In this article, we examine prop firms that accept traders from Argentina, focusing on the ability for funded account traders to trade internationally.

For instance, FundingPips, Alpha Capital and QT Funded have flexible evaluation, competitive profit splits and have MT4, MT5 and cTrader.

These prop firms help Argentine traders improve their trading abilities and grow their careers while trading reliably and sustainably with prompt payouts.

Key Point

| Prop Firm | Key Point |

|---|---|

| FundingPips | Offers instant funding with flexible profit splits for Forex traders. |

| Alpha Capital | Provides multiple account sizes and low risk rules for beginners. |

| QT Funded | Focuses on fast evaluation programs and competitive profit targets. |

| BrightFunded | Emphasizes transparency with no hidden fees and supportive education. |

| Funding Traders | Known for easy scaling plans and weekly payouts. |

| Blue Guardian | Provides low-stress trading environment with diverse asset options. |

| AquaFunded | Offers simple evaluation phases and reasonable drawdown limits. |

| Fintokei | Specializes in Forex and crypto funding with flexible trading rules. |

| Breakout | Focused on high-leverage opportunities with fast account approval. |

| PipFarm | Offers profit sharing with minimal KYC and beginner-friendly accounts. |

1. FundingPips

FundingPips is a global proprietary trading firm that, after passing their evaluation program, gives traders funded accounts. Prop Firms Accepting Traders From Argentina includes FundingPips, since it allows local traders to use the platform without having a residency.

Traders evaluation costs are low starting around $155 for a standard account, and they can appreciate a profit split from successful trades of 80%.

The firm supports MT4 and MT5, and has flexible account and risk management. FundingPips has fast payouts and transparent rules, and this is great for beginner and experienced traders from Argentina looking for reliable funding.

FundingPips

- Profit Split: Up to 90% for traders who pass the evaluation.

- Evaluation Cost: Starts at 29fora29fora5,000 account.

- Platforms Supported: cTrader, Match Trader, TradLocker.

- Scaling Potential: Accounts can scale from 200,000to200,000to2 million.

- Payouts: Bi-weekly payouts available.

- Additional Features: No personal capital required; traders keep a significant share of profits.

2. Alpha Capital

Alpha Capital is made for professional traders looking for flexible funded accounts. Among those Prop Firms Accepting Traders From Argentina, Alpha Capital stands out for having an easy evaluation process and having no considerable limits on trading methods.

Traders can start for an entry fee of $99 and receive 70-85% profit shares depending on account size and account performance in trading. Alpha Capital works with MT4, MT5, and cTrader platforms, having fast execution and great flexibility on Forex spreads.

Clients can withdraw their profit daily and receive customer support designed for overseas clients, facilitating Argentine traders for account growth under guidelines and low red tape.

Alpha Capital Features

- Profit Split: Up to 80%. (alphacapitalgroup.uk)

- Evaluation Cost: Starts at $40 for a 2-step evaluation.

- Platforms Supported: MT4, MT5.

- Leverage: Maximum of 1:100.

- Payouts: Every 2 weeks.

- Additional Features: No time limits for challenges; traders can choose from 1-step, 2-step, or 3-step evaluations.

3. QT Funded

QT Funded is a new prop firm with a focus on evaluation programs for traders of forex and CFDs. Prop Firms Accepting Traders From Argentina, like QT Funded, has traders in that region taking evaluation challenges that start at $149.

Traders can expect up to 80% profit for their work under a risk management scheme that secures the firm and the trader.

QT Funded links easily to MT4 and MT5, and offers live account management and trade oversight. It has become popular with Argentine traders for its emphasis on transparency and rapid access to trading funds.

QT Funded Features

- Profit Split: Up to 90%.

- Evaluation Cost: Starts at $149.

- Platforms Supported: MT5, cTrader, TradeLocker.

- Scaling Potential: Accounts up to $400,000.

- Payouts: Bi-weekly payouts; on-demand payouts available for certain account types.

- Additional Features: Multiple challenge models catering to different trading styles.

4. BrightFunded

Out of all Prop Firms Accepting Traders From Argentina, BrightFunded is the one that allows traders from Argentina to apply easily and has no residency restrictions. After going through their assessment programs, they provide traders with accounts that are funded.

Evaluation fulfillment starts at $130 and profit splits are as high as 75% on accounts that are successful. They accommodate MT4, MT5 and TradingView integrations, meaning traders have flexible options.

BrightFunded has a variety of accounts and instant funding programs for traders who are able to complete the evaluation, which is a great option for Argentine traders since they are fast to pay out and provide funding at low scalable levels.

