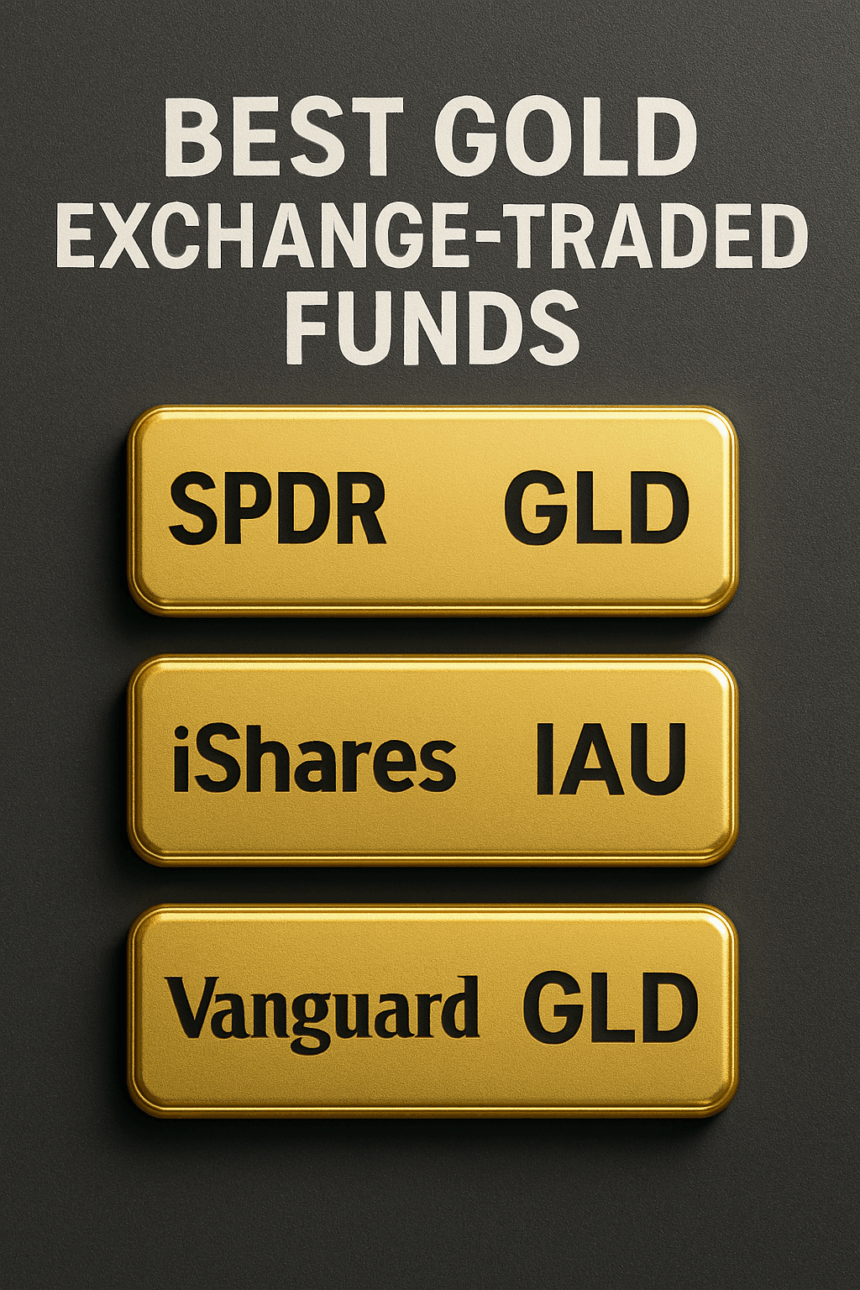

As a hedge against volatility and a means of preserving wealth, gold has long been trusted. Best Gold Exchange-Traded Funds are a great way to get access to gold without the hassle of physical ownership and the difficulties of gold storage.

Such ETFs are gold price trackers wherein they provide transparency, liquidity, and are cost-efficient. Because of these attributes, they are great long-term investments and are also targeted for diversification during these changing times.

