In this post, I will discuss the How to Farm Tokens with Minimal Risk. While yield farming has a lot of potential for building passive income, it does have many risks.

Knowing how to navigate these risks can help create a safe investment while maximizing returns—safely protecting your investment. Let’s explore effective strategies on how to farm tokens while reducing risks.

What is Farming Tokens?

Farming tokens, or yield farming as it’s commonly referred to, is the process whereby cryptocurrency holders lock or stake their tokens in DeFi systems. The holders earn rewards usually in the form of additional tokens or interest.

Users earn passive income by providing liquidity to decentralized exchanges or lending protocols facilitate borrowing and trading.

While farming tokens can be very lucrative, they also come with risks like price volatility, smart contract weaknesses, and others. Instead of just holding tokens, users can take part in the DeFi ecosystem and actively participate to enhance crypto assets through yield farming.

How to Farm Tokens with Minimal Risk

Here’s a simplified guide to low-risk token farming using liquidity pools with stablecoins:

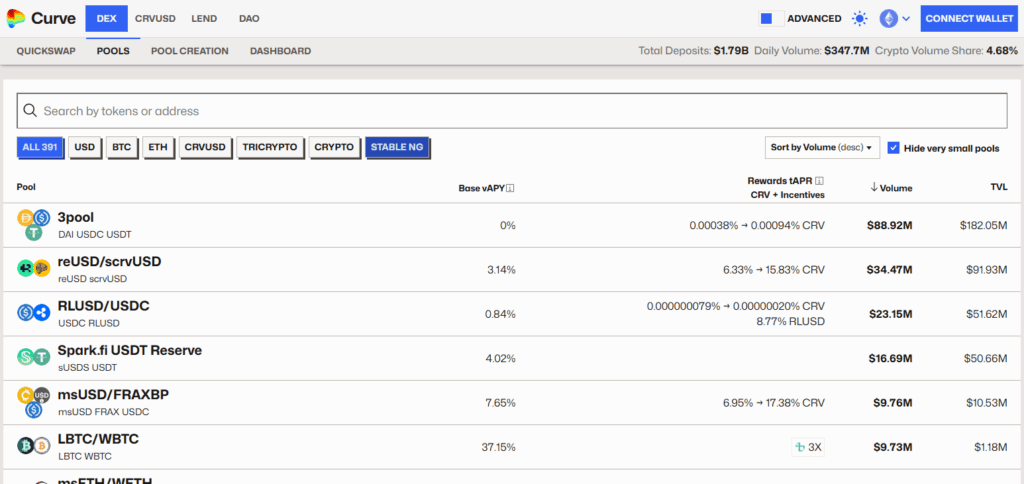

Example: Earning Tokens Using Stablecoins on Curve Finance

Select a Stablecoin Pool

Head over to Curve Finance and choose a low-volatility stablecoin pool (for example, USDC/DAI/USDT). These pools minimize exposure to price changes.

Connect Your Wallet

Link your MetaMask or Trust Wallet to Curve Finance. Make sure you have some stablecoins on hand.

Deposit Your Stablecoins

Deposit the required amount into the selected pool. Farming with stablecoins is less volatile and more dependable, making yields easier to predict.

Earn Trading Fees & CRV Farming Rewards

You are paid a proportionate share of the trading fees and rewarded with Curve’s native token (CRV), which can be farmed.

Enhance Earnings via the Curve Gauge System

Use veCRV governance staking to enhance rewards by participating in leverage reward through Curve’s Gauge system.

Track and Withdraw

With stablecoin pools, the risk of incurring impermanent loss is very low, enabling you to withdraw funds at any time with minimal disruption.

Other Place Where to Farm Tokens with Minimal Risk

Compound Finance

With Compound Finance, users can lend their crypto assets and earn interest through token farming without exposing themselves to significant risk. Its smart contracts are thoroughly audited, reducing the chance of vulnerabilities.

Unlike high-risk farming pools, Compound focuses on stable, transparent lending markets, minimizing exposure to impermanent loss and extreme volatility. This makes it ideal for conservative yield farmers who prefer a more stable financial ecosystem seek steady returns while retaining access to their assets.

Beefy Finance

Beefy Finance automates yield farming across different DeFi platforms, minimizing farming risks. Its smart vaults auto-optimizes the yields by compounding profits which saves time and reduces errors.

Regular audits and strategic investments help diversify risks, enhancing security. By using established protocols and spreading the investments, it protects users from potential losses while maximizing returns. This makes Beefy a go-to option for users who prefer efficient token farming that requires minimal supervision.

