I will cover the Best Platforms For Yield Farming On Fantom. Yield farming on Fantom is particularly rewarding due to its quick and inexpensive blockchain.

The platforms covered here provide yield farming with features like automated compounding, flexible staking, and inventive ways to supply liquidity. These top Fantom platforms are helpful for both beginners and veterans in DeFi to optimize their farming returns.

Key Point & Best Platforms For Yield Farming On Fantom List

| Platform | Key Point |

|---|---|

| SpookySwap | Leading DEX on Fantom network with multi-chain support |

| Beethoven X | Curve-based AMM offering stablecoin swaps on Fantom |

| Tomb Finance | Algorithmic stablecoin protocol with elastic supply |

| LiquidDriver | Incentive platform rewarding liquidity providers |

| Reaper Farm | Automated yield farming and compounding strategies |

| Scream | Decentralized lending and borrowing on Fantom |

| Tarot | Lending platform with unique fixed-rate loans |

| SpiritSwap | Fantom’s first AMM DEX with yield farming capabilities |

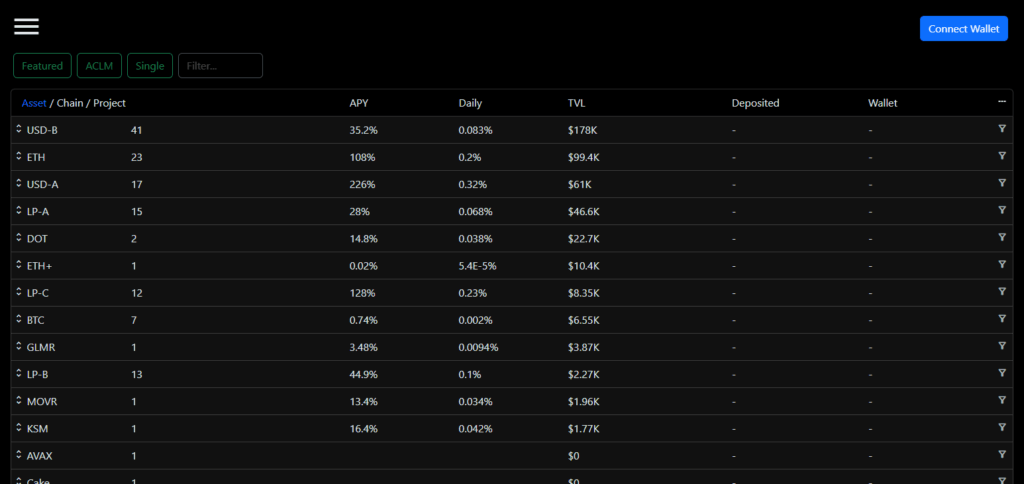

| Beefy Finance | Multi-chain yield optimizer with automated compounding |

| ACryptoS | NFT-based yield farming and gaming on Fantom |

1.SpookySwap

SpookySwap is among the best yield farming platforms on the Fantom network because of its ample liquidity and quick transactions alongside extensive support for various tokens. Cross-chain swap integration distinguishes .

SpookySwap as a native Fantom DEX, giving users the ability to cross-farm with assets from many different blockchains. Other features that make SpookySwap attractive include dual-token reward systems, automatic compounding in crypto vaults, and an intuitive interface that caters to novice and experienced yield farmers alike who prioritize high returns and consistent results on Fantom.

| Feature | Details |

|---|---|

| Platform Name | SpookySwap |

| Blockchain | Fantom |

| KYC Requirement | Minimal / None |

| Yield Farming Type | Liquidity Pool Farming |

| Native Token | BOO |

| Unique Selling Point | User-friendly DEX with high liquidity and fast transactions |