Key Points

| Fund Name | Key Point(s) |

|---|---|

| SPDR Gold Shares | Seeks to reflect the performance of the price of gold bullion, less Trust expenses. |

| iShares Gold Trust | Tracks the price of gold bullion by holding physical gold bars in vaults; cost-conscious option. |

| SPDR Gold MiniShares Trust | A lower-cost, physically backed gold ETF designed for long-term exposure. |

| iShares Gold Trust Micro | Very low expense physical gold ETF; aims for exposure to price of bullion with minimal costs. |

| abrdn Physical Gold Shares ETF | Physically backed gold stored in secure vaults (Switzerland), audited, with transparency. |

| VanEck Merk Gold ETF | Uniquely offers investors the option of physical delivery of gold (in addition to tracking gold price). |

| Goldman Sachs Physical Gold ETF | Backed by allocated physical gold; a newer entry with competitive cost structure. |

| Franklin Responsibly Sourced Gold ETF | Physical gold ETF but emphasises responsibly-sourced gold (LBMA standards). ( |

| GraniteShares Gold Trust | Among the lowest-cost gold ETFs; physically backed with transparent vaulting and audit. |

| WisdomTree Physical Gold | UCITS-eligible physical gold ETC (mainly Europe) backed by allocated gold meeting LBMA standards. |

1. SPDR Gold Shares (GLD)

GLD or SPDR Gold Shares is one of the largest and most liquid Gold ETFs. It is one of the least Gold ETFs and doesn’t require you to store or own gold yourself to have access to gold bullion. Gold is stored and held in vaults in London gold is stored in vaults.

It is also one of the most liquid ETFs and great for institutionals. It is also one of the Best Gold Exchange-Traded Funds. Most investors who invest in gold do it to diversify or protect their portfolios against inflation.

SPDR Gold Shares (GLD)

Pros:

- Exhibits extreme liquidity, showing huge daily trading volumes.

- Closely follows the price of gold with gold backing the valuation.

- Most trusted and recognized.

- Provides excellent diversification and inflation-hedging characteristics.

Cons:

- High expense ratio.

- Share price accessibility issues for smaller investors.

- No option for physical delivery gold.

- Complications regarding taxes for investors from the U.S.

