In the past, Best AI Billing Platforms That Replace Traditional Accounting, but with the introduction of AI billing software, businesses can now manage their finances with ease and automate accounting and billing with a high degree of accuracy and precision.

Vendors are now able to automate the invoicing, expense management, and reporting processes without needing as much manual entry. Companies of all sizes are now able to get real-time and accurate data. The following are leaders in the AI billing platform and the are the best in the industry.

Key Points Table – AI Billing & Accounting Platforms

| Platform | Key Point (What It’s Best Known For) |

|---|---|

| Vic.ai | AI-driven autonomous invoice processing (AP automation) with deep-learning accuracy. |

| Botkeeper | Automated bookkeeping — transaction categorization, reconciliations, and financial workflows. |

| Zeni | All-in-one AI finance platform for startups (bookkeeping, invoicing, reporting, forecasting). |

| Truewind | Automates accrual accounting, month-end close, and complex finance workflows for firms. |

| Zoho Books | AI-powered SMB accounting with automated invoicing, GST compliance, and reconciliation. |

| Xero | Smart categorization and automated bank reconciliation with strong small-business ecosystem. |

| QuickBooks | AI auto-categorization, invoice automation, receipt capture — easy, widely used accounting. |

| cc:Monet | Real-time AI bookkeeping with automated transaction classification & merchant reconciliation. |

| Barawave | ERP-level suite with AI automation for accounting, billing, payroll, and expense management. |

| Tipalti | Global vendor & payments automation — invoice capture, PO matching, AP, and compliance. |

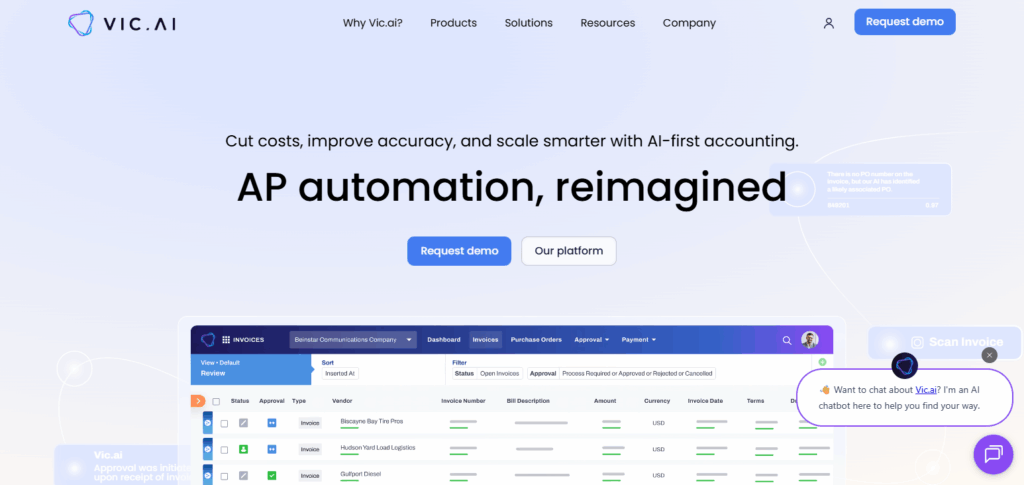

1. Vic.ai

Vic.ai is an AI accounts payable automation platform founded in 2017. Vic.ai uses deep learning to analyze billions of invoices and is able to eliminate errors and manual data entry. For pricing, they do custom quotes and offer enterprise pricing for more complex offerings.

Key features of Vic.ai include autonomous invoice processing, PO matching & approval flows, and AI-driven B2B payments. Most mid-paragraph highlights say “Vic.ai” is best is AI billing and accounting. With analytic and fraud detection and productivity increases of 355%, Vic.ai tops the billing list.

Vic.ai Features

- Deep learning invoice for autonomous invoice processing. Vic.ai is trained on millions of invoices.

- Lesser manual work through PO matching and approval flows.

- VicCard integration and AI expense management.

- Fraud Analytics for Intelligent decisioning and real-time data analytics.