| Additional Features | Yield farming, staking, token swapping |

| Security | Community-audited, decentralized |

| Fees | Low transaction fees due to Fantom’s network |

| Accessibility | Open to all without extensive verification |

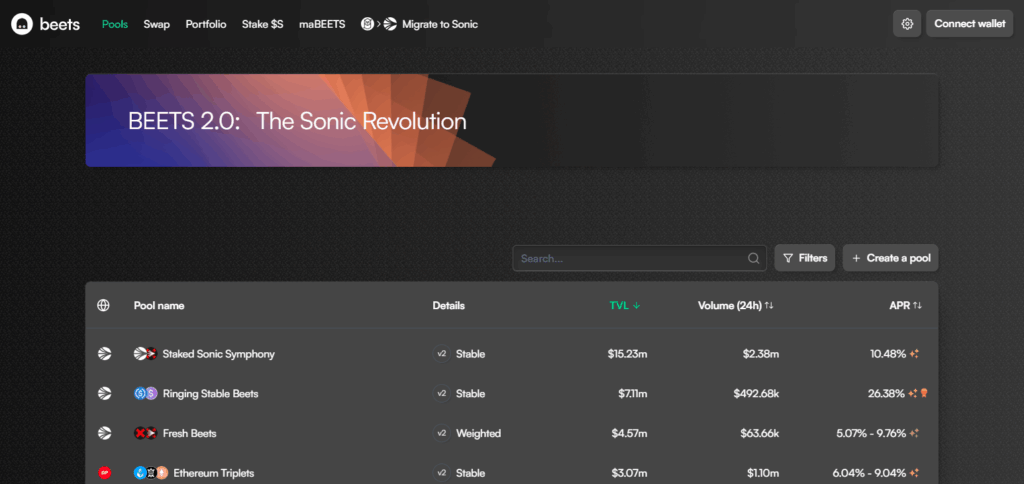

2.Beethoven X

Beethoven X is arguably one of the leading yield farming platforms on Fantom because of its unique application of weighted index pools. It permits custom token ratios in liquidity pools which provides better capital efficiency and minimizes impermanent loss, which is a lot more than what traditional AMMs offer.

Yield farmers have better command over risk-reward dynamics due to this resistance. Along with strong incentives and integration with top protocols on Fantom, farming strategies on Beethoven X can be optimized in a responsive and effective setting.

| Feature | Details |

|---|---|

| Platform Name | Beethoven X |

| Blockchain | Fantom |

| KYC Requirement | Minimal / None |

| Yield Farming Type | Balancer-style AMM with weighted pools |

| Native Token | BEETS |

| Unique Selling Point | Flexible liquidity pools with customizable weights for optimized yields |

| Additional Features | Yield farming, token swapping, staking |

| Security | Audited smart contracts |

| Fees | Low fees leveraging Fantom’s fast network |

| Accessibility | No extensive KYC required, open to all users |

3.Tomb Finance

Tomb Finance is an exceptional yield farming platform on Fantom, capitalizing on the algorithmic stablecoin, TOMB, which is pegged to FTM. This structure reduces impermanent loss in TOMB-FTM liquidity pools, providing users with exposure to FTM growth and earning rewards.

The platform’s multi-token system—TOMB, TSHARE, and TBOND—enables issuing and repurchasing of the stablecoin to regulate the supply and keep the peg headed. Tomb Finance is exceptionally optimized for yield farmers’ APR graveyards and masonry pools tomb.finance/auto-compounders like Grim Finance make it compelling for yield farmers eager for high returns within the Fantom ecosystem.

| Feature | Details |

|---|---|

| Platform Name | Tomb Finance |

| Blockchain | Fantom |

| KYC Requirement | Minimal / None |

| Yield Farming Type | Liquidity Pool Farming, Staking, Bonding |

| Native Tokens | TOMB (algorithmic stablecoin), TSHARE (governance), TBOND (bonding) |

| Unique Selling Point | Pegs TOMB to FTM, offering high APRs with low impermanent loss risk |

| Additional Features | Staking in Masonry, LP farming in Cemetery, Bonding in Pit |

| Security | Community-audited, decentralized |

| Fees | Low transaction fees due to Fantom’s network |

| Accessibility | Open to all without extensive verification |

4.LiquidDriver

LiquidDriver is yield farming innovator on Fantom, utilizing a special LaaS model that seeks to maximize returns for liquidity providers. LiquidDriver facilitates yield optimization with its native token LQDR by permitting users to stake LP tokens from DEXs such as SpiritSwap, SpookySwap, and Beethoven X.

