The Top Forex Brokers With Guaranteed Negative Balance Protection will be covered in this post. To safeguard your trading funds, particularly in erratic market conditions, you must select a broker that offers guaranteed NBP.

This function gives traders peace of mind by guaranteeing that their account balance never falls below zero. Here, we showcase leading brokers that integrate cutting-edge trading platforms, safety, and regulation.

What is Guaranteed Negative Balance Protection?

Some Forex brokers include a safety feature called Guaranteed Negative Balance Protection (NBP), which guarantees that a trader’s account balance never falls below zero, even in times of severe market volatility.

Rapid price changes or highly leveraged positions can occasionally result in losses in Forex trading that surpass the trader’s deposited funds, leaving them with a negative balance.

With guaranteed NBP, the trader is shielded from having to pay more than their initial investment because the broker automatically absorbs any excess loss. This function reduces financial risk and encourages safer, more responsible trading, which gives retail traders in particular peace of mind.

Factors to Consider When Choosing a Broker with Guaranteed NBP

Regulation and Licensing: Check that the broker is regulated by recognized financial authorities (for instance, FCA, CySEC, ASIC) because it comes with a requirement for client protection, including NBP.

Clarity of NBP Terms: Review the broker’s policy to ensure that NBP is truly guaranteed to all account types and no other limitations or conditional requirements apply.

Account Types Offering NBP: Look at how many account tiers NBP is included in—sometimes, NBP is only available in certain higher or premium accounts.

Leverage and Margin Requirements: Consider how the levels of leverage and margin requirements interact with NBP, as higher leverage will mean the risk of more rapid losses.

Trading Platforms and Tools: Assess the platform and the risk management features it offers (stop-loss orders, notifications) in addition to NBP.

Fees and Spreads: Consider the fee structure (spreads, commissions) to ensure that you’re not paying more than you should for the NBP service.

Execution Speed and Reliability: Faster trade execution with no interruptions or lags can reduce slippage, which would avoid situations that would necessitate the use of NBP.

Customer Service: If there are negative balance scenarios or questions about accounts, reception responsive customer service is key.

Key Benefits of Trading with Brokers Offering Guaranteed NBP

Protection From The Worst Case Scenario: No matter how volatile the market gets, no trader will ever owe more than what’s in their account.

Less Exposure to Risk: NBP provides a stream of protection from damages as you will never lose more than you deposited.

Traders Can Feel at Ease: The negative account restriction means less surprises and lets you concentrate on strategy.

Traders Can Trade Responsibly: Designed with risk control in mind, traders can rest easy knowing they will not have a negative balance when a position they opened counter trades on.

Retail Trader Protection: Particularly from a financial standpoint, NBP is extremely useful when it comes to protecting new/retail traders from being over stretched.

Key Point & Best Forex Brokers Offering Guaranteed Negative Balance Protection

| Broker | Regulation / Region | Platforms / Tools | Guaranteed NBP | Key Feature / Note |

|---|---|---|---|---|

| IG | FCA (UK), ASIC, CFTC | MT4, ProRealTime, Web platform | Yes | Extensive market range & strong regulation |

| FP Markets | ASIC (AU) | MT4, MT5, IRESS | Yes | Low spreads & ECN/STP accounts |

| OANDA | CFTC, NFA (US), FCA (UK) | MT4, fxTrade, Web platform | Yes | Trusted global broker with flexible accounts |

| FOREX.com | CFTC, NFA (US), FCA (UK) | MT4, WebTrader, Desktop | Yes | Strong research tools & educational resources |

| easyMarkets | ASIC, CySEC | Proprietary platform, MT4 | Yes | No requotes & guaranteed stop-loss orders |

| ThinkMarkets | FCA, ASIC | MT4, MT5, ThinkTrader | Yes | Advanced trading tools & low latency execution |

| Interactive Brokers | SEC, CFTC (US), FCA | Trader Workstation, Web, Mobile | Yes (for some accounts) | Global broker with multi-asset trading |

| CMC Markets | FCA (UK), ASIC (AU) | Next Generation platform, MT4 | Yes | Excellent charting & research tools |

| Swissquote | FINMA (CH) | MT4, MT5, Advanced Trader | Yes | Strong Swiss-regulated broker with multi-asset trading |

| Plus500 | FCA, CySEC, ASIC | Proprietary platform | Yes | User-friendly platform for CFD trading |

