In this article ,i will discuss the Best Stablecoins On Polygon Network. These stablecoins are integral in maintaining price stability and enabling fast and cheap transactions.

Whether you’re interacting with DeFi tools or just seeking a dependable digital currency, Polygon has several compelling choices. Let’s find out what stablecoins deserve the spotlight and understand their importance.

Key Point & Best Stablecoins On Polygon Network List

| Stablecoin | Key Point |

|---|---|

| USDT (Tether) | Most widely used stablecoin with high liquidity; backed by reserves and widely accepted. |

| USDC (USD Coin) | Fully backed by U.S. dollars, regulated in the U.S., and known for transparency. |

| DAI (Dai Stablecoin) | Decentralized and crypto-collateralized stablecoin governed by MakerDAO. |

| TUSD (TrueUSD) | Fully backed, audited stablecoin with strong emphasis on legal protection and transparency. |

| FRAX (Frax Protocol) | Hybrid stablecoin partially backed and partially algorithmic for stability and scalability. |

| MAI (MiMatic) | Polygon-based decentralized stablecoin backed by crypto assets via the QiDao protocol. |

| EURS (Stasis Euro) | Euro-pegged stablecoin backed 1:1 with Euro reserves, mostly used in Europe. |

| jEUR (Jarvis Synthetic Euro) | Synthetic euro stablecoin backed by USDC and managed by the Jarvis Network. |

| agEUR (Angle Euro) | Decentralized Euro stablecoin backed by over-collateralized crypto assets via Angle Protocol. |

| GUSD (Gemini Dollar) | USD-backed stablecoin issued by Gemini, regulated and audited monthly. |

1.USDT (Tether)

Tether (USDT) is one of the most prominent stablecoins on Polygon due to its unrivalled liquidity and usage across DeFi protocols. Its compatibility with Polygon guarantees rapid and economical transactions without price fluctuations.

Efficiency in bridging diverse value across chains is what sets USDT apart on Polygon, enabling support for numerous dapps. As a result, it caters to users who demand reliability, alongside extensive cross-functionality, within the Polygon network.

Features

- High Liquidity: Used extensively across multiple exchanges and DeFi services.

- Cross-Chain Support: Transferred easily across various blockchains including Polygon.

- Traders trust it: Typically traded owing to the economic depth of the market.

2.USDC (USD Coin)

Due to USDC’s (USD Coin) strong regulatory backing and consistent transparency, it is one of the best stablecoins on the Polygon network. What makes USDC stand out on Polygon is the trust factor—it guarantees a 1:1 dollar backing which makes it a pragmatic asset for DeFi users.

Moreover, USDC’s compatibility with major protocols and low transaction fees on Polygon enhances its versatility for trading, lending, and payments making it a preferred stablecoin for smooth transactions.

Features

- Regulatory Compliance: Compliance issued by a regulated entity within the U.S. and full audits.

- Transparent Reserves: Holds and maintains reserves for US dollars on a 1:1 basis.

- DeFi Friendly: Accepted in almost all DeFi protocols built on Polygon.

3.DAI (Dai Stablecoin)

DAI (Dai Stablecoin) is competitively one of the best stablecoins available DAI on the Polygon network. This is due to the reason that it is decentralized and resistant to centralized nature.

DAI is diferent Dai from other stablecoins since it is backed by collateral of cryptocurrency and is governed by smart contracts, providing users with censorship-resistant options.

On Polygon, its appeal resides in the offering of low cost and high speed finance activities, enabling users to fully partake in DeFi applications while maintaining control over their assets and avoiding custodial banking systems.

Features

- Decentralized: No central head controls the operations of DAI because it is governed by MakerDAO.

- Crypto-Collateralized: Instead of fiat currencies, it is backed up with several crypto assets.

- Stable Peg: Maintains value of dollar by employing smart contracts.

4.TUSD (TrueUSD)

TUSD (TrueUSD) sits atop the list of stablecoins on the Polygon network due to their strategic emphasis on compliance and transparency.

On Polygon, TUSD stands out due to having automation verification systems that provide real-time attestations of its USD reserves.

Such a high level of accountability cultivates trust among users, especially those who utilize DeFi services. With TUSD’s low gas fees and scalability, users requiring safety, consistency, and clear regulatory guidance in their transactions tend to rely on TUSD.

Features

- Real Time Audits: Automated systems are used to affirm and verify the reserves.

- Legal Protection: Token holders are provided with legal protection.

- Low Slippage: Reduced higher risk in DeFi trades due to stable pricing.

5.FRAX (Frax Protocol)

Frax Protocol has a standing among the best-known stablecoins in the Polygon network due to it’s fractional-algorithmic style structure. FRAX differs from fully collateralized or algorithmic stablecoins as it maintains it’s peg by shifting the collateral ratio depending on the market demand.

It’s strength lies in the Polygon network where fast, low-cost transactions are combined with capital efficiency. This dual model makes FRAX an optimal choice for users who are searching for both precision and ease within DeFi environments.

Features

- Fractional Collateral: Combination of crypto backed and algorithmic stability.

- Dynamic Peg System: Alters the ratio of collateral slowly and over time.

- Scalable Model: Low volatility and high efficiency.

