I’ll talk about the best non-KYC cryptocurrency exchanges in this post. These platforms give customers privacy, control, and flexibility by enabling cryptocurrency trading without the need for identity verification.

Non-KYC exchanges, which range from peer-to-peer platforms like Hodl Hodl and LocalMonero to decentralized exchanges like SushiSwap and PancakeSwap, offer safe, easy-to-use settings for novice and seasoned traders looking for anonymity and quick transactions.

Benefits of Non-KYC Crypto Exchanges

More Privacy – You can trade without giving away any personal information, thus keeping your anonymity.

Easy Onboarding – Access to trading is instant because there are no time consuming verification processes.

You Control Your Funds – Users have control of their wallets on a lot of Non-KYC platforms because they are non-custodial.

Accessible Worldwide – Non-KYC exchanges can be used in places where KYC exchanges are not available.

Less Chance of a Data Breach – Since there is not a lot of personal information on the exchange, the risk of hacks is low.

More Options for Trading – Non-KYC platforms have trading methods and cryptocurrencies to choose from without verification constraints.

Great for Users Who Want Privacy – For anyone who wants to remain anonymous during a financial transaction, this is a great choice.

Less Requirements for Small Traders – Small Investors and Beginners can start trading without having to go through an ID verification process.

Key Point & Top Non-KYC Crypto Exchanges

| Platform | Key Points |

|---|---|

| GhostSwap | Instant crypto swaps, privacy-focused, no mandatory KYC, simple interface |

| Margex | Leverage trading up to 100x, no KYC for basic use, advanced trading tools |

| BloFin | Derivatives trading, copy trading feature, competitive fees |

| TradeOgre | No KYC required, strong altcoin selection, simple trading platform |

| Hodl Hodl | Non-custodial P2P exchange, multi-signature escrow, Bitcoin-focused |

| LocalMonero | Monero-focused P2P trading, privacy-first platform, escrow protection |

| LocalCryptos | Non-custodial wallets, multi-crypto support, smart contract escrow |

| SushiSwap | Ethereum-based DEX, liquidity pools, yield farming, no KYC |

| PancakeSwap | Built on BNB Chain, low fees, staking & farming rewards |

| dYdX | Decentralized perpetual trading, high-speed execution, advanced order types |

1. GhostSwap

GhostSwap is an instant crypto swapping service that focuses on the privacy of its users. It is one of the Top Non-KYC Crypto Exchanges. Customers do not need to undergo identity verification in order to conduct crypto swaps, and do not have to create an account or upload verification documents.

GhostSwap is generally considered a non-custodial service, meaning users keep their crypto in a wallet they control for the duration of the swap. Customers enjoy the privacy protections, and the platform is designed to be user-friendly, resulting in fast swaps. However, the platform does not have an advanced trading features, and does not offer trading on leverage or allow for complicated order trading like the larger, centralized exchanges.

GhostSwap Features

- Immediate crypto swapping capabilities for several crypto assets.

- Privacy-centric platform with no KYC.

- User-controllable assets through non-custodial wallet support.

- Easy and simple interface.

- Transactions processed quickly and securely.

GhostSwap – Pros & Cons

| Pros | Cons |

|---|---|

| 1. Fast and instant crypto swaps | 1. Limited coin selection |

| 2. No mandatory KYC, high privacy | 2. No advanced trading features |

| 3. Non-custodial wallet support | 3. No leverage or margin trading |

| 4. Beginner-friendly interface | 4. Small user base, limited liquidity |

| 5. Secure and easy to use | 5. Minimal customer support |

2. Margex

Margex offers us derivatives trading with 100x leverage trading on most of the big cap cryptocurrencies. Margex is the most popular of the Top Non-KYC Crypto Exchanges as it offers users the ability to start trading without the need to complete KYC on the exchange.

You will find trading and risk management easily with their intuitive trading dashboard and charting tool. Margex invested heavily into their security with systems that protect traders from price manipulation and cold wallet storage.

Margex is more suitable for traders who want to have leveraged exposure to the market and not for users who want to have simple purchases of assets as the exchange focuses more on trading perpetual futures as opposed to spot trading.

