In this article, I will list the Best Aggregator for Bridging KYC compliant tokensand discuss platforms with cross-chain technology and robust identification systems.

In an era where compliance is becoming a necessity in cryptocurrency, picking the right aggregator makes sure that token transfers can be done without bypassing KYC and AML policies. Let us review the best options offered for safe and compliant bridging of digital assets.

Key Points & Best Aggregator For Bridging kyc-Based Tokens

| Aggregator Name | Key Points |

|---|---|

| AnySwap | Multi-chain support, strong KYC compliance |

| Wormhole | Fast cross-chain transfers, KYC integration |

| Synapse Protocol | Secure bridging, user identity verification |

| LayerZero | Low fees, advanced KYC features |

| Connext | Efficient token bridging, KYC checks |

| Celer cBridge | High scalability, supports KYC-based tokens |

| Multichain | Wide token coverage, robust KYC systems |

| Portal Token Bridge | Easy to use, integrated KYC protocol |

| ChainBridge | Open-source, customizable KYC modules |

| Binance Bridge | Backed by Binance, strong KYC enforcement |

10 Best Aggregator For Bridging kyc-Based Tokens

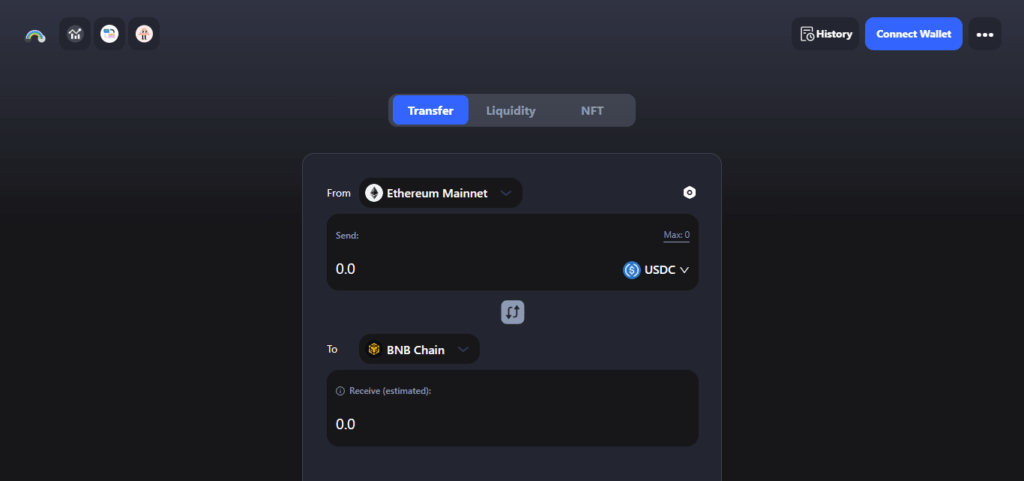

1.AnySwap

Now part of the Multichain ecosystem, AnySwap is a cross-chain bridge that is still decentralized and supports KYC compliant tokens on many networks. It is particularly strongest in regard to interoperability, connecting over 25 blockchains.

For projects needing identity verification and regulatory compliance, AnySwap provides institutional-grade custom smart contracts and liquidity services. Supported by secure multi-party computation (MPC) technology and decentralized liquidity provisions

AnySwap is a good fit for developers needing to efficiently circulate KYC-based assets across chains. Its versatility for EVM and non-EVM chains makes it suitable for regulated DeFi and tokenized financial products.

Features AnySwap

- Cross-chain liquidity support

- MPC based secure transfers

- Compatibility EVM/non-EVM

- Integrative regulatory module

2.Wormhole

Wormhole is a leading cross-chain messaging protocol that supports the movement of tokens across major Layer 1 and Layer 2 networks. Although not KYC-centric by default, it lays the groundwork for identity-driven applications to be built on top of it.

Wormhole supports low-latency bridging which allows developers to create wrapped tokens and tokens that can modularly enforce KYC through smart contracts or permissioned wrappers. Such an open design makes Wormhole adaptable to governed token systems.

It provides strong support for Solana and Ethereum, and is further integrating with Cosmos and Aptos, offering compliant bridging infrastructure for digital asset projects.

Features Wormhole

- Entire messaging protocol

- Fast cross-chain transfers

- Extensible smart contracts

- KYC flexibility wrapper

3.Synapse Protocol

Synapse Protocol has become popular because of its intuitive design and the ability to interchangeably bridge assets across multiple blockchains.

It combines quick finality of transactions with reliable crosschain communication, making it suitable for moving KYC-bound tokens where identity requirement’s enforcement is done via smart contracts.

