In this article, I will analyze Top Crypto Taxes Mistakes To Avoid every crypto investor should know about. As the evolution of cryptocurrency persists, the need to recognize its tax repercussions is crucial for every investor.

Failing to report losses, classifying activities incorrectly, and ignoring transactions are just a few of the costly punitive mistakes one can encounter. Let’s go over the most pivotal mistakes and how to avoid them.

Top Crypto Taxes Mistakes To Avoid

| Crypto Tax Mistake | Key Point |

|---|---|

| Ignoring Crypto Transactions | All crypto transactions must be reported, even small ones. |

| Misclassifying Crypto Activities | Different crypto activities have different tax treatments. |

| Forgetting About Airdrops and Forks | Airdrops and forks are taxable income when received. |

| Poor Record-Keeping | Incomplete records lead to inaccurate filings and audits. |

| Failing to Report Crypto-to-Crypto Trades | Trading one crypto for another triggers taxable events. |

| Overlooking Fees | Transaction fees are deductible and lower your taxes. |

| Incorrect Cost Basis Calculation | Wrong methods cause inaccurate gains and higher taxes. |

| Not Reporting Losses | Reporting losses can offset gains and reduce tax bills. |

| Assuming DeFi Activities Are Tax-Free | DeFi earnings usually trigger taxable events. |

| Delaying Until the Last Minute | Late tracking causes mistakes and missed deductions. |

1. Ignoring Crypto Transactions

Some cryptocurrency users mistakenly think that minor trades, gifts, or personal transactions do not need to be taxed. However, tax bodies such as the IRS sees, for example, using cryptocurrency to pay for a product as a taxable event.

Whether selling, trading, or using crypto to purchase goods, every activity done may incur a capital gains tax or tax on income. Not reporting these can result in penalties or even audits.

Everything from sending your cryptocurrency to a friend’s wallet or paying for a cup of coffee has to be documented. Keeping the right documents ensures that one does not end up in a tax compliance nightmare, especially with the increased scrutiny from tax agencies on cryptocurrency.

- Ignoring Crypto Transactions Examples

- All purchase and sales activity related to crypto is subject to taxation.

- Even minor transactions, such as gifts, must be reported.

- Not reporting these transactions can expose you to audits and significant fines.

2. Misclassifying Crypto Activities

It is only logical that activities that involve mining, staking or even trading currencies will each carry their own tax, which makes classifying them inaccurately very costly.

For instance, mining rewards are considered ordinary income when received and their fair market value price is accepted. The same can be said with trade profits as this is classed under capital gain tax.

Other staking rewards can also be accepted as income. Most paying tax faces challenges in meeting compliance obligations resulting in inappropriate filings. Knowing the rules around specific activities when it comes to taxes makes all the difference.

Misclassifying Crypto Activities Examples

- Trading, mining, staking, and earning crypto has different taxation implications.

- Incorrect activity labeling can result in overpaying taxes.

- Correct classifications guarantee reliable reporting of income and capital gains.

3. Forgetting About Airdrops and Forks

Airdrops and hard forks impose crypto users with unwelcome tax obligations. The tokens from an airdrop or new coins from a blockchain fork are largely considered fair market value income at the time they are received and are thus taxable, regardless of being sold or traded.

Many users do not consider the airdrops taxable until they are sold, assuming these “gifts” become taxable only at the point of sale.

Nontheless, such gifts, if unreported, can lead to penalties during audits. Thus, for proper reporting and compliance with tax authorities such as the IRS, it is crucial to monitor the date, value, and the originating entity of the assets.

Forgetting About Airdrops and Forks Examples

- Income tax is levied on assets acquired from airdrops or forks in the form of free tokens.

- The tax obligation arises on the receipt of the tokens, not on their sale.

- Failing to recognize these on declarations may result in taxes levied without declarations.

4. Poor Record-Keeping

In the context of crypto tax compliance, a lack of maintained records is a significant factor for many users trying to streamline record keeping, ignoring its importance altogether.

Each transaction, be it a trade, sale, or purchase, is accompanied with additional details such as date, sequential number, value in the open market, and reason for the transaction.

The absence of these details makes it almost impossible to calculate capital gains or losses and opens the door for audit complications. Tax authorities may want proof of your basis of expenses and the history of relevant transactions.

Maintaining detailed spreadsheets or using crypto tax software can ease monitoring. Claiming transaction fee deductions becomes exponentially more difficult with lack of proper documentation.

Poor Record-Keeping Examples

- Their absence makes the reporting of tax obligations intricate and involves various dates, currencies, and wallet addresses.

- Acess to incomplete records forces the establishment of estimates, thus increasing audit risks.

- The absence of proper documentation makes compliance unattainable.

5. Failing to Report Crypto-to-Crypto Trades

Crypto transactions done in a coin-for-coin basis such as Ethereum to Bitcoin conversion is a taxable event even if a fiat currency is not utilized. Most users assume that taxes are triggered only on cash-out transactions.

In fact, these transactions are treated as selling one asset to buy another and are considered capital gains or losses based on the market value at the time of the trade. Failure to report them will cause loss in taxes reporting causing the taxpayer in penalties.

Reporting each trades date, value, and cost basis makes trade tracking easier. Tax compliant software can calculate reported gains and ensure proper compliance with relevant reporting requirements.

