This article will outline the process of constructing a cryptocurrency exchange aggregator. I will explain the ways to link several exchanges using APIs, incorporate live data, implement security measures, and design an intuitive system.

This tutorial will aid entrepreneurs and developers in designing a dependable, streamlined, and profitable crypto aggregation platform.

What is Cryptocurrency Exchange Aggregator?

A crypto exchange aggregator is a platform, which consolidates a number of crypto exchanges into a single interface, enabling users to analyze, in real time, price, liquidity, and trading pair options. Traders can assess multiple exchanges and execute trades at the best rates, all from one interface, in seconds.

These aggregators offer efficiency and clear market data, which increases transparency in crypto trading – a vital commodity in the erratic world of crypto. Advanced features include portfolio management, immediate swaps, and wallet provisions. Crypto aggregators improve user experience by optimizing time, lowering expenses, and enhancing trading results.

How to Build a Cryptocurrency Exchange Aggregator

Example: Building a Cryptocurrency Exchange Aggregator (Step-by-Step)

Step 1: Define the Project Scope

Who you identify as your target users and your focus subject (spot trading, futures, or both) will set your aggregator’s centre. It might be retail traders, arbitrage bots, or institutional investors. Scope the main offerings: real-time price comparison, trading execution, and portfolio tracking.

Step 2: Choose the Technology Stack

Technology choices to build the platform include:

- Frontend: Use React.js or Vue.js to build responsive UI and for user Interactions

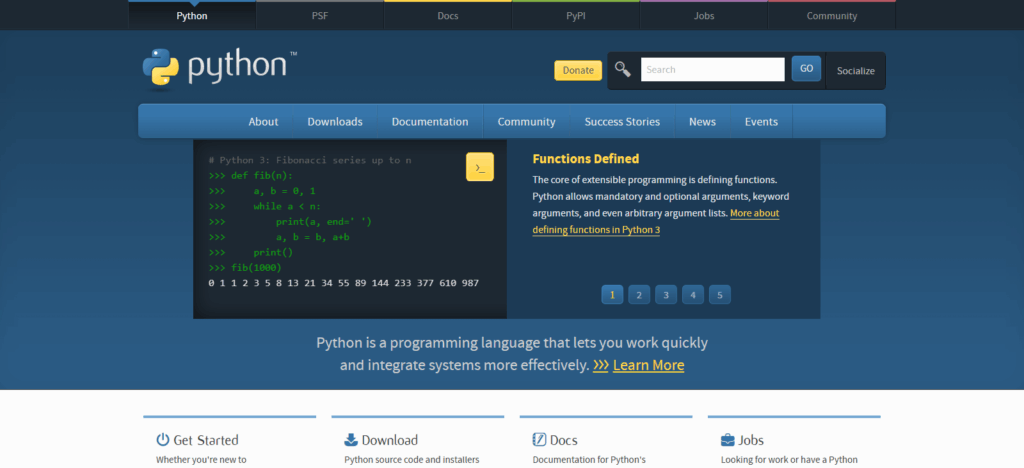

- Backend: Choose Node.js or Python (FastAPI, Django)

