This article explains How to Stake Stablecoins on Anchor Protocol for passive income. I’ll detail the entire procedure, from configuring your wallet to depositing your stablecoins and tracking your earnings.

Anchor Protocol is a go to for stablecoin staking due to its appealing yields and low volatility. This is an opportunity in DeFi that deserves full attention.

What is Staking Stablecoins?

Staking of stable coins involves putting cryptocurrencies with stable values (like USDT, or USDC, and UST) into certain DeFi protocols to earn passive income.

While crypto assets can be very volatile, stablecoins are pegged to fiat currencies so the chances of price fluctuations are reduced significantly. By staking, users are providing liquidity to the protocol that lends or invests the funds.

In return, users are rewarded with interest and/or native tokens of the protocol. This strategy is very popular among investors who seek to earn passive income without heavy risk incorporated.

How to Stake Stablecoins on Anchor Protocol

Staking stablecoins on Anchor Protocol is simple and easy. Let’s consider UST (TerraUSD) for this example:

Steps to Stake UST on Anchor Protocol:

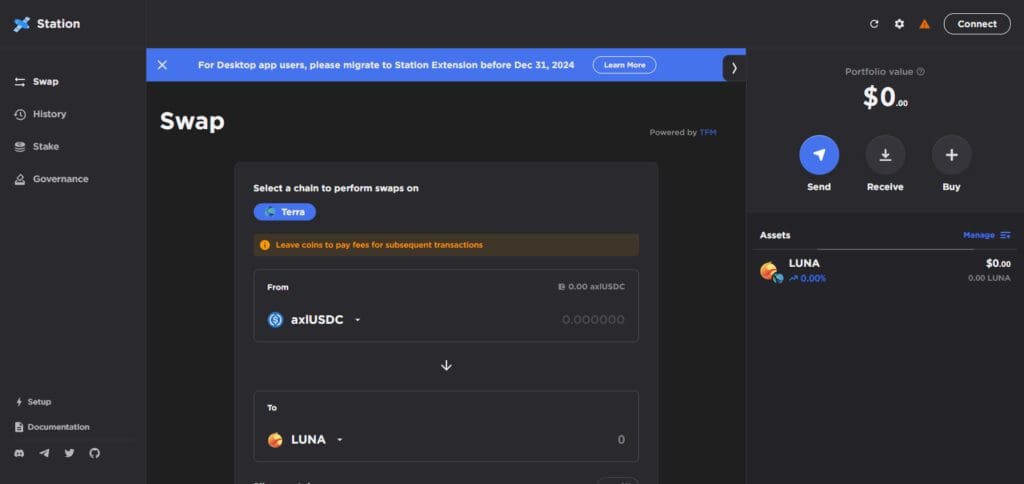

Set Up A Terra Station Wallet

Go to the website and install the Terra Station wallet browser extension.

If you don’t have a wallet, you can create a new one, or you can add an existing wallet using your seed phrase.

Your wallet needs to be loaded with UST tokens.

Access Anchor Protocol

Go to the Anchor Protocol link to start and connect your Terra Station wallet.

Go to the “Earn” Tab

Select the “Earn” tab within Anchor Protocol.

Deposit UST

Input the amount of UST you wish to stake.

Approve the transaction to deposit UST on Anchor Protocol.

Earn Rewards

Your UST deposits will accumulate yield rewards which is around 20% APY.

Other Place Where Stake Stablecoins on Anchor Protocol

Aave

Aave is at the forefront of DeFi protocols, enabling users to earn passive income by staking stablecoins in lending and borrowing markets.

Unlike Anchor Protocol, Aave provides users the option to choose between variable and fixed interest rates which works in their favor. It also allows the use of different types of stablecoins such as USDT, USDC, and DAI, which allows for diversification.

Aave is also well-known for its flash loans and over-collateralized lending, offering unique advanced financial tools on top of an already versatile staking platform.