Synapse allows sending tailored messages, which can be used to enforce KYC during bridge transfers. Its community based governance and dependable liquidity pools enable safe and low slip margin exchanges.

Synapse is not KYC focused, but does offer builders the means to develop compliant multi-chain identity verification framed DeFi applications.

Features Synapse protocol

- Logic of custom bridges

- Identity enforced transactions

- Swaps with low slippage

- Interoperable message passing

4.LayerZero

LayerZero enables omnichain applications with strong security and modularity through its generalized messaging protocol. Its design suited developers building KYC compliant dApps with verified token movement across chains.

Due to LayerZero’s Ultra Light Node architecture, high throughput and low gas fees on sensitive or regulated asset bridging are maintained. It allows applications to set custom trust models, which is key when integrating KYC logic into bridging operations.

Projects needing strong compliance features can build on LayerZero’s infrastructure to manage KYC checks on every chain their tokens interact with.

Features LayerZero

- Omnicom chain application support

- Ultra-light node architecture

- Customizable layers of trust

- Ready for KYC enforcement

5.Connext

Assets and data across EVM compatible chains can be bridged securely and efficiently using Connext. Its Vector protocol enables rapid custodial-free transfers that can KYC using modular smart contracts.

Trust-minimized transfers makes Connext ideal for compliant financial applications. While a KYC provider, Connext furthers seamless integration through identity services for permissioned token transfer across chains.

Specially useful for projects needing to move regulated assets from Layer 2s, rollups, or Ethereum mainnet, it provides security and speed.

Features Connext

- Transfers custodial free tokens

- Smart contracts modular

- Focus on Rollup bridging

- Supporting KYC module

6.Celer cBridge

American Celer cBridge is a digital asset bridging solution that functions on over 30 Celer Network blockchains, incoporating swift and inexpensive token transfers. It also supports cross application messaging. Thus, it is ideal for KYC token use cases.

Celer Developers can construct KYC modules at the protocol level which ensures compliance during token bridging. Its liquidity pool model ensures high availability and speed, critical for institutional and regulatory use cases.

With a focus on compliance and scalability, cBridge builds foundational systems to enable the exchange of identity-verified tokens across blockchains.

Features Celer cBridge

- Cost effective asset transfers

- Routing liquidity pools

- KYC layer integration

- Speed, confirmation with fast

7.Multichain

Formely known as AnySwap, Multichain now stands as one of the largest and most trusted cross-chain bridging platforms. It offers interoperability for EVM, and non EVM chains as well. Using KYC tokens further enables asset control and defined bridging parameters.

With an emphasis on decentralised security through MPC, Multichain enables the use of regulated financial products while upholding compliance in multi-chain environments.

Its integration across more than 70 chains makes it the top choice for KYC oriented projects needing efficiency and reliability

Features Multichain

- Biggest chain support

- Bridges with permissions set

- Technology of secure MPC

- KYC token support

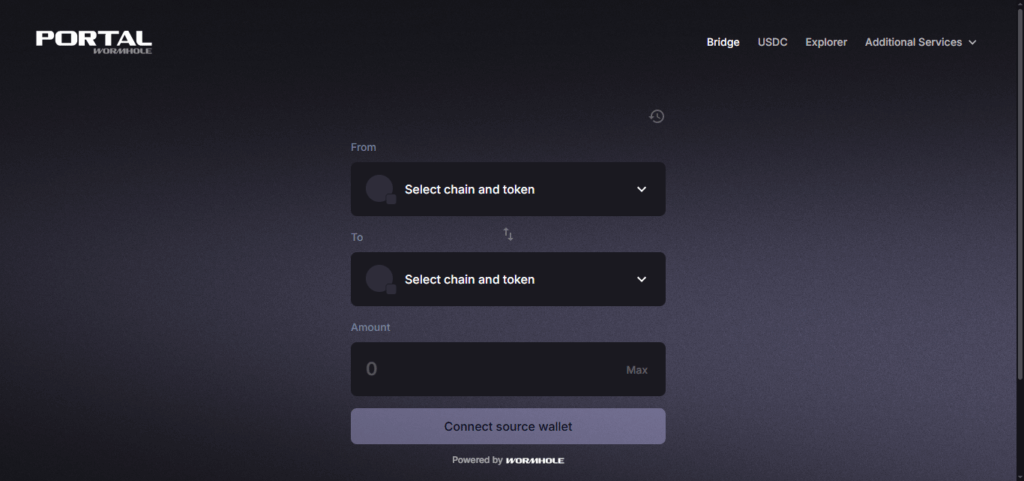

8.Portal Token Bridge

The Wormhole ecosystem has extended its services to include Portal, which specifically focuses on transferring wrapped tokens between blockchains.

