In this article, I will analyze Best Bridging Aggregator with Lowest Slippage, guiding you in finding the easy platforms for cross-chain transactions.

No matter if it is transferring assets from Ethereum, BSC, or Solana, the right aggregator can help minimize expenses while maximizing returns.

Let’s discuss some of the top providers that offer low slippage, smart routing, and wide network coverage.

Key Points & Best Bridging Aggregator with Lowest Slippage List

| Bridging Aggregator | Key Points |

|---|---|

| DeFiLlama Meta-Aggregator | Aggregates data from top platforms, shows liquidity & price comparisons. |

| 1inch | Efficient DEX aggregator offering reduced slippage and better price execution. |

| OpenOcean | Multi-chain aggregator optimizing swap routes across various DEXes. |

| Matcha | Offers the best price by connecting to multiple liquidity sources. |

| ParaSwap | Aggregates liquidity from DEXes and offers smart routing for lower slippage. |

| Jupiter Exchange | Solana-focused aggregator ensuring low fees and high efficiency. |

| Portal Token Bridge | Cross-chain token bridging with low fees and high security. |

| Allbridge | Supports multiple chains with a focus on seamless cross-chain transfers. |

| Celer cBridge | Fast and low-cost transfers between chains with support for numerous tokens. |

| Synapse Protocol | Cross-chain liquidity protocol that enables low-slippage swaps and bridging. |

10 Best Bridging Aggregator with Lowest Slippag

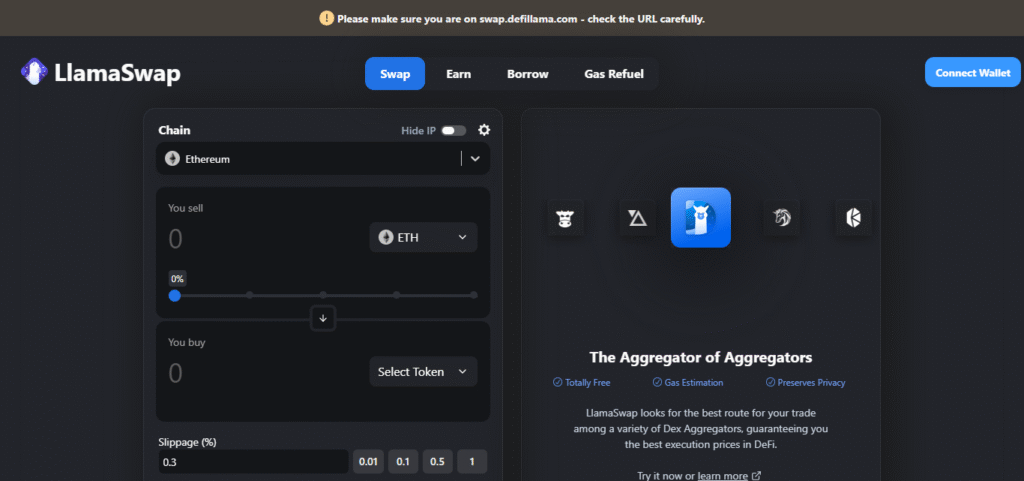

1.DeFiLlama Meta-Aggregator

DeFiLlama Meta-Aggregator stands out as one of the leading bridging platforms that can help users identify optimum routes for swaps across different DeFi protocols with minimal slippage. It supports a myriad of chains such as Ethereum, Binance Smart Chain, and Polygon enabling cross-chain transactions.

The platform ensures that trades are executed at the optimal price with minimal slippage on the defined parameters, thanks to its advanced routing algorithms. Coupled with a non-restrictive policy regarding tracking, users can monitor accessible liquidity, price discrepancies alongside set routes for all transactions.

DeFiLlama Meta-Aggregator

- Data-Driven Platform: This aggregator gathers data from top DEXes and bridges in real-time.

- Chain Support: Ethereum BSC, Polygon, and several other chains are covered.

- Slippage Optimization: Allows users to view slippage across all platforms so they can select the best-optimized route.

- User Transparency: Clear comparison analytics and other verifiable information.

2.1inch

1inch is a popular DeFi Meta-Aggregator whose primary focus is slippage minimization and optimal price execution on multiple decentralized exchanges (DEXes). It works with different chains like Ethereum, Binance Smart Chain, Polygon, Avalanche, and others.

The platform runs on an algorithm which divides trades across different liquidity pools in order for users to get the lowest slippage and the best rate possible.

