Proprietary trading gives motivated traders a chance to use a company’s capital, employ sophisticated techniques, and possibly reap significant gains. Along with the great return potential, trading returns demand a great deal of self-control, discipline, and the ability to work under extreme pressure.

To ensure a successful career, each trader needs to gain a complete view of the benefits and burdens. The best prop trading platforms allow intelligent traders to optimize returns while minimizing risk in volatile environments.

What is Prop Trading?

Proprietary trading, or prop trading for short, occurs when a financial trader or firm trades its own capital, instead of a client’s, with the aim of gaining profits for themselves.

In contrast to client-commissioned trading, where a broker earns a fee by executing trades for a client, prop trading gives traders the ability to handle complex strategies, high-level algorithms, and sophisticated risk evaluation to grow profit margins.

This form of trading can be especially lucrative, and equally dangerous, when done with equities, foreign exchange, and other commoditized derivatives.

Due to the significant risk involved, capital allocation and structured training, as well as risk-averse profit loss strategies are provided by the Best Prop Trading Companies.

How Prop Trading works?

In proprietary trading, a firm gives a trader a certain amount of capital to use in the markets while the trader keeps the profits made.

Proprietary traders are able to select the trading strategies they want to use while dealing with exactly the same market issues as regular traders. These strategies can range from various arbitrage strategies, global macro trading, swing trading, and day trading.

Since the firm’s capital is at stake in proprietary trading, risk management is of primary importance. Prop traders are, therefore, subject to strict supervision and various trading-ethics rules.

For example, one of the most common rules is the maximum drawdown limit, which, when crossed, results in the trader’s account being suspended.

The Best Prop Trading programs balance all three: capital, strategy, and risk control to optimize profitability while safeguarding the firm’s balance sheet.