Margex Features

- Perpetual futures contracts trading with up to 100x leverage.

- Sophisticated trading and charting instruments.

- No KYC for fundamental withdrawals.

- Risk management via stop-loss and take-profit.

- Cold storage and other rigorous security measures.

Margex – Pros & Cons

| Pros | Cons |

|---|---|

| 1. Up to 100x leverage for high profit potential | 1. High risk due to leverage |

| 2. Advanced trading tools and charting | 2. KYC required for high withdrawals |

| 3. No KYC for basic withdrawals | 3. Complex for beginners |

| 4. Strong security protocols | 4. Limited cryptocurrency options |

| 5. Risk management features (stop-loss, take-profit) | 5. Trading fees apply |

3. BloFin

BloFin is a crypto derivatives exchange that provides futures trading, copy trading, and offers a competitive fee structure. With nowhere to complete KYC, BloFin remains in the Top Non-KYC Crypto Exchanges list. Some access features may enable you to withdraw more, but you must do KYC. Professional traders are targeted with advanced analytics and risk management tools.

One of the most inviting features is copy trading where novices can copy the trading strategies of experienced traders. With a focus on the smooth execution of orders and high liquidity, the exchange is suitable for futures traders who want to retain a little more privacy than is usually possible.

BloFin Features

- trade Derivatives and futures.

- There is a Copy trading feature to allow the inexperienced to trade alongside the experienced.

- Trading fees are competitive.

- For analogous Limited KYC Access and privacy

- There are tools for sophisticated analytics and reporting.

BloFin – Pros & Cons

| Pros | Cons |

|---|---|

| 1. Copy trading feature ideal for beginners | 1. Liquidity may vary depending on market |

| 2. Limited KYC access, privacy-friendly | 2. KYC needed for higher withdrawal limits |

| 3. Competitive trading fees | 3. Primarily derivatives-focused, limited spot trading |

| 4. Advanced analytics tools | 4. Risk in copy trading |

| 5. Supports active traders | 5. Smaller user base than larger exchanges |

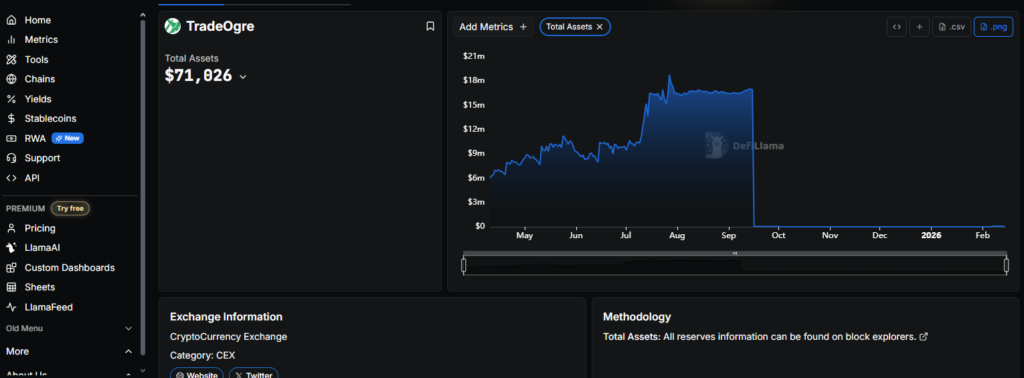

4. TradeOgre

TradeOgre is a basic cryptocurrency exchange with a plain appearance, but the privacy-loving cryptocurrency trading community have embraced it due to the great selection of altcoins and a strict no KYC policy. Also listed in the Top Non-KYC Crypto Exchanges, TradeOgre is uncomplicated.

Because it offers no KYC, it is a great exchange for traders who want privacy. Although the coin selection offered by TradeOgre includes a number of altcoins which are not available on many other Exchanges, the overall design of the exchange is poor and the lack of advanced functionality, such as derivatives trading, may be undesirable to many. degenerate traders.

There is also less liquidity and poor support for transactions using fiat currency. Overall, the trading experience is not as good as that offered by most of the large international exchanges.

TradeOgre Features

- TradeOgre does not require KYC

- There are many altcoins available.

- The user experience is simple.