BrightFunded Features

- Profit Split: Up to 100%.

- Evaluation Cost: Starts at $130.

- Platforms Supported: MT4, MT5, TradingView.

- Scaling Potential: Unlimited account size.

- Payouts: Fast Payouts; loyalty rewards available.

- Additional Features: Trade2Earn program offering free evaluations and rewards.

5. Funding Traders

For both novice and advanced traders, Funding Traders is a prop firm that provides equitable assessment standards along with funded accounts and is one of the Prop Firms Accepting Traders From Argentina as well.

They let traders from Argentina take part without any extra geographic restrictions. Their evaluation fee is priced from $149 and the profit share is set to 70-80% for traders who are successful depending on the type of account they have. Trading on MT4, MT5, and cTrader are all trading platforms that they provide as it covers most configurations.

They promise quick payouts which lets Argentine traders concentrate purely on performance, and the support is professionally organized and set to balance out any administrative issues that may be present.

Funding Traders Features

- Profit Split: Up to 100%.

- Evaluation Cost: Starts at $149.

- Platforms Supported: MT5.

- Scaling Potential: Accounts up to $2 million.

- Payouts: Weekly payouts; refund on first payout model.

- Additional Features: Multiple challenge structures (One-Step, Two-Step, Legacy) catering to different trading styles.

6. Blue Guardian

Blue Guardian has solid funded account programs and flexible risk rules. For Prop Firms Accepting Traders From Argentina, Blue Guardian is beginner-friendly during the evaluation process and has easy funding.

Traders earn profit splits up to 80% after paying a minimum fee of $120 and attaining the performance goal. They support both MT4 and MT5 and have real-time monitoring and instant funding.

For Argentine traders looking to advance their trading career with dependable capital assistance, Blue Guardian’s prompt payment procedure and transparent trading rules make the choice easy.

Blue Guardian Features

- Profit Split: Up to 90%.

- Evaluation Cost: Starts at $120.

- Platforms Supported: MT5, Match-Trader, TradeLocker.

- Scaling Potential: Up to $400,000 in funding.

- Payouts: Instant payouts; 24-hour payout guarantee.

- Additional Features: No evaluation required for instant funding; clear rules and risk management.

7. AquaFunded

For traders worldwide, AquaFunded provides funded accounts and competitive evaluation programs with global reach. For Prop Firms Accepting Traders From Argentina, AquaFunded allows local traders to fund accounts with no residency requirements.

Evaluation starts from $140 and performance determines profit splits which go up to 80%. AquaFunded provides excellent execution and analytical instruments. They have MT4, MT5, and WebTrader.

Traders operate in a professional environment and they have several withdrawal methods. For Argentine traders, the withdrawal ease and responsive support makes trading a good experience.

AquaFunded Features

- Profit Split: Up to 95%.

- Evaluation Cost: Starts at $140.

- Platforms Supported: MT4, MT5, WebTrader.

- Scaling Potential: Up to $2 million.

- Payouts: Bi-weekly payouts; full fee refund with fast rewards.

- Additional Features: Traders are not liable for any losses; 24/7 support

8. Fintokei

Fintokei Innovations focuses on funding forex and crypto traders along with unique risk management solutions. Fintokei has one of the lowest evaluation fees at $129 and offers account profit shares of up to 80%, which places it among the prop companies that accept traders from Argentina.

Fintokei uses MT4, MT5, and Ctrader, which allows traders to use different execution strategies. Monitoring is automated and customers have daily withdrawals and personalized support. This is perfect for traders from Argentina to prop firm programs that have funding with open and fast terms.

Fintokei Features

- Profit Split: Up to 95%.

- Evaluation Cost: Starts at $149.

- Platforms Supported: cTrader.

- Scaling Potential: Up to $4 million.

- Payouts: Bi-weekly payouts; first payout after 14 days.

- Additional Features: High commissions ($6 per lot); refund on first payout model.

9. Breakout

Flexibility around funding and minimal restrictions is one of the world prop trading programs. Breakout is one of the prop firms that accept traders from Argentina. Breakout is one of the prop firms that accept traders from Argentina.

No extra compliance frameworks/ barriers, evaluation fees from $150, profit share up to 80%. Their platforms are MT4 and MT5. Breakout offers fast account analytics with live monitoring.

Their fast payout schedule and professional support make them a solid choice for Argentine traders hoping to use trading capital to grow their money.

Breakout Features

- Profit Split: Up to 80%.

- Evaluation Cost: Starts at $150.

- Platforms Supported: MT4, MT5.

- Scaling Potential: Up to $500,000.

