Choosing the right broker is vital when trading, and AvaTrade and Exness stand out as options, each with their own pros. For beginners and multi-asset traders, AvaTrade is perfect because they offer several trading platforms, social trading, and strong global regulation.

For professionals and high-volume traders, Exness is useful because they provide ultra-tight spreads, quick withdrawals, and flexible accounts. Also, Exness is ideal for traders looking for advanced trading conditions in the forex and CFD markets.

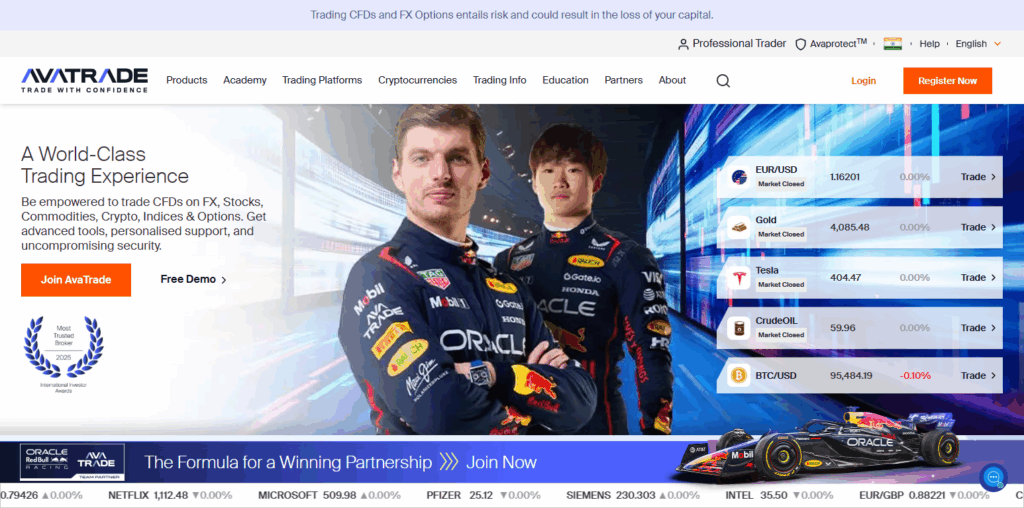

What Is AvaTrade?

Forex and CFD broker AvaTrade originated in 2006 and has grown into a prominent broker in the world due to the multiplicity of its offered assets (currencies, stocks, commodities, indices, cryptos, and ETFs).

AvaTrade has received various regulatory approvals owing to its reputation and credibility and offers a suite of trading platforms (AvaTradeGO, WebTrader, and MT4/MT5). Social trading, algo trading, and options trading are also offered through AvaOptions.

AvaTrade has a wealth of educational content, transparent pricing comprised of low spreads, and responsive support making the broker an excellent choice regardless of your trading experience.

What Is eXness?

Exness is a highly respected global Forex and CFD broker that provides excellent and unmatched trading condition with ultra-tight spreads and rapid withdrawal. Since 2008, Exness has been offering Forex, Metals, Indices, Cryptocurrencies, Stocks and Commodities.

Pro and high traded volume closed with Exness due to transparent and reliable execution. Leveraging till 1:2000 in some regions, highly demanded in today’s FinTech market.

eXness received several awards due to their 24/7 support, MetaTrader 4 and 5, and strong regulation. eXness offers high standard and regulation FinTech trading capabilities.

Exness vs AvaTrade: Broker Comparison Table

| Category | Exness | AvaTrade |

|---|---|---|

| Headquarters | Cyprus | Ireland |

| Regulators | CMA, CySEC, FCA, FSA, FSC Belize, FSC Mauritius, FSCA | ASIC, BVI, Central Bank of Ireland, FFAJ, FSCA, KNF, MiFID |

| Tier 1 Regulator(s)? | Yes | Yes |

| Owned by Public Company? | No | No |

| Year Established | 2008 | 2006 |

| Execution Type(s) | Market Maker | Market Maker |

| Minimum Deposit | $10 (varies by account type) | $100 |

| Negative Balance Protection | Yes | Yes |

| Trading Platforms | MetaTrader 4, MetaTrader 5, Proprietary platform | MetaTrader 4, MetaTrader 5, Proprietary platform, Web-based platform |

