In this article I will discuss the How To Trade Crypto Futures on Binance. You will learn the more important steps to help you start futures trading, know the different types of contracts, mitigate risks, and utilize Binance’s tools optimally.

This guide will empower all traders, be it you are new to Binance or Improvers, to trade confidently and trade smarter on Binance Futures.

What Are Crypto Futures?

Crypto futures are financial derivatives which enable investors to purchase or sell a cryptocurrency at a specified price at a certain date in the future. Unlike spot trading where the assets are exchanged at that moment and no price speculation is possible without ownership of the asset, futures trading allows price speculation without ownership.

Such trades would require leveraged capital in order to enhance the possible returns while simultaneously augmenting the risk. With the popularity of cryptocurrency, advanced traders are taking to futures trading as it allows hedging and profit in all markets.

How To Trade Crypto Futures on Binance

Example: Long Trade on BNB Futures via Binance

Log In & Transfer Funds

- You log into Binance and transfer $500 USDT from your spot wallet to your futures wallet.

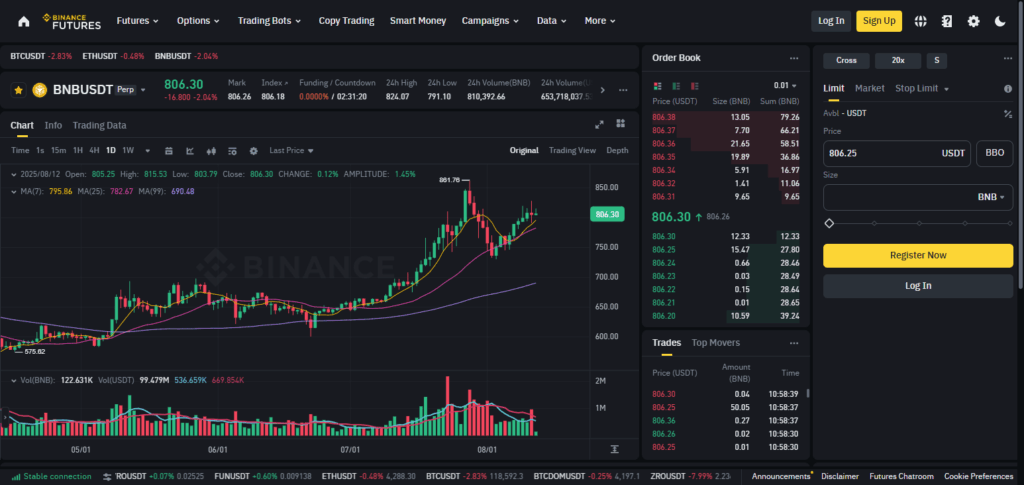

Choose the Futures Pair

- You select BNBUSDT Perpetual Futures under the USDⓈ-M Futures tab.

Set Leverage

- You choose 5x leverage, giving you $2,500 in buying power.

- Binance allows flexible leverage—adjust based on your risk tolerance.

Open a Long Position

- BNB is trading at $300.

- You place a market order to go long 8.33 BNB (2,500÷2,500÷300).

- Your margin used: $500 USDT.

Set Stop-Loss & Take-Profit

- Stop-loss: $290 (to limit loss to ~$83).

- Take-profit: $330 (to lock in ~$250 profit).

Keep an Eye on Funding Rate & PnL

- Funding rate is +0.01% every 8 hours—you’ll need to pay shorts.

- You monitor unrealized PnL and move your stop-loss as price progresses.

Reach Price Target

- BNB pumps up to $330.

- You hit take-profit, and the position is closed automatically.

Analyze Trade & Withdraw

- You earned ~250froma250froma500 margin trade, which is a 50% return.

- You may withdraw or choose to use profits for a different trade.

Types of Binance Futures Contracts

USDT-Margined Futures

- They are settled and margined in USDT (a Stable Coin).

- Simply allows profit evaluation in USD.