One of the crucial innovations is the auto-compounding yield farms or “Shadow Farms” which maximize yield leveraging governance tokens like inSPIRIT. Also, the platform’s revenue-sharing vault significantly compensates xLQDR holders, sharing a large portion of profits, thereby encouraging participation and locking value while synergistically growing the protocol.

| Feature | Details |

|---|---|

| Platform Name | LiquidDriver |

| Blockchain | Fantom |

| KYC Requirement | Minimal / None |

| Yield Farming Type | Liquidity Pool Farming, Single-Sided Staking, Shadow Farms |

| Native Token | LQDR (LiquidDriver), xLQDR (locked LQDR) |

| Unique Selling Point | Liquidity-as-a-Service (LaaS) model with revenue-sharing vaults and boosted pools |

| Additional Features | Integration with SpiritSwap, auto-compounding, governance through xLQDR |

| Security | Community-audited, decentralized |

| Fees | 4% deposit fee (used for buybacks and burns); no withdrawal fee |

| Accessibility | Open to all without extensive verification |

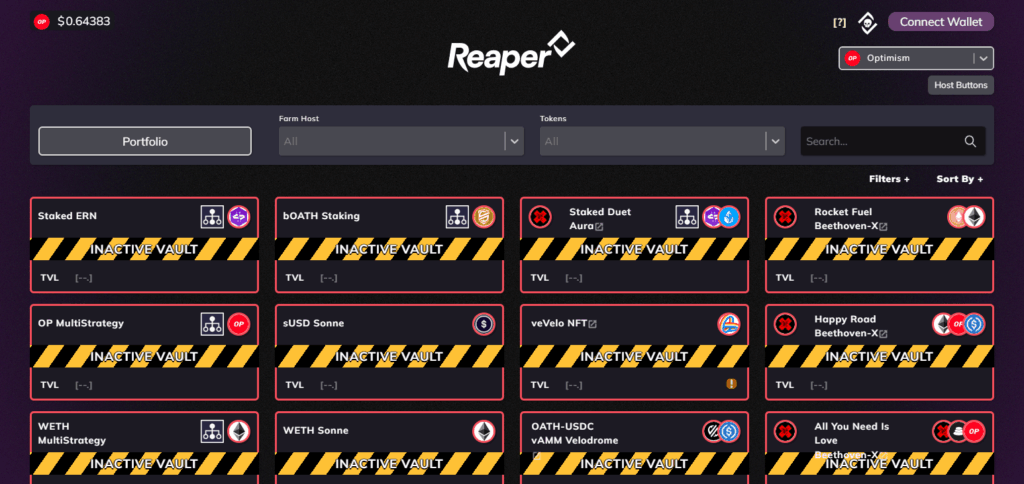

5.Reaper Farm

Reaper Farm is a top yield farming platform on Fantom, noted for its unique “Crypts” auto-compounding yield vaults. These vaults modulate the compounding frequency of yields based on the APR of the underlying assets to ensure maximum yield optimization.

Another distinct feature is the platform’s Harvest Bot that performs around 17 transactions per harvest and incentivized gas fees, thus increasing the profit margin from the user’s perspective.

The security features of Reaper Farm yield farming platform which includes multiple audits such as Certik and integration with various crypto protocols showcases the simplicity and safety offered by Reaper Farm. These factors make Reaper Farm one of the most sought after yield farms on the Fantom network along with automated precision and low cost.

| Feature | Details |

|---|---|

| Platform Name | Reaper Farm |

| Blockchain | Fantom |

| KYC Requirement | Minimal / None |

| Yield Farming Type | Auto-compounding yield aggregator utilizing LP tokens |

| Native Token | None |

| Unique Selling Point | Executes approximately 17 transactions per harvest, covering gas fees for users |

| Additional Features | Transparent on-chain analytics, supports multiple vaults, no hidden fees |

| Security | Audited by Solidity Finance; bug bounty program with rewards up to $200,000 |

| Fees | 0.1% security fee on withdrawals, 4.05% performance fee, 0.45% gas fee |

| Accessibility | Open to all without extensive verification |

6.Scream

Scream is a commendable lending protocol in the Fantom ecosystem as it aids users in borrowing and lending assets efficiently and cost-effectively. Scream, a modified version of Compound v2, uses Chainlink Price Feeds for its lending markets, fostering robust and reliable price data integration ensuring secure price data.