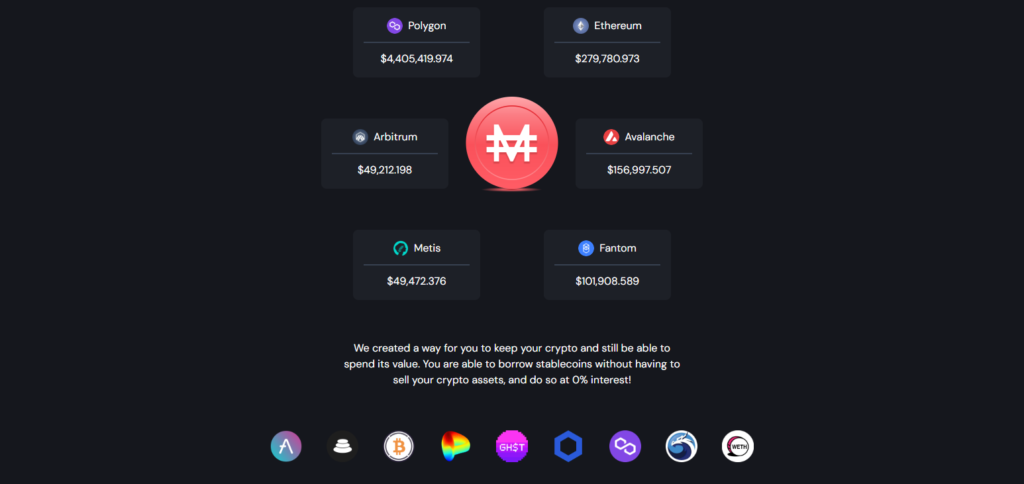

6.MAI (MiMatic)

MAI (MiMatic) is considered as one of the best stablecoin in the Polygon network due to its fully decentralized and over collateralized mechanics.

MAI issued by the QiDao protocol allows users to mint stablecoins by collateralizing crypto assets without the need to liquidate them.

On Polygon, MAIs native compatibility—engineered for the ecosystem—guarantees effortless operation with local DeFi applications. Coupled with Polygon’s low cost and fast transaction times, this provides users with an uncustodial and stable financial instrument.

Features

- Native to Polygon: Created specifically for the Polygon ecosystem.

- No Liquidation Risk: Stable during volatility and over-collateralized.

- Self-Minting: Allows users to mint MAI through locking their assets.

7.EURS (Stasis Euro)

EURS (Stasis Euro) remains one of the best stabledigned for on the Polygon Network by providing a euro-backed digital token in a market saturated with USD-pegged alternatives. Its singular advantage on polygon is unlocking euro value within the polygon ecosystem and enabling quick and cheap transactions.

EURS brings Euro-centric financial assets into the world of crypto, allowing deeper participation in European DeFi without the hassle of changing currencies. This makes it suited for users who want to use euros while enjoying the polygon’s blockchain marvels.

Features

- Euro-Pegged: Backed by actual Euros in reserves.

- Regulated Structure: Operates under European financial regulations.

- Good for Euro Exposure: Perfect for those wanting to avoid EUR/USD volatility.

8.jEUR (Jarvis Synthetic Euro)

jEUR (Jarvis Synthetic Euro) is one of the best stablecoins on Polygon network due to its innovative synthetic design offering euro exposure while using USDC as collateral.

Its deep integration with liquidity protocols enables euro-pegged assets trading in a non-centralized system.

It allows users to engage with euro-pegged assets without the necessity of having physical euros making it ideal for Defi users wanting to have access to non-USD stable currency with low slippage and fees.

Features

- Synthetic Asset: Pegged to the Euro through USDC collateral.

- Forex-like Trading: Freely exchanged for other stable or crypto assets.

- DeFi Integration: Compatible with liquidity pools and yield farming.

9.agEUR (Angle Euro)

agEUR (Angle Euro) is one of the stablecoins on the Polygon network best known for its decentralized nature and overcollateralized backing.

Propelled by Angle Protocol, agEUR preserves a euro peg while providing multiple minting and collateral flexibilities.

Its most fundamental trait on Polygon is composability, which allows for seamless integration with lending, swapping, and yield farming DeFi platforms. Such capabilities allow users to retain stability of the euro without sacrificing decentralization or network efficacy making agEUR a go to choice.

Features

- Fully Decentralized: Governed on-chain by the Angle Protocol.

- Multi-Collateral Support: Can be minted with multiple crypto assets as collateral.

- Euro Stability: Provides reliable euro exposure on Polygon.

10.GUSD (Gemini Dollar)

GUSD (Gemini Dollar) is one of the top stablecoins in the Polygon network with regard to trust and regulation.

GUSD is issued by Gemini and is supervised by U.S. regulators which makes it highly transparent with monthly audits.

GUSD’s unique advantage on the Polygon network is that it combines low fee transactions with regulatory assurance. This ensures that the currency is used for secure and fast transactions. GUSD is the solution for the stablecoin users in the Polygon ecosystem who need blockchain efficiency, compliance, and regulations.

Features

- Highly Regulated: Issued by a licensed U.S. trust company, Gemini.

- Monthly Audits: Reserves are audited by independent third-party firms.

- Institutional Trust: Used primarily by those valuing strict oversight.

Conclusion

In summary, the Polygon network includes a variety of stablecoins, each serving specific user requirements. Users have multiple options for stablecoins, such as USDT and USDC with high liquidity and regulatory trust,

DAI with decentralization, and FRAX with innovation. Further supporting financial versatility are Euro-backed stablecoins, EURS, jEUR, and agEUR. These stablecoins balance stability, low fees, and speed which improves the DeFi ecosystem in Polygon; thus, providing powerful resources for hassle-free and secure digital finance.