In this article, I will cover the Best E-currency exchange services offered today. Both the transfer and conversion of money internationally is made easy, fast, and cost-effective using these services.

If you need to exchange regular money to digital assets or vice versa, knowing the most popular services can save you at the top most services can save you at the top most services can save you at the top.

Key Point & Best E-currency exchange services List

| Platform | Key Point |

|---|---|

| PayPal | Widely accepted for global payments, but often has higher currency fees. |

| TransferWise (Wise) | Offers mid-market exchange rates with low, transparent fees. |

| OFX | No transfer fees and competitive rates for large transfers. |

| CurrencyFair | Peer-to-peer exchange model can offer better rates than banks. |

| XE Money Transfer | No fees for most transfers and strong global coverage. |

| World First | Best suited for businesses with high-volume currency transfers. |

| Fly Finance | Provides forex and remittance services with focus on Asian markets. |

| CoinCraddle | Crypto-focused platform allowing instant asset transfers globally. |

| FixedFloat | Fast crypto exchange with fixed and floating rate options. |

| EasyBit | Simple crypto-to-crypto exchange with no registration required. |

1.PayPal

PayPal is one of the best e-currency exchange services because of its global reach, user-friendliness, and solid purchase security. Its cross border payment functionality is great for freelancers, businesses, and even online shoppers.

Paypal’s integration with US business’s e-commerce websites, and the fact that users can maintain several currencies in their accounts, makes Paypal unique. This allows users to conduct international transactions without the hassle of currency conversion services.

| Feature | Details |

|---|---|

| Service Name | PayPal |

| KYC Requirement | Minimal KYC for basic accounts; identity verification needed for higher limits and full features |

| Currency Support | Supports multiple fiat currencies globally |

| Transaction Speed | Instant transfers between PayPal accounts; bank withdrawals may take 1-3 business days |

| Fees | Variable fees; currency conversion fees apply; transparent fee structure |

| Security | Strong buyer/seller protection, encryption, and fraud monitoring |

| User Accessibility | Easy to use with wide global acceptance and integration with many online platforms |

| Account Setup | Quick sign-up with email and basic info; enhanced verification for larger transactions |

| Use Cases | Online shopping, personal payments, freelance payments, small business transactions |

| Limitations | Higher fees compared to some specialized currency exchange services |

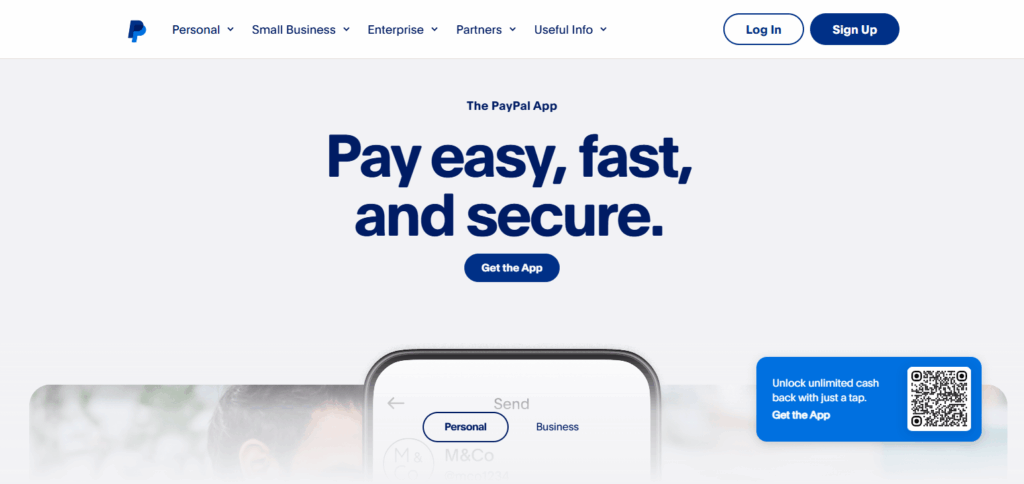

2.TransferWise (Wise)

Wise was previously known as TransferWise. Their commitment to cost-effective global transfers and transparency makes them one of the best e-currency exchange services.