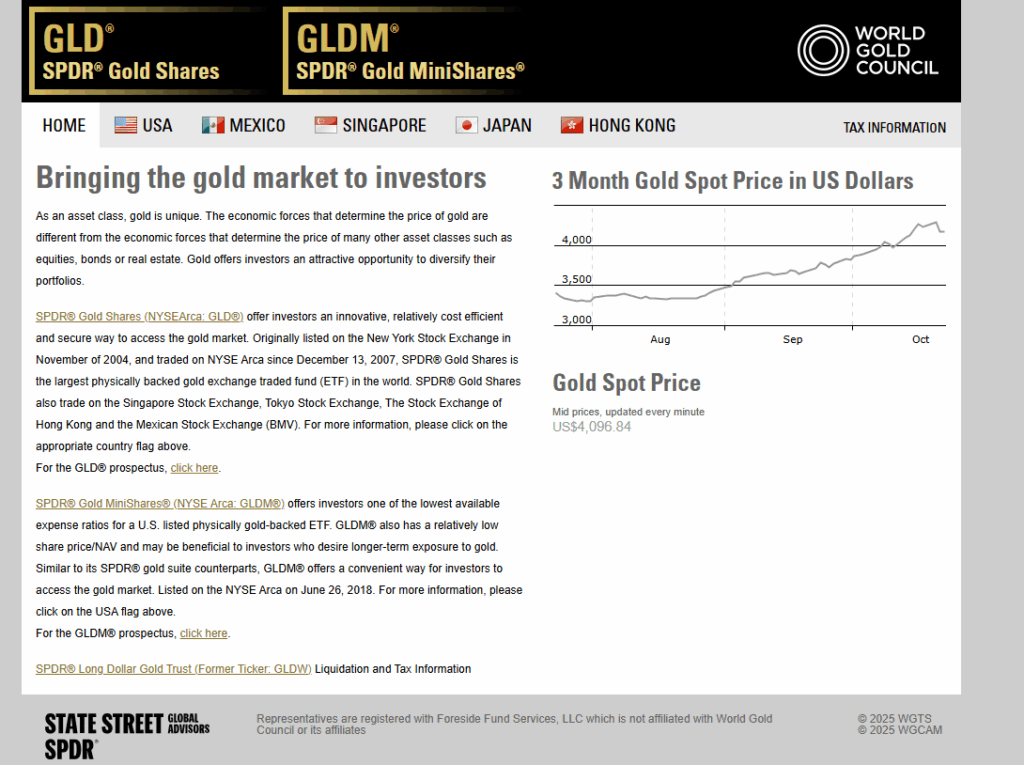

2. iShares Gold Trust (IAU)

IAU or iShares Gold Trust is one of the Best Gold Exchange-Traded Funds because of the lower expense ratio and ease of access to gold. It is also managed by BlackRock as explained in the first blog. Gold bullion is stored and held in vaults around the world.

IAU is also one of the most liquid Gold ETFs. It is a great option for long term investors as the expense ratio is also lower than GLD and most liquid Gold ETFs around the world.

IAU acknowledges the need for transparency, the ease of buying and selling units, and the ease of tracking with the price of gold. It is the most logical option to hedge a portfolio against the loss of buying power of the dollar and inflation.

iShares Gold Trust (IAU)

Pros:

- Lower expense ratio than GLD.

- Fully gold backed and offers an excellent level of gold securing.

- High trading volume and liquidity.

- Share price accessibility issues for smaller investors.

Cons:

- Displays the least liquidity.

- No option for physical gold.

- Price divergence from gold spot price.

- Low custodial risk.

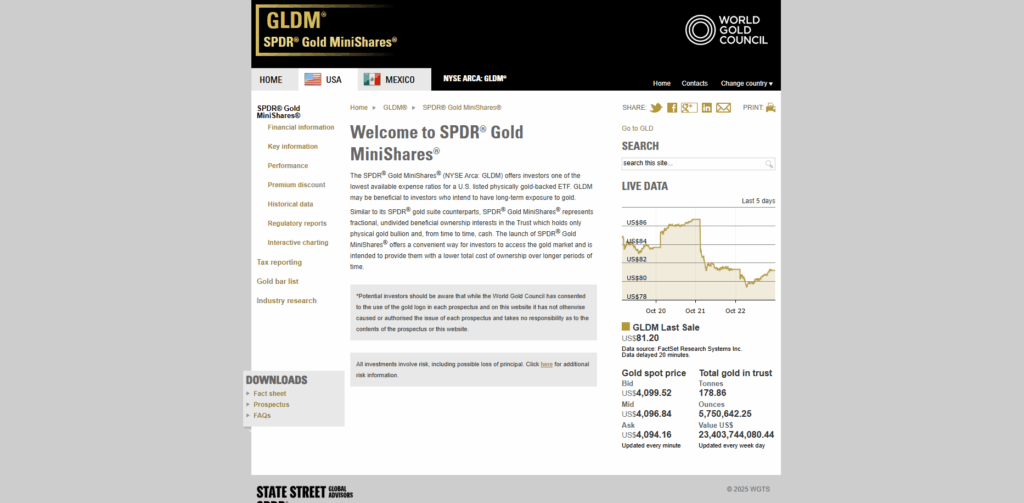

3. SPDR Gold MiniShares Trust (GLDM)

GLDM is a more affordable option for investors compared to the GLD as it allows for investment in physical gold in smaller, economical denominations, which is great for gold market investors with less capital. GLDM tracks the gold spot price and stores its holdings in secure vaults, ensuring transparency and trust.

Due to its low expense ratio, high accessibility, and ease of contacting customer service, long-term investors seeking protection from inflation are recommending it for gold portfolio stability. Gold merchants need to work with trustworthy gold ETFS to ensure compliance with gold trading regulations.

SPDR Gold MiniShares Trust (GLDM)

Pros:

- Extremely low expense ratio.