- Database: PostgreSQL or MongoDB

- Hosting: Use AWS, Google Cloud, or Azure

Step 3: Integrate Exchange APIs

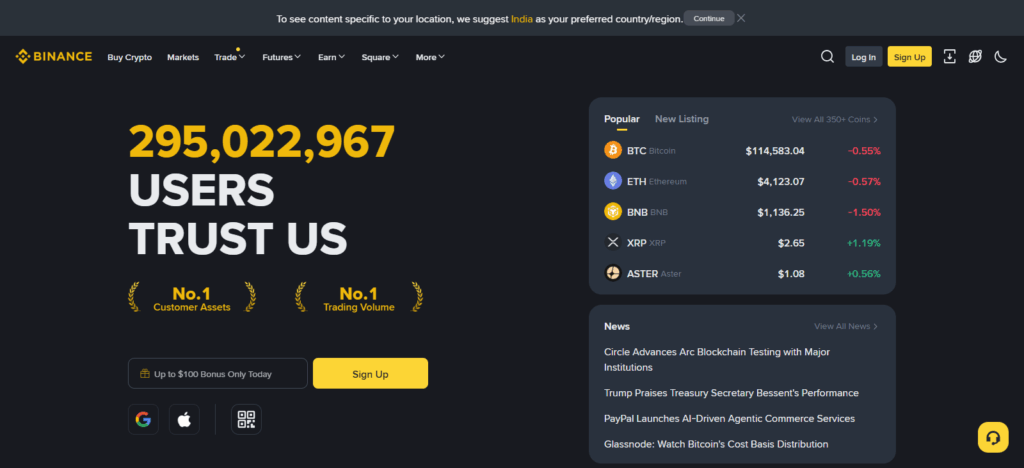

Register your API keys from the key exchanges, for example, Binance, Coinbase, Kraken, and KuCoin. Use their REST or WebSocket APIs to pull real-time market data, order books, and trading pairs. Build and implement logic to aggregate, ad, and compare the real-time data of all connected exchanges.

Step 4: Develop the Aggregation Engine

Build a backend module that accomplishes the following:

- The system pulls and trades liquidity from all exchanges and determines the most profitable trading pair on the top exchange.

- It performs and revalues the trade in real-time with WebSockets.

The aggregation will be the centre for all operations.

Step 5: Build the User Interface

Create a dashboard that shows:

- Prices and spreads

- Exchanges and trading pairs available

- Buy/sell interface linked to a wallet

Incorporate charts, filters, and searches to enhance the dashboard’s usability.

Step 6: Add Security Features

Implement the following:

- End-to-end encryption

- 2-Factor authentication

- Protection against DDoS attacks and secure APIs

Include basic KYC and AML measures.

Step 7: Test the Platform

Perform unit, and API stress, and performance testing. Check the system and data for accuracy, high-speed response times, and stability. Address any issues prior to launch.

Step 8: Deploy and Launch

Release the system on a secure cloud. Ensure optimal performance and system reliability. Take in the first batch of users for onboarding and feedback.

Step 9: Continuous Improvement

Enhance the system with new exchanges, integrated DeFi, or mobile system access. User feedback, security updates, and patches will guide optimizing system performance and usability.

Security and Compliance

KYC / AML Procedures — identify, risk score, and ongoing AML monitoring, and identify suspicious activities.

Regulatory Licensing — identify the required jurisdictions (money transmitter, VASP) and maintain files.

Data Protection & Privacy — implement the principles of GDPR/CCPA with minimal data retention, encryption in rest/in transit, and privacy policy.

Secure Key Management — Separate custody from non-custodial models; use HSMs, or cloud KMS and private keys with strict operational controls.

Cold Storage for Funds — Store majority of crypto in offline cold wallets with multisig and strong access procedures.

Encryption — Use TLS for network traffic, strong DB encryption, and secrets management for API keys and credentials.

Authentication and Access Control — implement MFA/2FA, strong password policy, and role-based access control (RBAC).

Secure API Handling — rate limit, validate input, rotate API keys, and don’t store third party credentials in an unsecured way.

Secure Coding and SDLC — use threat modeling, code reviews, dependency scanning, and security gates in CI/CD.

Pen Testing and Audits — conduct regular third-party pentests, and security audits alongside smart contract audits (if applicable).

Monitoring & Incident Detection — anomaly detection with alerts, real-time logging, and SIEM with logging and alerting of anomalous access or transactions.

Testing and Launch

Functional Testing

- Check API integration, price aggregation, and trading functions.

- Inspect user dashboards, wallets, and transactions for operational fluency.

- Review functionalities across various devices and browsers.

API Testing

- Validate linkages with each integrated exchange API (Binance, Coinbase, etc.).

- Assess data precision, velocity, consistency, and interface response.

- Track API rate limits and error response engagements.

Performance & Load Testing

- Analyze system performance by simulating heavy user traffic.

- Assess API call response time and server performance during load-testing.

- Focus on optimizing backend codes and database queries for streamlining.

Security Testing

- Assess system vulnerabilities through penetration testing.

- Inspect the efficacy and testing of 2FA, encryption, and user authentication.

- Validate secure data storage with DDoS attack protection.

User Acceptance Testing (UAT)

- Collect user feedback by inviting beta testers.

- Examine the real-world trading workflows for identified bugs and UI usability.

- Enhance application functionalities based on user experience.

Compliance Verification

- Activate KYC/AML and regulatory processes to confirm functionality.

- Validate compliance with privacy legislation (GDPR/CCPA) for data protection.

- Verify the audit logs and features associated with reporting.