- The platform supports trading of crypto for crypto.

- TradeOgre also supports trading of crypto for crypto.

TradeOgre – Pros & Cons

| Pros | Cons |

|---|---|

| 1. Full privacy with no KYC | 1. Limited fiat support |

| 2. Wide range of altcoins | 2. Low liquidity for some coins |

| 3. Simple and lightweight interface | 3. No advanced trading tools |

| 4. Quick and easy setup | 4. No leverage or margin options |

| 5. Minimal fees | 5. Minimal customer support |

5. Hodl Hodl

Hodl Hodl is a non-custodial exchange and Bitcoin trading platform that allows users to conduct trades without holding users’ funds. As one of the top non-KYC exchanges, Hodl Hodl employs a multi-signature escrow system to secure Bitcoin trades and close payment methods’ escrow in a secure and user-controlled manner.

By not taking custody of users’ funds, they custodial risk. Hodl Hodl also Bitcoin trades and custodial KYC user requirements. Hodl Hodl, however, is a marketplace that trades and provides operational speed based on the existing marketplace counterparties.

Hodl Hodl Features

- The platform is peer-to-peer and non custodial.

- Trades are secured by multi signature escrow.

- The platform is bitcoin only.

- There are several payment options available.

- No KYC is required for users.

Hodl Hodl – Pros & Cons

| Pros | Cons |

|---|---|

| 1. High privacy, no mandatory KYC | 1. Bitcoin-only trading |

| 2. Non-custodial, users control funds | 2. Liquidity depends on available sellers |

| 3. Multi-signature escrow ensures secure trades | 3. Moderate trading volume |

| 4. Global P2P accessibility | 4. Learning curve for beginners |

| 5. Supports multiple payment methods | 5. Limited customer support |

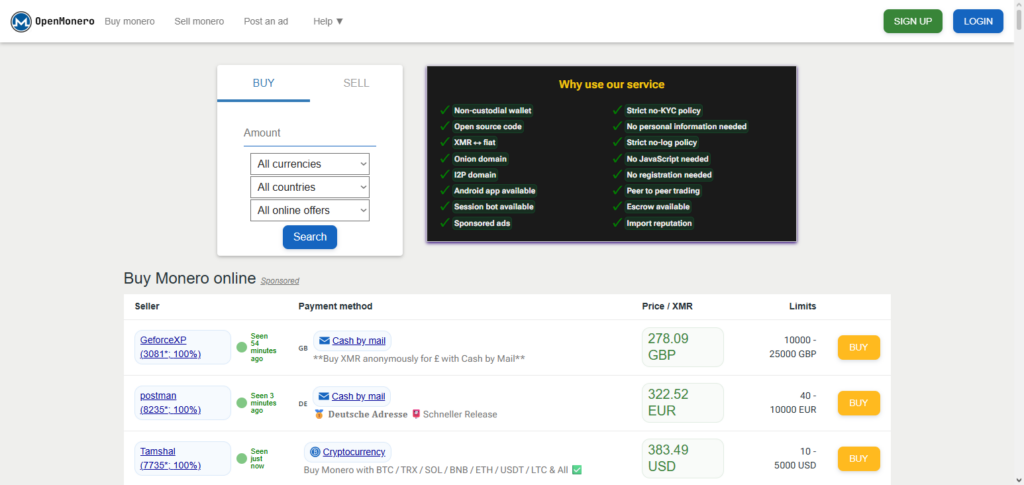

6. LocalMonero

LocalMonero is a peer-to-peer exchange and marketplace for buying and selling Monero, a non-custodial and privacy-oriented coin. As one of the top non-KYC exchanges, LocalMonero allows users to trade without identity verification and provides secure escrow that protects buyer and seller.

This platform has a high transaction volume, particularly for privacy-oriented users, cash methods, bank transfer methods, payment system methods, privacy methods. Its trade volume is dictated by a combination of demand and seller availability for the region. The platform designed to prioritize user privacy, Monero, is strongly aligned with the platform’s values.

LocalMonero Features

- The platform is designed for peer-to-peer transactions using Monero.

