading charts or relying on unreliable indicators leads to bad trades. |

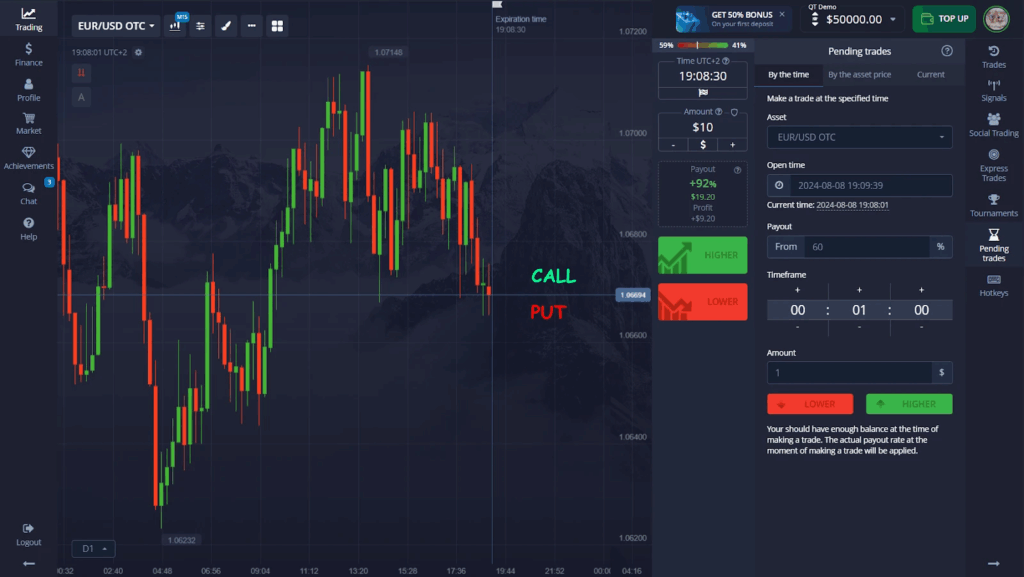

| Emotional Trading | Letting fear, greed, or revenge drive trades undermines discipline. |

| Lack of Education | Trading without understanding market mechanics is a recipe for failure. |

| Not Keeping Records | Failing to track trades prevents learning from past mistakes. |

| Blindly Following Others | Copying trades without understanding the rationale can be dangerous. |

11 Common Mistakes Traders Make In Both Crypto and Forex Markets

1. Lack of a Trading Plan

Not having a plan when entering the crypto or forex markets can cause traders to make poorly thought out and impulsive decisions. Kraken Trading has a plan and details the entry strategies.

Emotional guesswork, which will prevent evaluating a position, and learning from mistakes, can lead to un profitability.

Consistent profitability requires a trading plan, crossover discipline, and patience. Many traders abandon strategies too soon.

An unstructured plan causes unnecessary risk taking and will undermine success over time in both markets. 90 words

2. Overleveraging

Overleveraging is the excessive use of borrowed funds and extending the position. Overleveraging will increase the risk greatly and can wipe out the entire account in a matter of minutes.

When using overleveraging in the crypto or forex market the price can become highly volatile and is unpredictable. Most beginners will use a highly overengeged posiiton and will trigger a liquidation.

Preserving the account is a priority with conservative leveraging. The impatience and over confidence in the market is a leading cause of overleveraging. Make sure to understand over leveraging before trading.

3. Ignoring Risk Management

Many traders tend to fail because they do not implement Risk Management. Risk Management: Stop-losses, exposure, and position size.

Even winning strategies lose money without Risk Management during market volatility. This is hardly critical in the crypto and forex markets.

Risk Management is the only way to lose less money and make money over time. This is only getting worse in the market which can bring on large and sudden losses. This can make losing streaks very painful and emotionally make it impossible to lose consistently.

4. Chasing the Market

They get the term from late transactions in the early stages of a strong and fast-moving trend. With this type of transaction a trader is more likely to buy high or sell low which is more likely to lose money.

In the crypto and forex markets this is even more true because it is more likely that a trend will reverse.

This group of traders does not use the analysis and formal system like trade plan, but goes to the extreme of relying on a strategy and getting lucky.

This is the complete opposite of building a disciplined system. This is because it will bring on poor focus, stress, and irrational decisions.

5. Overtrading

Overtrading refers to trading much more frequently than a trading plan or personal strategy dictates. This is more frequently the case due to boredom, impatience, or over-confidence.

Overtrading generates extra transaction costs, spreads, and overexposure to market noise, drastically decreasing profitability.

Many overtrading individuals tend to fully ignore the quality of trading setups and pursue small trading gains or get triggered by price movements.

Overtrading is common in the crypto space due to the 24/7 volatility. Overtrading is not sustainable and extremely high probability setups should be the goal instead.