1. IG

With the global reach and with multiple Tier 1 licences (FCA (UK), ASIC (Australia), and others), IG is a well-established broker providing strong client protection and guaranteed negative balance protection for retail clients. Minimum deposit ranges is about $0–$250, depending on the funding method and the entity of the broker.

Driven by 1:200 (varies by country), IG has its own platforms and gives access to web/mobile MT4 and Pro RealTime. The broker is operational across the globe but has some restrictions. 24/5 support is available by phone, live chat, and email.

IG – Key Features

- Negative account balance protection for retail clients.

- Supervised by premium authorities like the FCA and ASIC.

- MT4, ProRealTime and web-based trading platforms.

- Android and iOS devices supported.

- Numerous forex trading pairs and CFDs.

- Educational tools and market analysis research available.

IG – Pros & Cons

| Pros | Cons |

|---|---|

| Strong Tier-1 regulation (FCA, ASIC) | Spreads higher on some forex pairs |

| Guaranteed negative balance protection | Platform features may overwhelm beginners |

| Wide range of tradable instruments | Limited bonuses or promotions |

| Advanced platforms (MT4, ProRealTime) | Higher margin on some assets |

| Excellent research & analysis tools | Not available in all countries |

2. FP Markets

FP Markets has multiple jurisdictions such as ASIC (Australia), and Cyprus, and they are able to offer negative balance protection for retail accounts in those jurisdictions.

The broker’s minimum deposit is around $50-$100, withmax leverage of 1:500 (depending on location). Traders can use MT4, MT5, cTrader including mobile apps for iOS and Android.

FP Markets has over 100 countries and 24/7 Multilingual email, live chat, and phone support. With tight spreads, and a wide variety of instruments, it is great for ECN/STP trading.

FP Markets – Key Features

- Negative balance protection for retail clients.

- Regulated by ASIC and Cyprus\’s CySEC.

- STP and ECN execution with low spreads.

- MT4, MT5 and cTrader are supported.

- 1:500 leverage and other tiered by region.

- Support is provided 24/7 in multiple languages.

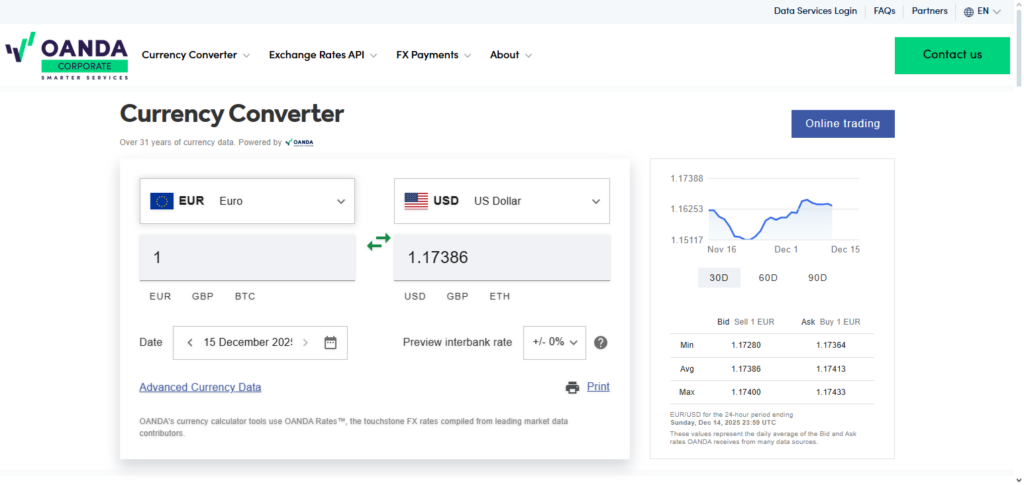

3. OANDA

OANDA is one of the most regulated brokers in the world by different authorities such as the FCA (UK), CFTC/NFA (US), and ASIC (Australia), and more, allowing for negative balance protection to be guaranteed where regulation requires it.