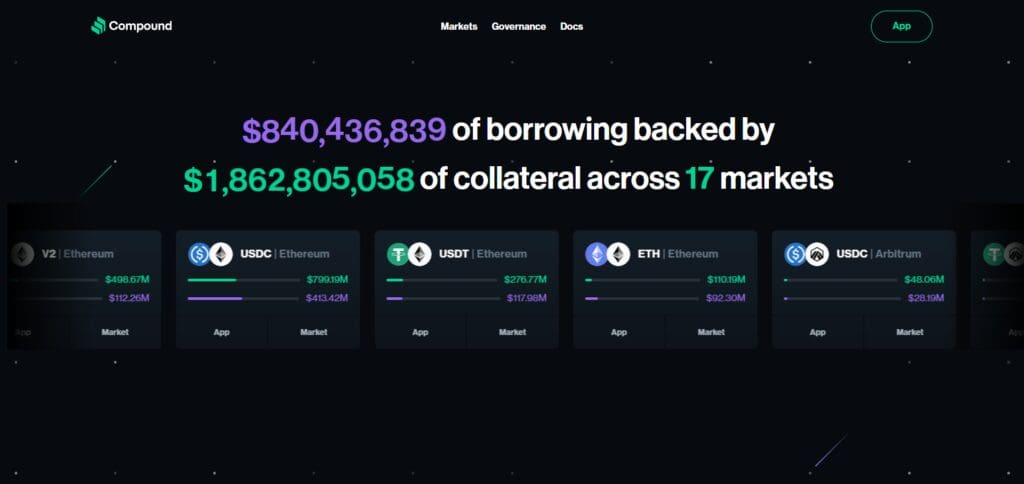

Compound

Compound is a well-known DeFi protocol whose users can earn interest from staking stablecoins as they easily provide liquidity to its lending pools.

In contrast to Anchor Protocol, Compound pays out interest through an algorithmically adjusted system based on supply and demand.

It supports several stablecoins like USDC and DAI, and it rewards users with cTokens, allowing users to earn additional tokens while staking. This blend of rewards makes Compound a great platform for stablecoin staking.

Monitoring Your Staking Rewards

Access the Anchor Protocol: Sign in and click on the “Earn” section.

Deposit Balance Overview: Confirm the amount of stablecoin you have staked and the remaining balance.

Interest Accrued Analysis: Analyze the rewards you have received, which are not cashed out, but reinvested for your compounding convenience.

APY Check: Look at what the current APY is to get a sense of how much you could earn.

Portfolio Tracking and Monitoring: Use dash DeFi to track funding rewards through numerous protocols.

Tips for Maximizing Staking Returns

Reward Compounding

Reinvest interest that you earn to take advantage of compounding.

Be Observant of APY Rates

Pay attention to Anchor Protocol’s yield rates, and alter your strategy as needed.

Cut Down On Transaction Fees

For network fees, try consolidating your withdrawals and deposits.

Invest In Multiple DeFi Protocols

Stake stablecoins on multiple protocols to diversify injection and return possibilities.

Use Efficient DeFi Dashboards

Manage performance better with Zapper or DeBank to track performance.

Pros & Cons

| Pros | Cons |

|---|---|

| High APY – Offers attractive, stable yields compared to traditional savings. | DeFi Risks – Vulnerable to smart contract bugs or exploits. |

| Low Volatility – Stablecoins reduce exposure to market fluctuations. | Anchor Dependence – Yields rely on the stability of the Anchor Protocol model. |

| Auto-Compounding – Interest is automatically reinvested, boosting returns. | UST Depeg Risk – If the stablecoin loses its peg, it may affect your holdings. |

| User-Friendly Interface – Easy-to-use platform for staking and monitoring. | Withdrawal Delays – Withdrawing staked funds may take time. |

| Passive Income – Earn consistent returns without active trading. | Network Fees – Transaction fees can reduce overall profits. |

Conclusion

To sum up, staking stablecoins on Anchor Protocol give people a trustworthy opportunity to earn passive income with relatively low risk in comparison to traditional banking.

By following the processes of depositing, monitoring and maximizing your rewards, you will benefit from the yields.

Always be APY and DeFi trend informed to enhance your returns. With DeFi protocols constantly evolving, there are risks to stablecoins but proper management of Anchor Protocol makes it a useful resource when hoping to grow your crypto portfolio.