In this article, I will discuss the Top Performing Mutual Funds. These funds are known for their strong financial returns, underpinned by reliable investment techniques and proficient fund management.

Knowing which funds outperform others is useful for both new and seasoned investors. Hence, understanding which funds outperform can enhance your financial strategies. Let’s delve into the top-performing funds and their distinguishing features in today’s marketplace.

Key Point & Top Performing Mutual Funds List

| Fund Name | Key Point |

|---|---|

| Aditya Birla Sun Life PSU Equity Fund | Focuses on growth opportunities in government-owned companies (PSUs). |

| SBI PSU Fund | Targets fundamentally strong PSUs benefiting from economic reforms. |

| ICICI Prudential Infrastructure Fund | Invests in infrastructure-related sectors with long-term growth potential. |

| HDFC Infrastructure Fund | Focuses on cyclical infrastructure companies for capital appreciation. |

| Quant Infrastructure Fund | Uses a data-driven strategy to invest in infra and allied sectors. |

| JM Aggressive Hybrid Fund | Combines equity and debt for balanced growth with moderate risk. |

| Axis Small Cap Fund | Invests in emerging small-cap companies with high growth potential. |

| Bandhan Infrastructure Fund | Focuses on digital and new-age infrastructure development themes. |

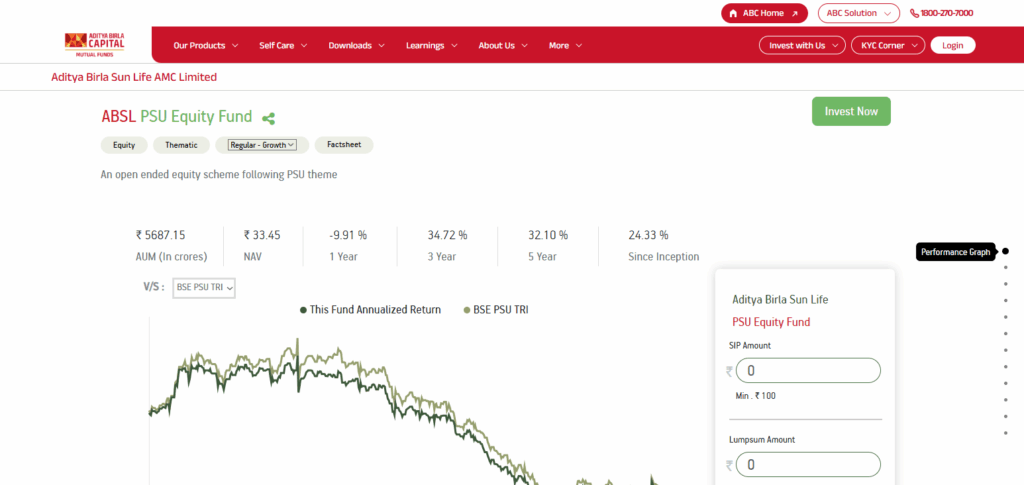

1.Aditya Birla Sun Life PSU Equity Fund

Aditya Birla Sun Life PSU Equity Fund is one of the best performing mutual funds with a focussed investment in fundamentally strong Public Sector Corporations (PSUs). The fund is well positioned to exploit the gains from government reforms, privatization policies, and capital expenditure cycles which enhance PSU valuations.

Its specific advantage comes from underestimating PSU during economic recoveries which translates to better returns. Better performance is also aided through active fund management and sector rotation which appeal most thematic investors.

| Parameter | Details |

|---|---|

| Fund Name | Aditya Birla Sun Life PSU Equity Fund |

| Category | Sectoral – PSU Equity |

| Fund Type | Open-ended Equity Scheme |

| Focus Area | Public Sector Undertakings (PSUs) |

| Risk Level | High |

| Minimum Investment | ₹100 or as per platform |

| KYC Requirement | Basic KYC (Aadhaar + PAN via eKYC accepted on most platforms) |

| Unique Point | Focuses on undervalued and growth-oriented PSUs benefitting from reforms |

