In this article, I will look at solutions to paying employees in crypto with Crypto Payroll Solutions with Stablecoin Disbursement. As the name suggests, these platforms allow firms to pay their staff easily and at little or no cost, even when dealing with remote and offshore employees.

Using stablecoins, companies can guarantee no change in the salary value, avoid bank delays in processing payments, and streamline borderless payroll work.

What is Payroll Solutions?

Payroll solutions are custom processes or software that focus on streamlining and automating the handling of matters related to employee compensation and payment.

This includes computing wages, tax deduction, benefit administration, time recording, and ensuring compliance with local laws and regulations that pertain to work and taxation.

With the use of payroll solutions, businesses save time, eliminate errors, and uphold the integrity of critical records that are essential for audits and financial reporting.

Most payroll systems are designed to interface with HR information systems for seamless employee data management, quicker payment processing, more accurate reporting, and hence greater organizational productivity and employee satisfaction.

Key Point & Crypto Payroll Solutions With Stablecoin Disbursement List

| Platform | Key Feature / Highlight |

|---|---|

| Rise | Supports stablecoin disbursement with automated payroll. |

| Bitwage | Global crypto payroll solution with multi-currency support. |

| Request Finance | Simplifies invoicing and crypto payments for teams. |

| Onesafe | Focuses on secure wallet management and compliance. |

| Utopia Labs | Offers decentralized payroll solutions for remote teams. |

| Toku | Real-time stablecoin payroll with transparent reporting. |

| Sablier Finance | Enables streaming payments in crypto for continuous payroll. |

| Superfluid | Supports live streaming of salaries in stablecoins. |

| Colony | Integrates payroll with project management and rewards. |

| Opolis | Provides US-compliant crypto payroll for freelancers and employees. |

1. Rise

Rise provides an innovative crypto payroll software that allows businesses to pay their employees and freelancers with stablecoins with great speed and security.

Automating payroll while balancing transparency for every transaction in real time on the blockchain is where the company’s strength comes from. Rise is optimized for teams all over the world because it supports multiple stablecoins and thereby reduces exposure to volatile crypto markets.

Tax compliance and other regulatory frameworks are simplified with the software’s automated features. Rise eliminates the hassle of payroll management while providing stable pay to employees.

Rise Features

- Stablecoin Payments: Businesses can pay employee salaries in stablecoins such as USDC or USDT to minimize volatility.

- Global Payroll Access: Employees in any country can be credited with salaries in real-time—supports cross-border payments.

- Integration with HR Systems: Simplifies payroll management by integrating with existing HR and accounting software.

2. Bitwage

Bitwage resolves the issues of traditional crypto payroll systems by allowing the payments to be done in stablecoins, thus integrating the world of stablecoins to the world of traditional finance.

One of the best features of the platform is its accessibility, permitting payroll payments to be sent anywhere in the world without high overhead costs or payment delays.

Users of Bitwage benefit from automated paycheck conversions, allowing users to pay recipients crypto wages that will be paid in convenient stablecoins, mitigating the volatility of crypto pay.

Bitwage allows users to retain the modern edge with its integrated multi-currency payroll system, in addition to its tax solutions and international payroll system.

Bitwage Features

- Multi-Currency Payouts: Employees can receive flexible remuneration in crypto and fiat currencies.

- Automated Payroll: Businesses can pay stablecoins in scheduled cycles without having to initiate payment manually.

- Tax Compliance Tools: Relieves Businesses from legal-related burden by providing tax reporting features for various jurisdictions.

3. Request Finance

Request Finance is a leading developer of crypto payroll solutions that allow businesses and freelancers to receive payments directly in stablecoins and simplify invoicing and payroll.

Its unique differentiate is in auto-generated payment requests and instantaneous disbursement of stablecoins, providing employees and contracts with on-time and reliable salary disbursement without the risk of crypto volatility.

Request Finance also offers multi-chain support, accounting software integrations, and flexible payment plans.

It offers pay-with-withheld stablecoins solutions that monthly paid employees withdraw and flexible paid employees receive in monthly pay, in addition to payment plans that minimize crypto-exposure for the payroll and enterprise customers’ global teams. It is a modern payroll in meeting users preference for consolidated crypto-disbursed payroll.

Request Finance Features

- Invoice-to-Payment Automation: Allows for payment of invoices by crypto without owner approval.

- Stablecoin Support: Predictable value of salary for employees through payment in stablecoins.

- Multi-Blockchain Capability: Supports various blockchains—scalable and flexible.

4. Onesafe

Onesafe is a reliable crypto payroll software that allows companies to pay employees directly in stablecoins with ease. It achieves this by combining its proprietary patented technological automation, bank-grade wallet security, and payroll disbursement systems to ensure stablepay disbursement, digital asset volatility exposure payability, and payroll disbursement security optimal distribution.

Due to its emphasis in disbursing multi-stablecoin payments, compliance management, instantaneous transaction tracking, and real-time monitoring, Onesafe is well-suited for companies with international and remote employees. Due to its focus in disbursing optimal security and payroll disbursing convenience, Onesafe enables visibility and predictability in payroll operations within modern organizations.

