In this article, I will review the top P2P crypto borrowing platforms that you can access today. Users may receive loans of cryptocurrency directly from other persons through these platforms, which is far better and flexible than traditional systems.

I will facilitate your decision-making by analyzing the ecosystem steps, advantages, and specific characteristics of each platform for your borrowing needs.

Key Point & Best P2P Crypto Borrowing Platforms List

| Platform | Key Point |

|---|---|

| Binance | One of the largest global crypto exchanges with extensive trading pairs. |

| KuCoin | Offers a wide range of altcoins and user-friendly trading features. |

| OKX | Known for advanced trading tools and DeFi integration. |

| Aave | Leading decentralized lending protocol with flash loans. |

| Liquity | Offers interest-free borrowing using ETH as collateral. |

| Unilend | Combines spot trading and lending for all ERC-20 tokens. |

| Venus Protocol | Lending and borrowing platform on BNB Chain with stablecoin minting. |

| Compound | Decentralized algorithmic interest rate protocol for lending and borrowing. |

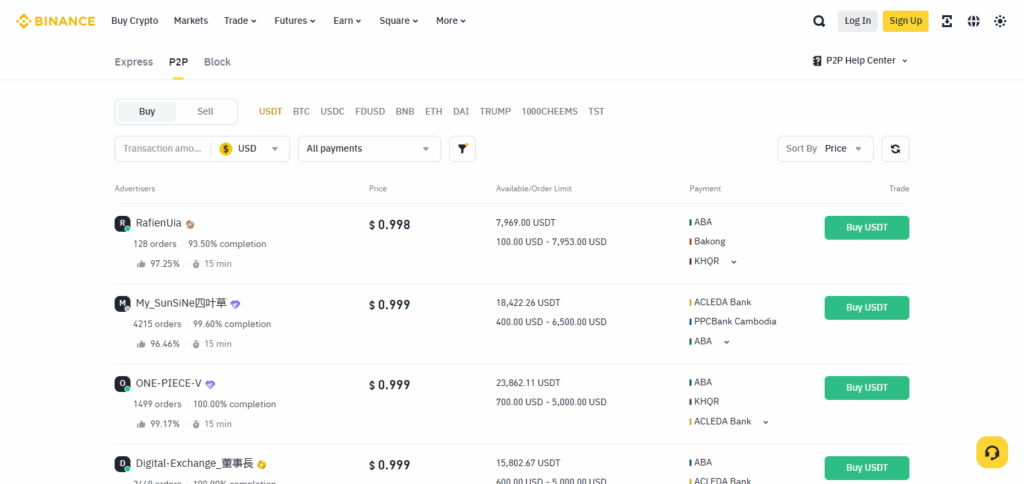

1. Binance

Binance is one of the foremost P2P crypto borrowing platforms since it allows lending services to be performed within a marketplace.

The direct connection of buyers and sellers without any middlemen, the customization to fit borrowers’ needs, and the competitive pricing all make this platform stand out. The marketplace’s security features like strict user verification alongside the automated escrow service provides reliability.

The liquidity and worldwide access guarantees quick service between users, making the cryptocurrency loans very simple and easy to obtain.

Binance Features

- Diversity of Cryptos: Binance offers trading for over 350 cryptocurrencies

- More Trading Functionalities: Binance allows for spot, margin, futures, and options trading.

- Binance Earn: Provide earning through staking, tiered savings, and liquidity farming.

2. KuCoin

KuCoin is one of the best options for P2P crypto borrowing because of its lending interface and useable digital assets. Its flagship feature is KuCoin Earn which allows users to lend or borrow assets directly from other users at variable or fixed interest rates.

The low-cost fees alongside simple design, secure risk control measures, and flexible borrowing options bolster the users’ experience. Passive income opportunities for lenders are further accelerated through the auto-lend feature while maintaining control for the user.

KuCoin Features

- Large Selection of Alt Coins: Has numerous low market cap and emerging tokens.

- Trading Bots Easy to Use: Automated bots for more effortless trading.

- KuCoin Earn: Passive income stream through staking, lending, and fixed-term deposits.

3. OKX

Due to the security of centralized platforms, OKX is regarded as one of the best P2P crypto borrowing platforms because it integrates decentralized finance options.

The ability to cross-margin and isolated-margin borrow through P2P with dynamically changing interest models is what sets OKX apart.

Users can optimize their borrowing strategies depending on the market. In addition, OKX has wide altcoin support, offers risk management tools, and protects borrowers and lenders through an escrow system which makes OKX reliable for P2P crypto lending and borrowing.

OKX Features

- And Web 3 Wallet: Serves as both centralized exchange and provides a decentralized Web 3 wallet.

- Extensive Derivatives: Covering futures, perpetuals, and options trading.

- Earn Hub: Products such as staking, dual investment, and savings offer earnings.

4. Aave

Aave is one of the most renowned P2P crypto borrowing platforms because of its decentralized and trustless blockchain lending systems. Its unique feature is the introduction of “aTokens” which gives out interest in real-time for lenders, earning their trust in clear visbility and efficient systems.

Rather than relying on traditional P2P systems, Aave utilizes smart contract pools, which allow borrowers to draw funds at the click of a button. This model increases flexibility as well as reduces wait times while mitigating risk, all of which positions Aave at the forefront of innovation in decentralized crypto lending.

Aave Features

- Lending without Intermediaries: Aave allows users to lend and borrow assets without a middleman.

