In this article, we will discuss the Top eMerchant Services that help businesses accept payments safely and seamlessly.

Services like Square, Stripe, PayPal, and others help you process payments online and in person, manage subscriptions, POS systems, and offer fraud/risk protection.

The right eMerchant service will streamline your operations, improve your customers’ experience, and help your business grow in today’s competitive digital market.

What is eMerchant Services?

eMerchant Services provides businesses with tools to handle digital payments and track them seamlessly in physical and virtual environments. They streamline payment transactions with quick and simple touchpoints in the order flow.

Payments made with digital wallets, debit and credit cards, and bank transfers are all captured by the system, and features like invoicing, recurring payments, and chargeback fraud tools provide comprehensive order and payment tools.

eMerchant Services tracks and analyzes payments to help businesses make informed decisions. All businesses today, whether they are e-commerce, retail, or service-based, depend on these services to operate in the digital economy.

Key Points & Top eMerchant Services

| eMerchant Service | Key Points |

|---|---|

| Square | Easy setup, point-of-sale integration, competitive flat-rate fees, good for small businesses and in-person sales. |

| Stripe | Developer-friendly, highly customizable, global reach, supports subscriptions and marketplaces. |

| Helcim | Transparent pricing, multi-currency support, strong customer service, suitable for growing businesses. |

| Shopify Payments | Fully integrated with Shopify, easy setup, competitive rates for Shopify users, supports multiple payment methods. |

| Authorize.Net | Reliable and established, supports recurring billing, fraud detection, best for merchants with technical resources. |

| PaymentCloud | High-risk merchant processing, flexible underwriting, supports a wide range of industries. |

| Clover | All-in-one POS system, hardware and software bundle, customizable apps, suitable for retail and restaurants. |

| Braintree | Owned by PayPal, supports mobile and web payments, recurring billing, multiple currencies, marketplace support. |

| PayPal | Widely recognized, easy integration, buyer protection, supports online and in-person payments, global reach. |

9 Top eMerchant Services

1. Square

Square is an easy-to-use eMerchant service for small to medium-sized businesses. Complete with a fully integrated POS system with payment processing.

Square works for in-person, online, and mobile transactions, and it’s great for retailers, restaurants, and service providers.

In addition to payment processing, Square offers inventory, sales performance tracking, employee management, digital invoicing, and a suite of analytics tools.

Square’s payment processing is quick, and businesses can start accepting payments in seconds with no hidden fees.

Square’s fraud detection, payment encryption, and third-party app integration are just a few features that make sure Square is a dependable solution.

| Feature | Description |

|---|---|

| Point-of-Sale (POS) | Fully integrated POS system for in-person sales. |

| Flat-Rate Fees | Simple, transparent pricing with no hidden charges. |

| Mobile Payments | Accept payments via mobile devices easily. |

| Inventory Management | Track stock and manage products within the system. |

| Invoicing & Billing | Create and send invoices digitally. |

| Analytics & Reporting | Sales data and insights for business growth. |

2. Stripe

As a developer-oriented eMerchant service, Stripe has the most sophisticated online payment tools.

Stripe processes payments globally in different currencies, handles subscriptions, and supports recurring billing, making it a good fit for SaaS, e-commerce platforms, and marketplace platforms.

Businesses can customize their entire payment workflow while utilizing Stripe’s fraud detection, PCI compliance, and secure payment data storage.

Stripe processes payments over the web and mobile, allowing businesses to choose how to receive payments.

Its payment and business data analytics, advanced technology, and transparent fees differentiate it from most online merchants and services.

Then there’s the widely used seamless integrations. This flexibility is a necessity to scale most businesses.

| Feature | Description |

|---|---|

| Developer-Friendly | Easy API integration and highly customizable. |

| Global Payments | Accept payments in multiple currencies worldwide. |

| Subscription Management | Handle recurring payments effortlessly. |

| Fraud Prevention | Built-in security and fraud detection tools. |

| Mobile & Web Payments | Supports all types of online transactions. |

| Marketplace Support | Split payments and marketplace transactions. |

3. Helcim

Helcim identifies itself as an eMerchant service because of its open approach to interchange-plus pricing, providing clarity on service charges.

Helcim accommodates online, in-person, and invoice payment options, providing attendance for SMEs as well.

With Helcim, multi-currency payment processing and recurring invoicing and billing are a breeze. Sales and customer behavior tracking for businesses are made possible by the analytics and reporting features available on the dashboard.