Onesafe Features

- Secure Crypto Vaults: Payroll funds are stored securely in multi-signature wallets.

- Instant Stablecoin Disbursement: Employees can be paid instantly with stablecoins.

- Audit & Compliance: Fulfills regulatory requirements by providing real-time auditing for transactions.

5. Utopia Labs

Utopia Labs is a next-generatoin crypto payroll solution that enables organizations to pay employees and freelancers directly in stablecoins which is fast and reliable and enables blockchain transparency.

It stands out due to its decentralized payroll modules which allows teams to receive real-time and on-time payroll without banking system hold-ups.

Utopia Labs enables seamless cross-border payments, which makes blockchain payments simpler by supporting multiple stablecoins, automated compliance monitoring, and reducing crypto volatility exposure. This is why it remains a preferred choice for remote organizations and companies that want to streamline their payroll.

Utopia Labs Features

- Decentralized Payroll System: Streamlines payroll processing by eliminating central intermediaries via blockchain technology.

- Stablecoin Salary Distribution: Guarantee payments are made in currencies that maintain their value.

- Smart Contract Automation: Payroll deductions and payments are scheduled automatically through smart contracts.

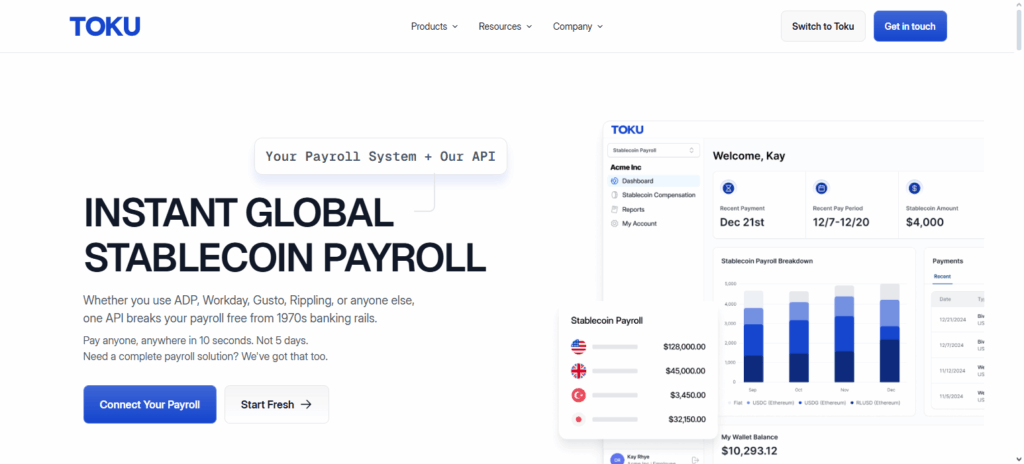

6. Toku

Toku is on the cutting edge of crypto payroll solutions, enabling businesses to pay employees and contractors directly in stablecoins and making sure that salaries are disbursed fast, securely, and predictably.

Its real-time payroll processing feature, which allows instant access to funds, while lowering exposure to cryptocurrency volatility, is perhaps the most revolutionary aspect of the Toku service.

Toku is the first provider of real time multi-stablecoin payments, automated compliance tracking, internal fintech workflows, and multi-stablecoin payments. Toku has combined speed, reliability, and ease of use to streamline global payroll management and is, therefore, perfect for remote teams and modern organizations.

Toku Features

- Real-Time Payments: Salaries are available in seconds after approval.

- Multi-Currency Payroll: Provides stablecoins and various cryptocurrencies.

- Expense Management: Payroll and reimbursement are consolidated in an all-inclusive system.

7. Sablier Finance

Sablier Finance is very distinct because it offers crypto payroll solutions that allow businesses to pay employees and freelancers in stablecoins through streaming payments technology that enables them to receive their salary in real time continuously.

The platform’s streaming payment method enables businesses to pay employees in stablecoins incrementally instead of in lump sums. Employees get paid in real time and the company is ensured that its employees will remained financially stable.

Sablier Finance is also perfect for global payroll since it supports multiple stablecoins which decreases compliance and blockchain transparency risks. This is perfect for members of a fully decentralized team.

Sablier Finance Features

- Streaming Payments: Salary payment in stablecoins that streams continuously in real time.

- Transparency: Employees can track accrual of their salaries in real time.

- Automated Compliance: Smart contracts handle taxes, returns, and deductions.

8. Superfluid

Superfluid offers advanced payroll features that let companies pay their staff by sending funds via stablecoins with continuous streaming payments, and paying contractors in stablecoins streaming payments in real time.

Employees can view their pay instantly as a set pay stream without having to reroute pay for traditional pay cycles. Superfluid offers real-time salaries, supports multiple stablecoins, blockchain-tracked payments, automated compliance, and Superfluid payroll, while embracing traditional features.

Superfluid offers an integrated solution with speed, transparency, low volatility risks, and low Superfluid fees to remote and global teams seeking modern flexible payroll systems.

