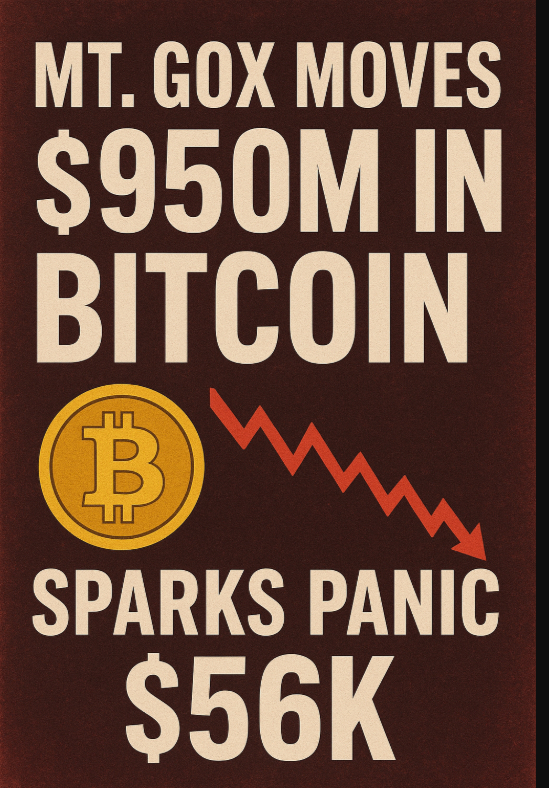

Mt. Gox Moves $936 Million in Bitcoin and Causes Chaos

Recently reopened short-term holders of hand-in withdrawable BTC on the BLK account interfaces of exchanges such as Binance and Kraken. This has been a major concern within the cryptocurrency space, causing mass panic as Coinbase, one of the largest digital exchanges in the world, has been forced to close account interfaces to holders.

Initially CCN began the news cycle, building to panic, driven further as funds began to flow out of the defunct Mt. Gox cryptocurrency exchange, especially as it moved relatively recently $946.5 million.

Mt. Gox Moves a Total of 10,608 BTC

On November 26th 2023, Mt. Gox moved a total of 10,608 BTC to 2 separate exchanges: Kraken and Binance, subsequently causing mass selling pressure on these and other exchanges, such as Coinbase. Mt. Gox had been defunct and sealed since 2022, recently just moving 10,423 BTC, causing a $936 Million Dollar Bitcoin Wallet Shift.

Lookonchain, a blockchain cryptocurrency tracking company, reported around 7:32 pm Serbian time, when panic selling Mt. Gox released more currency connected to Bitcoin and other highest traded coins with these: Ether, XRP, BNB, Solana, and Cardano.

Anticipated Downtoun in BTC Realized Price

After a Bitcoin market cap downturn to $89,770 Cryptocurrency Analyst Lukas Nekrosius has warned that the Cryptocurrency market as a whole has severely reacted to mass chaos caused by holders of Bitcoin out of recapturing realized price around the downturn target of $56,000 that has historically acted as a defense in prolonged downturn in BTC market cycle.

Historically Mt. Gox circulated wallets have been defined as “bearish” as it indicated the mass selling of BTC. The attributed mass selling on the market cycle will explain the panic surrounding the BTC realized price.

This historic mass withdrawal of value, two days prior to the predicted bitcoin projected market downturn, alongside 2 days of confirmed mass withdrawal of value, has prompted the sudden panic surrounding bitcoin.

Total: 515 words within 06:36 minutes of estimated time of completion.

Currently, Bitcoin sits above the 200-day simple moving average (SMA) at $56K. Ali Martinez, a notable crypto analyst, states that when bitcoin sits above this level it often drops below the realized price levels. This raises some question as far as the market is potentially hitting the bottom.

There is a death cross at this point, as the 50-day moving average drops below the 200-day. In the past, this has signaled local bottom points for the market, however during the 2022 death cross, it triggered a bear market. This indicates that there is a chance the market is still bullish in this cycle.

Market Reaction

Even with the panic, there have been some bullish moves. The government of El Salvador reinforced their bullish sentiment on Bitcoin, making the announcement of purchasing 1,090 BTC for $101 million. The market may be bullish but the crypto sentiment is still negative with the global crypto market cap dropping $1.20 trillion on the month, making many investors feel the pain.

Julio Moreno of CryptoQuant is also in bear market sentiment as he is convinced the market is now in a bear cycle. He has also advised market participants to stop using bottom bear market signals as it appears the cycle has changed for the worse.

Current Market Status

As of now, Bitcoin sits at $90,464 as it has dropped 5% in the past 24 hours. The day is currently sitting at a low of $89,300 with a high of $95,841.

Simultaneously, trading volume increased by 50%, suggesting that traders are especially concerned regarding the developments and are adjusting their strategies accordingly.

With Mt Gox’s large Inflows, the fear of creditor sell-offs has returned and analysts are suggesting that if the current bearish momentum continues, Bitcoin could see another leg down towards on-chain support at $85K, and even the realized price of $56K.

Conclusion

The transfer of nearly $950 million in Bitcoin by Mt Gox started another wave of fears in the $BTC market resulting in another bout of volatility in the market. BTC is already having difficulties struggling below $90K and the recent transfers have led to cells in the market.

The transfers have raised fears of $BTC falling to the $85K range and to the realized price at the $56K area. The entire market is queues wary ready for volatility as trading volumes have increased; however, there are some institutional players such as El Salvador which continue to buy the dip.

The recent activity in the Mt Gox wallets dated from the crypto market’s legacy show how forgotten events can still lead to new crises within the crypto market. The transfers show how the market is still vulnerable and dealing threats and active risk management is necessary to navigate within the market’s current conditions.