- Multiple payment options

- Privacy first platform

- No mandatory KYC

LocalMonero – Pros & Cons

| Pros | Cons |

|---|---|

| 1. Privacy-focused Monero trading | 1. Only Monero supported |

| 2. Escrow-protected transactions | 2. P2P liquidity dependent on users |

| 3. Multiple payment methods | 3. Slower than centralized exchanges |

| 4. No mandatory KYC | 4. Moderate fees |

| 5. Global access for buyers/sellers | 5. Interface may be confusing for beginners |

7. LocalCryptos

LocalCryptos is a peer-to-peer decentralized exchange where you can buy and sell Bitcoin and Ethereum, as well as a number of other cryptocurrencies. A highlight of the firm is that it is one of the Top Non-KYC Crypto Exchanges. localCryptos provides a non-custodial wallet, smart contract escrow, and did we mention that you can trade without an identity verification? Yes.

You’ll maintain full privacy and autonomy to trade as you please. LocalCryptos is a great option if you want to manage your trade funds without a central, custodial service taking control of your money.

LocalCryptos Features

- Support BTC, ETH and other cryptocurrencies

- Users have non-custodial wallets

- KYC not required, a privacy option

- Secure trade system via smart contract escrow

- Encrypted messaging system

LocalCryptos – Pros & Cons

| Pros | Cons |

|---|---|

| 1. Supports multiple cryptocurrencies | 1. Liquidity depends on user activity |

| 2. Non-custodial wallet control | 2. P2P fees may vary |

| 3. Optional KYC preserves privacy | 3. Limited advanced trading features |

| 4. Smart contract escrow for security | 4. Slower trades than centralized exchanges |

| 5. Encrypted messaging for secure communication | 5. Requires learning escrow system |

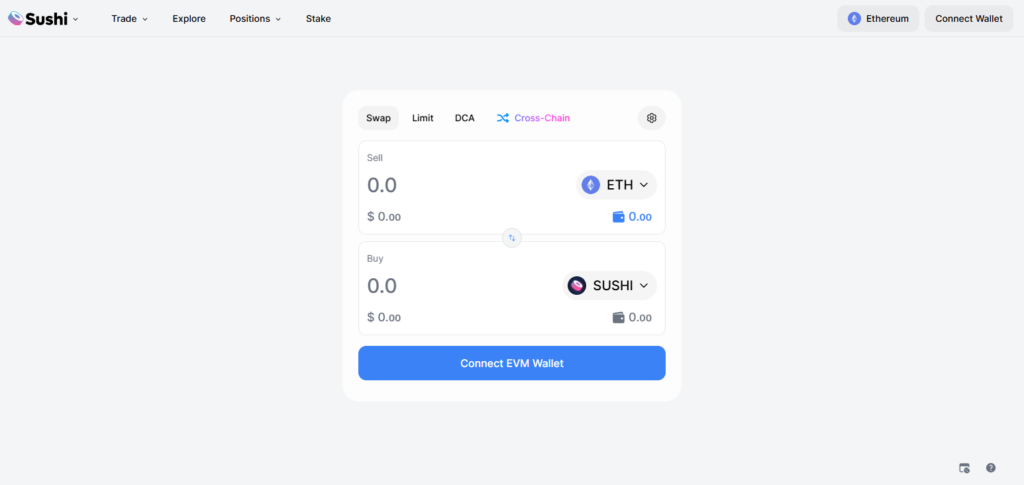

8. SushiSwap (DEX)

SushiSwap is a decentralized exchange (or DEX) that was originally built on Ethereum. It’s an AMM, which stands for Automated Market Maker, and allows users to trade their tokens with the liquidity pools. Along with the other Top Non-KYC Crypto Exchanges, SushiSwap is a DEX that has no identity verification, which is a plus.

Your trade is done through your private crypto wallet, and as an added feature, it has yield farming, staking, and liquidity mining programs to gain earnings outside of just trading. SushiSwap maintains full control to the users over their funds, which is part of what makes it a DEX. The entire exchange operates through smart contracts, but the downside is that you have to pay the gas fees, which can vary a lot depending on how congested the blockchain is.

