This article will cover how to open a Binance Corporate Account. A Binance Corporate Account enables entities to carry out crypto trades, secure digital assets, and utilize advanced capabilities, such as multi-user access; higher withdrawal limits; and fiat currency integration.

In this article, I will outline the prerequisites for opening a corporate Binance account, the account setup process, account security, and account setup troubleshooting to ensure the process goes as smoothly as possible.

What is Binance Corporate Account?

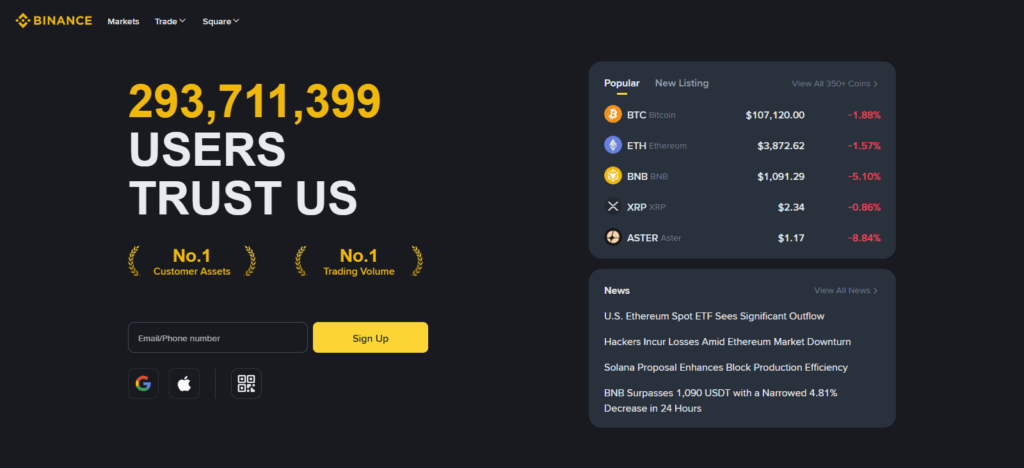

A Binance Corporate Account is distinct from regular crypto accounts in that it is specifically set up for businesses, institutions, and organizations to access crypto markets on Binance, which is one of the most reliable and largest crypto exchanges in the world.

Unlike individual accounts, a corporate account has multiple authorized account managers while having robust security and compliance safeguards. Corporate accounts have features which include higher limits on trading and withdrawals, multi-user access and permission layering, as well as enabling treasury and payments system to support crypto corporate accounts.

Companies wanting to open an account must do a corporate Know Your Customer (KYC) verification which includes a business license, certificate of incorporation, tax ID, and details of directors or authorized signatories.

Corporate Accounts Binance offers direct linking of corporate bank accounts for deposits, withdrawals and for trading, which adds a layer of fiat integration. Corporates with crypto trading, investment management or who accept crypto payments find Binance Corporate Accounts really advantageous.

It comes with security features such as two-factor authentication (2FA), whitelists for withdrawals, and audit logs. Overall, it equips businesses with financial instruments to access the ecosystem of digital assets while meeting professional compliance.

How to Open a Binance Corporate Account

Here is an example of how to open a Binance Corporate Account:

Step 1: Visit the Binance Official Website

Go to Binance.com and look at the sections dealing with corporate accounts, or just search the internet for “Binance Corporate Account.” Click on “Register” to open an account.

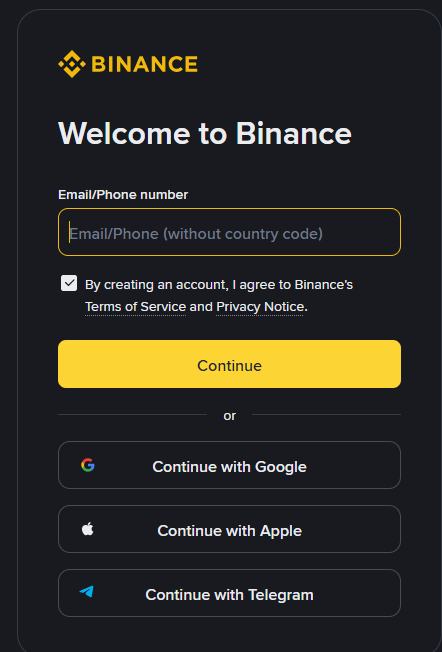

Step 2: Sign Up with a Business Email

Register the account with an official corporate email. Choose a strong password and hit the “agree” button on the Binance terms and conditions.

Step 3: Complete Corporate KYC Verification

Gather the following:

- Business registration certificate or incorporation certificate

- Tax identification documents

- Proof of address of the company

- Information about authorized directors or signatories

Upload the documents and fill in all required corporate information.

Step 4: Add Authorized Representatives

Add the employees or executives who will have access to the corporate account. Also, set permissions for things such as trading, deposits, withdrawals, and administrative functions.

Step 5: Link Corporate Bank Account

Attach your corporate bank account for deposits, withdrawals, and fiat transactions. Ensure that the bank account corresponds with the company information that was provided during KYC.

Step 6: Review and Submit

Make sure that you verify all the details and documents that you provided. Once you are certain about everything, submit the application for verification.