Helcim employs advanced methods for fraud prevention and data storage. With adaptable customer service and seamless integration options, Helcim becomes an attractive candidate for businesses wanting clarity and reliability, along with the ability to scale.

| Feature | Description |

|---|---|

| Transparent Pricing | No hidden fees; interchange-plus pricing model. |

| Multi-Currency Support | Accept payments in multiple currencies. |

| Invoice & Payment Links | Send payment requests via links or invoices. |

| Customer Service | Personalized support for merchants. |

| Recurring Billing | Supports subscription-based business models. |

| Reporting & Analytics | Detailed sales and transaction insights. |

4. Shopify Payments

As the e-commerce payment service is integrated into every Shopify store, Shopify Payments allows customers to pay with credit and debit cards, digital wallets, and local payment methods.

Its competitive transaction fees add to the service’s value proposition and promise customers hassle-free automated fraud detection.

Merchants value the ability to assess and track different aspects of their business with custom, automated, and detailed reports on revenue, customers, and sales analytics.

Shopify Payments allows merchants to configure and streamline payment processing without the complexities of third-party payment processors.

Merchants can approve sales and process payments anytime using mobile-friendly tools. Overall, payment processing is efficient, cost-effective, and safe, and merchants can pay their undivided attention to their store.

| Feature | Description |

|---|---|

| Shopify Integration | Seamless setup with Shopify stores. |

| Multiple Payment Methods | Accept credit cards, wallets, and more. |

| Competitive Fees | Lower fees for Shopify users. |

| Fraud Protection | Built-in fraud analysis tools. |

| Dashboard Analytics | Track sales and customer data efficiently. |

| Mobile-Friendly | Manage payments from mobile devices. |

5. Authorize.Net

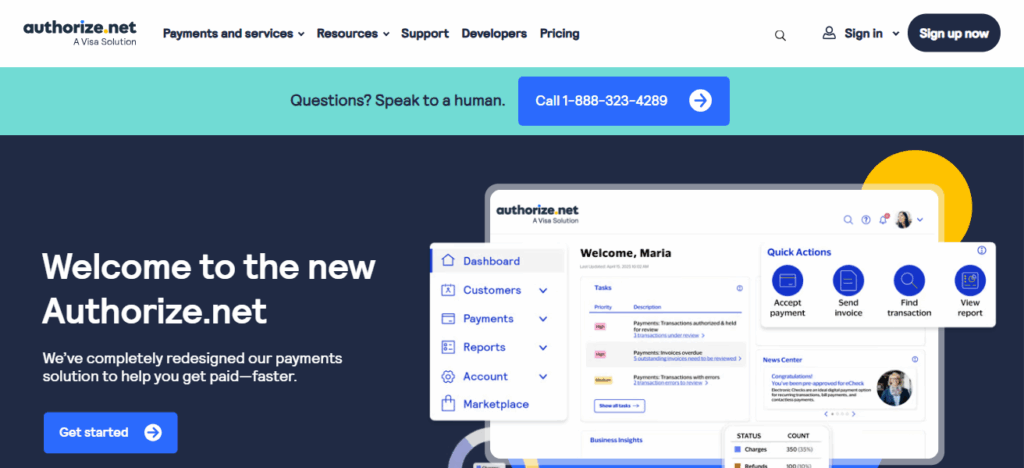

Authorize.Net has established itself as a reliable eMerchant service for the secure processing of online, in-person, and mobile payments for a long time.

Its facilities support recurring billing and subscription management, as well as multi-channel payments, which suit businesses with diverse revenue streams.

Authorize.Net also provides fraud detection, PCI compliance, and secure, encrypted storage of customer data, protecting both the merchant and the customer.

It integrates with popular shopping carts, e-commerce platforms, and accounting software for operational streamlining.

It also features robust customer management and reporting, invoicing, and billing tools. Authorize.Net’s reputation for reliability, flexible integrations, and robust security makes it perfect for businesses that need a professional, scalable, and secure payment processing system.

| Feature | Description |

|---|---|

| Reliable & Established | Trusted solution for decades. |

| Recurring Billing | Automate subscription payments. |

| Fraud Detection | Advanced fraud prevention tools. |

| Multi-Channel Support | Online, mobile, and in-person payments. |

| Integration Options | Connect with multiple shopping carts and platforms. |

| Customer Information Manager | Securely store customer payment data. |

6. PaymentCloud

PaymentCloud offers payment processing services focused on high-risk merchants and industries that other processors pass on.

It covers online, in-person, and recurring billing payments and customizes solutions according to each business.

PaymentCloud’s flexible underwriting allows high-risk merchants to open merchant accounts on short notice. For various industries, PaymentCloud’s integration with many shopping carts and POS systems helps with payment processing.

PaymentCloud’s security measures include PCI compliance, fraud monitoring, and data encryption/secure storage.