- Smaller share price and added accessibility for retail.

- Gold backing and transparent.

- Consistently effective tracking of the valuation.

Cons:

- Volume of trading is lower compared to GLD or IAU.

- There are no options available for physical delivery.

- There may be slightly heightened bid-ask spreads.

- Relative to GLD, it has less recognition.

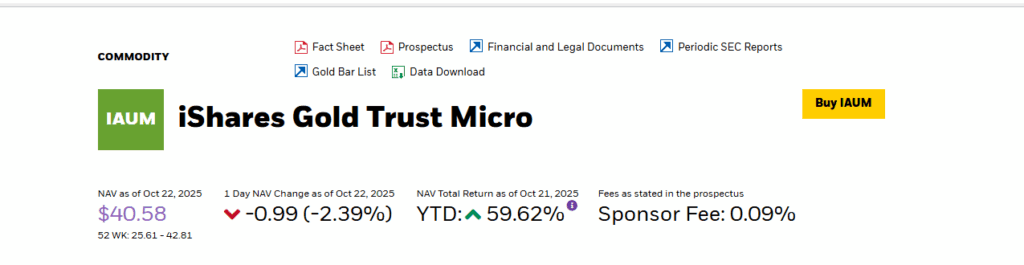

4. iShares Gold Trust Micro (IAUM)

IAUM is a new, low-fee gold ETF investment option with the aim of allowing investors to gain micro-level exposure to the gold market. It has the same benefits as IAU but with more affordable share prices. Managed by BlackRock, IAUM has physical gold and is fully transparent and backed by gold..

Among the many Gold Exchange-Traded Funds, IAUM takes the lead due to its very low expense ratio, significant liquidity, and seamless trading capabilities for small investors, especially those constructing diversified portfolios on a tight budget.

iShares Gold Trust Micro (IAUM)

Pros:

- Extremely low expense ratio.

- For micro-level investment, the share size is very small.

- There is physical gold backing for transparency.

- For building diversified portfolios, it is convenient.

Cons:

- GLD/IAU has lower liquidity.

- There is no physical redemption option.

- There is a limited historical track record.

- There is a slight tracking error possible during extreme market conditions.

5. abrdn Physical Gold Shares ETF (SGOL)

SGOL allows investors to gradually diversify their portfolios with gold, as it invests in gold in a fully transparent and secure process, as the gold is stored in safe vaults in Switzerland. To provide further assurance, SGOL publishes the gold bars’ serial numbers and weights for investors to verify.

SGOL is one of the Best Gold Exchange-Traded Funds because of its safety and assurance. SGOL is perfect for conservative investors because it directly tracks the spot gold price and is equally secure and transparent.

abrdn Physical Gold Shares ETF (SGOL)

Pros:

- Gold is stored in secured vaults in Switzerland.

- You may verify gold bars by their serial numbers which are published.

- There is strong transparency and trustworthiness.

- Gold is tracked spot quite closely.

Cons:

- Expense ratio higher than GLDM/IAUM.

- It is primarily Europe-focused, less awareness from U.S. investors.

- There is no option for physical delivery of gold.

- Small trading volumes compared to top U.S. ETFs.