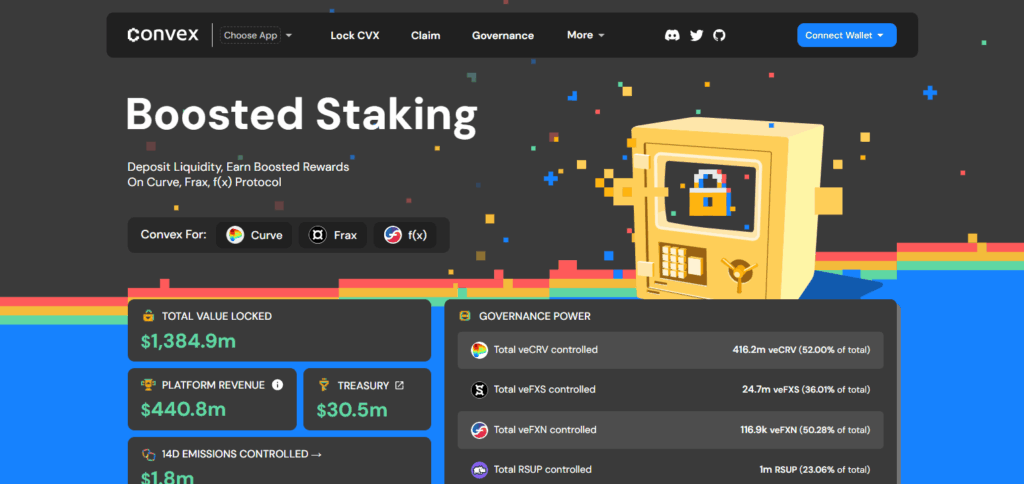

Convex Finance

Convex Finance allows users to farm tokens with minimal risk by boosting rewards on Curve Finance without needing to lock tokens. Its focus is on merging assets to improve yield while also reducing risk and exposure for individual users.

Prioritizing stability and effectiveness, Convex uses Curve’s established liquidity pools to reduce volatility and impermanent loss. The platform’s intuitive interface and robust security features protect users farming tokens through advanced collective strategies.

Strategies to Minimize Risk While Farming Tokens

Choose Audited Platforms: With a good reputation and validated smart contracts, DeFi protocols are confirmed to be safer.

Diversify Farming Pools: To mitigate the impact of one source on your investment, spread it across multiple pools.

Stake Stablecoins: Limit exposure to price fluctuations by choosing stablecoins or low-volatility tokens.

Start Small: When trying out new farms, begin with small amounts to see how things go before increasing investment.

Avoid Unrealistic APYs: Extremely high returns are often linked to high-risk investments or scams, so tread carefully.

Monitor Regularly: Ensure that you are actively managing your positions and the markets so that you can respond instantly if necessary.

Safe Yield Farming Tips

Conduct Comprehensive Research

Learn about the project, its team, and the platform before putting any money.

Use Audited Protocols

Choose platforms that have gone through third-party security audits to minimize smart contract risks.

Keep Funds in Your Control

Use wallets that give you private keys instead of centralized custody.

Set Exit Strategies

Have a clear plan on when to take profits and when to cut losses to avoid losing money in a sudden drop.

Stay Updated

Follow official social media for updates on protocol changes or security notifications.

Watch Out for Exorbitant Fees

Farming needs to be profitable so always calculate for gas and transaction costs.

Avoid Phishing Social Engineering Attacks

Always double-check URLs and never disclose private keys or seed phrases.

Risk & Considerations

Smart Contract Vulnerabilities

Bugs or exploits can cause loss of funds.

Impermanent Loss

Changes in price within liquidity pools can reduce returns.

Market Volatility

Earnings can be impacted by a dramatic shift in token price.

Platform Risk

Risks such as hacks, rug pulls, or protocol failures.

Lock-Up Periods

Grants may be locked restraining access to your tokens.

High Fees

Profits can be greatly reduced by gas and transaction fees.

Regulatory Risks

Changes in law may impact DeFi platforms or farming activities.

Pros & Cons

| Pros | Cons |

|---|---|

| Earn passive income on crypto assets | Lower returns compared to high-risk farms |

| Access to decentralized finance opportunities | Potential exposure to smart contract bugs |

| Opportunities to compound rewards automatically | Impermanent loss can still occur in liquidity pools |

| Diversification reduces overall risk | Gas fees and transaction costs can reduce profits |

| More control over funds than centralized platforms | Market volatility can impact token values |

| Use of audited and reputable protocols enhances security | Some platforms may have lock-up periods limiting liquidity |

Conclusion

Yield farming with minimal risk benefits from careful planning, research and smart strategies. Well known platforms, diversifying farming positions, and focusing on stable farming pairs lower exposure to common risks such as impermanent loss or smart contract exploits.

Keeping updated with market news, manually tending to your positions, and avoiding chasing high unrealistic yields further safeguard your capital. Employing these tactics allows farming to emerge as a less-risk method to passively earn crypto and steadily accumulate wealth as the DeFi ecosystem develops.