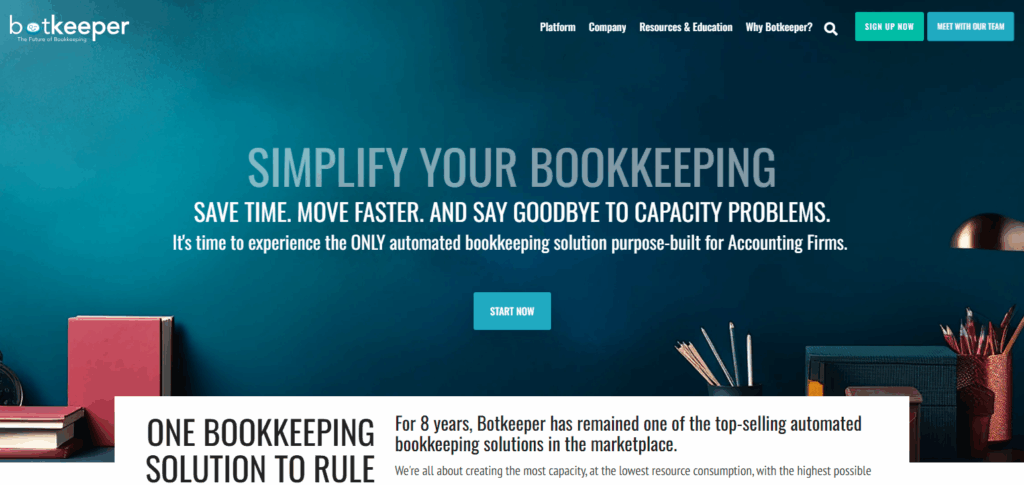

2. Botkeeper

Founded in 2015 in Boston, Botkeeper offers bookkeeping that employs AI automation and human involvement. For pricing, Botkeeper starts at “69 per license/month” for their Infinite platform, but custom pricing is available to firms.

Such features offer will include transaction and activity tracking, reconciliations, journal entry automation, and more. However, most mid-paragraph highlights say “Botkeeper” is best in accounting billing.

Although, Botkeeper is one of the AI billing platforms that is helping SMBs and accounting firms eliminate manual errors and financial workflow bottlenecks.

Botkeeper Features

- Bookkeeping accuracy is ensured through Human expertise and AI.

- Automated categorization & reconciliations of transactions.

- Workflow tools for task assignments and approvals as well as collaboration.

- Accounting software offers Customizable Dashboards & Integrations.

3. Zeni

Zeni is a startup AI bookkeeping platform that began operations in 2019. The pricing schedule is $549 per month for pre-revenue companies and grows to $799 per month for companies in the growth stage. There are bespoke plans for large companies.

Available features are daily bookkeeping, updates, real-time dashboards, automated bill payment and invoicing, and cash flow insights. In paragraph highlights are Zeni is a bookkeeping platform that says in its marketing that it saves 70+ hours per month.\

Zeni Features

- Instant AI Bookkeeping. Information is updated in real-time.

- Automated reimbursements & bill payments.

- Receipt categorization and bank reconciliation.

- Tax support and fractional CFO services for new business.

4. Truewind

Truewind, an AI-powered digital accountant for early-stage startups, began operating in 2021. Pricing begins at $300 per month for essential plans and moves upward beyond $650 per month to around $2,000 per month for growth packages.

Available features are AI bookkeeping, revenue recognition, payroll reconciliation, investor reporting, and customized dashboards.

In paragraph highlights are Truewind is a bookkeeping platform that boasts of concierge support and quicker book closures for businesses in the growth phase.

Truewind Features

- Bookkeeping also for AI-driven and startups.

- Smart automation of work papers results in faster month-end closure.

- Automation of bank categorization & reconciliation.

- Tax & CFO services and R&D credits support.

5. Zoho Books

The accounting software from Zoho Corporation, *Zoho Books, is a product of 2011, and is a fully cloud-based accounting software.