OANDA has no formal minimum deposit start that allows beginners to trade with this broker and has approximately 1:200 leverage worldwide (this varies based on region).

OANDA has its own trading platform called fxTrade, while also providing MetaTrader 4 and a mobile trading applications for both iOS and Android. Customer support is offered in different languages by chat, email, and phone, and is available to customers in many countries around the world.

OANDA – Key Features

- Negative balance protection in select areas is guaranteed.

- Supervised by FCA, CFTC/NFA, and ASIC.

- No minimum investment is required.

- fxTrade is their proprietary platform and they support MT4.

- Competitors’ pricing and superior analytics.

- Excellent support with great access in the global markets.

OANDA – Pros & Cons

| Pros | Cons |

|---|---|

| No minimum deposit | Leverage restricted in some regions |

| Strong global regulation | Fewer account type options |

| Transparent pricing model | Limited asset variety |

| Guaranteed negative balance protection | Desktop platform feels basic |

| Reliable execution & data | Advanced tools require external add-ons |

4. FOREX.com

FOREX.com has more than 5 regulatory authorities around the globe with the most important ones in the world being the FCA (UK), CFTC/NFA (US), and ASIC (Australia), and many others. This allows FOREX.com to have significant protection in regards to negative balance as well as significant oversight.

Minimum deposits vary by region but commonly start around $100 with maximum leverage being around 1:200 or more due to local regulations.

All traders can utilize MT4, WebTrader, and other proprietary desktop and mobile applications with concerning ease-of-use. Global support by country and customer support 24/5 by phone, email, and live chat is backed with bonus research and education products.

FOREX.com – Key Features

- Negative account balance protection for retail clients.

- Supervises clients in real time and is regulated by CFTC/NFA, FCA and ASIC.

- custom trading platform easy to use

- availability of the MT4 platform for advanced traders

- Extensive educational research tools

- round the clock customer service

easyMarkets – Pros & Cons

| Pros | Cons |

|---|---|

| Fixed spreads with no requotes | Limited professional trading tools |

| Guaranteed stop-loss & NBP | Smaller asset range |

| Very beginner-friendly | Not ideal for scalping |

| Low minimum deposit | Leverage restricted in EU |

| Simple web & mobile platforms | Fewer advanced indicators |

ThinkMarkets – Pros & Cons

5. easyMarkets

EasyMarkets is overseen by authorities such as CySEC (Cyprus), ASIC (Australia), and Seychelles FSA offering guaranteed negative balance protection and also offers risk mitigation solutions such as fixed spreads and guaranteed stop loss orders. Brokers usually have a low minimum starting deposit (~$25).

This broker also offers proprietary web and mobile platforms along with MetaTrader 4 and user friendly apps with iOS and android. EasyMarkets customers and traders from all around the globe (excluding the US) and customer support is live chat, phone, $\textit{and}$ email, and is often multilingual to aid in the greater accessibility.

easyMarket – Key Features

- All retail traders get loss protection

- Fixed spreads and no requotes.

- Stop loss guaranteed.

- Custom web and mobile platforms of the firm.

- Classic traders can rely on MT4.

