In This article I Will Talk About will target the top enterprise cross-chain aggregators, paying attention to systems that allow easy movement of an asset across the chains.

A cross-chain aggregator is selected with its corresponding considerations as enterprises are now integrating DeFi solutions.

I will discuss the major features of the topmost platforms that enable enterprises make appropriate selections suited for growth, operational effectiveness, and smooth integration.

Key Points & Best Cross-Chain Aggregator For Enterprises List

| Platform | Key Points |

|---|---|

| Synapse Protocol | Supports multi-chain communication with a focus on liquidity pools; emphasizes low fees and fast transactions. |

| Stargate Finance | Focuses on enabling seamless cross-chain transfers of assets, optimizing for both speed and cost. |

| Across Protocol | Specializes in bridging assets between different blockchain ecosystems with low fees and fast swaps. |

| Rango Exchange | A cross-chain swap platform that aggregates multiple liquidity sources for the best rates. |

| RhinoFi | An aggregation protocol offering seamless cross-chain asset swaps and optimizing for enterprise use. |

| Orbiter Finance | A decentralized bridge protocol focusing on cross-chain liquidity and asset transfers. |

| Hop Protocol | Optimizes liquidity and offers a fast, low-cost solution for transferring tokens across multiple networks. |

| Binance Bridge | A bridge by Binance for transferring assets across Binance Smart Chain and other networks. |

| Portal Bridge | Specializes in bridging assets across various chains with a focus on decentralized finance (DeFi) applications. |

| Orbit Bridge | A decentralized bridge facilitating transfers of assets across multiple blockchains with a focus on scalability. |

10 Best Cross-Chain Aggregator For Enterprises

1.Synapse Protocol

Synapse Protocol is a premier aggregate across chains that provides multi-blockchain interoperability solutions to enterprises. It helps streamline businesses by incorporating multiple blockchains, allowing for smooth transferring of assets and information across different networks which improves scalability and effectiveness.

Synapse ensures the pools of liquidity and lower fees related to the transactions add to its advantage, allowing cost saving. Quick transaction execution captures the attention of enterprises as well.

The protocol’s infrastructure is well built for token swaps and DeFi supported applications which is helpful for enterprise grade multi-chain infrastructure applications. Its intuitive design coupled with secure crosschain architecture make it appealing for business to have a dependable and scalable synapse level solution.

Features Synapse Protocol

Cross-Chain Liquidity Pools: Enables transferring of assets from one blockchain to another by providing liquidity to multiple blockchains simultaneously.

Interoperability: In addition to multiple blockchains synapse also supports a variety of decentralized finance (DeFi) applications.

Low Fees and High Speed: Minimal transaction costs and quick processing times are achieved through optimization.

Scalable Infrastructure: Enterprise level solutions are built to be as scalable and robust as possible.

2.Stargate Finance

Custom-made for enterprises requiring smooth blockchain integration, Stargate Finance is an extremely sophisticated aggregator. For the purpose of bridging assets between chains, Stargate aids in the faster and economical token transfer between decentralized networks.

Its novel framework increases operational efficiency and liquidity scalability so that enterprises can easily assimilate into multi-chain ecosystems. Enterprises can securely execute cross-chain transactions, enhancing operational efficiency in their DeFi services.

Stargate Finance’s primary goal is to boost assets value and connectivity through different blockchain networks while reducing transaction fees, enabling flexible resource allocation and strategic management.

Features Stargate Finance

Cross-Chain Asset Transfers: Supports transfers of assets between blockchains and does so efficiently and quickly.

Optimized for Speed: Ensures that transactions go through quickly, and are processed with low costs.

Decentralized and Secure: Previously verified security measures make transactions trustless and decentralized.

Liquidity Pools: Manages efficient cross-chain swaps by utilizing liquidity pools.

