In this article, I will cover the How to Choose a Reliable DEX and make cryptocurrency trades with confidence. Decentralized exchanges are increasing in number, and like with anything else, knowing what to consider about these platforms is critical.

Security, liquidity, and overall user experience are some of the fundamental elements this guide will address in your search for the most suitable DEX.

What is DEX?

A Decentralized Exchange (DEX) operates as a cryptocurrency trading platform which does not have any central authority performing governing functions. Instead, users are able to trade directly from their wallets.

DEXs differ from centralized exchanges in that they utilize smart contracts and blockchain technology to facilitate transactions on a peer-to-peer basis, affording greater privacy and control over funds.

Since users define full ownership over their assets, the risk of hacks and custodial failures is minimized. Apart from being transparent, DEXs are secure, and able to list large amounts of tokens without requiring permission from any central governing body.

How to Choose a Reliable DEX

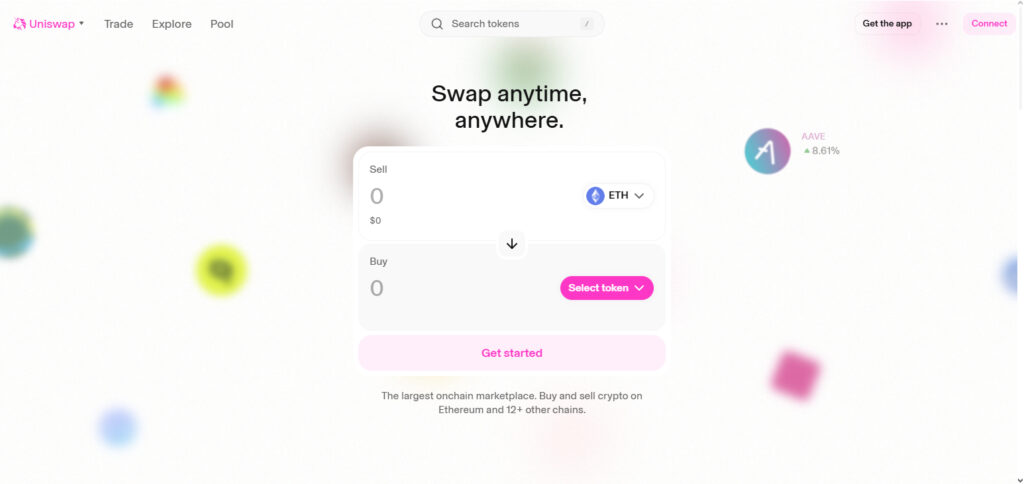

It is essential to pick a dependable decentralized exchange (DEX) when crypto trading to guarantee safety and efficiency. Let’s use Uniswap as a case study and look at particular aspects worth noting.

Security & Smart Contract Audits

Uniswap built on Ethereum. It underwent various security audits ensuring its smart contracts are airtight and cannot be exploited.

Liquidity & Trading Volume

A reliable DEX needs to have enough liquidity. Unisupm is at the very top in trading volume making it a solid choice.

User Experience & Accessibility

You don’t need an account to use swap at Uniswap’s liquidity pool which makes it easy particuler to beginners.

Supported Tokens & Networks

It supports thousands of ERC-20 tokens so there are many trading options. Some DEXs offer cross chain compatibility.

Fees & Cost Efficiency

Other DEXs are not very competitive. Uniswap is saying the liquidity fee is 0.3%.

Decentralization & Governance

Uniswap acts and is treated as a fully decentralized protocol governed by the communities through UNI voting.

Privacy & KYC Requirements

Uniswap is like all other DEXs that don’t require KYC so you can trade without giving up your identity unlike CEXs.