| Ideal For | Long-term investors with high risk appetite |

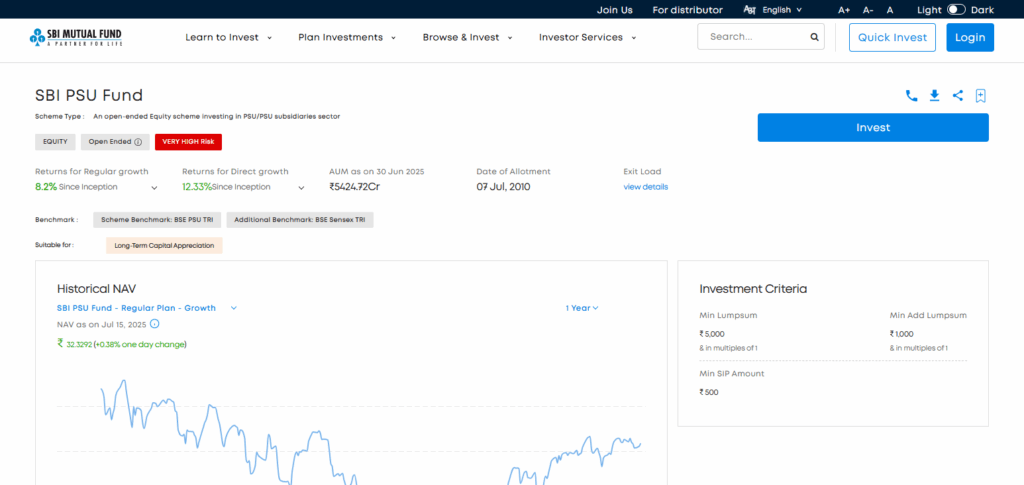

2.SBI PSU Fund

SBI PSU Fund is recognized as a top-performing mutual fund due to its dedicated focus on high-potential Public Sector Undertakings (PSUs) in the energy, banking, and infrastructure sectors. Its distinct advantage comes from capitalizing dimmed PSUs that rawly respond to India’s economic turnaround and reforms initiated by the government.

The fund’s strategic allocation to fundamentally sound but neglected firms enables it to benefot from inefficiencies that the market offers. Ongoing strong management, appropriate timing in rotating sectors, and an overall strong managements always attracts long investors in the PSUs.

| Parameter | Details |

|---|---|

| Fund Name | SBI PSU Fund |

| Category | Sectoral – PSU Equity |

| Fund Type | Open-ended Equity Scheme |

| Focus Area | Public Sector Undertakings (PSUs) across key industries |

| Risk Level | High |

| Minimum Investment | ₹500 (lump sum) / ₹500 (SIP) |

| KYC Requirement | Basic eKYC (PAN + Aadhaar OTP verification accepted on major platforms) |

| Unique Point | Targets value opportunities in PSUs likely to benefit from policy reforms |

| Ideal For | Aggressive investors with a long-term outlook on PSU sector recovery |