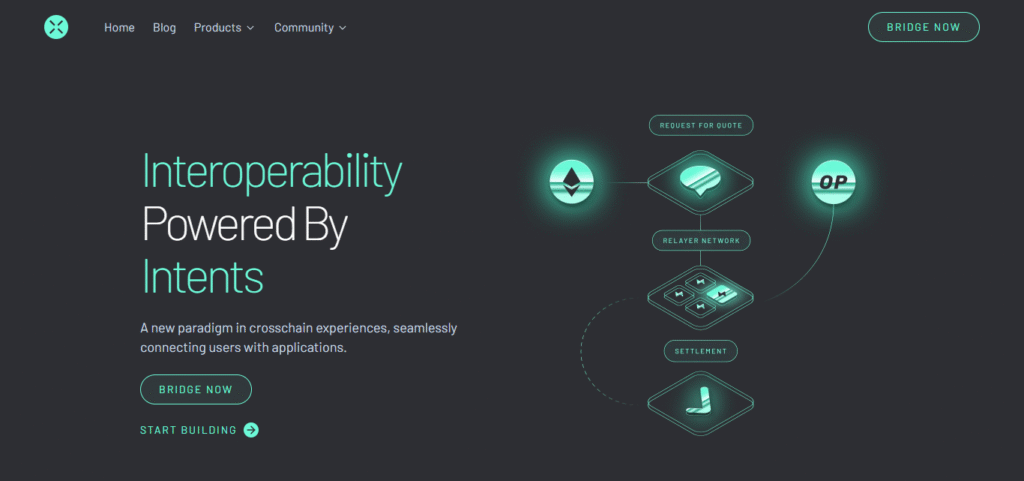

3.Across Protocol

At Across Protocol, we are developing a next generation cross-chain aggregator for businesses that seek to improve blockchain interoperability. The unlockable value of Across Protocol lies in its intent-based systems structure. It allows businesses to specify what goals they want to accomplish, whereby relayers can bid on the best path to execution.

Because of this design, transactions in multi chains are done seamlessly, swiftly, securely and most importantly, at a lower cost. At Across Protocol, we take pride in being a leader in multi-chain integration, having transacted volumes exceeding $14 billion and a transaction completion time averaging less than a minute.

Those enterprises that are looking for effortless integration across various blockchains will find value with us. In conjunction with other client-friendly resources such as APIs and SDKs, the Across Protocol enables developers to easily build cross-chain dapps.

Features Across Protocol

Modular Architecture: Features an intent-based design that allows for customizable cross-chain execution.

Low-Cost and Fast Transfers: Transfers of assets can occur at rapid speeds and with little cost.

Broad Blockchain Support: Aided in bridging around multiple networks, including EVM and non-EVM chains.

Developer Tools: Through APIs and SDKs, cross-chain capabilities can be added into dApps easily.

4.Rango Exchange

Rango Exchange specializes in cross-chain aggregations that appeal to enterprises requiring blockchain interoperability. Rango supports 71 plus blockchains including Bitcoin, Ethereum, Solana, and Cosmos which makes asset transfers across varying ecosystems seamless.

Its smart routing technologies aggregate liquity from over 120 DEXs and bridges to provide the best swap rates and slippage. Rango’s custodial model eliminates KYC requirements, enabling a multi-chain wallet integration experience without user restrictions.

Developers can access cross-chain capabilities for their applications through Rango’s API and SDK, improving the scalability and operational efficiency of their applications. Rango non-custodial platforms award users the ease of use and disable KYC requirements.

Features Rango Exchange

Multi-Chain Liquidity Aggregation: Besting swap rates by aggregating liquidity from 120+ DEXs and bridges is a feature.

Supports 71+ Blockchains: Allows for exchanges of assets across diverse blockchains.

Non-Custodial: Guarantees privacy and security, as users retain complete control of their assets.

Smart Routing: Guarantees the best rates for swaps by ensuring the most efficient paths are taken.

5.RhinoFi

RhinoFi offers blockchain aggergation for business use at a level that has yet to be matched. With the capacity to serve 30 blocks, such as: Ethereum, Polygon, Arbitrum, Optimism, zkSync and BNB Smart Chain, transfers aross varying ecosystems can be acheived seamlessly and swiftly at a low cost.

They achieve outposts and preserve self serve contracts which ensures them unmatched liquidity, privacy, and control of assets. Also, endorsed L2 infrastructure with StarkEx deployed along with gasless transactions makes it suitable for business trying to integrate DeFi systems in thier opperations.

Features RhinoFi

Cross-Chain Aggregation: Includes over 30 blockchains, plus leading DeFi chains, with transfers of assets.

StarkEx Layer 2: Implements StarkEx, which enables gasless transactions on layer 2 networks, for scaling.

Liquidity Providers: Improves the bridge’s utility by providing rewards for liquidity providers.

Security and Control: Improves security by self-custody and control of the assets.

