In this article, I will focus on AAVE Crypto A token of Aave Companies and its prominence in the cryptocurrency space especially in lending and borrowing.

Let me recap, Aave in short, allows users to lend or borrow assets and pay or receive interest without needing any third parties.

It combined its new feature such as flash loan together with the existing attractions like lending and borrowing to a quickly growing liquidity pool with AAVE decentralized governance enabling the swift evolution of AAVE.

Now let’s go through its main features of openness, its premium advantages, and its essence in the provision of economic freedoms.

What is Aave Crypto?

Aave is a decentralized finance protocol that allows people to lend and borrow crypto.

Lenders earn interest by depositing digital assets into specially created liquidity pools. Borrowers can then use their crypto as collateral to take out a flash loan using this liquidity.

Aave (which means “ghost” in Finnish) was originally known as ETHLend when it launched in November 2017, but the rebranding to Aave happened in September 2018. (This helps explain why this token’s ticker is so different from its name!)

AAVE provides holders with discounted fees on the platform, and it also serves as a governance token — giving owners a say in the future development of the protocol.

| Metric | Value |

|---|---|

| Price | $282.29 |

| Market Cap | $4.24B |

| Volume (24h) | $327.66M |

| Fully Diluted Valuation (FDV) | $4.51B |

| Vol/Mkt Cap (24h) | 7.39% |

| Total Value Locked (TVL) | $20.43B |

| Market Cap/TVL Ratio | 0.2092 |

| Total Supply | 16M AAVE |

| Max Supply | — |

| Circulating Supply | 15.04M AAVE |

Aave Price Live

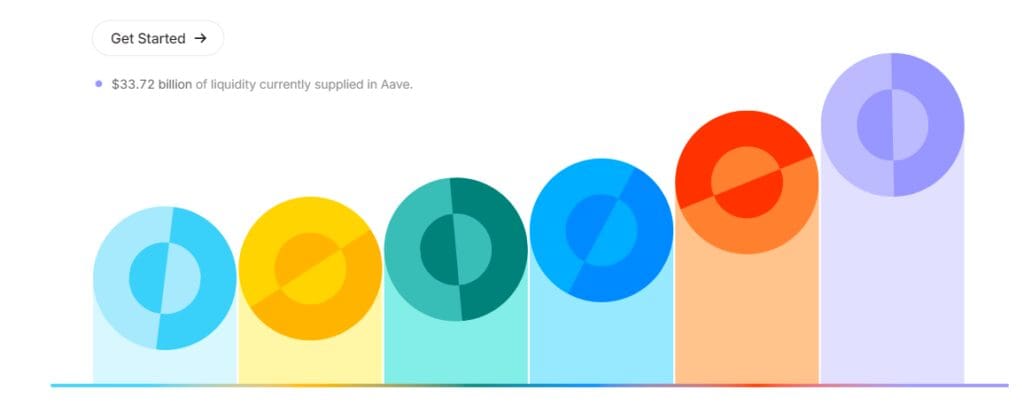

Access the full power of DeFi.

Aave is the world’s largest liquidity protocol. Supply, borrow, swap, stake and more.

Aave Features

Aave Features

Decentralized Lending and Borrowing

Individuals are able to lend and borrow multiple cryptocurrencies in an easier way without any third party regulations in place.

Liquidity Pools

Individuals are able to contribute liquidity to certain pools and receive rewards for that.

Flash Loans

Users are able to borrow assets without any collateral as long as the loan is returned within the same transaction.

Interest generation

Previously, owners of deposits were only able to issue loans to other users; however, with the new update, owners of deposits will also be able to earn interest on their deposits through aTokens which are essentially interest-bearing tokens.

Governance

The platform is community-based, as all users of the system can become decision-makers and vote on all important matters, and for that, they need to hold an AAVE token.

Cross-Chain Support

Can perform operations not only within the framework of a single system, but also in other blockchains.

Transparent and open source

All software and smart contracts are written in an open manner, which helps maintain transparency and security of the platform.

Automated Market Maker (AMM)

Gets the use of AMM protocols to assist in making trades and offers liquidity.

Meet Aave.

Supply – Earn interest by supplying assets to liquidity pools.

Borrow – Borrow against your collateral from across multiple networks and assets.

Aave by the numbers.

Aave is one of the largest DeFi protocols with billions of dollars in weekly volume across Ethereum and 12+ networks.

Does Aave have risks?

No protocol can be considered entirely risk free, but extensive steps have been taken to minimize these risks as much as possible — the Aave Protocol code is publicly available and auditable by anyone, and has been audited by multiple smart contract auditors.

Any code changes must be executed through the onchain governance processes. Additionally, there is an ongoing bug bounty campaign and service providers specializing in technical reviews and risk mitigation.

What is the Aave token?

AAVE is used as the centre of gravity of Aave Protocol governance. AAVE is used to vote and decide on the outcome of Aave Improvement Proposals (AIPs). Apart from this, AAVE can be staked within the protocol Safety Module to provide a backstop in the case of a shortfall event, and earn incentives for doing so.

Where is Aviliable Aave(AAVE)?

Starting off, Aave (AAVE) is available across multiple blockchains such as Ethereum, Polygon, Avalanche, Optimism, and Base. Aave is considered to be one of the biggest non-centralized finance provisions and facilitates the users allowing them to plus, minus and provide liquidity over the given networks. Other than that, Aave is able to be accessed through multiple DEX’s and compatible wallets which support the specified blockchain.

Aave Crypto Alternatives

1inch Network: Combines liquidity from many different DEXs to ensure the optimal rates for swap with the lowest slippage.

Compound: Permits its users to lend and borrow multiple cryptocurrency coins and earn interest on their deposits.

Alchemix: Offers prepayment on yield farming through tokens that are synthetically created and backed by underlying assets.

Balancer: Allows the users to establish and control liquidity pools with preset parameters they desire to implement.

Ion Protocol: Concentrated on DeFi services, enables users to lend and borrow funds using staked assets as collateral.

Aave Crypto Security

Advanced cloud-based DDoS protection services are used to identify and neutralize threats before they reach interface infrastructure. Scalable solutions are used so that applications can remain accessible, even during periods of high request volume.

To safeguard the domain, DNSSEC is used to protect against DNS spoofing and validate that domain name requests are securely authenticated. Regular monitoring and updates to DNS configurations help prevent unauthorized domain transfers.

Conclusion

Aave emerges as a trailblazing actor in the DeFi space with its unprecedented financial services that it offers. Its distributed lending and borrowing facilities and other features such as flash loans, liquidity pools and governance through AAVE tokens extend unique opportunities for users to secure and generate their wealth.

With its potential for cross-chain transactions and being open source, the platform is ideal for a larger audience. In light of its principles of transparency, security and constant evolution, Aave is right on track to maintain its leading status in the changing DeFi landscape.