Overtrading is psychologically damaging and creates capital losses, mental fatigue, diminished decision capabilities, stress, and poor decision making. This cascade of overtrading-related issues can magnify losses.

6. Neglecting Fundamental Analysis

Most traders focus exclusively on price charts and give no thought to fundamental analysis, which in a simple definition tries to incorporate the influence of economic, political, and/or technological factors upon the correlation of various assets.

Movements of fiat currency pairs and cryptos is influenced by different geopolitical events and economic indicators (e.g. interest rates).

Cryptos and other traceable assets react to project developments and regulated crypto trading practices.

Holding a losing position during a major fundamental economic event or dropping a fundamental tool during trading can result in unreasonable price movement and a lack of prediction of market trends.

For reasoned decision making, the combination of differing analytical approaches is necessary. The fundamentals will always be there to capture lost opportunities and leave you at risk of sustained losses during trading of overreaching price movements.

7. Poor Technical Analysis

Understanding market trends, patterns, and entry and exit points is crucial for any successful trader. Poor technical analysis stems from chart misinterpretation, unnecessary complexity, or unreliable signal reliance.

Many traders skip understanding support, resistance, and momentum, which usually leads to mistimed trades. Relying too much on one tool and not having confirmation leads to exposure on the other end and possible capitulation.

Solid technical knowledge, practice, and disciplined implementation of strategy are necessary to succeed in the crypto and the forex market.

Traders tend to repeat losses and find it difficult to gain consistent edge primarily due to failure in integrating technical analysis in trading.

8. Emotional Trading

Fear, greed, and excitement can disrupt rational analysis and, thus, decision making. Traders may close winning trades too early, and exit losing positions, hoping for a reversal.

Emotional bias can lead to impulsive trading, overtrading, and reckless risk violations in the highly volatile crypto and forex markets.

To succeed in these markets, traders must develop discipline. Emotional trading and market-cycle stress lead to inconsistency, making it impossible to sustain any short-term gain.

To avoid emotional trading and protect capital, impulsive behaviors must be countered with awareness and a systematic approach.

9. Lack of Education

Participants in the crypto and forex markets often do so with no foundational knowledge about the principles of trading, the relevant strategies, and the dynamics of the market.

Mistakes stemming from a knowledge deficit include overleveraging, mistaking price action, skipping risk management, and others. The absence of a learning plan is a critical oversight.

The pace of the market’s evolution demands an equally rapid evolution of a trader’s strategies. Knowledgeable traders master the mechanics of the market and the tools and indicators of market analysis.

With no education, a trader relies purely on luck, and hearsay, escalating losses. Courses and redundant reading, coupled with practice, provide traders with the tools needed to identify likely opportunities, manage risks, and earn constant profitability over a protracted period.

10. Not Keeping Records

Not recording trades leads to an inability to evaluate performance, gain insights from one’s mistakes, and make necessary adjustments to one’s strategies.

A trading journal tracks entry and exit points, position sizes, the reason for making the trade, and the outcome, creating a system for pattern recognition, both for success and failure.

If records are not kept, mistakes are made repeatedly, and lost profit, to negligence, is irrecoverable.

A journal creates a system of discipline, accountability, and progressive improvement. In both crypto and forex, an overarching system is required in which every trade is tracked.

This enables an assessment of risk-reward, strategy consistency, and profit relative to the invested time and effort.

11. Blindly Following Others

Some traders rely on copied signals, social media pointers, and strategies and to execute trades without understanding the reasoning involved.

Following others without conducting personal analysis can expose traders to the risk of misinformation, poor risk management, erroneous entry and exit, and timing issues.

Every trader has a different risk appetite, different capital, and different goals, and so strategies cannot be one-size-fits-all.

Overreliance on outside information for one’s decisions can be debilitating, and a profitable trader learns to assess different information, backtest the strategies, and come to personal conclusions.

Copying others disables the development of personal skills and self-esteem, resulting in an acute lack of knowledge and discipline rigidly required for consistent profitability in the crypto and forex markets for the long term.

Conclsuion

In both the crypto and forex markets, poor planning and the absence of a risk management strategy, making decisions based on emotions, and depending too much on other people can end succees.

Results depend on the regulation of oneself, the constant acquisition of knowledge, and the presence of discipline strategies.

It is possible to avoid these demerits, maintain a trading schedule, and blend different types of assessments to safeguard one’s capital, enhance the constancy of results, and realize profitability in the long run.

FAQ

What is a common reason traders fail?

Lack of a trading plan and strategy leads to impulsive and inconsistent decisions.

Why is overleveraging risky?

Using too much leverage amplifies losses and can wipe out accounts quickly.

How does ignoring risk management affect trading?

It exposes traders to large, preventable losses and reduces long-term survivability.

What is market chasing?

Entering trades late after price movements, often resulting in buying high or selling low.

Why is overtrading harmful?

Excessive trades increase costs, mental fatigue, and exposure to market noise.