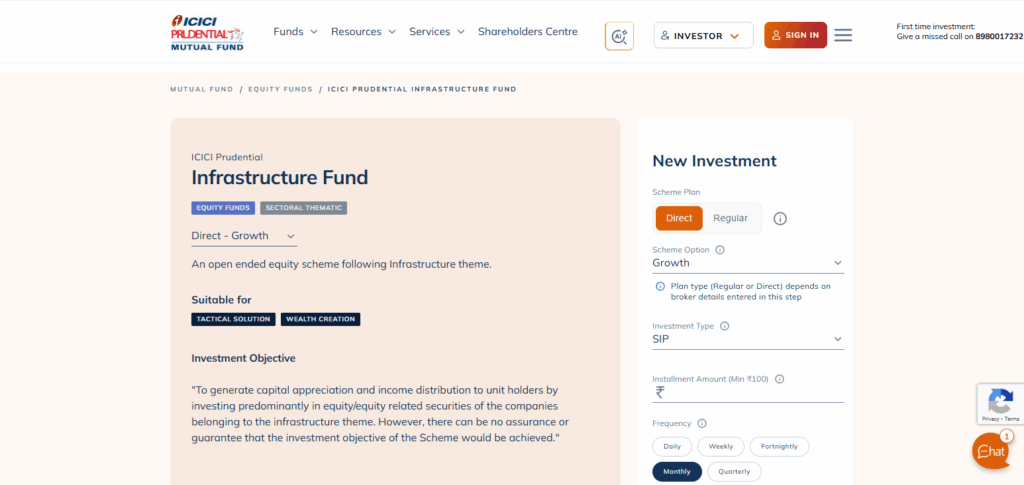

3.ICICI Prudential Infrastructure Fund

The ICICI Prudential Infrastructure Fund is one of the best mutual funds available due to the fund’s investment focus on the developing infrastructure sector in India. The fund captures growth at the country’s widest developmental spectrum which includes power, construction, transport, and many more allied industries.

Its strength lies in identifying early-stage growth capital opportunities and investing during the initial phases of expansion. With an active management style and a diversified infrastructure investment theme, the fund has strong return to risk metrics and is therefore recommended for investors wishing to gain exposure to sectoral growth.

| Parameter | Details |

|---|---|

| Fund Name | ICICI Prudential Infrastructure Fund |

| Category | Sectoral – Infrastructure |

| Fund Type | Open-ended Equity Scheme |

| Focus Area | Infrastructure-related sectors (power, transport, construction, etc.) |

| Risk Level | High |

| Minimum Investment | ₹100 (lump sum) / ₹100 (SIP) |

| KYC Requirement | Basic eKYC (PAN + Aadhaar with OTP on most investment platforms) |

| Unique Point | Actively managed fund capturing India’s infrastructure growth cycle |

| Ideal For | Long-term investors with high risk tolerance and sector-specific interest |

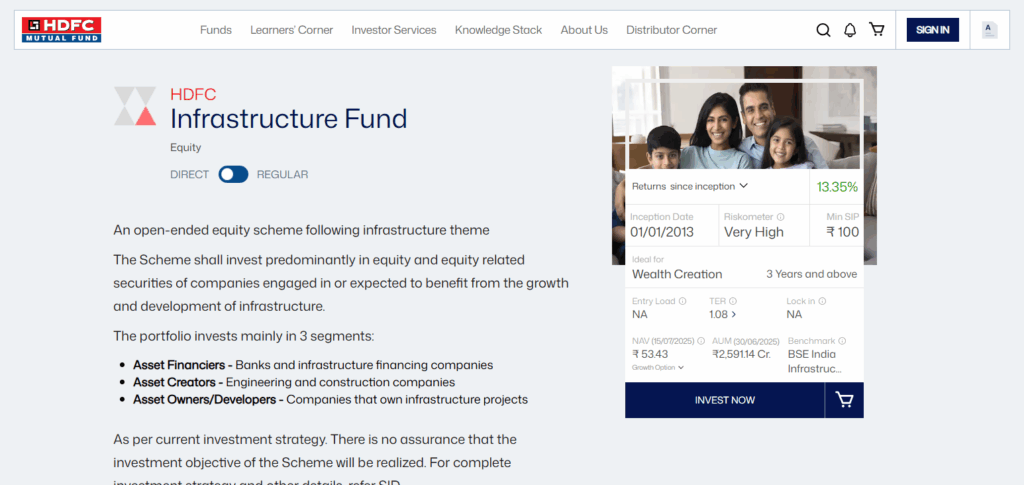

4.HDFC Infrastructure Fund

HDFC Infrastructure Fund is among the best performing mutual funds taking advantage of India’s infrastructure growth cycle. Its competitive advantage comes from making investments in companies that are likely to benefit from the government spending on roads, power, and industrial development.

The fund also invests in cyclical industries and is able to take advantage of economic recoveries. By focusing on strong companies coupled with good timing, it has delivered sustained long-term returns which will appeal to investors looking for high returns in infrastructure.

| Parameter | Details |

|---|---|

| Fund Name | HDFC Infrastructure Fund |

| Category | Sectoral – Infrastructure |

| Fund Type | Open-ended Equity Scheme |

| Focus Area | Infrastructure sectors like construction, energy, metals, etc. |

| Risk Level | High |

| Minimum Investment | ₹100 (lump sum) / ₹100 (SIP) |

| KYC Requirement | Basic eKYC (PAN + Aadhaar OTP through online platforms) |

| Unique Point | Invests in cyclical infrastructure themes aligned with economic growth |

| Ideal For | Investors seeking long-term capital appreciation with high risk appetite |

