In this article, I will discuss what TradingView’s API Pull Request Limit is. TradingView is a popular platform for charting and analyzing financial data, but it does not offer a traditional public API for pulling raw data.

Instead, users rely on unofficial methods or third-party tools, which may impose their limits. Let’s explore this in detail.

What Is TradingViews API

Through its application programming interface (API), TradingView enables developers to embed its charting libraries into various websites or applications.

Users can access the Charting Library Application Programming Interface (API) for engaging charts, while Pine Script aids in developing and deploying individualized indicators and trading systems.

Users of TradingView can use the webhooks to notify themselves about some specified conditions when the market meets those conditions.

Nonetheless, there is no standard public-facing REST API that allows for the scraping of market data; therefore, most users look for other unofficial sources for this.

API Pull Request Limit

Unlike other vendors for financial data, TradingView does not provide a normal public REST API interface.

Instead, users, however, adduce alternate ways or make use of other tools to extract data from TradingView, such as scraping and third-party Rest APIs like PyTradingView using TradingView charts and signals.

Taking into account that TradingView does not support this process, its particularities do not allow setting officially defined pull request limits. Limits may be determined by the following:

- Third-Party Solutions: Each method of fetching data from TradingView might come along with its particular rate limitation.

- Account Type: In the case of Steve Terry using restrictive unofficial APIs or excessive web scraping, such user’s account type (free or premium) would also dictate the rate limit. More restrictions are noted in free accounts than in paid plans.

While addressing the issue of using unofficial API, any such account or users of TradingView may be throttled or banned for abusive requests within a short period.

API Features

Charting Library API

As stated earlier, TradingView has its own Charting Library API that allows embedding highly customizable market charts into the website or application.

Webhook Integration

TradingView allows creating alerts via a webhook, so traders can send alerts to a specific site when certain conditions appear on the market.

Signals and Strategies

Besides using the extensive existing capabilities of TradingView, including the social part, creating and executing own buy and sell signals or strategies is also possible through Pine Script.

Pros and Cons

Pros of TradingView API:

- Customizability: The TradingView Charting Library API allows deep customization for charts and indicators.

- Extensive Data: Access to real-time stock, forex, crypto, and commodities data from major exchanges.

- Webhooks: Trading alerts can be sent to external platforms via webhooks, supporting automation.

Cons of TradingView API:

- No Official REST API: Unlike platforms like Alpha Vantage or Yahoo Finance, TradingView lacks an official REST API for pulling raw data.

- Limited by Account Type: Free users have more restrictions compared to premium users in terms of data access and webhook limits.

- Unofficial Solutions: Users relying on third-party APIs or scraping might face rate limits or account bans if they violate TradingView’s terms of use.

Alternatives for TradingView API

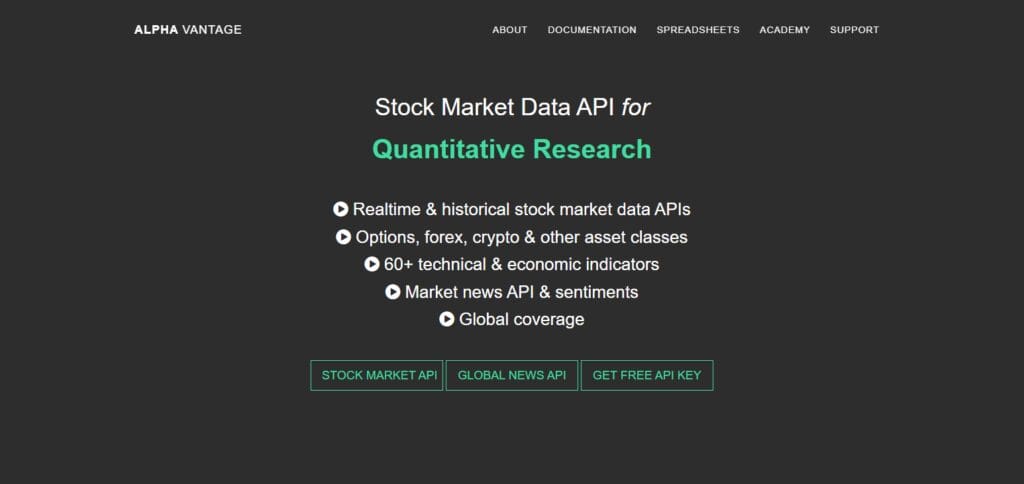

Alpha Vantage

Provides stock, forex, and cryptocurrency real-time and historical data. A very simple and quick REST API is offered for free with multiple endpoints for time series and technical indicators.

It offers a free tier with generous API request limits and premium plans for larger consumption.

Yahoo Finance API

Provides information on stock and mutual funds along with commodities. Access to real-time and historical data. Financial reports and news are also available.

The financial data API is well known and in great demand, as it has an extensive set of data and flexible rate limits.

CoinGecko API

Provides prices, market cap, and trading volume for cryptocurrencies and other digital assets.

Ninety per cent of its daily active users are within the crypto developer’s reach because of free usage with a lot of rate limits. Both live and historical data and analytics metrics are available on demand.

IEX Cloud

A US stock market data API with live prices, financial data, and news articles. REST API is supported

With various data tiers, a free tier for basic usage and paid tiers for advanced data. WebSocket Support is in place for live streaming.

Conclusion

In summary, the trading view does not provide an official public API for data extraction. There is no specific limit towards the number of pull requests.

Users commonly use unofficial means or other tools which have their restrictions.

In order to prevent account geolocation limitations or account bans, it is necessary to utilize terms of service-compliant TradingView data scraping, such as the Charting Library or webhooks, for automation.