Key Features of a Crypto Exchange Aggregator

Real-Time Price Comparison

- From multiple exchanges collects and compares real-time prices.

- Displays immediately buy/sell rates (most favorable).

- Useful to users who want to avoid losing trades and wish to not overpay for a deal.

Multi-Exchange API Integration

- Connects to market leaders exchanges (Binance, Coinbase, Kraken and KuCoin).

- Market information, order books and liquidity details are fetched (applied) every time.

- Users are expanded to trade in the multiple networks from the centralized hub.

Unified Trading Interface

- Simplification of the trade processes is centralized to one identified interface.

- Instant swaps along with order execution all with no platform switching.

- Users and their trades make no difference compared to the interface of the other exchanges.

Advanced Analytics and Insights

- Live charts, analyses of prices, traded volumes and of the trend within a set time.

- Tools are within for reporting of a portfolio and have a visual representation.

- Predictive price alerts along market signals aimed to tram AI to market signal extraction (analysing).

Secure Wallet Integration

- Encryption and private key of the user wallet is compressed within.

- Guarantees safe wallet to users with their funds stored.

- Cross-border and multi-wallet, as well as, currencies are supported.

Planning Your Aggregator Platform

Define Your Target Audience

- Determine whether your target users will be retail traders, arbitrageurs or institutions.

- Identify their requirements, trading patterns, and favorite cryptocurrencies.

- Adjust your focus on simplicity, quickness, and advanced features according to their needs.

Research Market and Competitors

- Look into current aggregators including CoinSwitch, Swapzone, and 1inch.

- Determine if there are gaps in the market, what users are struggling with, and how they could be helped.

- Study the features of the system that are most appealing to high volume traders.

Choose Supported Cryptocurrencies and Exchanges

- Choose a balanced array of dominant and emerging exchanges including Kraken, Binance, OKX, and so on.

- Provide service for the major coins and well known alt coins including BTC, ETH, USDT.

- Make sure your system has a flexible API to allow for partnerships in the future.

Determine Core and Advanced Features

- Core features include price aggregation, trading interface, and wallet integration.

- Advanced features would be mobile support, AI analytics, and liquidity pooling.

- Define your essential features for your MVP and focus on scaling as necessary.

Choose a Business Model

- Identify your monetization options including trading fees, premium memberships, and affiliate commissions.

- Make sure your revenue streams are transparent and realistic.

Future Enhancements

Future enhancements in cryptocurrency exchange aggregators emphasize innovation, scalability, and user-centrism.

Future editions are expected to combine DeFi and DEX protocols, giving users on one interface access to liquidity from centralized and decentralized sources. Artificial intelligence enhanced analytics will improve predictive trading with smarter insights and customized recommendations.

Tokens will seamlessly swap as cross-chain interoperability is achieved. Also, expanded mobile applications and advanced UI/UX trading designs will increase accessibility for users worldwide.

Advanced security frameworks, automated compliance mechanisms, and multilingual capabilities will deepen trust and make aggregators efficient, inclusive, and ready for the future.

Conclusion

To sum up, while working on a cryptocurrency exchange aggregator, one must keep a proportionate integration of advanced system designs, security, and real-time data integration, and security.

Developers are able to provide a consolidated aggregator that delivers optimal trading rates and liquidity and disposes of convenience to clients.

For sustainability, for long-term sustained success, you must precise integration of planning, real-time adherence to KYC/AML law constructs, and active breach testing.

For sustainability, late adaptability of DeFi, AI integrations, and cross-chain tools will help your aggregator to sustain relevance. One must aim to provide advanced trading systems that assemble safety, efficiency, and customer appreciation.

FAQ

What is a cryptocurrency exchange aggregator?

A cryptocurrency exchange aggregator is a platform that connects multiple crypto exchanges into one interface, allowing users to compare prices, trade, and manage portfolios efficiently without switching between exchanges.

How does a crypto exchange aggregator work?

It uses APIs from different exchanges to fetch real-time data on prices, liquidity, and order books. The platform then aggregates this information to offer users the best trading rates and execution options.

What technologies are needed to build an exchange aggregator?

You’ll need a robust tech stack such as React.js or Vue.js for the frontend, Node.js or Python for the backend, and PostgreSQL or MongoDB for databases. Cloud platforms like AWS or Google Cloud ensure scalability and reliability.