Choosing the right provider when it comes to sending money internationally can save you time and money. Wise and OFX are two of the most popular, both providing secure services and competitive rates.

While Wise is faster and more transparent with it services as well as offering more multi-currency accounts, OFX is known for larger, more complex transfers with quick processing and minimal, if any, fees.

Knowing these differences helps businesses and individuals make more efficient payment choices internationally.

What is Wise?

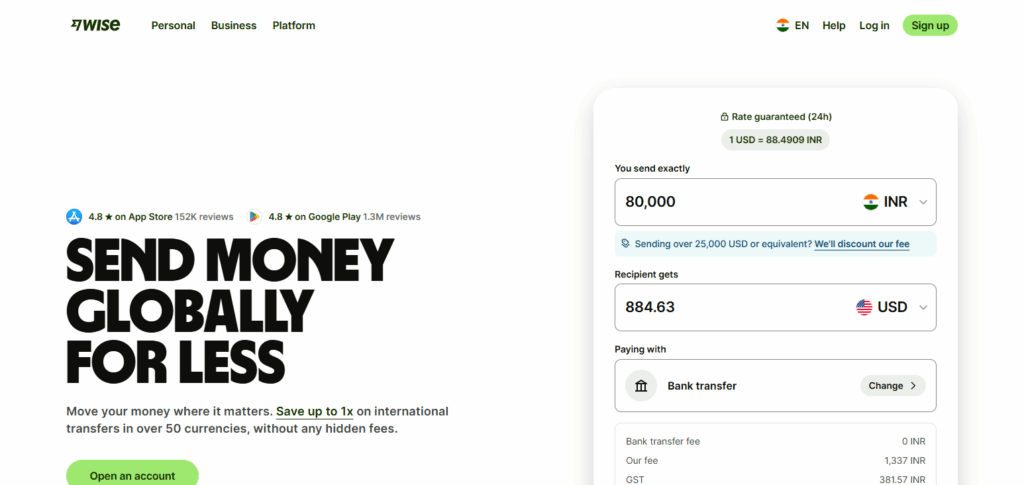

Wise, which used to be called TransferWise, is a financial technology company focused on international money transfers. The company lets people and organizations send money across borders more quickly, safely, and inexpensively compared to traditional banking.

Wise is a transparent service without hidden fees; it uses real exchange rates and tells customers how much money will actually be received. O wise and transparent pricing.

Wise is ideal for travelers, businesses, and especially freelancers who need to cost-effectively manage international payments, thanks to features like multi-currency accounts and debit cards.

What is OFX?

OFX is an international money transit and foreign exchange service, except unlike traditional banks, it offers better exchange rates and lower fees, while still maintaining security and reliability.

Since banks do not offer services as OFX, is it used by many individuals and OFX has become even more popular for businesses as it offers tools that effectively assist with international payments/transactions.

As of now, OFX is still a business that has <24/7 Customer Support>. This is more helpful for bigger businesses that value money and thus, have to transfer and receive money internationally more often.

Wise Business vs OFX Business: Pricing:

| Feature | Wise Business | OFX Business |

|---|---|---|

| Account Opening Fee | One-time setup fee (varies by region) | No fees |

| Monthly Subscription | No fees | No fees |

| Currency Exchange Fees | From 0.33% or 0.41%, depending on the currency pair | Competitive exchange rates with no hidden fees |

| Money Transfer Fees | From 0.33%, varies by currency | No OFX fees for transfers over certain amounts; third-party bank fees may apply |

| FX Fees | Uses mid-market rate with transparent fees | Competitive exchange rates with no hidden fees |

Regarding OFX and Wise, Wise has no monthly fees and maintains a straightforward fee structure, while OFX has good exchange rates and no fees if your transfer is above a certain amount. Depending on how much you plan to transfer and which currencies you are using, you will want to go with which one is more cost-efficient.

Real Fees & Hidden Fees

When considering real fees and hidden costs, both Wise and OFX try to avoid surprises, especially from those additional costs banks try to sneak in over international transfers, which can range from $20 to $100.

Both service providers have a large network of local bank accounts which helps avoid those bank fees on both sides of the transfer. Wise is the most transparent with no fixed charges on transfers and a simple calculator showing all the fees.

OFX also keeps most fees transparent, but they do charge a $15 fee on some transfers under $10,000 which can often be waived through various links or promotions.

Generally, Wise provides the most visibility into costs, whereas OFX is dependable for larger transactions where the fees can be reduced.

| Feature | OFX | Wise |

|---|---|---|

| Account Opening | Free | GBP 60 |

| Getting Local Account Details | Free | GBP 60 |

| Account Monthly Fees | Free | Free |

| Receive Local Payments | Free | Free |

| Receive International Payments (SWIFT) | Free | Depends on currency:- USD payments: USD 6.11- CAD payments: CAD 10- Other currencies: Varies by bank handling fees |

| Sending Money | Free, but third-party banks may deduct a fee | From 0.33% |

| FX Fee | Information not available | From 0.33% (varies by currency) |

| FX Rate | Mid-market exchange rate | Mid-market exchange rate |

Exchange Rates

For most money transfer services and banks, the exchange rate offered is usually the single biggest component of the entire fee breakdown.