Scream’s most notable feature is the high-liquidity stablecoin markets that it offers allowing users to earn yields of over 8% for USDC and DAIs. Also, Scream motivates users to add to the platform’s liquidity by participating in yield farming and Scream it’s native token can be earned and staked for rewards. Due to these features, Scream is aspiring to be one of the top-tier platforms for yield farming in Fantom.

| Feature | Details |

|---|---|

| Platform Name | Scream |

| Blockchain | Fantom |

| KYC Requirement | Minimal / None (Note: Not available for users based in the United States) |

| Yield Farming Type | Lending and borrowing of crypto assets |

| Native Token | SCREAM |

| Unique Selling Point | Overcollateralized loans with low fees (~0.02%) and rewards in SCREAM tokens |

| Additional Features | Staking SCREAM for xSCREAM tokens, LP farming with SCREAM-FTM pairs |

| Security | Built on Compound v2, audited, decentralized |

| Fees | 0.02% transaction fee, 0.5% deposit fee for LPs |

| Accessibility | Open to all users, except those in restricted regions |

7.Tarot

Tarot distinguishes itself as a yield farming platform on Fantom through its leveraged yield farming via isolated lending pools. Its differentiating function permits users to borrow extra tokens against LP tokens already deposited, thus enabling yield farming on greater returns.

This system limits risks due to the isolation of each lending pool; in case one pool has an issue, it will not affect the others. Lenders who supply single tokens earn passively without bearing impermanent loss. With Tarot, Fantom users can adopt different approaches to maximize their DeFi profits due to its innovative features.

| Feature | Details |

|---|---|

| Platform Name | Tarot Finance |

| Blockchain | Fantom |

| KYC Requirement | Minimal / None (Note: Access restricted for U.S. residents and OFAC-sanctioned countries) |

| Yield Farming Type | Leveraged Yield Farming, Lending, Staking |

| Native Token | TAROT (Governance), xTAROT (Staked) |

| Unique Selling Point | Leverage LP tokens for enhanced yield farming; xTAROT offers governance and rewards |

| Additional Features | Auto-compounding, isolated lending pools, partner-incentivized pools |

| Security | Audited by CertiK; decentralized protocol |

| Fees | 0.1% borrow fee, 10% performance fee on Supply Vaults |

| Accessibility | Open to all users, except those in restricted regions |

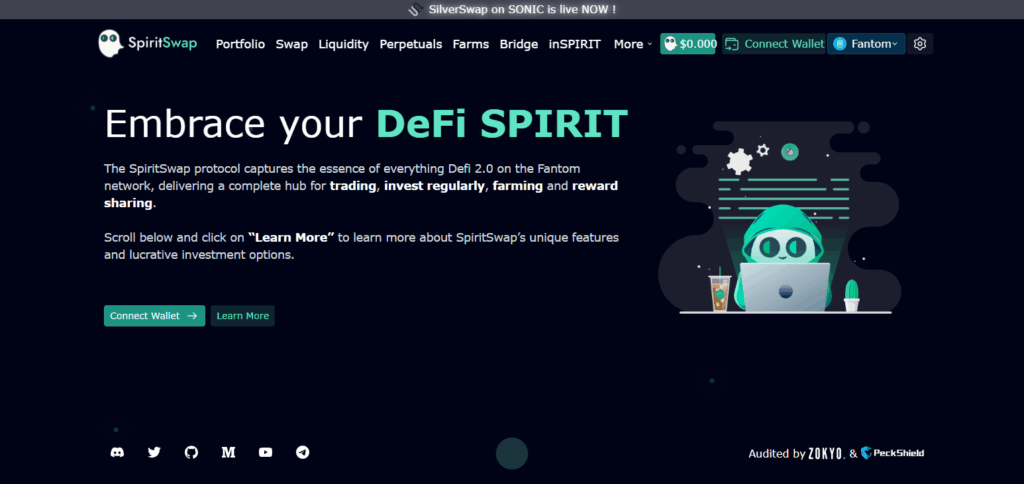

8.SpiritSwap

SpiritSwap is one of the top decentralized exchanges (DEXs) on the Fantom network, with integrated capabilities for token swapping, liquidity furnishing, yield farming, and other DeFi services.