Its smart routing mechanism also optimizes swaps, placing it among the most efficient, user-friendly bridging aggregators in DeFi. For users looking for seamless, cross-chain transactions with minimal slippage, 1inch is perfect.

1inch

- Smart Routing: Makes trades to multiple DEXes to get better prices.

- Multi-Chain Support: Over 7 Multi Chains including Ethereum, BSC, Polygon, Avalanche, Arbitrum, and Optimism.

- Low Slippage: trade paths optimization minimizes slippage on larger orders.

- Gas Token Support: Transaction costs are lowered with the use of CHI gas token.

3.Open Ocean

OpenOcean acts as a singular terminal (or a meta-aggregator) in DeFi space, optimizing cross-chain transactions: it aims to achieve the lowest slippage possible. It aggregates liquidity from multiple sources, including both decentralized exchanges (DEXes) and centralized exchanges (CEXes), providing users with the best price and minimal slippage.

OpenOcean supports many chains such as Ethereum, Binance Smart Chain, Polygon, Avalanche, among others. Using DEX’s innovative routing algorithms, OpenOcean excels at propelling users along the best-priced routes.

Slips on split trades are automatically adjusted across different liquidity providers optimizing numerous benchmarks. OpenOcean is ideal for those bridging for low slippage and high efficiency due to seamless platform integration across chains.

OpenOcean

- DEX & CEX Aggregator: Integrates liquidity from centralized exchanges and decentralized exchanges.

- Chain Compatibility: Ethereum, BSC, Solana, Avalanche and many more on Wide support.

- Intelligent Routing: AI tackles the issue of best pricing with slippage negotiation on routing.

- Cross-Chain Swaps: Bridging is speedy and affordable.

4.Matcha

In the world of DeFi, Matcha is a cross-chain aggregator which focuses on minimizing slippage and ensuring that the best prices are executed for swaps. The platform integrates liquidity from various DEXs like Uniswap and SushiSwap to provide the optimal trading route.

Matcha operates on Ethereum and Binance Smart Chain and Polygon as well as Optimism and other chains. Through smart order routing, it automatically breaks up single orders into multiple fragments to reduce slippage.

When bridging, users prefer Matcha because of its easy to use interface achieved from its sophisticated systems for automation.

Matcha

- Very Nice UI: Clean interface that is more suitable for beginners.

- Multi-Liquidity Sources: Uniswap aggs, SushiSwap, Curve, Balancer, and many others including DEXs.

- Order Splitting: Reduction of slippage through minimal obstructions.

- Chain Support: Ethereum, BSC, Polygon, Optimism.

5.ParaSwap

ParaSwap’s robust design as a Meta-Aggregator allows users to experience low slippage and optimal pricing on cross-chain transfers. By collecting liquidity from numerous DEXes and other sources, ParaSwap guarantees price execution at the best mark.

This platform has extensive chain support that includes Ethereum, Polygon, Avalanche, Binance Smart Chain, and many others.

With the use of intelligent slippage minimization, slippage maximization, and trade splitting technology, smart routing allows trades to be executed efficiently on different platforms. Users striving for smooth, affordable, high yield results, and low fees deem the platform their first choice.

ParaSwap

- Advanced Trading Engine: Features smart order routing, dynamic gas, and price strategies.

- Chain Integration: Ethereum, BSC, Avalanche, Polygon, and many others are supported.

- Minimal Slippage: Split order execution across DEXs for optimal slippage.

- Developer Friendly: APIs and SDKs are available for seamless integration.

6.Jupiter Exchange

Jupiter Exchange is a premier Solana ecosystem’s Meta-Aggregator which strives to provide the optimal price execution and slippage for cross-chain transactions. It consolidates the liquidity from multiple DEXs and other liquidity providers within Solana’s ecosystem.

Jupiter operates primarily with Solana, but also supports cross-chain interoperability with various other chains.

It has a smart routing system that partitions orders across multiple liquidity sources to reduce slippage and ensures efficient trade execution. Solana-based bridging is done with minimal slippage because of Jupiter’s rapid transaction execution and fee payment system.

Jupiter Exchange

- Solana Native: The platform is developed for the Solana ecosystem.

- Speed & Cost Efficiency: Transactions are quick and have a low fee.

- Smart Routing: Executes trades cross DEXs on Solana for optimization.

- Cross-Chain Expansion: Integration with multiple chains is in progress.