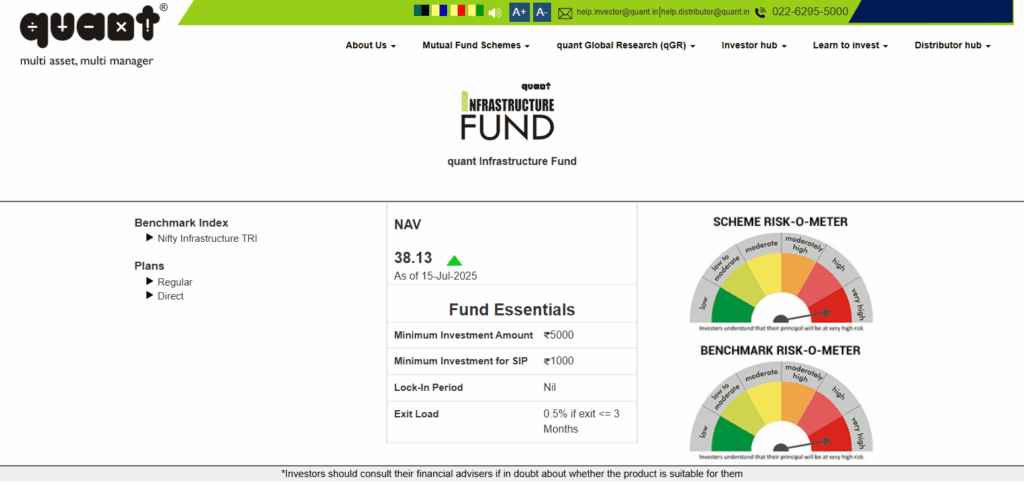

5.Quant Infrastructure Fund

Quant Infrastructure Fund is recognized as one of the best-performing mutual funds thanks to its model-based and dynamic approach to infrastructure investing. Rather than following a “set it and forget it” approach like many of its counterparts, the fund strategically pivots from one sector to another within the infrastructure theme based on real-time data and risk-adjusted metrics.

This nimbleness ensures effective capturing of short and medium-term opportunuties. Its distinct advantage comes from merging macroeconomic factors and quantitative models, enabling exceptional outperformance and volatility control—appealing to aggressive investors looking for tactical shifts.

| Parameter | Details |

|---|---|

| Fund Name | Quant Infrastructure Fund |

| Category | Sectoral – Infrastructure |

| Fund Type | Open-ended Equity Scheme |

| Focus Area | Infrastructure and allied sectors using dynamic, model-based strategies |

| Risk Level | Very High |

| Minimum Investment | ₹5,000 (lump sum) / ₹1,000 (SIP) |

| KYC Requirement | Basic eKYC (PAN + Aadhaar with OTP on most online platforms) |

| Unique Point | Uses quantitative models to actively manage infra sector opportunities |

| Ideal For | Aggressive investors seeking tactical exposure and higher return potential |