Step 7: Await Verification Approval

At this stage, your details and documents are sent to Binance for review. Approval may take a few business days. Once approved, your corporate account will be fully active, and you will be able to trade and carry out other business operations.

Prerequisites for Opening a Corporate Account

Step 1: Valid Business Registration

Your company must be legally registered. You should have a business license or an incorporation certificate. This shows your company legally exists.

Step 2: Tax Identification Documents

Tax ID, VAT registration, or any relevant tax compliance document must be provided. Binance needs proof of tax compliance to open a corporate account.

Step 3: Authorized Representatives Information

Determine the company directors, executives, or staff who will be managing the account. You will need their names, ID documents (passport, national ID, or driver’s license), and proof of address.

Step 4: Official Corporate Email

Register the account with a corporate email address. This will be used in all communications and verification procedures from Binance.

Step 5: Proof of Business Address

Document your company’s address. Proof can be a utility bill, an address lease agreement, or bank statement in the company’s name.

Step 6: Corporate Bank Account

A corporate bank account in the company’s name should be set up. This account will be linked to the Binance account for deposits, withdrawals, and fiat transactions.

Benefits of a Binance Corporate Account

Greater Withdrawal and Trading Limits

Corporate accounts afford larger transactions in contrast to individual accounts which facilitates more manageable crypto trades for businesses.

Access to Several Users and Roles

Account access can be structured around customizable roles which fosters secure and efficient collaboration among the users.

More Security Layers

Corporate funds are enhanced security through 2FA, Whitelisting withdrawals, and audit logging.

Complete Fiat Integration

Corporate accounts facilitate a more efficient treasury with deposits and withdrawals through linked bank accounts.

Better Trading Features

Corporate Accounts provide advanced trading capabilities, integrated APIs, and analytical tools tailored for strategic business planning.

Corporate Payments Support

Businesses receive crypto payments and administer crypto assets through Binance Corporate Accounts.

Lexical Compliance

Corporate KYC and verification provide adherence to the global AML and financial regulatory frameworks.

Security Best Practices for Corporate Accounts

Enable Two-Factor Authentication (2FA)

Require all users to enable 2FA to provide another layer of protection besides passwords.

Set Withdrawal Whitelists

Prevent unauthorized transfers by restricting withdrawals to pre-approved bank accounts or crypto addresses.

Assign Role-Based Access

Limit permissions for trading, deposits, and withdrawals to only what is necessary for each team member to reduce exposure.

Regularly Monitor Account Activity

Logs and transaction histories should be examined routinely to identify any suspicious discrepancies.

Use Strong Passwords

Complex passwords should be created, maintained, and periodically changed to minimize unauthorized access.

Keep Devices Secure

All devices that will access the account should be connected to protected and secure networks, and should have maintained antivirus software.

Enable Account Notifications

For immediate monitoring, email and app notifications should be available for login attempts and withdrawals.

Periodic Security Audits

For first-class security, regular checks should be done for user permissions, the bank accounts that are linked and account settings.

Common Issues and Troubleshooting

KYC Verification Delays

This process can take a few days. Document clears, validity, and accuracy matter a great deal for avoiding any delays.

Document Rejection

Documents may be rejected if they are expired, mismatched, and/or are of poor quality. Make sure these are accurate.

Bank Account Linking Errors

Make sure the corporate bank account is tagged to the exact name of the company, and if necessary, it must be able to process international transactions.

Login or Access Problems

Access issues may be experienced in multi-user accounts. Make sure the necessary permissions are given and the 2FA codes are entered correctly.

Withdrawal Restrictions

If the security settings or whitelists are not set, the system may impose withdrawal limits. Examine your whitelist.

API Integration Issues

While connecting trading bots or other tools, people may run into errors. Check the API keys and permissions.

Account Lockouts or Suspensions

Accounts may be locked for a period because of high-risk activity. Make sure to reach out to Binance and, if necessary, present the verification docs.

Conclusion

For businesses and institutions seeking to effectively handle cryptocurrency payments and trading, a Binance corporate account is a necessity. Companies enjoy heightened trading capabilities, multi-user access, and enhanced protective measures when advanced security is in place for corporate KYC verification and designated authorized representatives. Binance corporate accounts aid businesses in maximizing operational efficiencies, ensuring compliance, and employing premium-grade digital asset management tools due to the security best practices, account verification, and integration of bank accounts.

FAQ

How long does the corporate account verification take?

Verification usually takes a few business days, depending on the completeness and accuracy of the submitted documents.

What documents are required for a corporate account?

You need your company’s business registration or incorporation certificate, tax ID, proof of address, and identification documents of authorized representatives.

Can multiple employees access the corporate account?

Yes, Binance allows multi-user access with customizable roles and permissions for trading, deposits, withdrawals, and administrative tasks.

Are there withdrawal limits for corporate accounts?

Corporate accounts have higher trading and withdrawal limits compared to individual accounts, but exact limits depend on verification level and account settings.

Can I link a corporate bank account for fiat transactions?

Yes, corporate accounts can connect a company bank account for deposits, withdrawals, and payment management.