Wise takes user satisfaction a step further as well: their multi-currency account allows users to hold and convert over 40 currencies, making it easier for global freelancers, remote workers, and travelers. Unlike banks that often disguise their service fees within exchange rates, Wise does charge a fee, however, it is minuscule and reflects the real mid-market rate.

| Feature | Details |

|---|---|

| Service Name | TransferWise (Wise) |

| KYC Requirement | Minimal KYC for small transfers; full identity verification required for higher amounts |

| Currency Support | Supports over 50 currencies globally |

| Transaction Speed | Typically same day or next business day for most transfers |

| Fees | Low, transparent fees with mid-market exchange rates |

| Security | Regulated by multiple financial authorities; strong encryption and compliance |

| User Accessibility | Easy-to-use app and web platform with multi-currency account capabilities |

| Account Setup | Quick registration with email; KYC varies by country and amount |

| Use Cases | Personal transfers, freelancer payments, international business transactions |

| Limitations | Transfers may be delayed for compliance checks in some regions |

3.OFX

OFX is considered an expert when it comes to e-currency exchange services. This is especially true for businesses and individuals who deal with large international transfers. The reason ofx is e-conomically advantageous is due to zero transfer fees and competetive exchange rates, particulary low cost for large transactions.

Unlike many services, OFX provides 24/7 customer support and dedicated currency experts which increases trust in the service. Also, the company’s strong regulatory compliance and secure infrastructure make it a good e-conomical choice users looking for large scale currency e-change at minimum charges without compromising quality and security.

| Feature | Details |

|---|---|

| Service Name | OFX |

| KYC Requirement | Basic KYC required for registration; full verification for large transfers |

| Currency Support | Supports over 55 currencies worldwide |

| Transaction Speed | Typically 1-2 business days for transfers |

| Fees | No transfer fees; competitive exchange rates |

| Security | Regulated globally with strong encryption and fraud protection |

| User Accessibility | User-friendly website and mobile app |

| Account Setup | Requires ID verification during sign-up |

| Use Cases | Large personal and business international transfers |

| Limitations | Minimum transfer amount applies; not ideal for very small transfers |

4.CurrencyFair

Considering CurrencyFair for e-currency exchange services places the company among the top contenders owing to their unique innovation in peer to peer exchange methods. This allows users to set their own exchange rates and “ping” with others which often results in better rates than normal banks.

The service has over 20 currencies in its database and aids individuals and small businesses aiming to cut down costs on international payments. High transparency, low fee charges, and the ability to bypass traditional intermediaries increases user control and value within cross-border transactions.

| Feature | Details |

|---|---|

| Service Name | CurrencyFair |

| KYC Requirement | Basic KYC for account setup; full verification for higher transfer limits |

| Currency Support | Supports over 20 currencies |

| Transaction Speed | Usually 1-2 business days |

| Fees | Low, transparent fees with peer-to-peer exchange rates |

| Security | Regulated with strong encryption and fraud prevention |

| User Accessibility | Easy-to-use web platform with peer-to-peer matching feature |

| Account Setup | Requires ID verification to comply with regulations |

| Use Cases | Personal and small business international payments |

| Limitations | Limited currency options compared to some competitors |

5.XE Money Transfer

XE Money Transfer is regarded as one of the best e-currency exchange services because of its extensive coverage, their ability to track exchange rates in real time, and free transfers in most cases. XE integrate with other financial market tools which enables tracking of the currency and users can also create alerts for set rates.