| Avg. Trading Cost (EUR/USD) | 0.6 pips | 0.9 pips |

| Avg. Trading Cost (GBP/USD) | 0.7 pips | 1.5 pips |

| Avg. Trading Cost (WTI Crude Oil) | 6.7 pips | $0.03 |

| Avg. Trading Cost (Gold) | 11.3 pips | $0.29 |

| Retail Loss Rate | Undisclosed | 77.82% |

| Minimum Raw Spreads | 0.0 pips | Not Applicable |

| Minimum Standard Spreads | 0.3 pips | 0.9 pips |

| Minimum Forex Commission | $7 per 1.0 standard round lot | Commission-free |

| Islamic Account | Yes | Yes |

| Signals | Yes | Yes |

| US Traders Accepted? | No | No |

| Managed Accounts | No | No |

| Official Website | Visit Website | Visit Website |

Account Types

Exness has Standard accounts, which are beginner-friendly, and Pro and Raw accounts for seasoned traders with higher leverage and better spreads. They also have Crypto and MT5 accounts, which allow for diversification across different asset classes.

AvaTrade also has different accounts, starting with Standard accounts that have either fixed or variable spreads. There are VIP accounts for higher-tiers traders, demo accounts for educational purposes, as well as AvaOptions accounts, which provide a complete environment for trading on derivatives.

Exness has a very flexible account structure which appeals to traders of all levels, while AvaTrade has an emphasis on educational support, versatility across platforms, and derivatives trading.

Trading Platforms and Tools

Access to trading tools and frameworks that help optimize trading and enhance performance metrics further characterize the level of efficiency performance.

Exness users access MetaTrader 4 and MetaTrader 5 that have great charting features, allow access to various technical indicators, automated trading can be done through Expert Advisors (EAs), provide different order types, and have total integration via mobile or web, hence allowing access to trading at any point.

AvaTrade provides more trading platforms than any other competitor, including MT4, MT5, AvaTradeGO, and AvaOptions. As a set, they have more advanced charting tools, provide the ability to trade/sell via copy and social trade, they have a user friendly instant derivative options trading and a fully featured phone trading that provides real time order trading and alerts.

AvaTrade provides options for social trading, while Exness provides Better user experience for forex and CFD traders that are methodical.

Fees, Spreads, and Leverage

Cost of trading and leverage plays vital role on profitability. Exness is known with really tight spreads, even 0 and 0.0 pips for majors. Commission based accounts have clear pricing and volumetric trading, meanwhile standard accounts are commission- free with a bit wider spreads. Leverage depends on account type and regulations, on some accounts it can even go 1:2000.

Ava trade also has tight spreads but a bit wider than exness on majors. Their account structure is also commission free, although there can be some extra fees for options or other specific products. ava trade’s leverage can get up to 1:400, which is lower than exness but also ava trade has options to trade which is not available to other brokers.

In conclusion, Exness is more competitive on leverage and spreads for traders who do forex, meanwhile ava trade has option to trade with more diversification on products and a bit higher fees.

AvaTrade Feature

Strong Regulation & Security

Though AvaTrade has many branches, they are all done to ensure that the customers are safe all the time, and that the funds are not lost in the process.

Diverse Trading Platforms

All the platforms provide the customers the same level of precision and facilities, but differ in the type of interface they provide. Purpose of the interface is to provide ease.

Social & Copy Trading

Traders of all levels of experience are enabled by AvaTrade to automate their trades, while novices use the platforms DupliTrade and ZuluTrade to follow the trades of successful experts.

Options & Derivatives Trading (30 Words)

The analytics and monitoring of positions in this section of the apps is superior, allowing traders to manage their risks effectively, all while playing in a controlled environment with unlimited freedom.

Educational Tools & Resources

With various tutorials, presentations, market analyses, webinars, and trading guides, AvaTrade equips its clients with decision-making and analytical skills, and with that, real market proficiency, regardless of the client’s experience level.

User-Friendly Mobile App

AvaTradeGO enables users to receive notifications in real time, use diverse charts, and execute trades all with directional, hands-on movements. This app enhances the mobile trading experience in any market.

Low Costs and Ultra-Tight Spreads

Due to Exness’s transparent pricing system, offering low commissions and tight spreads (starting from 0.0 pips) on Raw accounts, the brokerage is optimal for day and high-volume traders.

