In this article, I will discuss the Top Ways To Connect Your Bank To Budgeting Apps , focusing on the most effective and secure options.

These solutions—whether it be integration without cumbersome KYC processes or live updating currencies—ensure that users can take full advantage of their budgeting apps while managing their finances efficiently.

Key Point & Top Ways To Connect Your Bank To Budgeting Apps List

| Provider | Key Feature |

|---|---|

| Plaid | Popular for easy integration with banks, used for payments, financial data, and account linking. |

| Yodlee | Focuses on aggregation of financial data, offers tools for credit, loan, and personal finance management. |

| Finicity | Specializes in real-time financial data and credit decisioning. |

| MX | Provides data aggregation, categorization, and insights for financial institutions and fintech apps. |

| TrueLayer | Focuses on enabling open banking, payments, and data access for Europe and other regions. |

| Salt Edge | Offers open banking solutions, financial data aggregation, and secure APIs for financial applications. |

| Teller | Provides banking APIs, real-time financial data, and account verification services. |

| Nordigen | Provides free and premium open banking API solutions for financial data aggregation. |

| Budget Insight | Specializes in open banking and financial data aggregation with a focus on expense management and budgeting. |

| Direct Bank APIs | Offers access to financial data directly from banks through secure, customizable APIs. |

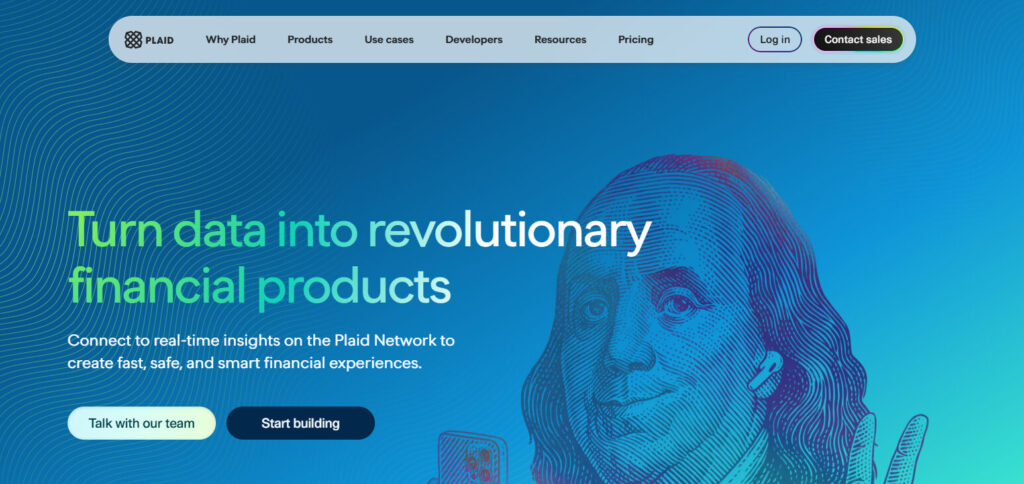

1.Plaid

Plaid’s cross-platform integrations with countless banks make it one of the most preferred services for connecting with budgeting apps. By linking their financial accounts, users can access real-time information in a safe manner.

Easy integration with mobile or web apps allows smooth updating of transaction history, balance details, and spending patterns, making personalized planning and tracking effortless.

| Feature | Detail |

|---|---|

| KYC Requirement | Minimal, mainly for verifying identity when linking accounts. |

| Data Access | Provides access to transactions, balances, and account details. |

| Security | Uses encryption and secure OAuth protocols for data protection. |

| Supported Regions | Primarily North America and Europe. |

| Integration | Easy integration with a wide range of budgeting apps via APIs. |

| Speed | Instant account linking and real-time data updates. |

| User Consent | Clear user consent required for data sharing. |

| Customization | Flexible data filtering options for personalized budgeting insights. |

2.Yodlee

Yodlee remains one of the best options to link a bank account with budgeting applications because of its comprehensive financial data aggregation capabilities. It offers greater support for financial institutions that provide insights into spending, income, and even investments.