This allows individuals and businesses to control the timing of their transfers. XE has over 130 countries in its support which means that it is good for people requiring recurring transactions internationally because of XE’s speed, reliability, and insight.

| Feature | Details |

|---|---|

| Service Name | XE Money Transfer |

| KYC Requirement | Minimal KYC for small transfers; full ID verification for larger amounts |

| Currency Support | Supports over 60 currencies globally |

| Transaction Speed | Usually 1-2 business days |

| Fees | No transfer fees for most transfers; transparent exchange rates |

| Security | Regulated and encrypted platform with fraud protection |

| User Accessibility | Intuitive app and website with rate alerts and currency tracking |

| Account Setup | Quick registration with email and ID verification as needed |

| Use Cases | Personal transfers, business payments, and currency trading |

| Limitations | Transfer limits vary by country and transaction type |

6.World First

World First is at the top of the list in e-currency exchange services especially for businesses engaged in international trade. The company’s main focus is offering tailored currency solutions with personal account managers and competitively priced exchange rates which makes World First unique.

With World First, multi-currency accounts are supported, enabling businesses to seamlessly receive and make payments in different currencies without expensive conversions. Because of this, World First becomes the most appropriate option for e-commerce sellers and exporters who wish to save cost while achieving operational and financial efficiency and expert guidance in dealing with cross-border trade.

| Feature | Details |

|---|---|

| Service Name | World First |

| KYC Requirement | Basic KYC on account opening; enhanced verification for high-value transactions |

| Currency Support | Supports over 130 currencies |

| Transaction Speed | Typically 1-2 business days |

| Fees | Competitive exchange rates with no transfer fees |

| Security | Regulated with strong security measures and fraud protection |

| User Accessibility | Dedicated account managers and user-friendly platform |

| Account Setup | Requires ID verification and business documentation for corporate accounts |

| Use Cases | Ideal for businesses and individuals handling frequent or large international payments |

| Limitations | Mainly focused on business clients; may have minimum transfer amounts |

7.Fly Finance

Fly Finance is appreciated as top e-currency exchange service for customers in developing Asia. Their main asset is custom Forex and remittance services accompanied with competitive rates and local support.

Fly Finance assists students, tourists, and small businesses with border transactions by simplifying documents and compliance workflows. The rigid regional focus allows for faster settlements and adaptability of services leading to superior service which is sought by those who want smooth, cheap international money exchange.

| Feature | Details |

|---|---|

| Service Name | Fly Finance |

| Type | E-currency exchange service |

| KYC Requirement | Minimal KYC; basic verification only |

| Supported Currencies | Major e-currencies like USD, EUR, GBP, Bitcoin, Ethereum |