Failing to Report Crypto-to-Crypto Trades Examples

- Trading one cryptocurrency for another is equated with selling.

- Gains or losses arise at the time of the trade.

- Without self-reporting there will be a loss of unclaimed taxation opportunities.

6. Overlooking Fees

Gas fees on Ethereum or exchange fees are transaction fees that are forgotten when calculating taxes on crypto. A good portion of these fees can be deducted and lower taxable income or capital gains.

For instance, paying fees lowers the reported profit, which can be beneficial when seeking to reduce tax obligations. Undarkening costs may(correct this owe hypothesis) overstate profits and increase the tax obligations. T

Tax documentation should give substantiation of fees claimed for every crypto transaction so they can be accurately reported. Fee accounting can be automated with crypto tax software ensuring proper fee attribution.

Overlooking Fees Examples

- Fees related to trading, withdrawing, and networking diminish your profits.

- Fees that are disregarded seem to increase taxable profit excessively.

- Fees that need to be corrected can change the tax burden drastically.

7. Incorrect Cost Basis Calculation

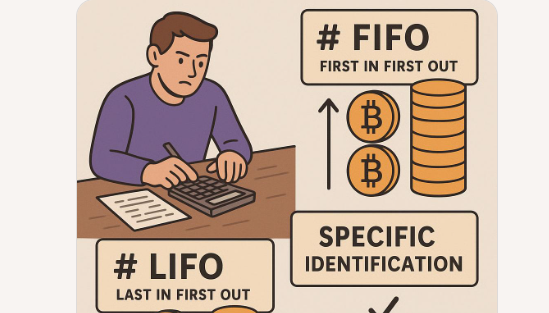

Calculating the cost basis for crypto assets is important in determining capital gains and losses, but applying the wrong methodology can cause issues. Common methods include FIFO (First In First Out), LIFO (Last In First Out), or Specific Identification.

Each method can yield different tax outcomes, and inconsistent or incorrect application can result in penalties. For example, FIFO assumes you sell your oldest acquired assets first, while Specific Identification allows you to decide which assets to identify.

Tax authorities require consistency in your chosen method. Having a clear understanding of and documenting your cost basis methodology is important for accurate submissions and being audit ready.

Incorrect Cost Basis Calculation Examples

- Accounting profit and losses require profit filing the tax document on FIFO, LIFO, or Specific Identification.

- Wrong calculations imply inaccurate profit and/or loss calculations.

- Paying attention to cost basis properly documented prevents paying taxes unnecessarily or inadequately.

8. Not Reporting Losses

Mistakes that are made by non-recognition of losses become misinformation and not useful for tax purposes. Losses from crypto sales or trading eliminate capital gains, thereby reducing tax burden.

In some jurisdictions like the US, excess losses can offset other income subject to a limit. Loss reporting is where many users fall behind, especially during bear markets when they assume losses are irrelevant.

However, documented losses can provide great deductions. Properly tracking and reporting all transactions, even those that seem unprofitable, is essential.

Not Reporting Losses Examples

- Lost bets on trades result in decreased taxable income and offset other income if reported.

- Failure to report losses brings an opportunity to save taxes that are wasted.

- Carryforward rules might be the sole option in future periods when the losses surpass the gains if they surpass the loss in subsequent years.

9. Assuming DeFi Activities Are Tax-Free

DeFi activities such as lending, yield farming, or providing liquidity are often classified as having taxable income or gains. Users often wrongly assume that such activities are tax exempt since they take place on decentralized platforms.

For instance, interest received from crypto lending or tokens received from yield farming are usually considered to be ordinary income. Additionally, token swaps in liquidity pools can cause capital gains. Not reporting these details can lead to penalties of some kind.

Tax software that keeps track of all DeFi transactions such as dates and fair market values can ensure that one stays compliant with ever changing tax laws.

Assuming DeFi Activities Are Tax-Free Examples

- DeFi income taxation includes income from staking, farming, and lending.

- Certain activities in DeFi are recognized as rewards or interest.

- Tax policies maximize the chances of greatly underreporting taxes if DeFi profits are disregarded and unexplained.

10. Delaying Until the Last Minute

Waiting until the deadline to prepare for crypto taxes has become a norm that leads to incomplete and inaccurate filings. Each crypto transaction is unique in its own way and they require maintaining an elaborate record of trades, fees, and cost basis throughout the year.

Compiling this data at the last minute also increases the chances of missing out on deductions such as fees or losses, and also increasing the chances of reporting under errors.

Tax authorities tend to be heavy handed when it comes to imposition of penalties for reporting inaccuracies. Simplifying the process is regular tracking with crypto tax software or spreadsheets.

Waiting Until The Last Minute Examples

- Deciding to prepare hastily incurring various missed deductions leads to mistakes and incomplete documents.

- Allotting ample time for recording trades and income minimizes pressure.

- Prompt submissions escape additional payment requirements and do not incur penalties.

Conclusion

To sum up, knowing crypto taxation blunders and evading them is essential in remaining compliant and reducing chances of getting penalized.

Efficiently managing your crypto taxes includes reporting all transactions, selecting the appropriate tax methodology, maintaining reliable records, and following the changing crypto or DeFi trading guidelines.

Proactively eliminating crypto tax mistakes will enable taxpayers to avoid costly repercussions, thereby greatly simplifying tax season.