I will explain the discuss the How to Automate Crypto Trading Bots. Automation, especially in cryptocurrency trading, can minimize emotions and save time.

In this article, I will explain the steps required to configure and operate a trading bot that can generate trades automatically based on one’s strategy. It is aimed at novice traders.

What is a Crypto Trading Bot?

A crypto trading bot automates the purchase and sale of cryptocurrencies on exchanges using a computer program. It calculates and bases its actions on the set rules and strategies of the crypto trader, analyzes relevant data, and conducts trades.

With no human input, these bots can work non-stop, further optimizing compared to manual traders. Since they don’t make trading decision based on emotions, crypto bots improve the chances of users sticking to their trading strategies, reducing the chances of losses and improving the chances of profits in the fluctuating crypto market.

How to Automate Crypto Trading Bots

Example: Automate Cryptocurrency Trading Bots with 3Commas

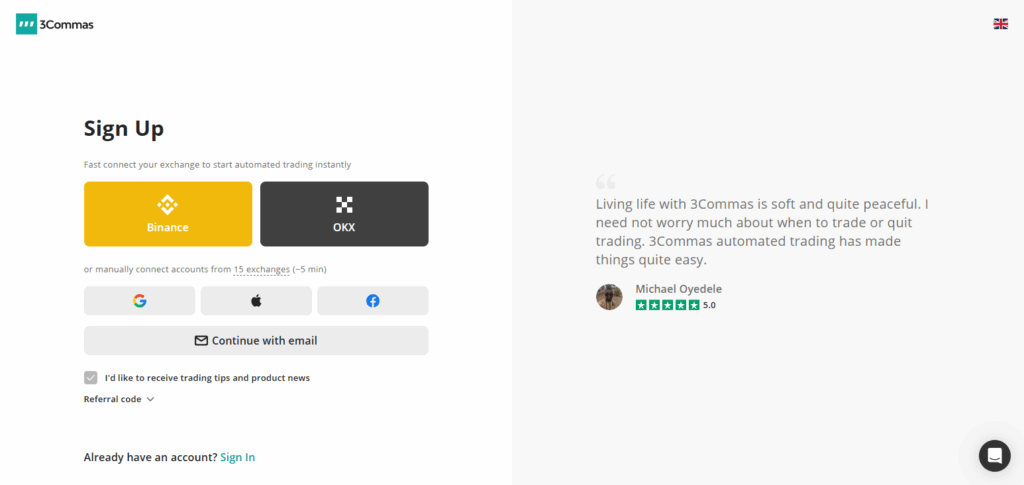

Step 1: Signup on 3Commas

Create either a free or a paid account on 3Commas.io and rejoice over free trials for paid features.

Step 2: Link your Exchange Account Via API

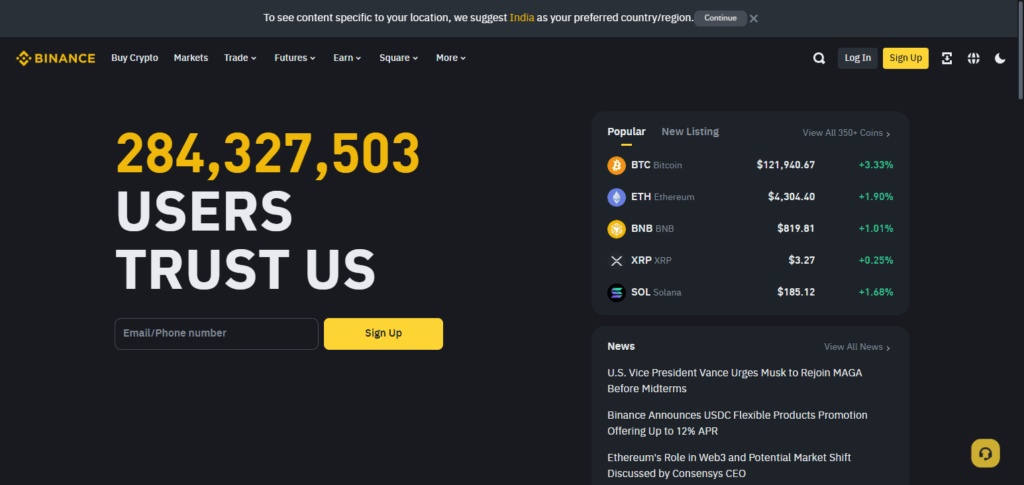

Go to your chosen cryptocurrency exchange like Binance, and log into your account. Create API keys with trading access and withdrawal permissions turned off to safeguard your account. In addition, link these API keys to 3Commas.