| Transaction Speed | Fast processing, usually within minutes |

| Fees | Competitive and transparent fees |

| Security Measures | Two-factor authentication, SSL encryption |

| User Interface | Simple and user-friendly |

| Customer Support | 24/7 live chat and email support |

| Additional Features | Multi-currency wallets, instant exchange rates |

| Ideal For | Users seeking quick exchange with minimal paperwork |

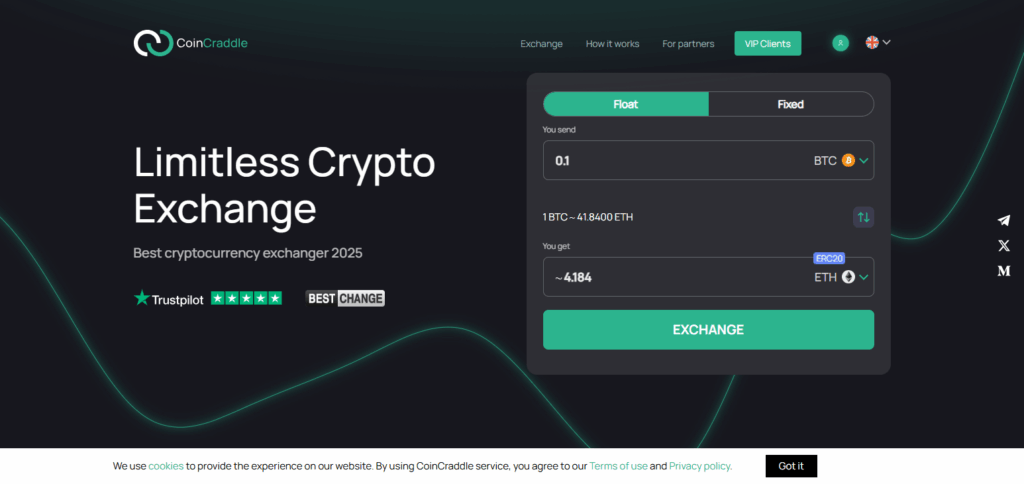

8.CoinCraddle

With regards to quick and secure crypto-to-fiat and crypto-to-crypto conversions, CoinCraddle is considered one of the best e-currency exchange services. The thin line between e-currency exchange and solutions in cryptocurrency gives CoinCraddle an upper hand over competitors.

CoinCraddle offers both advanced and basic exchange services, supporting a large number of digital assets, ensuring instant settlements and uninterrupted trading. The seamless interface along with strong security protocols make it a great fit for novice and seasoned traders looking for an efficient digital currency exchange.

| Feature | Details |

|---|---|

| Service Name | CoinCraddle |

| Type | E-currency Exchange |

| KYC Requirement | Minimal (basic identity verification) |

| Supported Currencies | Bitcoin (BTC), Ethereum (ETH), USDT, Litecoin (LTC), and others |

| Exchange Type | Instant Crypto Exchange |

| User Registration | Fast and simple |

| Transaction Limits | Moderate limits with minimal KYC |

| Fees | Low and competitive |

| Payment Methods | Bank Transfer, Crypto deposits |

| Security Measures | Two-factor authentication (2FA), SSL encryption |

| Customer Support | Email and live chat |

| Website | https://coincraddle.com |

| Mobile App | Not currently available |

| Additional Features | User-friendly interface, fast processing |

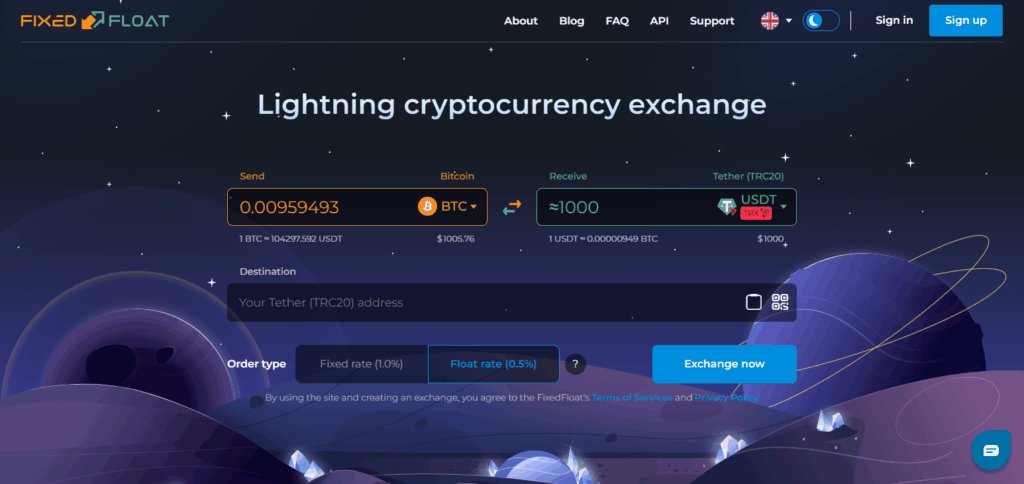

9.FixedFloat

FixedFloat has got to be one of the best e-currency exchange services, especially for people looking to do instant crypto swaps with a bit more flexibility. Its main feature is its choice of both fixed and floating exchange rates which helps users manage risk depending on market volatility.