For the Standard and advance plans priced at ₹899/month (approx. 11 dollars) and ₹1,799/month (approx. 22 dollars), the products offer invoicing, GST/tax compliance, and expense tracking; along with managing bank reconciliations, inventory, and multiple currencies.

Mid-paragraph highlight: *Zoho Books is a billing platform replacing accounting with automation software and compliance tools, and best suited for small businesses.

Zoho Books Features

- Recurring billing and invoicing is automated.

- Support is available in multiple languages and currencies.

- Bank reconciliation and expense tracking.

- Inventory management, Tax Compliance and Compliance management.

6. Xero

Xero is a cloud accounting software services company located in New Zealand, and was established in 2006. $29/month (Starter) to $75/month (Premium) is the price of the services, along with invoicing and bank reconciliations at no extra charge.

Xero also offers expense tracking, and project accounting for active integration, and other services to over 1,000 active apps.

Xero Xero is a billing platform replacing accounting, and best suited for freelancers and small businesses (SMEs) with real-time tracking of finances.

Xero

- With automated reminders, invoicing is done online.

- Automated reconciliation and Bank Connections

- Payroll Management and Expense Claims

- 1,000+ app integrations and Multi-currency support

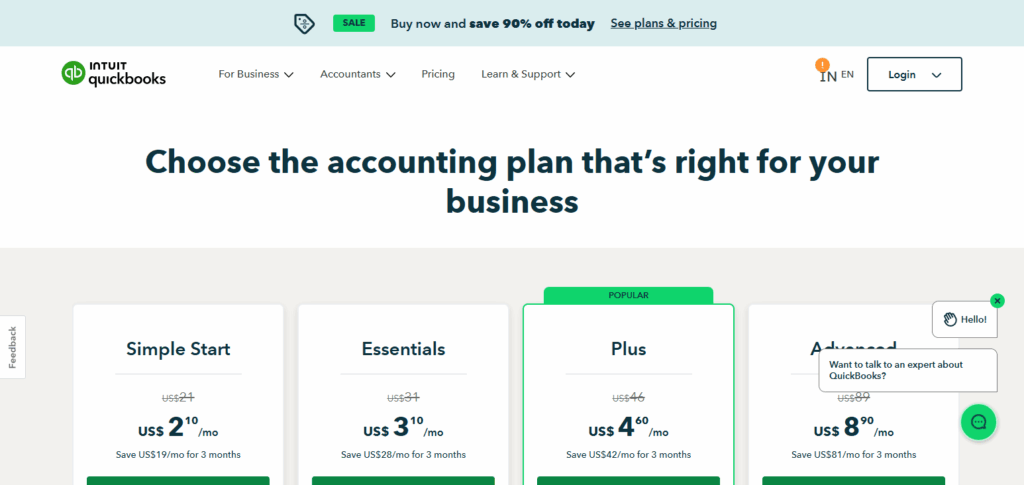

7. QuickBooks

An accounting company called *Intuit created *QuickBooks in 1983, and it is still active currently. As one of the top software accounting businesses, the price of its services in 2025 is expected to be 35 dollars/month (approx 35 dollars) for Simple Start), to $235/month for advanced.

QuickBooks services offered includes income and expense tracking, invoicing, bill management with automation for payroll, and tax prepping; and billing services replacing accounting. *QuickBooks is best automated services for freelancers, small and medium businesses (SMBs) and enterprises.

AP, and tax prep reporting. Along with billing services replacing accounting, *QuickBooks is the best for automated services for freelancers, small and medium businesses (SMBs) and enterprises.

QuickBooks Features

- Invoicing and quotes that are customized with per-ordered templates.

- Digital receipts are also substantiations that enable expense and income tracking.

- Reports for payroll, tax, and inventory where tax and inventory stock levels are organized

- P&L, balance sheet, cashflow and other customized financial reports to choose from.

8. cc:Monet

An AI assistant specialized in Finance, cc:Monet was established in Singapore in 2023. Pricing is flat-rate custom on a per deployment basis.