- Supports high leverage on popular contracts up to 125x.

Coin-Margined Futures

- They are settled and margined with the underlying crypto (BTC, ETH).

- Profit and loss are in the same coin you perform the trade.

- Useful for traders who wish to trade and hold the underlying asset.

Perpetual Contracts

- No expiry, allowing the position to be held indefinitely.

- Close tracking of the spot price through funding rates.

Quarterly (Delivery) Contracts

- Fixed and determined expiry dates e.g every quarter.

- Settlement of the contracts take place on expiry date.

How to Deposit Funds for Futures Trading

Deposit Funds to Your Spot Wallet

Deposit either fiat or cryptocurrency via bank transfer, credit card, or via crypto transfer to your Binance spot wallet.

Go to Binance Futures Wallet

Navigate to Binance Futures tab and open your Futures wallet.

Withdraw From Spot Wallet to Futures Wallet

Click on “Transfer” and set the amount and asset (e.g. USDT) to be withdrawn from Spot wallet to your Futures wallet.

Complete the Transfer

Finish the step of transferring funds, the balance will be reflected in your Futures wallet in no time.

Risk Management Strategies

Set Stop Loss Orders: If the market moves against you, Limit losses to a position you set.

Take Profit Orders: Capture profits by letting a position run to a certain level then close it.

Manage Leverage: Use less leverage for a new position to reduce the risk of losing a lot of money.

Don’t Concentrate Investments: Make sure not to deposit all your funds in a single trade.

Maintain up to date Position Monitoring: Ensure continuous updating of open positions due to market volatility.

Don’t Use Excessive Trading: Ensure you keep to your trading plan to avoid losing your funds due to hasty decisions.

Tips for Successful Futures Trading on Binance

Start Small: Limit your risks when you are learning the ropes by starting with smaller positions.

Use Binance Demo/Testnet: Build your confidence and learn the platform by practicing trading on its demo versions which do not require real money.

Understand Leverage: Take care when using leverage, as the risks associated increase with its use and degree.

Keep Up with Market News: Focus on trends and news within the crypto sphere that can affect prices.

Determine and Stick To Your Goals: Emotional trading can be avoided by planning your trades in advance with specific goals set.

Use Risk Management Tools: Your capital can be protected by using risk management tools such as take profit and stop loss orders.

Evaluate and Educate: Your trading history should be analyzed routinely to find patterns that need to be addressed.

Common Mistakes to Avoid

Over Leveraging – Putting up too much margin on a trade can lead to a quick loss.

Ignoring Fees and Funding Rates – Trading fees and periodic funding payments, if ignored, can significantly lower profits.

Not having a Strategy – Trades taken on the spur of the moment without an entry, exit and risk strategy are likely to increase losses.

Not having Risk Management – Not using a minimal critical loss level with appropriate position sizes invites the risk of substantial losses.

Loss Recovery – Forfeiting any control of losing strategy by trying to recover losses by increasing risk tends to lead to larger losses.

Market Movements and Updates – Not paying attention to the current news and trends of the market makes one vulnerable to price changes.

Conclusion

We discussed onboarding trading crypto futures on Binance from account creation to risk management. While futures trading is an excellent way to profit from volatile markets, it comes with risks that require a well-structured approach and strict self-discipline.

You can build confidence on Binance Futures by starting small and observing proper risk management practices. Always remember that you should never stop learning and practicing, and you will surely turn into a great futures trader while keeping your investment safe.

FAQ

What is the minimum deposit to start trading futures on Binance?

Binance does not have a fixed minimum deposit for futures trading, but you need enough funds to cover margin requirements, usually starting from around 10 USDT.

Can beginners trade futures safely on Binance?

Yes, beginners can trade safely by starting with low leverage, using the Binance Futures testnet, and applying strict risk management.

How do I transfer funds to Binance Futures wallet?

You must first deposit funds into your Binance Spot wallet, then transfer them to your Futures wallet via the “Transfer” option.