- Payouts: Weekly payouts; 24-hour payout guarantee.

- Additional Features: No evaluation required for instant funding; clear rules and risk management.

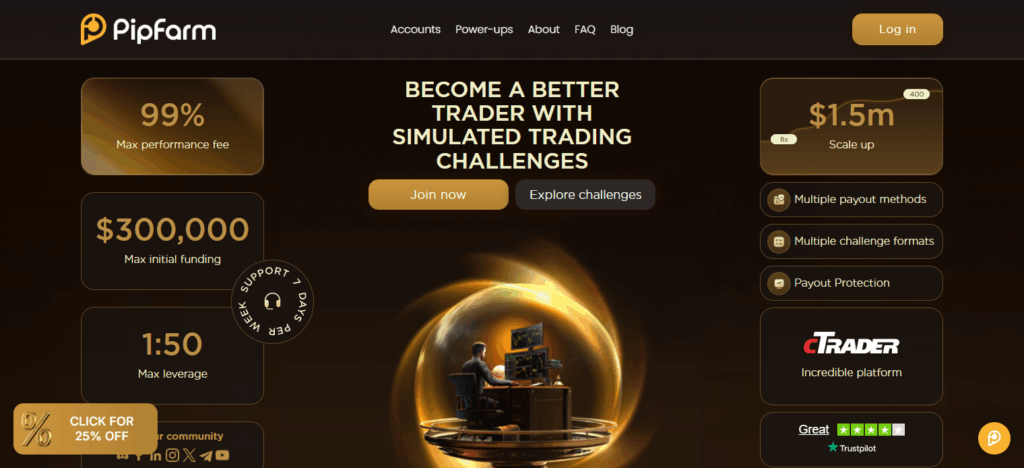

10. PipFarm

PipFarm offers prospective traders a funded account. For traders from Argentina, they have evaluation programs available from $129, which is considered pretty inexpensive. For profitable trader accounts, PipFarm offers an outstanding profit share of 75%-80%.

The risk is managed at a firm level, and they have policies which promote account growth. The firm operates through MT4, MT5, and cTrader, allowing traders to pick their preferred execution environment and integrate their strategies.

PipFarm is an excellent choice for Argentine traders due to its rapid funding, clearly defined policies, and monitored accounts which they can professionally trade.

PipFarm Features

- Profit Split: Up to 75%.

- Evaluation Cost: Starts at $129.

- Platforms Supported: MT4, MT5.

- Scaling Potential: Up to $1 million.

Conclusion

Prop firms which accept traders from Argentina offer new and seasoned traders the ability to obtain a large amount of trading capital without risk to their own account. Such as these are FundingPips, Alpha Capital, QT Funded, BrightFunded, Funding Traders, Blue Guardian, AquaFunded, Fintokei, Breakout and PipFarm.

They also support MT4, MT5, cTrader and TradingView. Traders from Argentina enjoy profit payouts that are fast, accounts that are scalable and rules that are straightforward to trade under. They do not need to manage their risk as they are being funded.

These firms allow Argentines to access a professionally designed trading environment from anywhere in the world. They can maximize their profit potential and professionally manage their risk.

FAQ

What are prop firms?

Prop firms, or proprietary trading firms, provide traders with funded accounts to trade financial markets, such as forex, stocks, or cryptocurrencies. Traders use the firm’s capital, and in return, they share a portion of the profits with the firm. This allows traders from Argentina to access significant trading capital without risking their personal money.

Can traders from Argentina join prop firms?

Yes. Many prop firms, including FundingPips, Alpha Capital, QT Funded, BrightFunded, Funding Traders, Blue Guardian, AquaFunded, Fintokei, Breakout, and PipFarm, explicitly accept traders from Argentina. They usually have no residency restrictions, making it easy for Argentine traders to participate.

What platforms do these prop firms support?

Most prop firms supporting Argentine traders offer popular trading platforms like MT4, MT5, cTrader, TradingView, and WebTrader. This ensures compatibility with most trading strategies and tools used globally.

How much does it cost to join a prop firm?

Evaluation fees vary by firm. For Argentine traders, costs typically range from $29 to $150, depending on the account size and evaluation program. Some firms also offer refund or free evaluation programs after passing certain milestones.

What profit splits do Argentine traders get?

Profit splits usually range from 70% to 100%, depending on the firm and account type. Successful traders keep the majority of their profits, making it highly rewarding for consistent performance.

How are payouts handled?

Prop firms generally offer weekly, bi-weekly, or instant payouts. Most firms allow Argentine traders to withdraw profits via PayPal, bank transfer, or crypto, ensuring smooth and timely access to funds.