In this post, l explain how much mortgage I can afford and the main things that shape that number. Looking at your income, debts, credit score, and monthly bills shows how big a loan feels comfortable for you.

Whether youre buying a first house or moving up, knowing your price range lets you shop smart and keep home-buying fun.

Overview

Buying a house is likely the largest money move youll ever make. For most folks, the idea is thrilling-yet nerve-racking, mainly because they keep asking, How much mortgage can I really afford? That query goes well beyond simply securing a pre-approval from the bank.

Its about digging into your personal numbers, setting honest expectations, and making sure that monthly loan bill slides easily into the rest of your budget.

Understanding Mortgage Affordability

Mortgage affordability means figuring out the biggest loan you can take without drowning in monthly payments or neglecting bills. Its not only about a lender saying yes; its about living with that debt every day.

The goal isnt to grab the biggest check theyll write. Its to choose a number that keeps your budget steady and your mind calm.

Key Factors That Affect Affordability

Income

The first number lenders notice is your gross monthly pay-the cash that hits your account before taxes or health insurance. A bigger paycheck usually signals you can handle a larger mortgage, yet it isnt the final word.

Debt-to-Income Ratio (DTI)

Lenders check two DTI ratios:

- Front-end ratio: This shows what slice of your paycheck would cover home-related bills like the mortgage, taxes, and insurance. Most banks like it under 28-31% of your gross income so daily living costs and savings still have room.

- Back-end ratio: This larger test adds car loans, credit cards, student debt, and any other bills. Many lenders keep it below 36-43% so buyers dont stretch themselves too thin.

To see how that works, imagine you earn $6,000 a month. At 28% the front-end limit would set your housing budget at about $1,680 each month.

Credit Score

Your credit score acts like a report card for lenders. A solid grade can land you a lower mortgage interest rate, which shrinks each payment and lets you stretch your budget a little farther. On the flip side, a weak score often brings steeper rates and fewer loan options, making home ownership harder to reach.

Down Payment

The bigger your up-front cash, the smaller the loan you need, and the smaller the loan, the smaller the monthly bill. Putting down at least 20 percent can also keep private mortgage insurance, or PMI, out of your budget.

Interest Rate

Just a tiny shift in the interest rate can swing the planets on your affordability meter. When the rate creeps up by one full percentage point, it can slice tens of thousands off what you can spend.

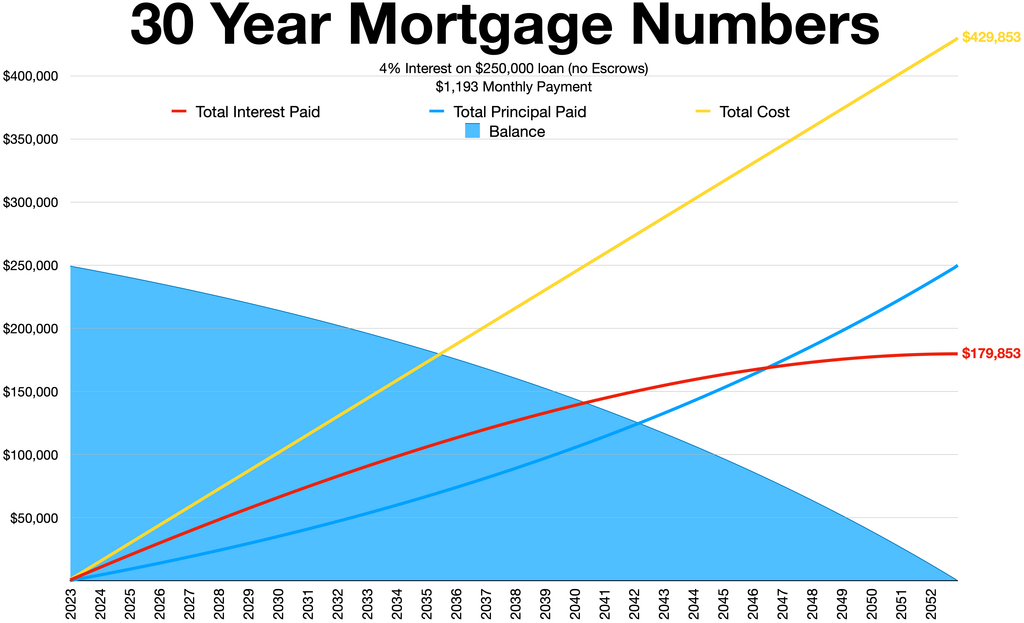

Loan Term

Standard mortgage terms run for 15, 20, or 30 years. Stretching the payment over 30 years shrinks the monthly bill, but the total interest tacks on thousands in extra cost.

Monthly Costs to Consider

Before deciding how much house you can really afford, dont focus only on the loan total. A typical monthly mortgage bill covers a few other things you must remember:

- Principal: The slice of the mortgage you pay back each month.

- Interest: The fee the lender charges for letting you use their cash.

- Property Taxes: Local governments tax land and buildings, and that cost shows up here.

- Homeowners Insurance: A policy that keeps you covered if fire, storms, or burglary strike.

- PMI: Private Mortgage Insurance kicks in when your down payment is smaller than 20 percent.

Rule of Thumb: The 28/36 Rule

A widely accepted guideline is the 28/36 rule:

- Spend no more than 28% of your gross monthly income on housing expenses.

- Spend no more than 36% on total debt payments.

This rule helps keep your finances balanced and reduces the risk of becoming “house poor,” where you own a home but have little money left for other needs or savings.

Using a Mortgage Calculator

Using a mortgage calculator can save you time and guesswork when deciding how much home you can afford. These free tools take your income, debts, and planned down payment, then spit out a rough loan amount, monthly payment, and interest cost over the life of the mortgage.

The numbers look neat on the screen, but do not treat them as gospel. Double-check the results against a full household budget, and if possible, chat with a local loan officer or trusted financial planner before signing anything so you really know what you can comfortably spend.

Conclusion

How much mortgage you can really afford isnt only about what lenders say; its about making sure the house fits your whole money picture. A good loan lets you enjoy the porch swing today without trading away your monthly freedom tomorrow.

Before you sign anything, crunch the numbers yourself, chat with a friendly mortgage pro, and pick an amount that works for your budget-not just for the banks calculator. Owning a home should bring calm roots, not restless worry.

FAQ

What does “how much mortgage can I afford” mean?

It refers to the maximum loan amount you can borrow to purchase a home, based on your income, debts, credit score, and down payment. Affordability includes not just the mortgage payment, but also taxes, insurance, and other monthly costs.

What factors affect mortgage affordability?

Higher, stable income increases affordability.

Is there a quick rule of thumb for mortgage affordability?

Spend no more than 28% of your gross monthly income on housing expenses.