With Yodlee, APIs enable syncing of information in real-time, ensuring users access adequate and accurate information on their finances from every platform they are on, making it ideal for extensive budgeting and financial planning.

| Feature | Detail |

|---|---|

| KYC Requirement | Minimal, with basic identity verification for account linking. |

| Data Access | Access to transaction history, balances, investments, and spending. |

| Security | Uses strong encryption and secure data protocols for user protection. |

| Supported Regions | Available globally, with a focus on North America and Europe. |

| Integration | Easy API integration for seamless connection with budgeting apps. |

| Speed | Fast syncing of financial data for real-time updates. |

| User Consent | Requires explicit user consent for data access and sharing. |

| Customization | Offers data categorization and filtering for tailored budgeting. |

3.Finicity

Finicity has excelled in the field of providing real-time financial data for credit decisioning, making it a top choice for connecting users’ banks with budgeting apps. With their secure APIs, account balances, transactions, and credit data can be accessed, allowing users to make informed financial choices.

The speed and accuracy with which Finicity transmits data makes it optimal for incorporating budgeting and financial planning insights into various applications.

| Feature | Detail |

|---|---|

| KYC Requirement | Minimal, requires basic identity verification for account linking. |

| Data Access | Access to transactions, balances, credit data, and spending insights. |

| Security | High-level encryption and secure API protocols. |

| Supported Regions | Primarily available in North America. |

| Integration | Easy API integration for budgeting apps and financial platforms. |

| Speed | Real-time data syncing and updates. |

| User Consent | Explicit user consent required for data sharing. |

| Customization | Offers credit and transaction data for personalized financial advice. |

4.MX

MX is a leader in linking a clients bank account to spending apps, due to their high quality data categorization and visual representation features.

By default, MX categorizes and schedules spending in ways that make sense so the users can understand their finances at a glance.

MX’s powerful data aggregation engine enables accurate, real-time information data streams to budgeting applications which use these powerful engines to provide tailored guidance, goal management, and comprehensive financial planning to users on multiple platforms.

| Feature | Detail |

|---|---|

| KYC Requirement | Minimal, basic identity verification for linking accounts. |

| Data Access | Provides transaction history, balances, and categorized spending data. |

| Security | Uses strong encryption and secure API connections. |

| Supported Regions | Primarily available in North America. |

| Integration | Seamless API integration with various budgeting apps. |

| Speed | Fast, real-time updates on financial data. |

| User Consent | Requires explicit user consent for data access and sharing. |

| Customization | Advanced data categorization and visualization for personalized budgeting. |

5.TrueLayer

TrueLayer stands out as the primary choice for integrating banking with budgeting applications because of its open banking framework and API capabilities.

Its integration facilitates quick and safe access to financial information from several institutions, particularly in Europe.

With budgetary applications, TrueLayer ensures that accurate and personalized financial guidance is provided through seamless data updating and user consent that prioritizes privacy, hence earning the user’s trust.

| Feature | Detail |

|---|---|

| KYC Requirement | Minimal, with basic identity verification during account linking. |

| Data Access | Provides real-time transaction data, account balances, and payments. |

| Security | High-level encryption and secure API connections. |

| Supported Regions | Primarily focused on Europe, with expanding global coverage. |

| Integration | Easy API integration with various financial apps and platforms. |

| Speed | Instant access to financial data and updates. |

| User Consent | Explicit user consent required for sharing data. |

| Customization | Customizable data access and filtering for specific budgeting needs. |

6.Salt Edge

Salt Edge distinguishes itself as one of the best ways to link your bank with budgeting applications due to its comprehensive open banking services and secure data aggregation.

It provides multiple financial data APIs, which facilitates integration with budgeting applications.

Through advanced security measures, Salt Edge provides instant and accurate access to transaction data, enabling users to effectively manage their finances and make rational budgeting decisions.

| Feature | Detail |

|---|---|

| KYC Requirement | Minimal, basic identity verification for linking accounts. |

| Data Access | Provides access to transactions, balances, and account details. |

| Security | Uses high encryption and secure protocols for data protection. |

| Supported Regions | Available globally, with a strong presence in Europe and North America. |

| Integration | Simple API integration for seamless connection with budgeting apps. |

| Speed | Real-time data syncing and updates. |

| User Consent | Requires explicit user consent for data access and sharing. |

| Customization | Offers data filtering and categorization for personalized insights. |

7.Teller

Teller stands out as a leader in linking a user’s bank to budgeting applications because of its precise focus on real-time financial information and quick API integrations. It has an intuitive system that provides easy retrieval of bank account transactions, balances, and spending summaries.