Wise actually gives you the mid-market rate- that is, there is absolutely NO FEE embedded in their exchange rate.

Instead, Wise charges a simple, easy to understand fee of, on average, 0.62% of the amount and usually around 0.35% for the more popular currencies.

With Ofx, they are like everyone else in that they build in a fee into their exchange rate. Starting at around 1.5%, Ofx decreases this fee to around 0.5% as the amounts get larger.

Pros & Cons Wise

| Pros | Cons |

|---|---|

| Transparent fees with no hidden charges | No cash pickup or deposit options |

| Uses mid-market exchange rates | Customer support can be limited or slow |

| Fast international transfers, often within 24 hours | Exchange rates may change if funding is delayed |

| Multi-currency account for holding and managing multiple currencies | Higher fees when using credit or debit cards |

| User-friendly website and mobile app | Not always ideal for very large transfers |

| Secure and regulated with encryption and two-factor authentication | Account verification can sometimes take a few days |

| Batch payments feature for businesses | No cryptocurrency support |

OFX

| Pros | Cons |

|---|---|

| No account opening or monthly fees | Small fee of $15 for some transfers under $10,000 |

| Competitive exchange rates for large transfers | May not be the cheapest option for very small transfers |

| Free international payments for amounts above certain thresholds | Third-party bank fees may still apply |

| Secure and regulated in multiple global markets | Account verification may take a few business days |

| Supports transfers to over 195 countries | Limited cash deposit or pickup options |

| 24/7 customer support via phone and email | Customer support can be less personalised than some competitors |

| Can handle large international transfers efficiently | Fewer features for multi-currency account management compared to Wise |

Customer Support: OFX vs Wise

| Feature | OFX | Wise |

|---|---|---|

| Communication Channels | Email and Phone Call | Help Centre (available for everyone); Phone, Email, and Personalised Support (for Wise account holders) |

| Working Hours | 24/7 | Not specified |

Security and Trustworthiness

Wise and OFX operate in the same sort of space and are known to be safe and secure because both have high security ratings and great reputations. Wise has exemplary security and transparency because he works with the UK’s Financial Conduct Authority and follows their operational guidelines.

Customers are given the opportunity to view the fees and their policies to avoid hidden fees. Added to this are security measures such as the use of data encryption in conjunction with multi-factor authentication which keeps the transactions and the customers’ information safe. OFX has similar competencies in terms of security and reliability.

OFX has different operations and regulations in different parts of the world that is why he is able to process Payments in Europe via the SEA secure network. As an FCA-approved institution the OFX has a robust security architecture in place to mitigate any unauthorized access as well as fraudulent acts.

All in all OFX and Wise have the same degree of security which offers peace of mind to their customers which is why they are some of the most suitable companies in the market.

Conclusion

Both Wise and OFX provide seamless and secure international transactions, but they each have their own specializations. Wise is best for people and companies needing fast, low-cost international transfers with no hidden fees at conversion rates that are closer to interbank rates, thus giving a lower cost to the consumer, and the ability to hold and manage multiple currencies in a Wise account.

OFX is best for higher international transactions as they provide better rates at a higher cost, and remove fees altogether on larger transactions with top-of-the-line support. Your choice will ultimately depend on how much and how often you transfer, what currencies you want to use, and if you need fast transfer speeds and transparency (Wise) vs higher volume with lower overall cost (OFX).

FAQ

Which service is cheaper for international transfers, Wise or OFX?

Wise generally offers lower fees for smaller transfers and shows all costs upfront, while OFX can be more cost-effective for larger transfers due to fee waivers and competitive exchange rates.

How fast are transfers with Wise and OFX?

Wise transfers are usually completed within 24 hours, depending on the currency and payment method. OFX transfers may take 1–3 business days, especially for larger transactions or certain currency corridors.

Can I hold multiple currencies in my account?

Wise allows you to hold, send, and receive in multiple currencies. OFX does not offer multi-currency accounts but can send money to over 195 countries efficiently.

Are both Wise and OFX secure?

Yes, both are regulated by financial authorities. Wise is regulated by the UK FCA, uses encryption, and supports two-factor authentication. OFX is also regulated globally and employs secure verification and payment protocols.

Do they charge hidden fees?

Wise is very transparent, showing all fees before you confirm a transfer. OFX has no hidden fees for large transfers, though small third-party bank fees may apply for certain payments.