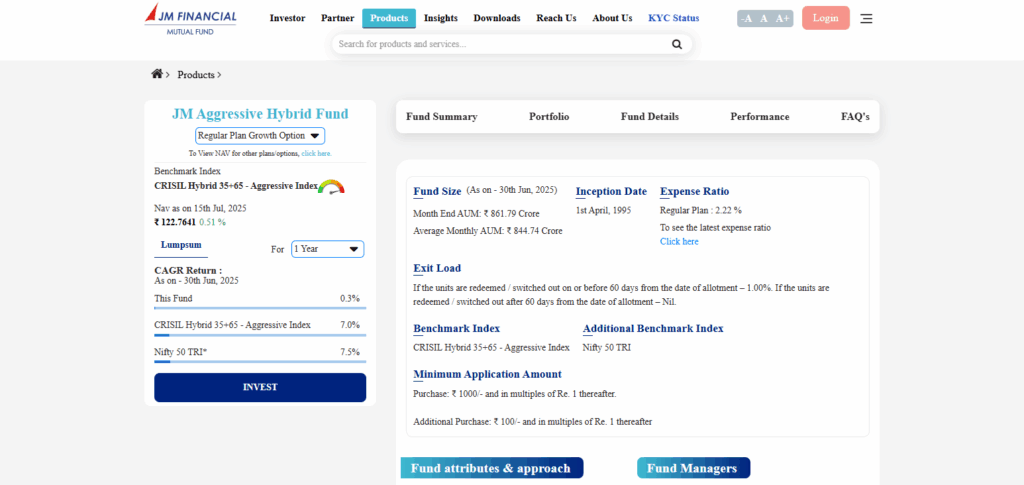

6.JM Aggressive Hybrid Fund

The JM Aggressive Hybrid Fund is recognized as one of the most successful mutual funds owing to its balanced approach of combining equity and debt within a flexible allocation framework. Its singular strength is in active equity selection that favors high-growth sectors, cushioning volatility using debt instruments simultaneously.

This dual method enhances risk-adjusted returns during periods of high market volatility. It is suited to investors who want growth, but with moderate protection and need quick adaption to changing market cycles.

| Parameter | Details |

|---|---|

| Fund Name | JM Aggressive Hybrid Fund |

| Category | Aggressive Hybrid |

| Fund Type | Open-ended Hybrid Scheme |

| Focus Area | Mix of equity (65–80%) and debt for balanced growth |

| Risk Level | Moderately High |

| Minimum Investment | ₹1,000 (lump sum) / ₹100 (SIP) |

| KYC Requirement | Basic eKYC (PAN + Aadhaar OTP via online platforms) |

| Unique Point | Balances equity growth with debt stability for better risk-adjusted returns |

| Ideal For | Moderate investors seeking growth with controlled volatility |

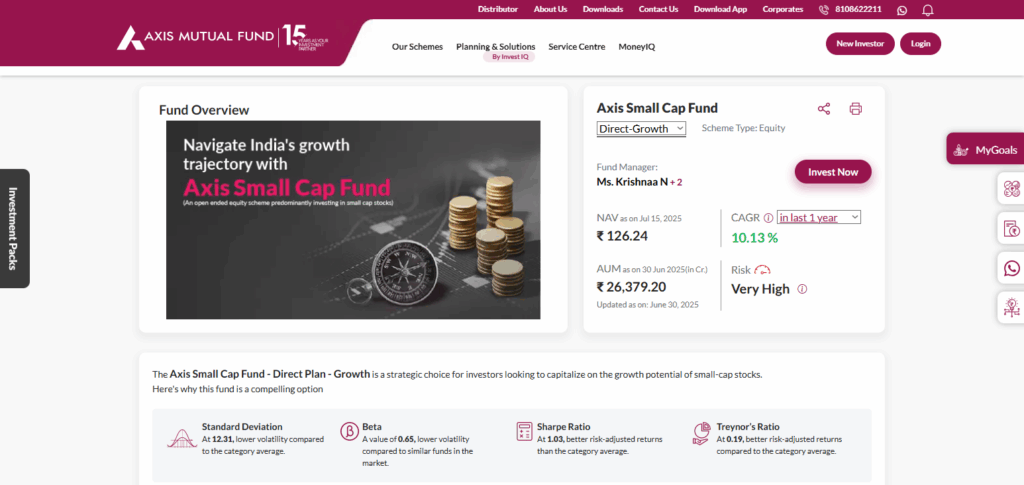

7.Axis Small Cap Fund

Axis Small Cap Fund is one of the leading mutual funds which focuses on investment in small cap companies which have high growth potential and best in class management. Its primary advantage stems from a bottom up stock selection method that pays attention to sound corporate governance, steady earnings appreciation, and industry leadership.

