In this Article, I Introduce What Estimated rate of return should you use for retirement planning. Picking a return rate is crucial for calculating savings and planning for financial stability in the future.

I’ll discuss how different types of inflation and taxes as well as various types of investments affect returns so you can make the right decisions based on your goals.

What Estimated rate of return should you use for retirement planning?

Understanding the retirement rate of return is vital for planning an individual’s financial strategy and ensuring that lasting stability is sustained. It is important to remember a rate of return which is realistic in terms of benefits, taxes, fees, and inflation when planning for retirement.

After accounting for these factors, the historical data indicates that, the stock market has provided an average return of roughly seven percent in a year. The outcome of retirement plans is shaped by the taxes which impact investment returns in a big way.

While anticipating retirement, a clear distinction should be made between the real rate and nominal rate of return.

The former considers the impact of inflation, while the latter is the stated figure. Rational planning needs to consider these income sources: inflows, as well as the outflows, which are fees, taxes, and inflation, to set a return rate that meets your financial and future goals.

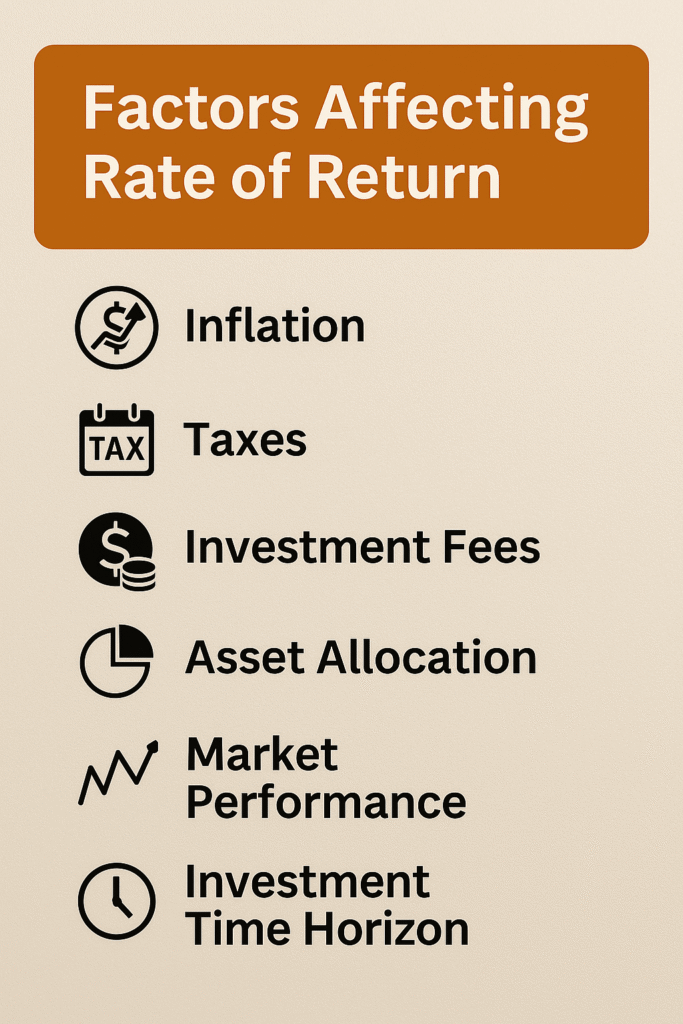

Factors Affecting Rate of Return

While thinking about retirement, one’s investments and anticipated returns are balanced against risk tolerance. Here are some of the factors that can affect your rate of return:

Asset Allocation: Diversifying the portfolio by placing funds in different asset categories can mitigate risk while optimizing returns, depending on one’s level of market risk aversion.

Retirement Timing – The voluntary retirement age and the investment policies are inter-related. Conservatively allocating a portion of the investment towards safer assets helps shield the accrued wealth from the turbulence of the financial markets.

Investment Knowledge – Managing a portfolio necessitates a comprehensive understanding of various asset types, their associated returns, fees, and risks. A sound strategy focuses on structural alignment of the portfolio with the set financial objectives and the defined risk level.

Calculating Rate of Return for Retirement

An equally important step towards guaranteeing financial stability during retirement is calculating the rate of return on investments.

While this determines whether or not the amount projected will meet the expected living standards, retirement costs including inflation, fees, and taxes also require consideration.

A couple of things to remember include:

After taxes, fees, and inflation, have a 7% set rate of return to increase the closer you get to the retirement age to ensure there are no deficits during withdrawal.

Income taxes significantly impact the net profit of any resource. Therefore factoring them is essential to arriving at the actual income.

Guaranteed income goals should always have buffers. To reduce overestimation, set by a conservative assumption of 4% to 6% on rate of return.

How to Choose the Right Estimated Rate of Return?

Use Historical Data as the Baseline

Always consider long-term averages of 6-8% for stock portfolios and 4-6% for balanced portfolios. These are typical estimates of real returns post inflation.

Adjust Return Rate for Inflation

Always take into account the real rate of return which is nominal return minus inflation. In this case, 7% nominal return with 2% inflation equals 5% during return.

Consider Fee and Tax Factors

Always subtract investment fees and expected taxes from the total mean return in order to achieve clearer indication of net return.

Consider Level of Risk Accepted

Absolute return conservative investors could use figures of 4-5% while absolute aggressive investors use 7-8% and vice versa.

Repeat as Needed

Always reassess the estimated return as market shifts, goals change and retirement approaches.

Importance of Inflation in Returns

Knowing how inflation impacts the income from your investments is vital for planning your retirement effectively. Since inflation diminishes the value of currency over time, it affects the real returns, as well as the future purchasing power of the currency.

Consider the following 3 points when incorporating inflation in retirement planning:

Historical Inflation Trends** – Inflation in the United States has ranged between 1.5% and 4% annually. These variations will affect the returns that are required to ensure financial stability.

Real versus Nominal Returns:** Analysis of investment returns gives a better insight into how a particular investment performs and its sustainability only when it is done after factoring in the inflation.

Preserving Value Over Time:** Using inflation while planning ensures that the spendable amount during retirement increases reliability while retaining the value of money meant for future use.

Retirement Saving Strategies

Diversified portfolios containing bonds and stocks provide the best means to maximize retirement savings. This mitigates risk while still putting returns on the horizon for the foreseeable future.

Furthermore, goals relating to finances, alongside a tolerance for risk, will be the guiding factors when constructing a sound plan for retirement.

Three ways to improve overall retirement savings have been enlisted below:

Make use of tax-advantaged accounts – Accounts like IRAs and 401(k)s can elevate the amount of return on investment over time due to their offered tax advantages.

Work with a trusted financial planner – Certified planners are available to work closely and create an individualized plan according to one’s personal goals, timeline, and preferred comfort when dealing with risk.

Adjust and keep track frequently – Retirement calculators can aid in tracking progress and estimating returns, which can be improved through fine tuning strategies.

Conclusion

To summarize, the appropriate estimated rate of return according to one’s strategy, risk appetite, and objectives has a unique importance.

Conservative approaches usually recommend 5-7% annual returns for balanced portfolios considering inflation, taxes, and fees.

Applying the most realistic value increases forecast accuracy, thereby improving the most preparedness for a secure and comfortable retirement.