SushiSwap (DEX) Features

- AMM on Ethereum

- Liquidity pools enable the swapping of tokens

- Allocation and yield farming

- KYC and registration not required

- Swapping tokens, along with yield farming, KYC and registration not required

SushiSwap (DEX) – Pros & Cons

| Pros | Cons |

|---|---|

| 1. Full wallet control (non-custodial) | 1. Gas fees on Ethereum can be high |

| 2. Yield farming & staking rewards | 2. Impermanent loss risk for liquidity providers |

| 3. No KYC or registration required | 3. Complex interface for beginners |

| 4. Wide token variety | 4. No fiat currency support |

| 5. Transparent smart contract operations | 5. Dependent on liquidity pool availability |

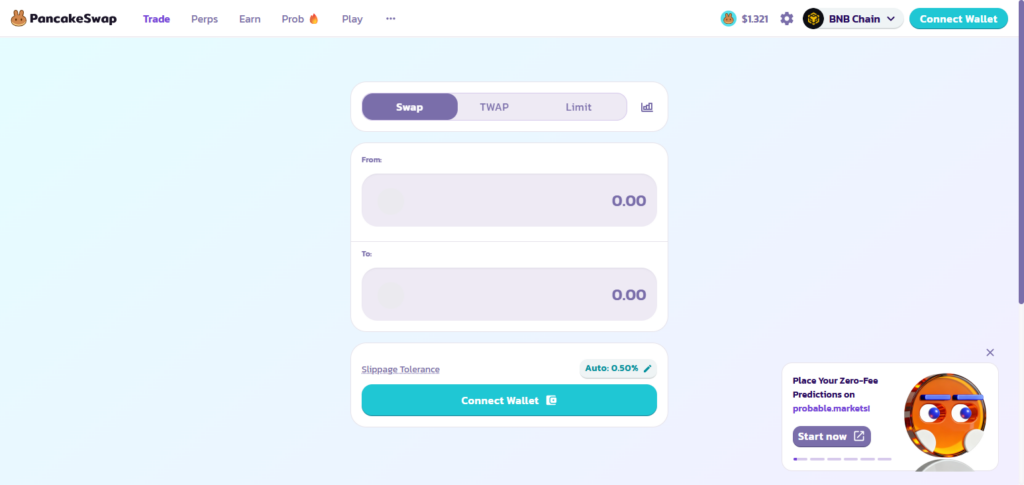

9. PancakeSwap (DEX)

PancakeSwap ranks highly among the best Non-KYC Crypto Exchanges for being a quick and inexpensive decentralized exchange on the BNB Chain, and also for customer liquidity provision.

Users can connect and trade directly from their wallets, and create new tokens via Initial Farm Offerings (IFOs) with BNB Chain based tokens, farm and stake for rewards, and enter a lottery. As an Automated Market Maker, PancakeSwap uses customer liquidity provision and thus pays lower fees to customers than higher ETH based fees decentralized exchanges (DEX). Consequently, PancakeSwap DEX attracts clients as a cost-effective decentralized exchange to trade and swap tokens seamlessly.