One of the most distinguishing features of SpiritSwap is the inSPIRIT mechanism whereby users can lock their SPIRIT tokens to receive inSPIRIT which permits them to earn boosted farming rewards along with a share of trading fees and governance rights.

Also, with SpiritSwap’s Zap function, liquidity provision is made easier because users no longer need to perform several steps to convert a single asset into LP tokens. SpiritSwap’s interface makes it effortless for yield farmers on Fantom while innovatively rewarding them.

| Feature | Details |

|---|---|

| Platform Name | SpiritSwap |

| Blockchain | Fantom |

| KYC Requirement | Minimal / None (Note: Access restricted for U.S. residents and OFAC-sanctioned countries) |

| Yield Farming Type | Liquidity Pool Farming, Staking, Boosted Farming |

| Native Token | SPIRIT (governance), inSPIRIT (locked SPIRIT) |

| Unique Selling Point | inSPIRIT mechanism allows users to lock SPIRIT tokens for boosted rewards and governance participation |

| Additional Features | Token swapping, cross-chain bridging, limit orders, Spirit Wars gamified incentives |

| Security | Audited by MixBytes; decentralized protocol |

| Fees | 0.3% swap fee (0.25% to liquidity providers, 0.05% for SPIRIT buybacks and burns); low Fantom network gas fees |

| Accessibility | Open to all users, except those in restricted regions |

9.Beefy Finance

Beefy Finance is known as a leading yield optimizer on the Fantom network due to its automated compounding vaults that get the most out of all available DeFi protocols.

One of the notable fantom features is its beFTM token that permits users to stake FTM and reap boosted validator rewards far exceeding the competition without the standard one-year lock-up period, providing liquidity.

Users in Beefy’s ecosystem have their yield generated automatically in the form of ‘mooVaults’ which significantly reduces the user workload, gas fees, and time needed for transaction processing. With strong security features like Certik audits as well as the ease of use interface, Beefy Finance provides effective and safe Fantom yield farms.

| Feature | Details |

|---|---|

| Platform Name | Beefy Finance |

| Blockchain | Fantom |

| KYC Requirement | Minimal / None |

| Yield Farming Type | Auto-compounding vaults, liquidity pool farming |

| Native Token | BIFI (governance and rewards) |

| Unique Selling Point | Automated compounding strategies across multiple blockchains, including Fantom |

| Additional Features | Multi-chain support, user-friendly interface, secure and transparent operations |

| Security | Built on audited smart contracts, ensuring safe fund management |

| Fees | Low fees with efficient fee structure, maximizing user returns |

| Accessibility | Open to all users, providing easy access to yield farming opportunities |

10.ACryptoS

ACryptoS distinguishes itself as a yield farming platform within the Fantom ecosystem by providing unique features, one of them being the FTM Liquidizer Vault. This vault allows users to stake FTM tokens for a period of up to one year while retaining the ability to withdraw with minimal slippage.

On top of this, ACryptoS offers single-token vaults that avoid impermanent loss and are actively managed for best returns. Focused on robust security and long-term yield farming value, ACryptoS is an attractive yield farming platform on Fantom.

| Feature | Details |

|---|---|

| Platform Name | ACryptoS |

| Blockchain | Fantom |

| KYC Requirement | Minimal / None |

| Yield Farming Type | Liquidity Pool Farming, Staking, Vaults |

| Native Token | ACS (governance and rewards) |

| Unique Selling Point | Automated Concentrated Liquidity Management (ACLM) for efficient yield optimization |

| Additional Features | Single-token vaults, Venus Vaults, StableSwap integration |

| Security | Community-audited, decentralized |

| Fees | Low fees with efficient fee structure, maximizing user returns |

| Accessibility | Open to all users, providing easy access to yield farming opportunities |

Conclusion

In summary, the Fantom network contains some of the top yield farming platforms, each having their own distinctive factors which can optimize profits in different ways. SpookySwap and SpiritSwap give great usability alongside deep liquidity pools and community incentives.

On the other hand, Beethoven X and Tarot offer powerful features for diverse farming flexibility. Tomb Finance and ACryptoS have innovative stablecoin and liquidity management. Platforms like Fantom and Beefy Finance enable yield farming on autopilot with strong security and automatic farming processes making yield farming effortless and cheap.