Even if Portal does not impose KYC requirements, it still provides the infrastructure of identity-compliant systems through its open communication protocol.

KYC enforcement can be built at the layer of the application while leveraging Portal’s quick and safe bridging layer for asset transfer.

Its multi-chain handling of token metadata, smart contract logic, and governance facilitated the use of verified tokens for compliant DeFi, tokenized securities, and enterprise applications. It serves as a basis for regulated cross-chain token ecosystems.

Features Portal Token Bridge

- Support wrapped tokens

- High-speed interoperability

- KYC enforcement on an app level

- Model of secure validators

9.ChainBridge

ChainSafe developed ChainBridge, which is the first modular framework of its kind built with open-source principles that facilitates bridging between different ecosystems, whether they are permissioned or permissionless.

With a KYC requirement, its application-specific design makes it easier to customize than other bridging systems. Identity verification and compliance logic can be added directly into the bridge’s relayer and handler modules.

Such features make it perfect for institutional or enterprise-level applications where regulatory compliance is mandated.

Though more configuration is required than with plug-and-play systems, its compliance flexibility makes it ideal for projects dealing with living digital assets.

Features ChainBridge

- Open source modular design

- Architecture is Relayer based

- Custom logic with permissions

- KYC supporting grade enterprise

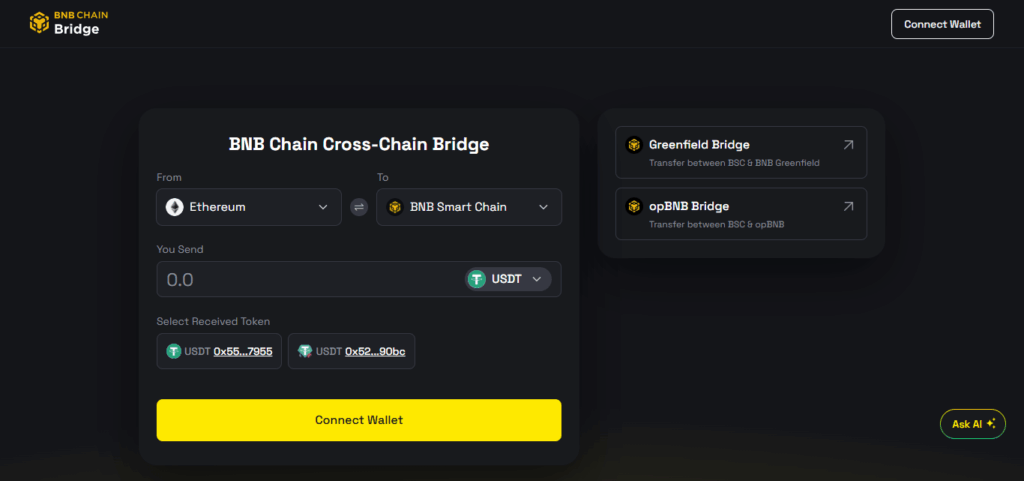

10. Binance Bridge

Binance Bridge provides an efficient and simple method for transferring assets from other networks, such as Ethereum, to the Binance Smart Chain (BSC) and the other way around.

It is mostly used for public token transfers but also supports KYC and institutional applications through Binance’s existing corporate structure.

KYC Verified users transferring tokens can use Binance’s KYC based system for moving assets from their accounts with ease.

While this may be viewed as less decentralized than others, for regulated projects that require token bridging capabilities, the speed, ease of use, and integration with Binance’s exchange ecosystem make it a pragmatic choice.

Features Binance Bridge

- Central KYC infrastructure

- Transfer to Exchange with speed

- Seamless transfers BSC

- Compatible with regulated tokens

Conclusion

In conclusion, the most effective aggregators for bridging KYC-based tokens optimally balance the compliance of law regulations, security, and ease of use. Zypto, Revolut, and Anchorage Digital exemplify these attributes by offering compliant, frictionless cross-chain transfers.

Their comprehensive KYC/AML frameworks, coupled with crypto-enhanced service offerings, positions them as market leaders for safe and efficient token bridging for individuals and institutions navigating modern finance.

FAQ

What is a KYC-based token?

A KYC-based token requires users to complete Know Your Customer (KYC) verification to access or transfer the asset, ensuring regulatory compliance and reducing fraud.

What does a token bridge aggregator do?

A token bridge aggregator connects multiple blockchains, allowing users to transfer assets across chains seamlessly while selecting the best route for speed, cost, and compliance.

Why is KYC important in token bridging?

KYC helps platforms verify user identity, comply with regulations, prevent illegal activity, and ensure secure cross-chain token transfers.