Other Best Reliable DEX

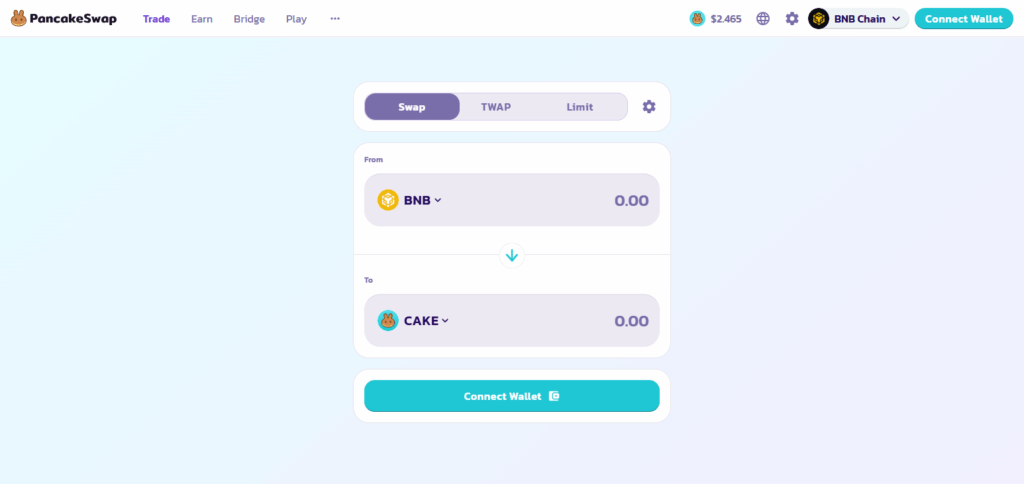

PancakeSwap

PancakeSwap stands as a decentralized exchange (DEX) because of its credible supported infrastructure on the Binance Smart Chain which guarantees quick and cost-effective transactions.

Its dependability is further distinguished by having active developer support alongside regular updates which drive new features while simultaneously securing the platform. This makes PancakeSwap innovative and secure at the same time.

It maintains a balanced liquidity across numerous trading pairs, which, together with the intuitive interface, places its accessibility within grasp of both novice and seasoned traders.

dYdX

dYdX distinguishes itself as a reliable DEX by enabling perpetual contracts and margin trading whilst preserving decentralization.

Its greatest dYdX advantage with Etherum and StarkWare, enabling low fee, high speed trading, order execution, and non custodial asset control simultaneously enhancing user security, provides without sacrificing asset security. advanced.

Why Choosing a Reliable DEX Matters

Security of Funds

Trustworthy DEX offers the best security for your assets by having smart contracts that are audited and offering non-custodial control. This significantly reduces the chances of hacks and theft.

Fair and Transparent Trading

Trustworthy DEX gives fair pricing alongside trading history which promotes honest market activity and prevents market price manipulation.

Consistent Liquidity

The DEX you select should have adequate liquidity to enable seamless trades with minimal slippage.

User Protection and Support

For the most part, reputable platforms have communities, documentation, and technical staff available maintained which is an added bonus.

Sustainable Platform Growth

With reliable DEX also comes strong long term development agendas. They have active update schedules ensuring the platform remains adaptable and secure.

Risk & Considerations

Smart Contract Vulnerabilities

DEXs make use of smart contracts which can be buggy or insecure. These might be maliciously exploited putting your money at risk.

Low Liquidity

There is a low trading volume on some DEXs which leads to slippage or problems in placing big orders.

Lack of Customer Support

Most DEXs do not provide support which is a problem as their users are not able to fix problems through specialists.

Impersonation and Fake Tokens

It is very easy for fake tokens or scam projects to be listed. Always check the token contract before trading.

Poor Usability for Those Who Are New

Some DEXs are complex which can result in high losses if the platform is wrongly used.

Pros & Cons

Pros

Complete Control of Funds – There is no need to trust anyone when users possess their crypto assets.

Increased Anonymity: KYC requirements are rare, if non-existent in most DEXs, ensuring user anonymity.

Variety of Tokens – Newly issued and different tokens are available.

Decentralization – Lesser chances of centralized contingencies and restrictions.

Universal Accessibility—Any person with a crypto wallet and internet access can use it.

Cons

Absence of Customer Support: Problems have to be fixed alone with no assistance.

Smart Contract Threats – Unprotected weaknesses can cause the loss of funds.

Worse Liquidity – Lesser trading activity of smaller DEXs.

Gas Costs – Constrained availability of essential resources which fund essential services.

Difficult Navigation – Uncomplicated and intuitive navigation that is straightforward to use is rare.

Conclusion

In conclusion, selecting a dependable DEX is vital for smooth and effective crypto trading. Through measures such as security protocols, liquidity, UX design, and reputation of the community, most prevalent risks can be mitigated and one can trade with higher confidence.

Research is paramount, as well as starting with smaller trades on platforms that have transparent policies and robust technological backing. A well-maintained DEX not only safeguards one’s assets, but also improves the overall trading experience.