In this article, I will address Commit Capital Prop Firm, a new proprietary trading firm that offers traders funded accounts and a variety of flexible programs.

With several funding options, high profit splits, and trader-first policies, Commit Capital enables novice and advanced traders, under professional supervision and minimal personal liability, to trade forex, indices, commodities, and cryptocurrencies.

What is Commit Capital Prop Firm?

Commit Capital Prop Firm Modern proprietary trading firms offer traders trading accounts and professionally flexible trading conditions programs without putting their own money at risk.

The firm gives funded traders the autonomy to choose their own trading style. Scarcity of flexible accounts trading accounts coupled with unlimited instant funding coupled with unlimited funding and the option to scale within the firm increases trading volume and profitability for the firm.

The firm offers trading in multiple asset classes and multiple trading strategies, and Activ Traders and Commit Capital. Fast funding is provided to traders who employ trading with fair floating equity dispersion and proprietary algorithms, and tight trading spreads contribute to dispersed equity and execution.

The firm provides education and fast, secure profit sharing, making it attractive for both parties. Its strong and responsive customer service is a strong trade marketing proposition. Scarcity of flexible accounts is a strong trade marketing proposition. Strong and responsive service to the customer is the trade marketing proposition.

Key Point

| Category | Details |

|---|---|

| Firm Name | Commit Capital Prop Firm |

| Founded | 2023 (relatively new but rapidly growing in the prop trading industry) |

| Headquarters | Operates globally through online platforms (exact base not publicly stated) |

| Category | Proprietary Trading Firm (Prop Firm) |

| Core Offering | Funded trading accounts with flexible programs and scaling opportunities |

| Account Types | Instant Funding Accounts, Evaluation Accounts, Scaling Accounts |

| Profit Split | Competitive model (up to 80–90% to traders depending on performance) |

| Supported Assets | Forex, Indices, Commodities, Stocks, and Cryptocurrencies |

| Trading Platforms | MT4, MT5 (MetaTrader platforms widely used by traders) |

| Trading Rules | Flexible – allows scalping, swing trading, hedging, and use of EAs |

| Leverage Offered | Up to 1:100 (varies by instrument and account type) |

| Minimum Payout | Monthly/bi-weekly payouts available with fast processing |

| KYC Requirements | Minimal verification; focus on quick onboarding |

| Community Support | Active trader community, mentorship programs, and educational resources |

| Unique Advantage | Freedom in trading strategies with instant funding and fair profit sharing |

How to Get Started with Commit Capital Prop Firm

Visit the Official Website

Check the Commit Capital site. You will find various funding options, programs, and accounts to consider.

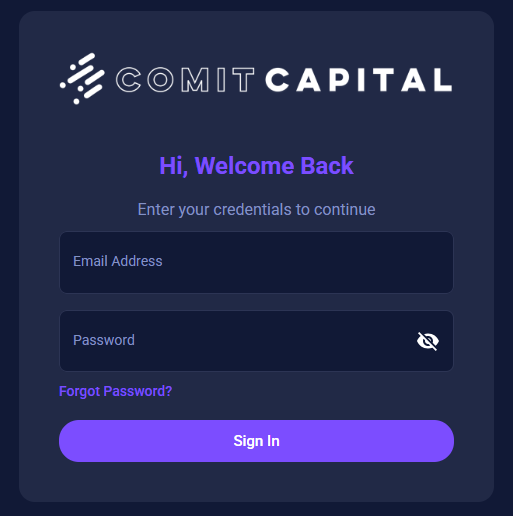

Create an Account

You will need to provide your email, full name, and a password, and fill out a quick registration form to gain access to the client portal.

Choose a Funding Program

Depending on your trading goals, you can choose Instant Funding, One-Phase, or Two-Phase evaluation challenges and choose an appropriate account size.

Review Rules and Risk Limits

Understanding compliance requires careful reading of the profit target requirements, daily and overall drawdown limits, and trading restrictions.

Pay the Challenge Fee

You will find the challenge fee. Please note that it is non-refundable, and it reserves your spot in the evaluation.

Start the Evaluation Challenge

You will need to trade the challenge account for a specified period, working to meet the profit target requirements while avoiding drawdown regulations.

Complete KYC Verification

You will need to provide KYC verification post-challenge completion to unlock your funded live account.

Begin Live Trading with Your Funded Account

Start trading with your funded account, adhere to specified regulations, and benefit from your share of the profits (which could be as high as 90% based on your account type).

Scale Up and Withdraw Profits

Based on the firm’s profit withdrawal timetable, you can withdraw your profits and expand your account based on your consistent trading profitability.

Use Approved Techniques

As described, Commit Capital accepts scalping, swing trading, and hedging along with Expert Advisors. Just ensure all your tactics meet the account policy.

Benefits of Using Commit Capital Prop Firm

Grow Your Account with Ease

Please take advantage of our flexible scaling plan, which allows you to expand your account size with a 10% maximum loss and a 5% daily loss limit. Achieve VIP status and scale up to $1,000,000.

Trade on Your Terms

Experience the freedom to trade without time constraints. With no minimum or maximum trading days, you can trade at your own pace, whenever it suits you best.

Flexible Payout Options

Receive your earnings every 7 days with up to a 85% profit split. Enjoy flexible payouts through bank transfers or cryptocurrency.

Tailor Your Trading Strategy

Customise your trading approach with the ability to use Expert Advisors (EA), hold positions during news events, trade over the weekends, and leverage large lot sizes. Flexibility is at your fingertips!

