In this article, I will discuss how to identify deposit options with profit opportunities while ensuring your funds remain secure.

It could be a traditional bank, a neobank, or even crypto platforms – the focus is always on maximizing interest with little risk. Let’s take a look at the most efficient ways to advance your financial goals using deposits.

What is a “Profitable Deposit ”?

A profitable deposit is a savings or investment vehicle which gives better returns than the standard deposits, thereby helping grow your money.

It usually consists of high-yield saving accounts, fixed deposits (FDs), and the more recent digital or crypto saving accounts with a high annual percentage yield (APY).

The term “profitable” relates to its ability not only to beat inflation but also preserve capital and provide passive income with very low risk.

While higher returns may include some trade-offs such as lock-in periods or counterparty risk, a profitable deposit would be ideal for cautious savers and aggressive investors since it maintains an optimum blend of return, safety, and liquidity.

How To Find Profitable Deposit

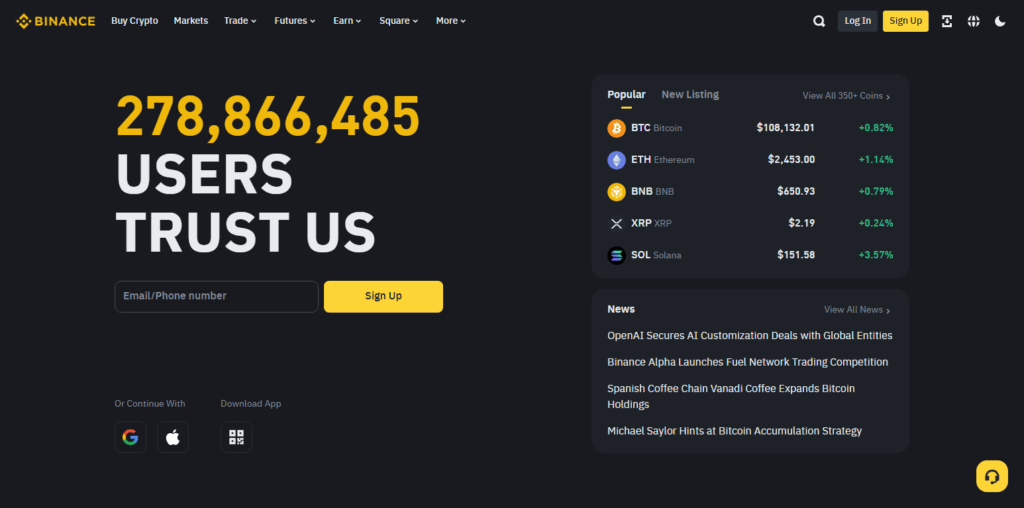

Example: Finding a Profitable Deposit on Binance Earn

Step 1: Sign Up and Access Binance Earn

Set up an account on Binance, one of the leading crypto exchanges. At the top menu, access the “Earn” section.

Step 2: Explore Available Products

Browse earning products like:

- Simple Earn (Flexible or Locked)

- Auto-Invest

- Liquidity Farming

Select stablecoins such as USDT, USDC, or FDUSD because they usually have less risk associated with them.

Step 3: Compare APYs

Check different lock periods. For instance:

- Flexible USDT: ~3% APY

- Locked 30 Days: ~6–7% APY

Higher the APY, higher the profit but less flexibility.

Step 4: Assess Risks Involved And Terms Of The Funds Transferable.

- Funds on Binance Earn are not insured.

- Using stablecoins is better than crypto assets considering market risks.

- Make sure to read all terms before subscribing.

Step 5: Withdrawals And Document Returns On Investments Made More To Gauge Pace For Scaling Steps Safer!

Start with a small deposit and gradually increase based on what seems best to you after monitoring returns, growing his level of confidence along with the steady growth observed.

What Makes a Deposit “Profitable”?

High Interest or APY (Annual Percentage Yield) Annual returns from the deposit exceed standard savings yields as well as inflation rates. Example: 6-9% in fixed deposits or 8–12% in crypto/stablecoin accounts.

Low or Acceptable Risk Funds are protected through insurance policies (e.g., DICGC/FDIC insured) or backed by stable assets in crypto. Uses reliable institution/platform.

Reasonable Lock-in Period Balances higher yield with liquidity needs.

Inflation-Measuring Returns Not only nominal value, but also real purchasing power is increased over time.

Compound Interest Increases total profits when interest earns interest

Tax Efficiency (Optional) Deposits may come with benefits that lower tax burdens increasing profit.

Key Factors to Compare Before Depositing

Interest Rate / APY

- It is crucial to remember that high interest rates direct to high returns.

- Always compare offers from different banks and check digital wallets or crypto focused platforms.

Lock-in Period / Tenure

- Fixed vs flexible deposits tailors ones needs with either fixed or variable time frames for deposits and withdrawal of funds.

- Longer duration deposits sometimes come at a cost which is poor liquidity.

Risk & Safety

- Is the deposit insured (e.g., FDIC/DICGC)?

- For cryptocurrencies, ensure that they are from credible platforms and check audits or reserve backing.

Liquidity & Withdrawal Terms

- Withdrawal policies such as early withdrawal remain applicable?

- Are there penalties associated with loss of interest on untimely withdrawals?

Minimum Deposit Requirement

Some platforms require higher investments in order to unlock better rates. This strategy has both pros and cons so always conduct thorough research before committing.

Safety & Risk Management Tips

Firmly Insured Or Regulated Platforms

- Make sure the bank is controlled by a financial authority and is insured such as DICGC or FDIC for fiat deposits.

- Check for regulated exchanges in crypto that are compliant and have audit history.

Recognize Policies And Penalties Regarding Withdrawals

- You should always be able to access your funds. Hence, check for lock-in periods, early withdrawal fee or interest loss before depositing.

- Ensure that the deposit safeguards liquidity.

Spread Funds Across Crypto Or Stablecoin Deposits

- Avoid placing all your fiat funds in one asset or platform to hedge risks.

- Mitigate risk by spreading funds across traditional FDs, high yield savings and crypto or stablecoin deposits.

Scale Formations Gradually After Starting Small

- Ramp manifests slowly after testing platforms with small deposits first.

- Increase amounts after evaluating performance, safety, and customer care services.

Conclusion

In conclusion, balancing the need for high returns with profit flexibility and safety is key when selecting a deposit. With the right platform—be it traditional banks or even crypto—you can evaluate risk and interest rates to grow your savings.

Always read the fine print, diversify, and start small. The right strategy allows you to turn deposits into powerhouse assets for passive income and financial growth.

FAQ

How often should I review deposit options?

Review options every 3–6 months or when market conditions change. Better rates and offers can appear anytime, especially in fintech and crypto.

Where can I find such deposits?

Compare banks, fintech apps, and crypto platforms. Use tools like BankBazaar or CoinGecko Earn.

Are crypto deposits profitable?

Yes, but riskier. Choose stablecoins and trusted platforms.