- Instant Transaction Loans: Unsecured loans provided instantly and executed within a single transaction.

- Avalanche, Polygon, etc.: Aave currently exists on Ethereum, Avalanche, and Polygon among others.

5. Liquity

Liquity is unique among P2P crypto borrowing platforms because it offers interest-free loans collateralized by Ethereum.

The zero-interest model where users can borrow the LUSD stablecoin by locking ETH as collateral with no ongoing borrowing costs is what distinguishes it. This interest-free cost structure improves long-term borrowing cash flow predictability.

It also adds decentralization to governance Liquity has no policy controls which mitigates governance risk. Its stability pool along with the instant liquidation mechanism improves confidence for borrowers and lenders in volatile market conditions.

Liquity Features

Providing Liquidation Reward: Providing liquidity to liquidation earns rewards.

Loan Without Interest: Allows borrowing LUSD stablecoin against ETH with no ongoing interest.

Non-Custodial: Decentralized and governance free.

6. Unilend

UniLend is a leading P2P crypto borrowing platform that uniquely integrates decentralized trading with lending for all ERC-20 tokens. Its distinguishing feature is unrestricted access: any user can l ist and lend unsupported tokens, thus providing liquidity for less popular assets. Unlike platforms which are restricted to specific tokens.

UniLend allows communities to manage the lending policies as they wish. This, together with automation via smart contracts and custody-free control, makes UniLend a flexible and comprehensive system for P2P crypto borrowing on the Ethereum ecosystem.

Unilend Features

- ERC-20 Role: Permissionless role where anyone can list any ERC-20 token and lend them out.

- Lending + Borrowing: Merges both functions into one process in a decentralized way.

- Flash Loans: Strips collateral requirements and enables more sophisticated features within DeFi.

7. Venus Protocol

Venus Protocol is a world-renowned crypto peer-to-peer lending and borrowing platform that operates on the BNB Chain, providing quick and economical lending. Its distinct advantage is the capability which allows users to mint a decentralized stablecoin called VAI, which provides immediate liquidity without having to liquidate assets.

This option of both borrowing and stablecoin generation on a single platform increases capital liquidity. Venus also provides a vast array of supported assets, allowing decentralized governance and risk-based management of the assets for safe and scalable borrowing.

Venus Protocol Features

- Synthetic Stablecoins: Create stablecoins with crypto collateral.

- High-Yield Lending: Supplied assets generate interest.

- Cross-Chain Collateral: Accepts collateral from different chains on the BNB Chain.

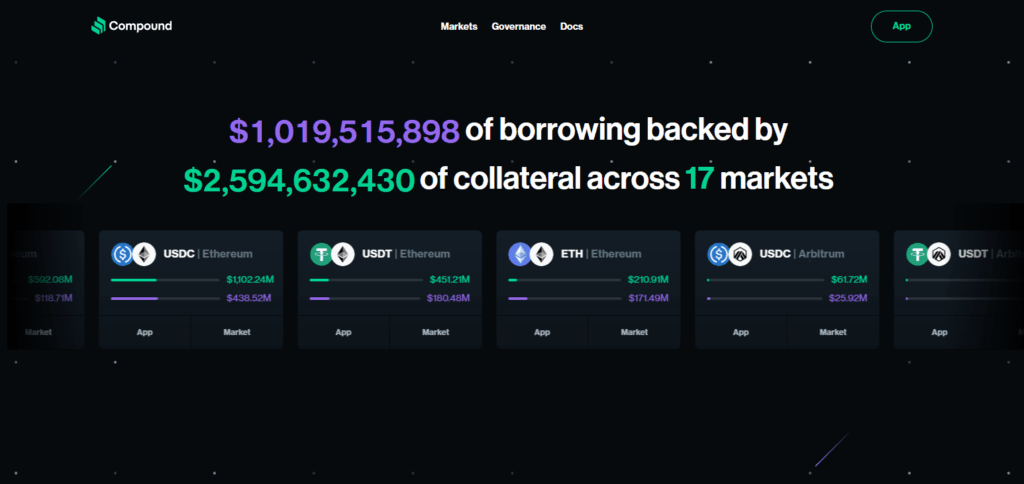

8. Compound

Compound is among the leading P2P crypto lending platforms, noted for its algorithmically modelled interest rate system and completely decentralized governance. Its primary distinct feature is the real-time calibration of borrowing and lending rates according to market demand, which helps create an efficient and transparent marketplace.

Users continuously earn interest via cTokens while retaining complete control over their assets. With Compound, the protocol gets the hands-off, abstractions of governance out of the way, providing a trustless, borderless, and automated lending framework of various cryptocurrencies.

Compound Features

- Algorithmic Lending: Interest is calculated and auto-adjusted from supply and demand.

- Governance Token (COMP): Allows users to participate in managing the protocol.

- Collateralized Borrowing: Offers a loan with cryptocurrency used as collateral.

Conclusion

To summarize, the prominent P2P crypto borrowing platforms stand out due to low fees, decentralization, flexibility, efficient risk mitigation, and other specialized user features.

Binance, KuCoin, and Aave are better known for their low-cost interest securing interfaces, while others like Liquity, UniLend and Compound offer unique innovations such as interest-free loans, versatile borrowing tokens, and streaming interest rate loans, all within a secure environment.

As discussed earlier, user-specific asset preferences, fee structures, and the level of borrowing flexibility determine the niche platform.