PancakeSwap (DEX) Features

- AMM DEX on the BNB Chain

- Liquidity pools allow trading of tokens

- Receive farming and staking rewards

- Token trading at low fees

- KYC and registration not required

PancakeSwap (DEX) – Pros & Cons

| Pros | Cons |

|---|---|

| 1. Low transaction fees (BNB Chain) | 1. Only supports BNB Chain tokens |

| 2. Fast transactions | 2. Impermanent loss risk for liquidity providers |

| 3. Staking & farming rewards | 3. Smart contract risk |

| 4. No KYC required | 4. No fiat support |

| 5. Wide token selection | 5. Requires knowledge of crypto wallets |

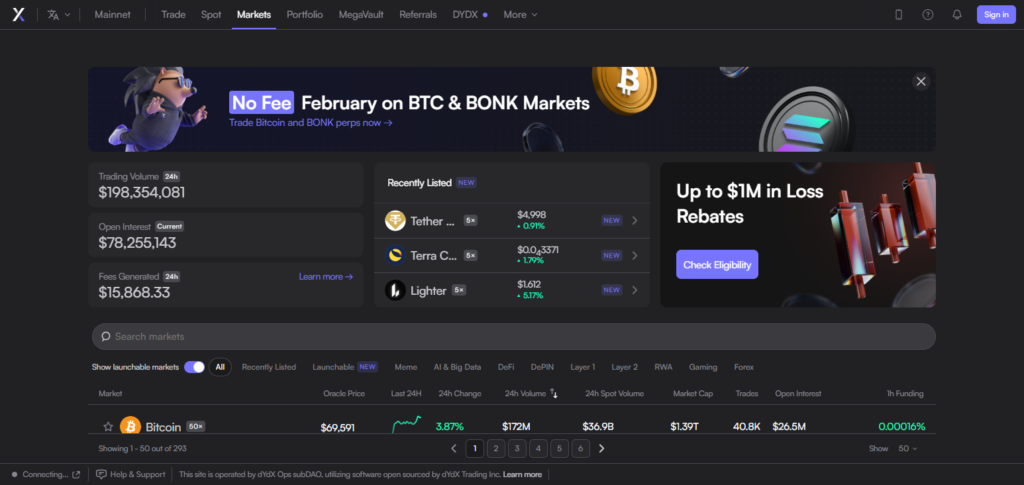

10. dYdX (DEX)

dYdX is a decentralized non-KYC perpetual trading exchange that focuses on futures and provides state-of-the-art trade execution, order types, and margin trading with instant sell-out and buy-in capabilities.

Leveraging Layer-2 technology, trading is executed with less gas (block space) fees, and as a result, the entire trade lifecycle is completed in less time than a traditional Ethereum trade. dYdX primarily attracts decentralized customers g in the derivatives markets to maintain control of their assets, as well as to exercise their trading rights.

dYdX (DEX) Features

- Derivatives and perpetual futures trading

- Limit and stop-loss advances among order types

- Low fees and high speed via layer-2 scaling

- No KYC for on-chain usage

- High speed and professional trading tools

dYdX (DEX) – Pros & Cons

| Pros | Cons |

|---|---|

| 1. Professional-grade derivatives trading | 1. Complex for beginners |

| 2. Advanced order types (stop-loss, limit) | 2. Limited trading pairs compared to CEX |

| 3. Layer-2 scaling for low fees & high speed | 3. Requires crypto wallet |

| 4. No KYC for on-chain use | 4. Only crypto derivatives supported |

| 5. High-speed execution & leverage options | 5. Smart contract risks |

Conclusion

In conclusion, for cryptocurrency traders who value anonymity and control over their money, Top Non-KYC Crypto Exchanges offer a special combination of privacy, flexibility, and accessibility.

Instant swaps, leveraged trading, and altcoin-focused marketplaces are provided by platforms like as GhostSwap, Margex, BloFin, and TradeOgre without requiring time-consuming verification. While decentralized exchanges like SushiSwap, PancakeSwap, and dYdX combine complete wallet management with sophisticated trading tools, peer-to-peer networks like Hodl Hodl, LocalMonero, and LocalCryptos provide users with non-custodial escrow systems.

When taken as a whole, these exchanges demonstrate the rising desire for user-focused, private, and safe cryptocurrency trading solutions across the globe.

FAQ

What are non-KYC crypto exchanges?

Non-KYC crypto exchanges are platforms that allow users to trade cryptocurrencies without submitting personal identification documents. These exchanges prioritize privacy, offer fast access, and often support non-custodial or P2P trading.

Are non-KYC exchanges safe to use?

Yes, many are safe, especially decentralized and P2P platforms with escrow or smart contract protection. However, users should exercise caution, verify liquidity, and use secure wallets since privacy-focused platforms sometimes have lower regulatory oversight.

Which are the top non-KYC crypto exchanges?

Top Non-KYC Crypto Exchanges include GhostSwap, Margex, BloFin, TradeOgre, Hodl Hodl, LocalMonero, LocalCryptos, SushiSwap (DEX), PancakeSwap (DEX), and dYdX (DEX).

Can I trade all cryptocurrencies on these exchanges?

Availability varies: platforms like TradeOgre focus on altcoins, P2P platforms support Bitcoin and select cryptos, while DEXs like SushiSwap and PancakeSwap allow trading of numerous ERC-20 or BSC tokens.