PaymentCloud offers customer support to help with configuration and daily operation. Because it concentrates on high-risk industries, PaymentCloud’s personalized service helps bridge accounts with specific merchant needs.

| Feature | Description |

|---|---|

| High-Risk Merchant Support | Accept payments for high-risk industries. |

| Flexible Underwriting | Customized approval process for businesses. |

| Multi-Industry Compatibility | Supports a wide range of business types. |

| Recurring Billing | Accept subscription payments. |

| Payment Gateway Integration | Works with popular gateways for easy setup. |

| Dedicated Support | Personalized assistance for high-risk merchants. |

7. Clover

Clover provides an all-in-one POS and payment solution for retail stores, restaurants, and service businesses. Along with the appropriate card processing hardware and software, Clover allows merchants to process mobile wallets and contactless payments seamlessly.

Clover helps merchants optimize their operations by offering invoicing, inventory management, employee management, customer loyalty programs, and advanced operational reporting.

Businesses can meet their unique needs by purchasing custom workflow applications from Clover’s app marketplace.

For both in-person and online payments, Clover offers secure and fraud-proof managed payment processing.

With flexibility in card processing hardware options, including registers, terminals, and mobile devices, Clover fits businesses needing an all-in-one payment solution.

| Feature | Description |

|---|---|

| All-in-One POS | Hardware and software bundle for stores. |

| Customizable Apps | Expand functionality with app marketplace. |

| Payment Processing | Accept cards, NFC, and mobile payments. |

| Inventory & Employee Management | Track stock and staff efficiently. |

| Analytics & Reporting | Insightful sales and performance reports. |

| Hardware Options | Terminals, registers, and portable devices. |

8. Braintree

Braintree is an excellent eMerchant platform for mobile and online payment processing, which extends its services to international organizations.

Braintree processes payments with major credit and debit cards, PayPal, and other fees with digital wallets.

Braintree makes recurring billing, subscriptions, and even payments through split transactions for marketplaces easy as well.

They place high emphasis on advanced fraud detection, PCI compliance, and secure tokenization of sensitive information.

Braintree is a good choice for organizations that need advanced payment solutions and wish to operate on an international level because of reasonable and competitive pricing, ease of use, and high reliability. Braintree is a PayPal subsidiary.

| Feature | Description |

|---|---|

| Mobile & Web Payments | Accept online and mobile transactions. |

| Multiple Payment Options | Cards, PayPal, digital wallets supported. |

| Recurring Billing | Subscription payment support. |

| Fraud Protection | Advanced tools to reduce fraudulent transactions. |

| Marketplace Payments | Split payments for platforms and marketplaces. |

| Global Reach | Supports multiple currencies and countries. |

9. PayPal

PayPal is one of the most recognized eMerchant services worldwide and accepts payments online, via mobile, and even in physical stores.

PayPal facilitates the acceptance of payments through credit, debit cards, PayPal balance, and digital wallets.

PayPal ensures safe transactions through buyer and seller protection, secure data, and fraud prevention. Easy PayPal account setup is perfect for tiny enterprises, freelancers, and e-commerce shops.

Additional offered PayPal services include an invoice generation, reporting, subscription management and cross-border payment support.

Thanks to universal acceptance, mobile-friendly design, and worldwide accessibility, PayPal is an adaptable, dependable, and trusted option for enterprises of any magnitude.

| Feature | Description |

|---|---|

| Global Acceptance | Recognized worldwide for online payments. |

| Buyer & Seller Protection | Secure transactions with dispute resolution. |

| Mobile & Web Payments | Accept payments from any device. |

| Multiple Payment Methods | Cards, PayPal balance, and wallets supported. |

| Quick Setup | Easy onboarding for merchants. |

| Invoicing & Reporting | Track sales, generate invoices, and monitor performance. |

Cocnlsuion

To summarize, leading eMerchant services such as Square, Stripe, Helcim, Shopify Payments, Authorize.Net, PaymentCloud, Clover, Braintree, and PayPal cater to a wide variety of merchant needs.

They integrate secure and advanced processors, allowing businesses to add subscriptions, POS systems, and international payments to their offering, all of which let merchants optimize their businesses, improve customer satisfaction, and grow at a remarkable pace.

FAQ

What is an eMerchant service?

An eMerchant service is a platform that allows businesses to accept payments online, in-person, or via mobile devices securely and efficiently

Which eMerchant service is best for small businesses?

Square and PayPal are ideal due to easy setup, low fees, and POS integration.

Can I use Stripe for subscriptions?

Yes, Stripe supports recurring payments and subscription management.

Which service supports high-risk businesses?

PaymentCloud specializes in payment processing for high-risk industries.

Is Shopify Payments only for Shopify stores?

Yes, it’s fully integrated with Shopify, offering seamless checkout and reporting.