Step 3: Select a Trading Bot

Choose a Simple Bot as it is more suitable for beginners. It automates buy/sell transactions based on market signals .

Step 4: Set Trading Pair

Choose a trading pair, for example, BTC/USDT, which the bot will use for trading.

Step 5: Set Bot Parameters

- Specify entry rules, like buy orders triggered when prices drop by 1 percent.

- Define take profit, for example sell when prices increase by 2 percent.

- Set limits on stop losses to control losses.

Step 6: Test your Strategies

Make use of 3Commas historical data markets to test your trading strategies with the strategy test simulator in order to optimize and adjust strategies.

Step 7: Engage Your Bot

Once the settings are completed, the bot can be activated to perform live trading based on the defined parameters.

Step 8: Review and Fine-tune

Keep evaluating bots and their settings against changing conditions in the marketplace.

Why Automate Your Crypto Trading?

Always Trading: Trade bots work around the clock for you—even when you sleep, they take advantage of the market.

Prompt Trading: Bots will trade instantly, unlike through manual intervention, which takes time.

Decisions Without Emotion: Unlike a human, a bot will not trade out of fear, greed, or other irrational reasons, mitigating costly botches.

Strategy Backtesting: Risking real funds is not a prerequisite for testing your strategies against bots.

Increased Accuracy: Discipline is important in trading. Algorithmic bots do the work with enhanced precision.

Provides Convenience: Automation allows not having to check the market regularly, hence saving time.

Controlled Risk: Diversifiable strategies and pairs of bots are available to trade with.

Key Components of a Crypto Trading Bot

Trading Strategy

Determines the logic for executing a buy or sell order based on certain indicators, signals, or rules set in advance of the trade execution.

API Integration

The trading bot’s capability to connect with cryptocurrency exchanges to get market information and provide data and conduct trading by the use of secured API keys.

Risk Management Settings

Protecting profits and controlling losses through parameters such as stop-loss, trade size, and take-profit.

Market Data Analysis

Evaluation and continual evaluation of the price of assets, their trading volume, and metrics to aid in decision making for the bot.

User Interface

A dashboard or platform through which users set, track, and configure parameters for the crypto trading bot, view performance metrics, and manage their trading bot.

Backtesting Module

Strategy creation and automated trading tools which enable the simulating of trading across historical data to evaluate the performance of the system.

Security Features

API keys and the trading activities conducted via them should be protected from the use of unauthenticated keys to ensure safety and piracy through hacking.

Tips and Best Practices for Beginners

Begin With A Smaller Investment: Start with a smaller trading account to learn how the bot operates with reduced risks.

Utilize Demo Accounts: Familiarize yourself with the bot’s functions in live demo environments so that you do not incur any financial losses in live trading.

Give Security The Highest Priority: Always keep your API keys private. Disabling withdraw API permissions ensures your funds are protected.

Employ Basic Strategies: Avoid trying to accomplish overwhelming amounts at once. Utilize simple bots to minimize confusion or in that matter any other bots.

Conduct Periodic Checks: Regular checks are needed to ensure the bot performs as intended.

Crypto News And Trends: Strategies concerning crypto and trading bots must keep evolving.

Restrict Transaction Limits To The Minimum: Excessive transactions will incur fees and this could be especially true for any auto trading bots.

Utilize The Most Recent Versions: Always work with the latest trading bot versions. These trading bots will have the latest updates to features and security.

Conclusion

The automation of crypto trading bots allows for faster and more efficient trading and aids in leaving behind the emotional component of trading, while enabling participation in the markets 24/7. Even for beginners, automation can improve trading results if a trustworthy platform is chosen, explicit strategies are set, risks are defined, and controls are in place.

Bear in mind to begin with a small scale investment, analyze results on a consistent basis, and adapt the automation parameters as market dynamics change. With the right amount of patience and self-discipline, crypto trading automation can streamline processes and and provide greater ease in managing investments.

FAQ

Are crypto trading bots safe to use?

Yes, but safety depends on choosing reputable platforms, securing your API keys, and avoiding bots that require withdrawal access. Always use trusted services and practice good security.

Do I need coding skills to automate crypto trading?

Not necessarily. Many platforms offer user-friendly interfaces and pre-built strategies that require no programming knowledge.

Can I use trading bots on any crypto exchange?

Most bots support major exchanges like Binance, Coinbase, and Kraken. Check your chosen bot’s compatibility with your exchange before starting.