Fast and Reliable Withdrawals

The near-instant automatic withdrawals Exness provides helps traders bypass any potential delay to access the funds and remove any trading restrictions, making the trading experience more convenient and improving trust.

Plenty of Account Types

New and experienced traders, as well as those trading multiple assets, can utilize Exness’s Standard, Pro, Raw Spread, Zero, and Crypto accounts and custom tailored high-leverage trading setups.

Powerful MT4 and MT5 Platform

Technical and algorithmic traders are served well by Exness’s MT4 and MT5 compatible with automated trading (featuring Expert Advisors), fast order execution, and high quality charts with many indicators available.

High Leverage

Because of Exness’s high leverage (region dependent) policies, experienced traders looking to take on more risk and volatility are able to access more of the market with smaller capital for trading.

Open Setting & Real-Time Data

Exness offers its users real-time market statistics, analysis of accounts, execution data, and pricing. This assists traders in making guided trading decisions while operational clarity and credibility are maintained.

Regulation and Security

Protection and oversight are essential while running a brokerage because of how important these factors are to customers. Exness’ oversight comes from respected institutions such as the FCA from the UK, the Cypriot SEC, and FSCA from South Africa.

This wide range of regulations supervises the management of clients’ funds having a separation of money, on top of negative balance protection and having resolution options to handle disputes.

AvaTrade also has greatly developed regulations which encompass the central bank of Ireland and has oversight of ASIC (Australian Securities and Investments Commission) and the Financial Services Commission (FSC) from the British Virgin Islands.

The global reach of these regulations allows a wide range of protection to clients, and the operations are conducted within a safe framework on a regulated basis and the funds are handled securely.

All brokers have prioritized the same regulations and protection using 2F authentication, transaction encryption, and account segregation. Exness and AvaTrade have also maintained a good reputation from other major global regulators. The Customer will feel secure with the execution of both brokers.

Customer Support

Supportive customer service makes trading seamless.

Exness provides 24/7 customer service via live chat, email, and phone in multiple languages. They receive positive reviews for their help and professionalism when it comes to assistance with deposited/withdrawed funds, account and trading tech problems.

Thanks to their live chat, email, and phone, AvaTrade services customers 24/5 or 24/7 depending on the region. They also direct novices to webinars and other Edu materials. Both companies have strong customer support, however, Exness has a larger global reach, while AvaTrade has an emphasis on Edu support and webinars and trading assistance.

Conclusion

Exness and AvaTrade are both honest brokers with strengths and weaknesses. Exness has unique ultra-tight spreads, lightning withdrawal speeds, and flexible account options with outstanding trading conditions set for scalpers and other pros.

AvaTrade has more platforms and social trading, is more heavily regulated and has great educational resources, so is more set for novice and multi-asset trading.

In conclusion, Exness is cost-efficient with more advanced trading and AvaTrade is more user-friendly while still incorporated strong regulatory compliance and data protection for more novice users.

FAQ

Which broker is more beginner-friendly?

AvaTrade is more beginner-friendly due to its educational resources, demo accounts, and intuitive platforms like AvaTradeGO, whereas Exness targets more experienced traders seeking advanced tools and low-cost trading.

Which broker offers lower trading costs?

Exness provides tighter spreads and lower commission structures, especially on Raw and Pro accounts. AvaTrade’s spreads are slightly higher, though it offers commission-free accounts and fixed/variable spreads.

Are both brokers regulated?

Yes. AvaTrade is regulated by authorities including the Central Bank of Ireland, ASIC, and FSC BVI. Exness is regulated by FCA, CySEC, FSCA, and other jurisdictions, ensuring strong client protection.

Which platforms do they support?

Exness supports MetaTrader 4 and 5 with advanced charting and automated trading. AvaTrade offers MT4, MT5, AvaTradeGO, WebTrader, and AvaOptions for social trading and derivatives.

Can I trade cryptocurrencies?

Yes, both brokers offer cryptocurrency trading. Exness provides dedicated crypto accounts with tight spreads, while AvaTrade offers crypto trading alongside forex, stocks, and options.

Do they offer social or copy trading?

AvaTrade offers social and copy trading via platforms like ZuluTrade and DupliTrade. Exness does not have integrated social trading features but focuses on technical and algorithmic trading tools.