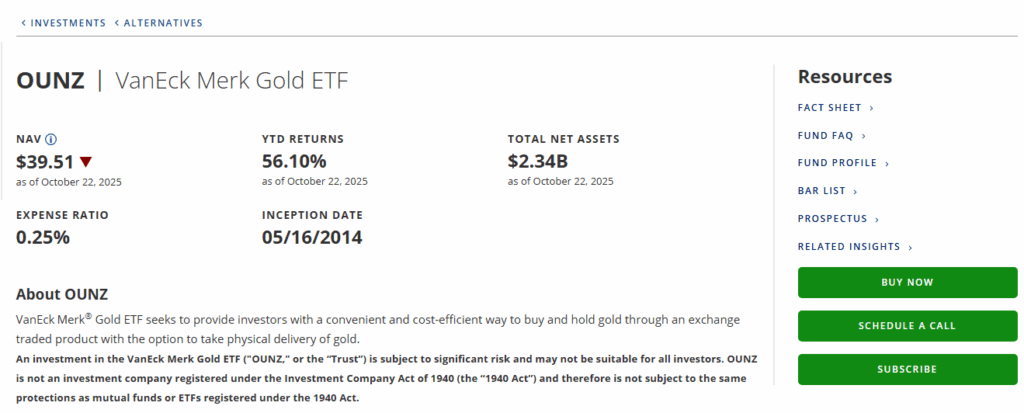

6. VanEck Merk Gold ETF (OUNZ)

The VanEck Merk ETF is one of the few unique gold ETFs in the market as it allows for direct gold price exposure as well as the ability to redeem gold directly from the fund. This unique feature greatly differentiates it from many other gold ETFs. OUNZ has secure vaults with allocated gold bars to imitate gold spot price movements.

OUNZ is an outstanding exchange-traded gold fund because of its adaptable options, options of physical delivery, and remarkable transparency in its funds. For investors who like redeeming their investment for physical gold, OUNZ is a fantastic choice.

VanEck Merk Gold ETF (OUNZ)

Pros:

- You can redeem shares for physical gold.

- Gold backing and certified audit trails are physical and ensures security.

- Gold is tracked spot closely.

- There is strong transparency and custodian credibility.

Cons:

- Expense ratio is slightly higher than others.

- Physical redemption for small investors can be cumbersome.

- Not as liquid as GLD and IAU.

- Short historical data.

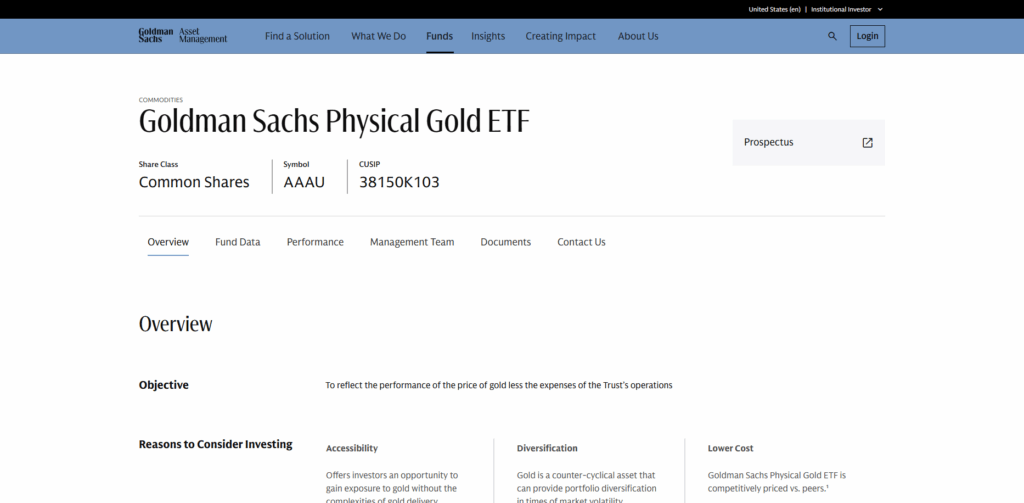

7. Goldman Sachs Physical Gold ETF (AAAU)

The Goldman Sachs Physical gold ETF (AAAU) is a low-cost ETF that is backed by gold that is stored in London vaults. Also, it aims to replicate the gold bullion market while is transparent and institution-managed.AAA gives investors gold ownership without the hassle of direct ownership.

As one of the Best Gold Exchange-Traded Funds, it has the Goldman Sachs institutional gold and low-cost standard, strict custodianship, and custodianship which makes it a reliable gold investment for both professional and retail gold investors.

Goldman Sachs Physical Gold ETF (AAAU)

Pros:

- First class gold bullion stored in vaults in London.

- Gold installment expenses.

- Good and clear declared custodians.

- Easy and straightforward to diversify and add to accounts.

Cons:

- Shorter performance history because the gold custodial is new.

- Not as liquid as the GLD and IAU.

- You cannot redeem to gold physically.