Attributes include invoice AI recognition, smart categorizations, automation of employee claim processing, approval workflow automations, and support for 50+ languages.

cc:Monet is a premier AI billing competing against traditional accounting and cutting 95% of the time spent on manual reporting.

cc:Monet Features

- Invoice recognition and categorization powered by AI

- Bookkeeping and reconciliation that keeps your ledgers.

- Claim automation for employees with approval workflow.

- Support for multiple languages and currencies

9. Barawave

Established in 2020, Barawave is a cloud-based enterprise resource planning software (ERP) system with AI billing capabilities. Pricing is custom-quoted. Attributes include integration with CRM, process workflow automations, resource management, and real time data analytics.

Mid-paragraph highlight: Barawave is a premier AI billing platform competing against traditional accounting with software automation at the ERP level for industries such as manufacturing, retail, and logistics.

Barawave Features

- ERP that is cloud-based with integrated AI billing

- Customer management with CRM tools

- Employee tracking and inventory control

- Deep reporting and financial management.

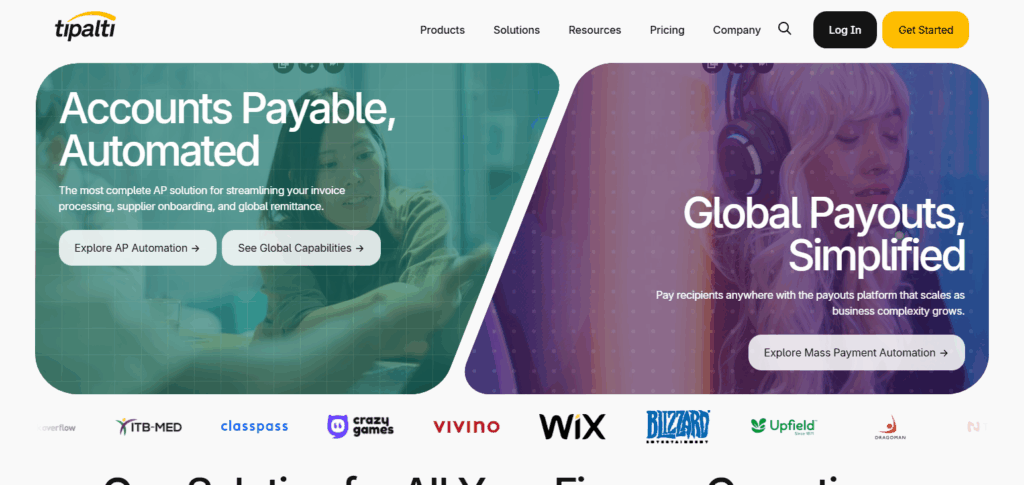

10. Tipalti

Founded in 2010, Tipalti is a platform for automation of global payables. Pricing starts at 99 USD/month, Select and increases to 199 USD/month, Advanced with custom enterprise plan options.

Attributes include tax compliant global payments, supplier onboarding, invoice scanning, PO matching and global payments to 120+ countries.

Mid-paragraph highlight: Tipalti is a premier AI billing platform competing against traditional accounting and is a trusted partner for mass payments and compliance.

Tipalti Features

- Automation for global accounts payables

- Payments in bulk across over 120 currencies.

- Compliance for taxes and onboarding for suppliers

- Fraud detection and integrations with ERP.

Conclusion

Businesses are experiencing a new age of finance management thanks to these AI billing platforms. These platforms are billing faster, smarter, and more accurately and are a great substitute to old-school billing.

These platforms atautomate processes such as invoicing, compliance, and reporting, and as a result, give teams financial clarity in real-time. These digital platforms are modernizing and streamlining the accounting processes to give accurate and scalable solutions.

FAQ

What do AI billing platforms do?

They automate invoicing, reconciliation, and financial reporting.

Can AI fully replace accountants?

AI handles tasks, but humans guide oversight and strategy.

Are AI billing tools accurate?

Yes, they reduce errors through machine learning.

Who benefits most from AI billing?

Startups, SMEs, and scaling businesses.

Are these platforms easy to integrate?

Most connect seamlessly with existing accounting systems.