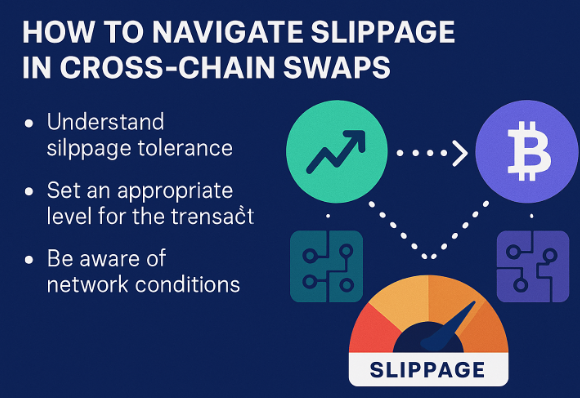

In this article, I’ll explain How to Navigate Slippage in Cross-Chain Swaps while minimizing losses and maintaining efficiency in trades.

I’ll explain the causes of slippage, how to manage it, strategies to avoid slippage, and some of the tools useful in optimizing your trades across blockchains.

What is Cross-Chain Swaps?

A cross-chain swap is a decentralized means of exchanging digital currencies between separate blockchains without a centralized exchange. It enables direct token transfers between Ethereum, BNB Chain, Polygon, and other networks using smart contracts, atomic swap technology, or bridging protocols.

Cross-chain swaps allow traders to tap into a deeper pool of assets, enhancing liquidity, and eliminating the need for multiple wallets or intermediaries, thus, streamlining crypto trading across various blockchain ecosystems.

How to Navigate Slippage in Cross-Chain Swaps

Example: Avoiding Slippage in Cross-Chain Swaps with Rango Exchange

Step 1: Wallet Connection

Access Rango Exchange and link your preferred wallet to the exchange, MetaMask or Trust Wallet, for seamless integration.

Step 2: Choose Source and Target Chains

Select the blockchain you’re exchanging from, Ethereum for example, and the blockchain you’re exchanging to, Binance Smart Chain in this instance.

Step 3: Select Currency and Input Amount

Choose the currency you wish to exchange (USDT) and the currency you wish to receive (BNB). Also, specify the exchange amount.

Step 4: Slippage Settings Check

Check the slippage settings (gear icon or settings menu) and set a reasonable tolerance (0.5%-2%). Slippage that is too low can result in numerous failed swaps during high volatility.

Step 5: Analyze Route and Fees

Rango will recommend a cross chain route with the lowest fees. Ensure that the bridge fees, gas fees, and the amount to be received is as expected before proceeding.

Step 6: Approve Transaction

Hit the “Swap” button, and approve the transaction in your wallet. The exchange will take care of the bridge and swap in the background.

Step 7: Checking Status Updates and Confirmations

As always, after all steps are done, double-check your wallet on the target chain to confirm that the funds received are in line with the expected value after fees and acceptable slippage.

Factors That Affect Slippage Severity

Liquidity Pool Depth Across Chains – Insufficient liquidity heightens price impact during swaps.

Network Speed & Finalization Periods – Transactions taking a long time incur price changes.

Token Price Volatility – Frequently fluctuating volatile tokens induce greater price movement.

Fee Method Of Bridge Or Swap Platform – Excessive fees may increase the effective slippage worsens.

Size Of Trade – Slippage worsens when the trade size increases because the market nearer move.

Strategies to Minimize Slippage

Select Well-Known Platforms with Great User Traffic – Choose cross-chain DEXs or bridges with high-market-cap DEX with greater value for liquidity to minimize price impact.

Adjust Your Slippage Settings – Change your settings to the lowest acceptable value while keeping in mind the chance of the transaction getting rejected.

Avoid Volatile Timestframes – Avoid executing swaps during high-activity periods of the market as it may lead to unanticipated price movement.

Strategize Your Swap in Smaller Parts – Dismemonvent your large transaction into smaller market swaps to mitigate the effects of moving the market.

Choose Optimized Bridges or Faster Blockchains – Avoid slow systems of executing orders as they lead to price shifts.

Common Mistakes to Avoid

Not Paying Attention to Slippage Tolerance – Unattended high default values can result in needless losses.

Changing Pairs of Tokens with Low Liquidity – Reduced liquidity heightens price impact, transaction failure rates, and incurs losses.

Not Avoiding Volatile Periods – Unpredictable price changes result in higher than normal slippage.

Not Evaluating Competing Platforms for S2 Solutions – Different DEXs and bridges have differing rates and fees.

Assuming One Order Will Execute a Cross-Chain Swap – Not iterating pairs for large trades can result in increased slippage.

Pros & Cons

| Pros | Cons |

|---|---|

| Enables access to better token prices by managing slippage tolerance | Too low slippage tolerance can cause failed transactions |

| Reduces unexpected losses in volatile markets | Requires extra time to monitor prices and liquidity |

| Improves trading efficiency by using optimal timing and platforms | May need to split trades, increasing transaction fees |

| Helps maintain control over trade execution | Limited liquidity on some chains still poses risks |

Conclusion

Managing slippage in cross-chain swaps is a compromise between getting a good deal and maintaining effortless execution of trades. Traders need to keep in mind elements such as liquidity, volatility, and network pace.

Take, for example, avoidance of expensive slippage through making advanced bookings in, high liquidity platforms, as well as during periods of lower network activity. Traders can greatly improve their outcomes, costs and losses, with better planning and through avoiding common blunders. Cross-chain transactions will always require slippage, but through better planning it is possible to achieve better outcomes.

FAQ

What is slippage in cross-chain swaps?

Slippage is the difference between the expected and actual execution price when swapping tokens across blockchains, often caused by volatility or low liquidity.

What is a good slippage tolerance setting?

A safe range is typically 0.5%–1% for stable pairs and 1%–3% for volatile tokens, depending on liquidity.

How can I avoid high slippage?

Use high-liquidity platforms, trade during low volatility, split large trades, and set a reasonable slippage tolerance.