Prioritise Your Well-being

We care about your mental health. Our dedicated mindset team offers personalised, one-on-one support to enhance your trading mindset and overall well-being.

Unlock Diverse Opportunities

Engage in our one-step and two-step evaluation challenges, providing multiple paths for traders to showcase their skills and excel in a competitive environment.

Join the #ComitChallenger Discord Community

Join a thriving community of like-minded traders -who are all navigating the same prop firm journey — from passing challenges to scaling funded accounts.

Get real-time support and answers from the Comit Capital team — we’re here to help you every step of the way, not just when things go wrong.

Connect, share, and learn through strategy discussions, trading psychology chats, and behind-the-scenes insights from traders just like you.

You’re not just a number here — every trader matters, and we take the time to offer personalised guidance to help you reach your trading goals.

You’re not just a number here — every trader matters, and we take the time to offer personalised guidance to help you reach your trading goals.

Key Features of Commit Capital Prop Firm

Multiple Funding Models

Offers Instant Funding, One-Phase, and Two-Phase challenges, which help traders select the best route to access a funded account.

Flexible Trading Rules

Trading strategies such as scalping, swing trading, hedging, and the use of Expert Advisors (EAs) are all permitted.

Wide Range of Instruments

Access to trade forex, indices, commodities, cryptocurrencies, and stocks through top-tier brokers.

High Profit Splits

Profit shares are between 75% to 90%, which is very competitive and mostly dependent on the program.

Scalable Accounts

Accounts can be scaled as traders show consistent profitability.

Fast Payouts

Payouts at regular intervals and help withdraw profits easily.

User-Friendly Platforms

Let users and traders access the system on MT4 and MT5 from different places in the world.

Affordable Entry

Entry level is very friendly to both traders and amateurs as challenge fees are very reasonable.

Risk Management Rules

Clearly sustainable daily and complete drawdown limitations to protect traders and the firm.

Active Community & Support

Community offers the most educational resources and responsive customer support on the market.

Risks and Considerations

Evaluation Difficulties

Traders have to meet highly stringent profit targets and stay within a predefined drawdown limit and passes the account failure test .

Fees are Not Refundable

Usually the challenge fees are non-refundable in case traders do not pass the evaluation .

Mental and Emotional Strain

The amount of time to meet the profit targets within a time limit can cause a emotional stress and help in poor decision making .

Drawdown Rule Breach

Any minor breach against the daily or the overall drawdown limit will directly amount to disqualification .

Brokers’ Execution

Slippage, unexpected spread changes, and downtime of trade execution platforms can directly cause poor execution of trades.

Inconsistency will result in a Challenge.

Account scaling will only happen in constant profit and will be a challenge for traders who are inconsistent.

Market Risks will always Exist

Ned for personal capital does ease a lot of the burden of personal drawdown, but volatility within the capital does exist with a drawdown limit.

Lack of Control Told Terms

The firm will have control of the profit splits, payout rates, and the rest of the rules and adjust them to their liking over time.

Payouts and KYC Delays

While the firms may advertise their payout processes as quick , they usually face verification , compliance checks and a lot of KYC.

Pros & Cons

| Pros | Cons |

|---|---|

| Multiple funding models (Instant, One-Phase, Two-Phase) | Strict profit targets and drawdown rules can be challenging |

| High profit splits (up to 90%) | Challenge fees are non-refundable if the trader fails |

| Flexible trading rules (scalping, swing, EAs, news trading allowed) | Breaching rules leads to immediate account disqualification |

| Wide range of instruments (forex, indices, crypto, commodities, stocks) | Psychological pressure due to evaluation deadlines and limits |

| Fast and reliable payout system | Dependence on broker execution (slippage, spreads, downtime risk) |

| Scalable accounts for consistent profitable traders | Scaling requires consistent results, which may be hard to maintain |

| Affordable entry fees compared to some other prop firms | Limited control over payout schedules and terms set by the firm |

| User-friendly MT4/MT5 platforms supported globally | KYC verification and payout delays possible in some cases |

| Active trader community, mentorship, and educational resources provided | Market risks remain, even with firm’s capital protection |

Conclusion

Commit Capital Prop Firm is regarded as a contemporary and adaptable approach for traders needing funded accounts, as it enables them to trade without risking their own money. It provides a variety of funding styles to meet the needs of novices and advanced traders looking for development, with sizable profit shares and a variety of trading techniques.

The depth of coverage on instruments, rapid payouts, and scalable accounts guarantees a significant competitive advantage in the prop trading market.

Although the balancing of evaluation criteria and the psychological load of drawdown constraints can seem daunting, the level of trading autonomy and prospect for profit are more than. Ultimately, Commitment Capital Trading Firm is a prop trading company that advanced traders from different capital trading backgrounds can profit from.

FAQ

What trading platforms are supported?

Commit Capital supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), the most widely used trading platforms globally.

When was Commit Capital founded?

Commit Capital was founded in 2023 and has quickly grown in popularity due to its flexible programs and trader-friendly rules.

What is Commit Capital Prop Firm?

Commit Capital Prop Firm is a proprietary trading company that funds traders with real capital once they pass evaluation challenges or choose instant funding programs.

Are strategies like scalping or EAs allowed?

Yes, Commit Capital permits scalping, swing trading, hedging, and the use of Expert Advisors (EAs), giving traders freedom in their approach.