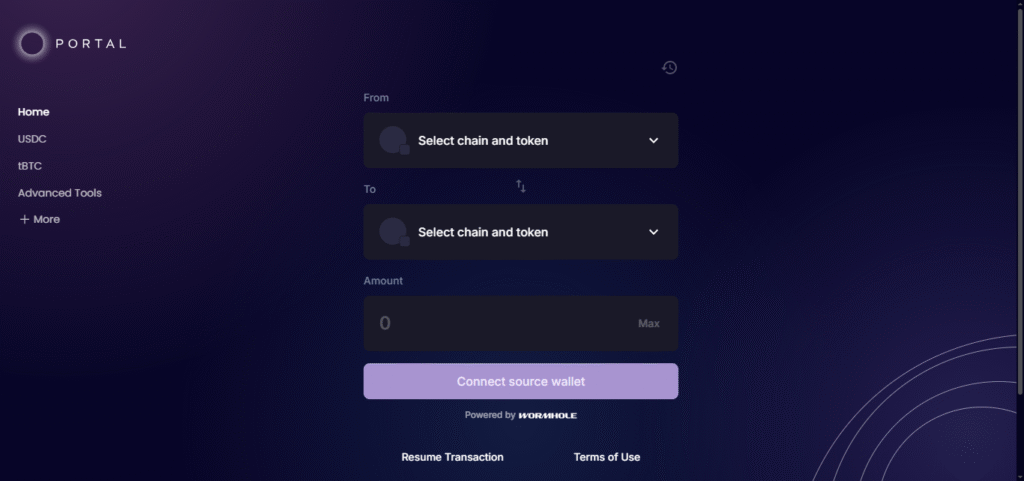

7.Portal Token Bridge

Portal Token Bridge operates as a Meta-Aggregator which optimizes cross-chain transactions with minimal slippage. It allows for the transfer of tokens between supported blockchains with better price execution.

The Portal does support multiple chains such as Ethereum, Binance Smart Chain, Avalanche, and others and therefore ensures wide compatibility.

The low slippage offered by the Portal is achieved through sophisticated routing techniques which determine the least effective and most profitable routes for transferring tokens.

With the use of ample liquidity pools and multiple liquidity sources, users are ensured fast routing, thus providing a low slippage experience across different networks.

Portal Token Bridge

- Cross-Chain Interoperability: Transfers assets between various blockchains.

- Security Focused: Ensures decentralization and verifiability of token transfers.

- Low Slippage: Utilizing Wormhole technology, brige routes are optimized.

- Chain Coverage: Covers Ethereum, BSC, Solana, Polygon, Avalanche, and others.

8.Allbridge

Allbridge is a powerful Meta-Aggregator that enables seamless low-slippage token transfers between different chains. It bridges different ecosystems like Ethereum, Binance Smart Chain, Polygon, Solana, Avalanche and many others for cross-chain bridging.

Allbridge has created a proprietary slippage reduction algorithm that uses various liquidity pools to minimize fencing slippage. Allbridge ensures excellent price execution for their users by optimizing route selections to use the lowest cost routes. Allbridge is ideal for low-slippage multi-chain bridging in the DeFi space due to its low-fee structure and high transaction speeds.

Allbridge

- Chain-Agnostic: Versatile support for Solana, Terra, Polygon, and many others.

- User-Friendly: An intuitive UI aids in one click asset bridging.

- Optimized Transfers: Transfers are executed with low slippage through liquidity pools.

- Token Flexibility: Support for stable coins, underlying tokens, and wrapped securities.