The fund does not chase short-term momentum plays but instead targets self-sustaining long-term winners. It has proven its attractiveness for risk tolerant long term investors by identifying emerging leaders in new industries and outperforming the market in the process.

| Parameter | Details |

|---|---|

| Fund Name | Axis Small Cap Fund |

| Category | Small Cap Equity |

| Fund Type | Open-ended Equity Scheme |

| Focus Area | High-growth potential small-cap companies |

| Risk Level | Very High |

| Minimum Investment | ₹500 (lump sum) / ₹500 (SIP) |

| KYC Requirement | Basic eKYC (PAN + Aadhaar OTP via online platforms) |

| Unique Point | Focuses on emerging businesses with strong fundamentals and growth outlook |

| Ideal For | Long-term aggressive investors seeking high returns from small-cap space |

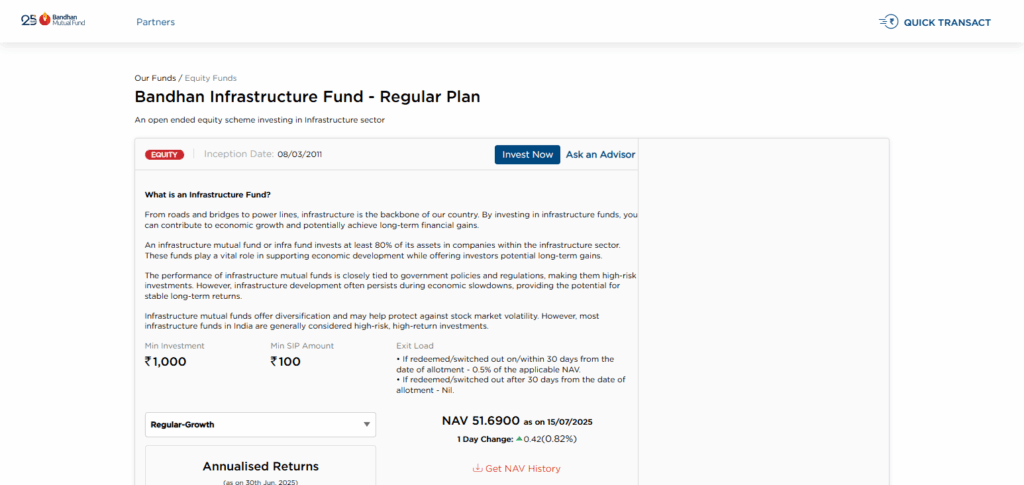

8.Bandhan Infrastructure Fund

Bandhan Infrastructure Fund is a top-performing mutual fund which is investing in India’s physical and economic infrastructure accelerating sectors. The fund’s unique advantage lies in its ability to capture government spending on capital projects, urbanization, and industrial growth.

The fund’s investment in construction, energy, logistics, and telecom infrastructure is also diversified to reduce concentration risk. With a research-driven strategy and active management, the fund captures both cyclical and structural opportunities, providing strong returns for investors who want targeted infrastructure investment.

| Parameter | Details |

|---|---|

| Fund Name | Bandhan Infrastructure Fund |

| Category | Sectoral – Infrastructure |

| Fund Type | Open-ended Equity Scheme |

| Focus Area | Core and emerging infrastructure sectors (energy, transport, telecom, etc.) |

| Risk Level | High |

| Minimum Investment | ₹1,000 (lump sum) / ₹100 (SIP) |

| KYC Requirement | Basic eKYC (PAN + Aadhaar OTP on supported online platforms) |

| Unique Point | Targets structural infra growth driven by government and private capex |

| Ideal For | Investors seeking sectoral growth with long-term capital appreciation |

Conclusion

The best mutual funds achieve superior performance through alignment with growth sectors, prudent fund management, and strong sector research due to disciplined strategies.

These funds are agile and responsive to market cycles, making use of emerging opportunities whether through specific themes such as infrastructure or PSU-focused funds, or via balanced approaches through hybrid models.

High-performing funds are useful in achieving long-term wealth creation; however, they should be selected based on an individual’s risk appetite, investment timeline, and personal financial objectives.

FAQ

What are top-performing mutual funds?

Top-performing mutual funds are those that consistently deliver higher returns compared to their category peers and benchmarks over different time periods, while maintaining sound risk management.

How are top-performing mutual funds identified?

They are typically evaluated based on past performance, consistency, fund manager expertise, risk-adjusted returns, portfolio quality, and alignment with market trends.

Are top-performing funds always safe to invest in?

Not necessarily. High returns often come with higher risks. Always assess your risk appetite and investment goals before choosing a fund.