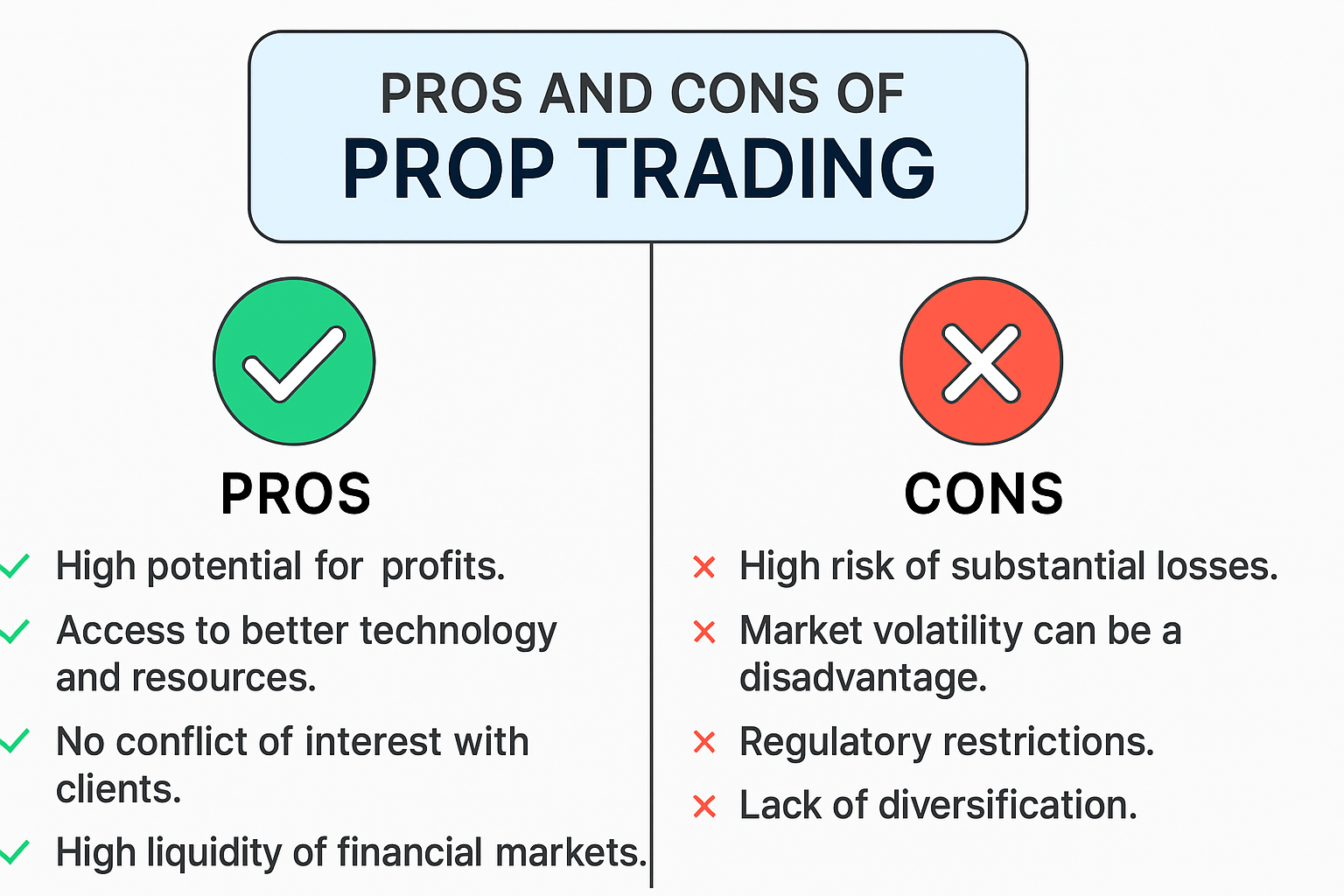

Pros and Cons of Prop Trading

Pros

Access to Capital. You can trade bigger positions without worrying about your own money.

Profit Sharing Opportunities. You can keep some of the profit, while the firm carries the loss, which protects your account.

Advanced Tools & Technology. You are able to use professional tools such as trading platforms, analytics as well as high quality research.

Risk Management Support. They set loss and capital protection parameters to shield the trader.

Skill Development. You can learn and build your trading skills as they provide mentorship.

Lower Personal Financial Risk. The firm absorbs the majority of the loss.

Networking Opportunities. You can meet and learn from experienced traders.

Incentives & Bonuses. Traders receive bonuses for hitting certain goals and performance.

Structured Trading Environment. You have rules and discipline to follow to stay within acceptable limits.

Focus on Trading. You don’t have to worry about asset management, you can dedicate yourself to trading.

Cons

Profit Split. Not all the profit is yours, you have to give some to the firm.

High Performance Pressure. Stress comes from constant targets which is regressive.

Strict Risk Rules. You have to follow firm rules on trade size and execution strategies which can be frustrating.

Psychological Stress. Expected profit and activity monitoring can create additional stress.

Limited Autonomy: The company has complete control over the capital allocation and the trading style.

Fee Structures: Some firms charge fees that can originate from desks or platforms.

Short-Term Focus: It can lead toward prioritization of short-term gain rather than sustainable growth.

Accountability for Losses: Underperformance results in lesser capital allocation in the future.

Eligibility Requirements: Accepted traders are typically those who are highly skilled or pre-tested.

Competitive Environment: There are intense competition and rivalry over available opportunities between traders.

Is Prop Trading a good career?

Proprietary trading or prop trading is a profession where traders use a company’s resources to trade equity and stock, forex, commodities, and derivatives instead of trading with their own money.

For aspiring traders, it becomes a fascinating opportunity to build a career which is intellectually rewarding and financially rewarding. Prop trading lets aspiring traders use advanced trading techniques, professional market exposure, and complex risk management.

There is, however, immense pressure, closely monitored trading, and considerable stress. Weighing all factors determines if prop trading is suitable for you, and your personal risk appetite, and long-term career vision.

How Much do prop traders earn?