The problem of secure access to rapidly changing multi-institution financial data is effectively tackled by Teller and results in a comprehensive solution for accurate data sharing that enhances budgeting application functionalities.

| Feature | Detail |

|---|---|

| KYC Requirement | Minimal, basic identity verification for account linking. |

| Data Access | Provides access to account balances, transactions, and spending data. |

| Security | Uses high encryption standards and secure data protocols. |

| Supported Regions | Primarily available in the UK and Europe. |

| Integration | Easy API integration with budgeting apps and financial platforms. |

| Speed | Real-time data syncing with instant updates. |

| User Consent | Explicit user consent required for data access and sharing. |

| Customization | Customizable data filtering and categorization for budgeting. |

8.Nordigen

Nordigen is one of the most popular options for linking banks and budgeting applications because of its free and paid open API solutions.

It allows effortless consolidation of data from various financial institutions, giving budgeting applications instant access to transactions and account details.

Nordigen’s policies on transparency and security and its ease of integration makes it appealing to developers and users seeking effective financial management.

| Feature | Detail |

|---|---|

| KYC Requirement | Minimal, with basic identity verification for linking accounts. |

| Data Access | Provides access to transactions, balances, and account details. |

| Security | Uses encryption and secure data protocols to protect user data. |

| Supported Regions | Primarily available in Europe, with expanding coverage in other regions. |

| Integration | Easy API integration for budgeting apps and financial services. |

| Speed | Real-time financial data syncing and updates. |

| User Consent | Requires explicit user consent for sharing data. |

| Customization | Offers flexible data categorization and filtering for budgeting. |

9.Budget Insight

Since Bank Insight offers an advanced approach to data aggregation for banks connecting to budgeting apps, it has become a. top tier option. Budget Insight gives actual access to transactions, account balances, as well as spending and offers secured access, making it an all encompassing solution for accessing data.

Its elaborate API solutions and thrust toward data aggregation makes its choice for bank connection simple enabling easy integration with budgeting and expense management apps.

| Feature | Detail |

|---|---|

| KYC Requirement | Minimal, basic identity verification during account linking. |

| Data Access | Provides access to transactions, account balances, and spending data. |

| Security | High-level encryption and secure data protocols. |

| Supported Regions | Primarily available in Europe. |

| Integration | Simple API integration with various budgeting apps and platforms. |

| Speed | Real-time syncing of financial data and updates. |

| User Consent | Requires explicit user consent for data sharing. |

| Customization | Customizable data filtering and categorization for personalized budgeting. |

10.Direct Bank APIs

Direct Bank APIs are preferred when integrating banks to budgeting applications considering that they provide safe and direct access to the bank’s financial data. Direct APIs provide faster and more accurate transaction updates as there are no intermediaries.

Because of their complete integration capabilities, Direct Bank APIs permit budgeting applications to provide real-time insights, track expenditures and manage finances efficiently. Thus, they are secure and reliable for users seeking tailored financial management.

| Feature | Detail |

|---|---|

| KYC Requirement | Minimal, basic identity verification required for linking accounts. |

| Data Access | Provides direct access to transactions, balances, and account details. |

| Security | Strong encryption and secure connection protocols. |

| Supported Regions | Available globally, depending on the bank’s API access. |

| Integration | Direct API integration for seamless connection to budgeting apps. |

| Speed | Instant access to financial data with real-time syncing. |

| User Consent | Explicit user consent required for accessing and sharing data. |

| Customization | Flexible data access and filtering for personalized budgeting insights. |

Conclusion

In summary, the distinct features and advantages from budgeting apps, including Plaid, Yodlee, Finicity, MX, TrueLayer, Salt Edge, Teller, Nordigen, Budget Insight, and Direct Bank APIs can all be seamlessly integrated with a bank. These solutions allow for effortless real-time data syncing, secure API connections, or complete financial data aggregation.

These tools help users monitor spending, mange finances, and make accurate financial choices which enhances the budgeting experience while ensuring efficient financial management.