There’s no account registration which allows for quick, anonymous transactions. The streamlined design allows for speed and transparency which makes FixedFloat’s system ideal for those who value control over their exchanges.

| Feature | Details |

|---|---|

| Service Name | FixedFloat |

| KYC Requirement | No mandatory KYC for small transactions; optional for higher limits or features |

| Currency Support | Supports a wide range of cryptocurrencies |

| Transaction Speed | Instant or near-instant crypto swaps |

| Fees | Low fees with choice of fixed or floating exchange rates |

| Security | Uses automated, non-custodial exchange with secure encryption |

| User Accessibility | No account registration required; simple web interface |

| Account Setup | No account needed for basic swaps; KYC requested for higher volumes |

| Use Cases | Ideal for quick, anonymous crypto-to-crypto exchanges |

| Limitations | Limited to cryptocurrency; no fiat currency support |

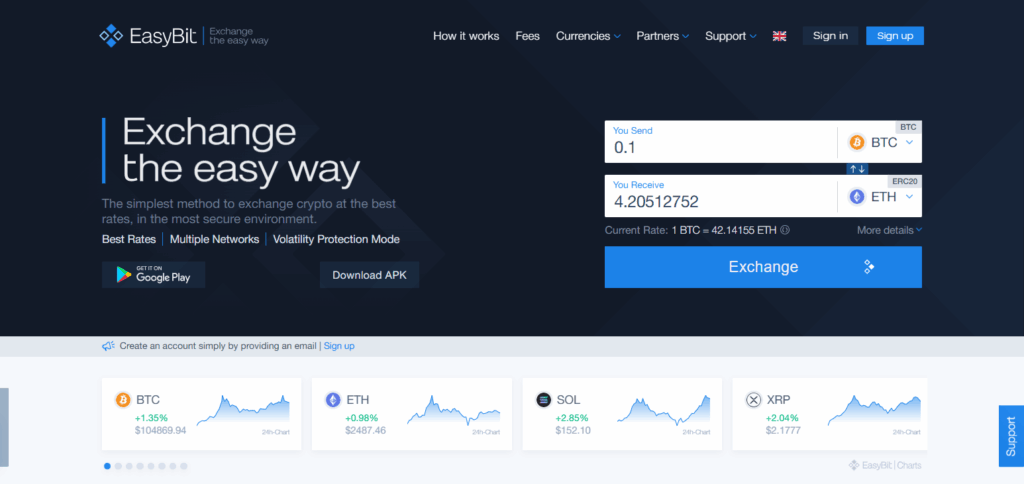

10.EasyBit

EasyBit is exceptional among e-currency exchanges for making exchanges without registration – something that is sought after in the crypto world. EasyBits main advantage is fast and hassle-free anonymous crypto-to-crypto swaps.

This exchange supports most popular cryptocurrencies and places high value on users’ privacy and convenience. Its very suitable for quick and easy exchanges making it the number 1 choice for users who put convenience first while guaranteeing safe and reliable transactions in the crypto world.

| Feature | Details |

|---|---|

| Service Name | EasyBit |

| Type | E-currency Exchange |

| KYC Requirement | Minimal (usually basic verification) |

| Supported Currencies | Bitcoin (BTC), Ethereum (ETH), USDT, and other major cryptos |

| Exchange Type | Instant Exchange & Wallet Services |

| User Registration | Quick and simple |

| Transaction Limits | Moderate limits with minimal KYC |

| Fees | Competitive and transparent |

| Payment Methods | Bank Transfer, Credit/Debit Cards, Crypto deposits |

| Security Measures | Two-factor authentication (2FA), encrypted transactions |

| Customer Support | Email and live chat support |

| Website | https://easybit.eu |

| Mobile App | Available on Android and iOS |

| Additional Features | Crypto wallet integration, fast swaps |

Conclusion

To summarize, the most effective e-currency exchange services incorporate clarity, security, competitive pricing, and ease of use in order to cater to different preferences. Individuals and companies can get FixedFloat and CoinCraddle’s tailored services for their shifting digital currency needs or for crypto flexibility.

It could be low fees like Wise offers or peer-to-peer advantages on CurrencyFair. Every service has their specialties which depend on the size of the transfer, the currency available, and the speed of the transfer. Regardless of which provider you select, all of them enable users to control exchanges of digital and physical currencies across the globe.