Superfluid Features

- Salary Streaming in Stablecoins: Employees receive real-time salary payment directly into their stablecoin wallets.

- Programmable Cashflows: Employers can schedule blockchain payments for salary increases and automated bonuses.

- Integration with DeFi: Employees can manage their earnings by directly engaging with DeFi protocols.

9. Colony

Colony is an innovative crypto payroll solution that integrates payroll with decentralized project management. This flexibility allows Colony to automate fund disbursement based on user-defined activity completion and contribution levels.

Additionally, Colony minimizes exposure to crypto-volatility by supporting numerous stablecoins with predictable on-time payments while upholding blockchain transparency and stablecoin usage. This blend of performance-based disbursement and disbursement reliability is perfect for global and remote decentralized teams seeking seamless payroll solutions.

Colony Features

- Decentralized Workforce Management: Automated payment and task supervision for remote teams.

- Stablecoin Rewards: Payments and bonuses are issued in stablecoins.

- Governance Features: Teams can vote on rules for payment distribution and spending.

10. Opolis

Opolis is one the latest technology platforms for crypto payroll aimed at employers and freelancers paid in crypto stablecoins. It’s fast, secure, and dependable. What sets Opolis apart from competitors is that it is the only payroll system that enables decentralized borderless payroll while abiding to U.S. labor and taxing rules.

Opolis’s risk exposure to cryptocurrency volatility is minimized through support for multiple stablecoins, automated salary payment, and comprehensive reporting. Opolis is an ideal solution for remote teams, freelancers, and companies that want to use crypto to pay their employees for borderless, decentralized work in real time. It’s payroll system combines regulatory real time compliance with stable payments.

Opolis Features

- Payroll-as-a-Service: They provides a fully decentralized payroll system for freelancers and remote teams.

- Stablecoin Disbursement: They offer stablecoin payments for salaries and contributions.

- Benefits Integration: They seamlessly consolidate taxes, insurance, and on-chain retirement contributions for ease of access and management.

Pros & Cons

Pros

Costly Transaction Fees is Reduced: Fees are important and stablecoin transacted are much lower than banking fees. This may make stablecoins attractive as a method of paying employees.

Payments Made Quicker: Transfers sent via stablecoin are instantaneous. Right away, salaries can be distributed and employees are happier.

Access To Payments Has Expanded: Employed people that don’t have access to a bank can have stablecoins sent to them if they have the internet and a stablecoin wallet. This is particularly useful to employees who live a long distance away and have very little banking options available.

Salary is Predictable And Stable: Employees of a company who get paid in stablecoins are somewhat in a better position than people paid in other cryptocurrencies because much of the risk is taken out.

Payments Made Cross Border Settle Faster: Transactions sent across borders in the form of stablecoins are done instantly. This transacts without paying high fees for the servicing of bank other currency being swapped, making it very useful for people who run payroll across multiple countries.

Cons

Uncertainty In Regulation: Uncertainty of the legal case of stablecoins and the law that pertains to them, may make it difficult for a company to get set up in a new jurisdiction.

Risk of De-pegging a Stablecoin.: Stablecoins are meant to hold value; however, some stablecoins have been de-pegged which causes value changes. This de-pegging undermines the stablecoins ability to function as a stable means of payment.

Worker Disinclination.: Some employees may not be comfortable receiving payment in stablecoins due to lack of understanding and trust in the cryptocurrency system. This could be a barrier in adopting crypto payroll systems.

Cryptocurrency Barriers: Payment in stable coins requires the employee to have a digital wallet and basic technical skills. This could be a barrier to those who have not been exposed to cryptocurrency related technologies.

Difficulty in Tax Reporting: Businesses are forced to spend considerable resources on advanced accounting due to the fact that treatment of stablecoins is vastly different across jurisdictions and is deemed complex.

Conclusion

Using stablecoins to pay employees promises to change how businesses complete crypto payrolls, especially in today’s remote and global shifts. Stablecoins allow payments to be made quicker, cheaper, and without the volatility of traditional bank payments.

Despite uncertainties with de-pegging, regulation, and the technology used, the advantages of stablecoins—such as financial participation, perpetual cross-border payroll barriers, and payments made in real time—sustain their growing popularity.

Services such as Bitwage, Opolis, Rise, and Sablier Finance are redefining digital payroll and blazing the trail of effective and compliant crypto payroll solutions. As a result, these providers present both employers and employees a more advanced way than what the archaic salary systems offer.

FAQ

Which stablecoins are commonly used for payroll?

USDC, USDT, DAI, and BUSD are the most popular due to their stability and widespread adoption.

How fast are payments with stablecoin payroll?

Payments are typically processed instantly or within a few minutes, unlike traditional banking transfers that can take days.

Are stablecoin payrolls safe?

Yes, when using reputable platforms like Opolis, Bitwage, or Rise, funds are stored in secure wallets, often with multi-signature protection.

Can employees convert stablecoins to fiat currency?

Absolutely. Employees can use crypto exchanges or wallet services to convert stablecoins to local currency.