- Mostly focused in the USA and not as known in Europe.

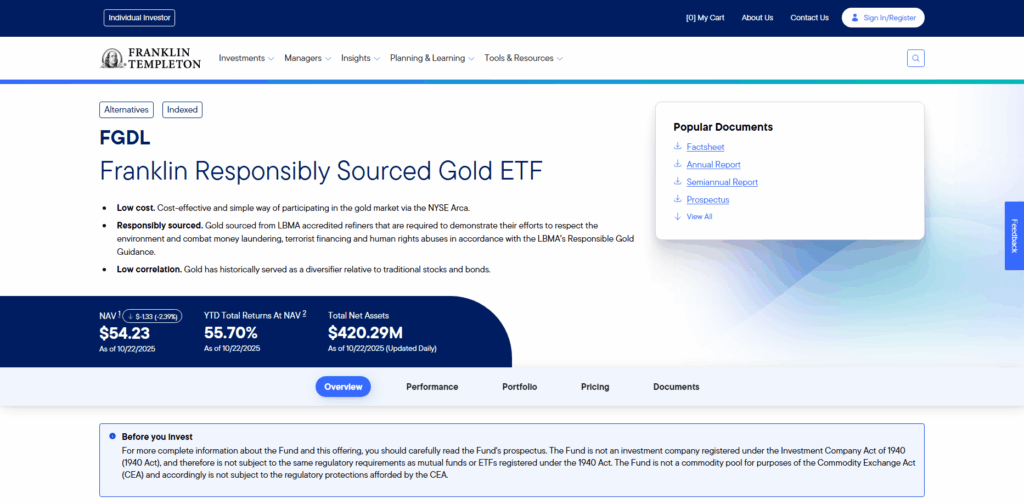

8. Franklin Responsibly Sourced Gold ETF (FGDL)

The Franklin Responsibly Sourced Gold ETF (FGDL) is for investors who value gold sourced in compliance with the London Bullion Market Association (LBMA) responsible gold standards.

Along with physical gold provides gold that promotes gold with verifiable sustainable traceable supply chains. For investors who want a good financial return and a good social impact, this is a good option.

Commended for offering some of the Best Gold Exchange-Traded Funds, FGDL is a responsible and economical option for investors looking to diversify their portfolios with gold. FGDL is a transparent and ethically responsible choice for gold investments.

Franklin Responsibly Sourced Gold ETF (FGDL)

Pros:

- Gold is ethically responsibly sourced.

- Gold is stored to back the investment.

- Gold prices the fund closely tracks.

- Good socially responsible investing.

Cons:

- Gold ethically sourced accounts for higher expenses.

- Not as known globally.

- Lower trading volume.

- No gold physically delivered.