The experience, performance, and area of the country working in, can create massive differences in earnings for prop traders. In the US, proprietary traders earn, on average, $100,000 a year and the total range spans $60,000 to $165,000.

Profit-sharing and performance bonuses allow high-class traders to earn much more, especially those in competitive markets and areas.

Due to high market activity and cost of living, New York and Rhode Island area traders report some of the highest average salaries in the country, often ranging between $124,000 and $126,000.

Some firms incorporate different compensation structures which change the risk and reward, and some are fixed salaries with performance bonuses. The Best Prop Trading firms reward skill, discipline, and consistent profitability with higher earnings potential.

Tips for Smart Traders in Prop Trading

Pick the Best Prop Firm – Consider the reviews about the firm’s reputation, profit shares, risk policies, and support before joining.

Know the Firm’s Risk Management Policy – Observe the risk limits to safeguard the capital, and to maintain continued access.

Begin with Small Positions and Gradually Scale Up – Begin with lower capital allotments until you demonstrate consistent profitable performance.

Create and Follow a Trading Plan – Adhere to proven strategies rather than constantly changing.

Maintain a Record of Your Trades – Keep a record of each trade, the victories and losses along with losses, to refine your thought process.

Practice and Apply Mental Discipline – Regulate your emotions to avoid the compulsion to overtrade and manage the pressure.

Utilize the Firm’s Facilities – Use the research, tools, and tech the prop firm provides.

Understand the Current Market – Keep learning and adjusting to the dynamic market conditions.

Make Rational Profit Expectations – Don’t pursue profit targets that are likely to breach the firm’s policy.

Connect with Other Traders – Develop your skills by obtaining insights from your peers.

Understanding the Legality of Prop Trading

When it comes to trading, understanding the importance of regulatory requirements is essential. Do proprietary trading firms operate illegally, or do they conform to all legal requirements?

Most beginner traders tend to forget that the prop trading market originated in the USA. This is important because the USA has some of the strictest regulations in the world, and thus, any company that operates within its borders will be heavily monitored.

The proprietary trading sector is, for all intents and purposes, legal in the USA and the EU, as well as in most other countries.

That said, some firms do come to market without the requisite financial regulatory permissions, which is a good reason not to do business with them. Legal, top-tier prop trading firms will always offer their clients clear and reasonable terms of business.

Conclusion

Proprietary trading provides an uncommon career with opportunities for exceptional pay, professional development, and large amounts of capital. Traders enjoy flexible strategies and advanced tools, along with rewards based on their performance.

There are, however, severe income fluctuations, extensive learning requirements, and high pressure resulting from limited available strategies and strict risk controls. Analytical discipline, comprehensive market knowledge, and ongoing consistent performance are vital and, in their absence, failure is practically guaranteed.

When considering a career in prop trading, one must carefully weigh the high potential rewards along with the associated risks. Ideal prop trading programs provide a structured environment in which professional skills can be fine-tuned and advanced while still providing ample opportunities for financial growth.

FAQ

What is prop trading?

Prop trading, or proprietary trading, is when traders use a firm’s capital to trade financial instruments like stocks, forex, commodities, or derivatives, aiming to generate profits for themselves and the firm.

What are the benefits of prop trading?

Benefits include access to significant trading capital, professional training, high earning potential, and the flexibility to use various trading strategies. Best Prop Trading platforms provide structured support and performance-based rewards.

What are the drawbacks of prop trading?

Drawbacks include high-pressure environments, strict risk management rules, potential income variability, and a steep learning curve for beginners or less experienced traders.

How do prop traders earn money?

Prop traders earn through salaries, performance bonuses, or profit-sharing models. Earnings depend on skill, market conditions, and firm policies, with top traders earning substantial income.

Is prop trading suitable for everyone?

No. Prop trading requires discipline, strong market knowledge, risk management skills, and the ability to handle stress. It is best suited for traders who are committed, skilled, and adaptable.