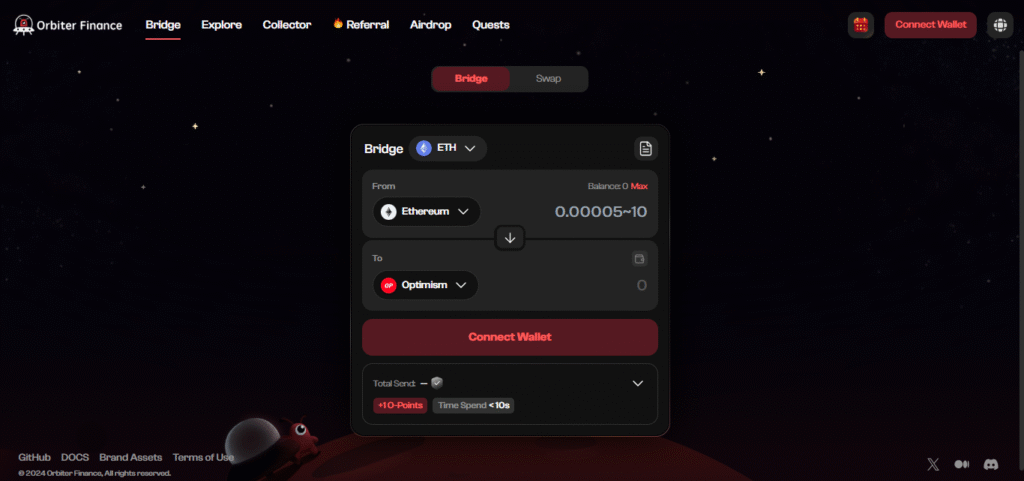

6.Orbiter Finance

Designed specifically for enterprises with advanced interoperability needs, Orbiter Finance is a decentralized cross-rollup bridge. It uses Ethereum Layer 2 (L2) solutions like Arbitrum, Optimism, and zkSync and permits secure, inexpensive, and speedy transfers of assets across multiple rollups and networks. Transfers are executed in under twenty seconds.

Decentralization increases security, and support for 70+ chains including L2s that aren’t EVM and even Bitcoin increases versatility.

Makers incentivized liquidity providers on Forge, which further enhances the ecosystem. Integration of multi-chain DeFi renders more elegant, smoother approaches practical, and Orbiter’s extensive extensibility and scalability tools makes it tailor-fitted for enterprises.

Features Orbiter Finance

Decentralized Cross-Rollup Bridge: Allows movements from other blockchains to Ethereum Layer 2 networks and vice versa.

Fast Transactions: Allows for extremely fast transfers of assets with little delay.

Broad Blockchain Support: Includes numerous ecosystems, like zkSync, Arbitrum, and Optimism, as Layer 2 chains.

Liquidity Incentives: Increases the liquidity pool by offering liquidity providers rewards.

7.Hop Protocol

Tailored towards enterprises that need quick and inexpensive movement of assets across Ethereum Layer 2 networks, Hop Protocol provides a decentralized cross-chain bridge.

Through the use of hTokens, which act as bridge intermediary tokens, bridging across chains like Arbitrum, Optimism, Polygon, and zkSync is done in virtually no time.

Its connection with Automated Market Makers (AMMs) augments the liquidity management system, while liquidity providers, termed as bonders, enable immediate token redemption.

This construct presents a cross-chain disparity solution that is effortlessly scalable and enhances the effectiveness of operations in decentralized finance applications.

Features Hop Protocol

Cross-Chain Asset Transfers: Focuses on bridging assets between Ethereum Layer 2 networks, such as Arbitrum, Optimism, and zkSync.

HTokens for Liquidity: Guarantees seamless cross-chain transfers via intermediary tokens (hTokens).

Inexpensive and Quick: Designed around very low transaction costs and speedy transaction completion.

Liquidity Provider Benefits: Makes token redemption instant, further enhancing speed and liquidity.

8.Binance Bridge

Binance Bridge is an intricate cross-chain gateway for businesses wishing to have clean blockchain interconnectivity. By linking various ecosystems, it facilitates the movement of assets across different blockchain networks which improves DeFi interactions.

The bridge works with partners such as Celer, deBridge, and Stargate for real-time transfers across chains, preset rates, and institutional liquidity.

Binance Bridge helps businesses broaden their access to networks and decentralized applications through blockchain by providing them with a cost-effective and efficient method of accessing different chains.

Features Binance Bridge

Supports Various Blockchains: Moves assets within the Ethereum ecosystem, BNB Chain, and other major blockchains.