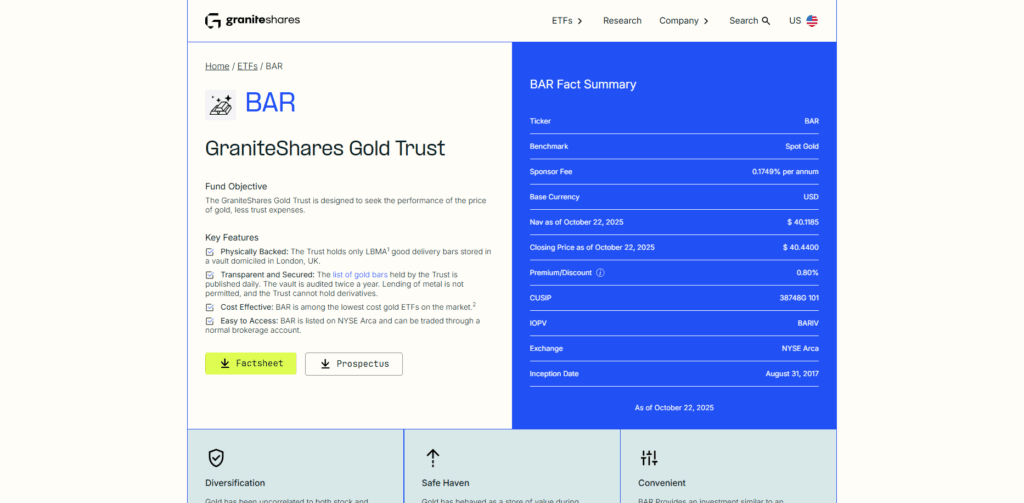

9. GraniteShares Gold Trust (BAR)

GraniteShares Gold Trust (BAR) is one of the best gold exchange-traded funds and is created to follow the gold market prices with one of the lowest gold-related expense ratios in the industry. Physically holds gold in vaults in London and shares vault details publicly.

It’s a good option for individual and institutional investors looking for inexpensive and dependable gold exposure. It’s valued for its gold market alignment and is widely used for its simplicity and affordability.

GraniteShares Gold Trust (BAR)

Pros:

- Lower and competitive expenses for-gold ETFs.

- Physical gold stored in London.

- Gold prices tracked closely.

- Good report transparency.

Cons:

- Lower liquidity than GLD and IAU.

- No gold delivered physically.

- Limited large investor recognition.

- Smaller historical performance.

10. WisdomTree Physical Gold (PHAU / PHGP)

WisdomTree Physical Gold (PHAU/PHGP) is a gold-related ETC based in Europe that offers investors exposure to gold that is 100% physically secure and stored in accordance with gold standards and LBMA regulations. It is a top choice in Europe with investors because of its UCITS compliance.

It is one of the Best Gold Exchange-Traded Funds, and gold through WisdomTree’s ETC gives investors strong confidence because of the transparent, economical, and regulated access provided along with the compliance and market regulations.

WisdomTree Physical Gold (PHAU / PHGP)

Pros:

- Fully compliant with the UCITS regulation which is suitable for European investors.

- Gold is fully backed and stored in protective vaults.

- Gold is tracked with the closest spot price.

- Has transparent reporting and is compliant with the LBMA.

Cons:

- Expense ratio is a bit higher than the alternatives in the U.S.

- U.S. investors have less accessibility.

- Compared to GLD/IAU, it has lower liquidity.

- Limited physical delivery for European small investors..

Conclusion

Gold exchange-traded funds (ETFs) are one of the most effective and accessible options for investors to obtain exposure to gold without the hassle of physically possessing and storing the gold.

Some of the best gold ETFs, including GLD (SPDR Gold Shares), IAU (iShares Gold Trust), and OUNZ (VanEck Merk Gold ETF), offer the gold market transparent, liquid, safe, and unencumbered access.

Each gold ETF has its own specific benefits—whether it is the ultra-low expense ratios and investments at micro levels, ethically sourced gold, or the option of physical gold delivery.

Smart ETF selection—taking into consideration liquidity, price, and specific gold market investment objectives—has proven effective in diversifying investments, sustaining gold market long-term growth, and defending against inflation.

FAQ

What is a gold ETF?

A gold ETF (Exchange-Traded Fund) is a financial instrument that tracks the price of gold. It allows investors to gain exposure to gold without owning physical bullion. Most gold ETFs are backed by physical gold stored in secure vaults, ensuring transparency and security.

How do gold ETFs work?

Gold ETFs hold physical gold or gold derivatives and issue shares representing a portion of the fund. Investors can buy or sell shares on stock exchanges like any other security. The share price generally tracks the spot price of gold, minus fund expenses.

Are gold ETFs safe?

Yes, gold ETFs are generally safe because they are backed by physical gold stored in secure vaults. Reputable funds like GLD, IAU, and SGOL also undergo regular audits to verify holdings. However, investors should consider market risks and expense ratios.

Can I take physical delivery of gold through ETFs?

Most gold ETFs do not offer physical delivery. An exception is the VanEck Merk Gold ETF (OUNZ), which allows investors to redeem shares for physical gold under certain conditions.

What are the advantages of investing in gold ETFs?

Gold ETFs offer liquidity, transparency, low management costs, and easy access to gold. They are ideal for portfolio diversification, inflation hedging, and gaining exposure to gold without storage concerns.