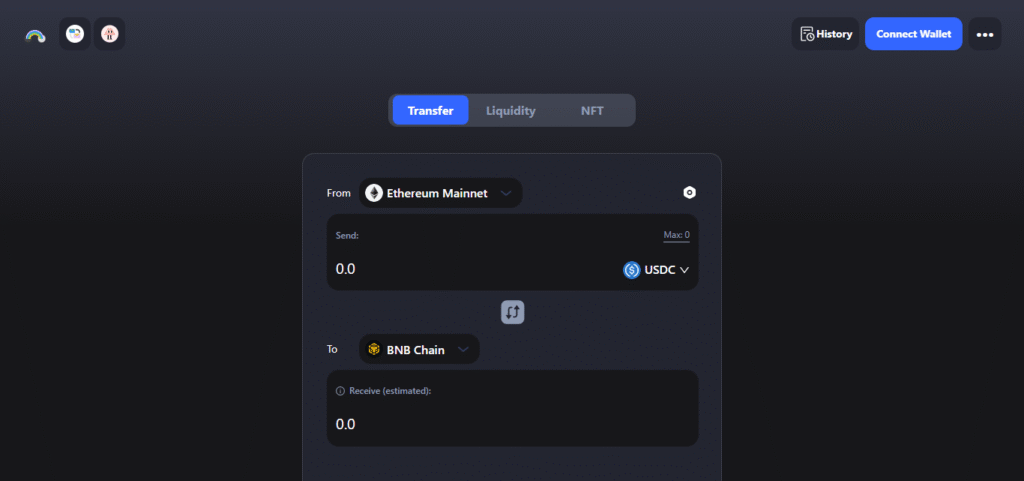

9.Celer cBridge

Celer cBridge is exceptional in its class as a Meta-Aggregator since it’s capable of executing fast, low-cost cross-chain transactions with minimal slippage. cBridge supports many chains like Ethereum, Binance Smart Chain, Polygon, Avalanche, and more, it guarantees smooth transfers of assets across various blockchains.

cBridge’s low slippage smart routing mechanism ensures that trades are split and routed through the liquid and efficient trims, which cut the price differeces, reducing slippage.

Celer cBridge has become one of the most popular cross-chain bridges among DeFi users due to its optimized inter-chain transfer protocol which guarantees low slippage and minimal cost.

Celer cBridge

- Fast Transfers: Transfers are completed almost instantaneously across chains.

- Extensive Chain Support: Ethereum, BSC, Avalanche, Arbitrum, Optimism, and others.

- Liquidity-Rich Pools: Enhances the liquidity available and mitigates slippage.

- Fee Efficiency: Cost-effective transactions and efficient pathfinding

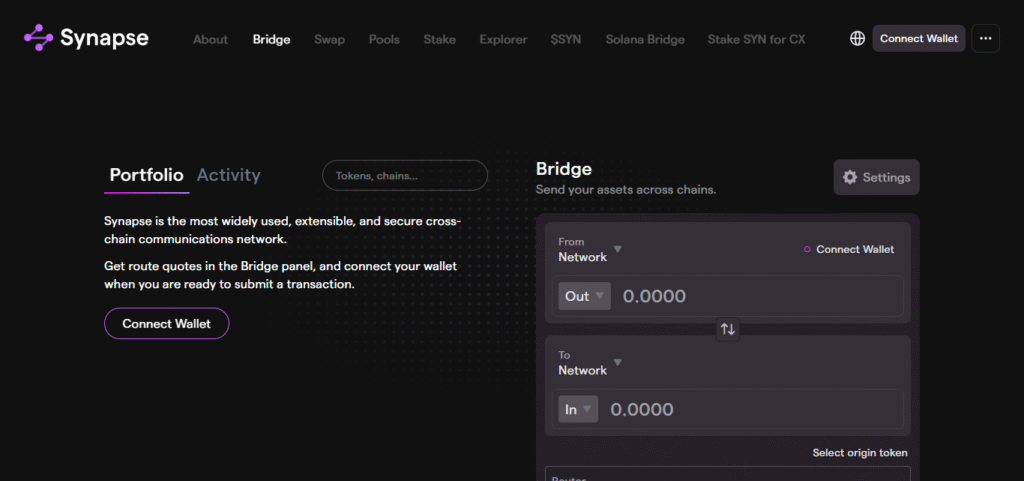

10.Synapse Protocol

Synapse Protocol is a sophisticated Meta-Aggregator aimed at providing low slippage cross-chain transfers among different blockchains. Ethereum, Binance Smart Chain, Avalanche, Polygon, and many more chains are supported.

This enables transfer of assets across various ecosystems. Synapse’s unique liquidity protocol and smart routing automate path selection and optimize transactions for swaps over the most liquid and efficient routes.

This achieves minimum slippage, low cost, and fast transaction speed. Bridging, liquidity aggregation and cross-chaining are made easy with Synapse Protocol which is perfect for the DeFi user who needs efficient low slip cross-chain transfer.

Synapse Protocol

- AMM-Powered Bridge: Leverages AMMs for cross-chain swaps.

- Broad Chain Support: Ethereum, Avalanche, BSC, Polygon, Arbitrum, Optimism, and more are included.

- Minimal Slippage: Ensured by smart pricing algorithms and ample liquidity.

- Secure Infrastructure: Decentralized, verified smart contracts.

Conclusion

To summarize, Selecting the optimal bridging aggregator with the least slippage possible guarantees smooth, economical cross-chain interactions. The smart routing, deep liquidity, and multi-chain coverage provided by 1inch, DeFiLlama, Synapse, and Celer cBridge shine.

These aggregators provide optimized sub-transaction experiences engineered for DeFi consumers throughout various blockchain networks, whether for trading or moving assets.