Low Rates and Quick Action: Makes low-cost and quick asset transfer a priority.

Wide Range of Assets: Increased flexibility of usage in DeFi applications due to broad support of various tokens and assets.

Security and Compliance: Protected transfer from spoofing attacks and adheres to the obligations of law and regulation.

9.Portal Bridge

Designed for enterprises that desire optimal blockchain interoperability, Portal Bridge is a decentralized cross-chain aggregator. It uses the Wormhole protocol to allow low-cost, secure transfers of assets on Ethereum, Solana, BNB Chain, Polygon, and Avalanche.

Portal Bridge facilitates transactions by locking tokens on the source chain which mint wrapped tokens on the destination chain. The bridges functionality with tokens and NFTs enhances its possible use-case with projects in the DeFi ecosystem.

Portal Bridge is an enterprise grade solution for multi-chain integration focusing on advanced developer tools and scalability hetreogeneous blockchain environments.

Features Portal Bridge

Multi-Chain Support: Transfers assets from one blockchain to another, providing interoperability for Ethereum, Solana, BNB Chain, and several other blockchains.

Wormhole Protocol: Provides secure and dependable management of assets across different blockchains using Wormhole’s technology.

Low-Cost and Fast: Conduct low-cost and rapid operations between chains.

Cross-Token and NFT Transfers: More use cases in decentralized finance enabled through the support of tokens and NFTs.

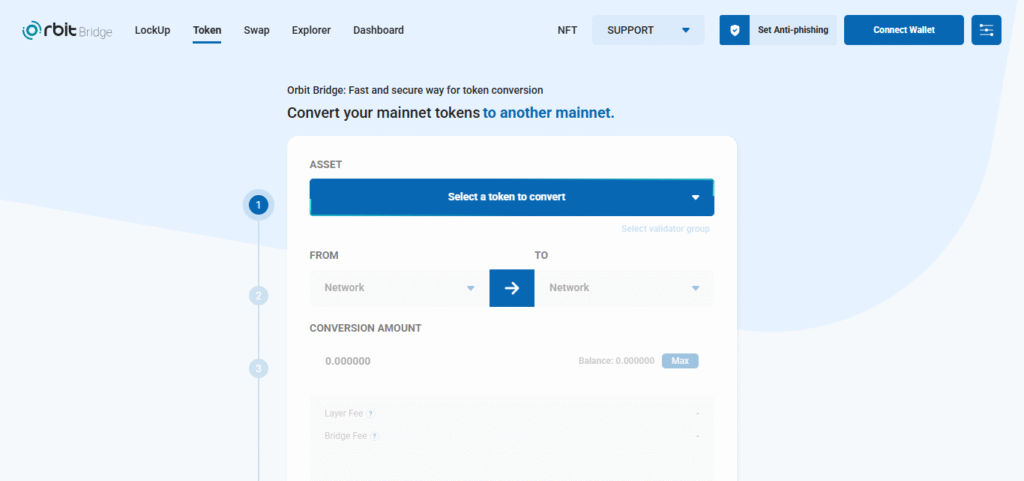

10.Orbit Bridge

Orbit Bridge is an interoperability solution tailored for enterprises looking to seamlessly integrate multiple blockchains.

Through Orbit Chain’s multi-signature BFT consensus, secure and transparent transfer of assets and value is possible across 15+ blockchains, like Ethereum, BNB Chain, Polygon, Klaytn, etc.

Supporting over 100 tokens, Orbit Bridge enables communication between different blockchains thus enhancing the potential of decentralized finance (DeFi) applications. On-chain validation and governance model provides enterprises with a scalable and trustless infrastructure for cross-chain enabled operations.

Features Orbit Bridge

Cross-Chain Transfers in a Decentralized Manner: Transfers assets across more than 15 blockchains which include Ethereum and BNB Chain.

High Security: Provides security during cross-chain transactions using BFT consensus mechanism.

Scalable Architecture: High transaction volumes and large-scale operations supported due to design.

Developer-Friendly Tools: Offers SDKs and APIs for seamless integration of cross-chain functionality into decentralized applications.

Conclusion

Finally, like Synapse Protocol, Stargate Finance and Rango Exchange, The highlighted cross-chain aggregators optimize interoperability across blockchains, provide low fee services, and facilitate rapid transactions.

These platforms are scalable and secure while also enabling efficient operations for businesses in an advanced DeFi ecosystem which integrates seamlessly within multi-chain environments, fortifying sustained operational success.