- Minimum capital acceptable to new traders.

easyMarkets – Pros & Cons

| Pros | Cons |

|---|---|

| High leverage availability | NBP depends on jurisdiction |

| MT4, MT5 & ThinkTrader | Limited market research |

| Fast execution speeds | Spreads widen during volatility |

| Strong regulation (FCA, ASIC) | Some tools locked to higher accounts |

| Supports automated trading | Education content is basic |

6. ThinkMarkets

ThinkMarkets is also regulated by bodies such as ASIC, FCA along with a stream of others to ensure the negative balance safety in some regions and to maintain strong protection overall.

Start-up required capital will likely be a $50 deposit and depending on your profile may receive leverage up to 1:500. The company provides ThinkTrader, MT4, and MT5 for their clients and can be downloaded on mobile and desktop.

ThinkMarkets has global reach, although specific parts of the world are restricted, and they offer 24/5 customer support over the phone, live chat, and email as well as automated and social trading.

ThinkMarkets – Key Features

- All retail accounts are protected from negative balance.

- Supervision of FCA and ASIC.

- Offered platforms include Think Trader, MT4, MT5.

- High leverage is available depending on the region.

- Enhanced charting and tools for managing risk.

- Quick response global customer support.

ThinkMarkets – Pros & Cons

| Pros | Cons |

|---|---|

| High leverage availability | NBP depends on jurisdiction |

| MT4, MT5 & ThinkTrader | Limited market research |

| Fast execution speeds | Spreads widen during volatility |

| Strong regulation (FCA, ASIC) | Some tools locked to higher accounts |

| Supports automated trading | Education content is basic |

7. Interactive Brokers

Interactive Brokers (IBKR) has its branch in regions that are public, and its entities are controlled globally as well. They have a zero minimum deposit for some regions and have some variable leverage for some other regions.

Even though they are best known for their tools that institutional level access, they are also known for their forex trading from their mobile app and desktop trading platforms (Trader Workstation) and other financial market tools. They have their customer relations in more than 100 countries, and have negative balance protection for some regions.

interactive brokers – Key Features

- Balance loss protection is available only where this is imposed by regulations.

- Excellent global regulation including SEC and FCA.

- Use of Trader Working Station platform of professional grade.

- Use of Forex and multi-assets trading.

- Sophisticated risk and tools for management of analytics.

- More than 100 countries.

Interactive Brokers – Pros & Cons

| Pros | Cons |

|---|---|

| Professional-grade trading tools | Steep learning curve |

| Global access in 100+ countries | NBP only where regulated |

| No minimum deposit | Complex platform interface |

| Multi-asset trading | Limited beginner education |

| Strong regulatory oversight | Fees may apply for inactivity |

8. CMC Markets

They have a CMC Markets which offer a variety of trading services in more than 90 different nations. They are regulated by the FCA (UK) as well as another 20 plus authorities, so you can rest assured they offer full forex and CFD trading services that also have guaranteed negative balance protection in the required regions.

This broker has become popular with all levels of traders due to its no minimum deposit requirement as well as its competitive leverage depending on your region. CMC Markets has Next Generation and mobile trading solutions which provide excellent charting and trading tools.

CMC Markets serves clients all over the world and has 24/5 multilingual customer support. Customers have quick access to their funds and can trade numerous instruments including forex as well as commodities and and indices.

CMC Market – Key Features

- All retail traders are protected from negative balance.

- Regulation from FCA and ASIC.

- Use of Next Generation trading platform of the firm.

- Advanced tools for charting and analysis of the market.

- Minimum deposit is zero.

- Comprehensive mobile trading app

CMC Markets – Pros & Cons

| Pros | Cons |

|---|---|

| No minimum deposit | Platform may feel complex initially |

| Advanced charting & analytics | Lower leverage in EU/UK |

| Guaranteed negative balance protection | Limited weekend support |

| Strong FCA & ASIC regulation | Some features not on MT4 |

| Powerful mobile app | Not ideal for ultra-short scalping |

9. Swissquote

Swissquote is a well-known and respected forex and CFD broker regulated by the Swiss bank and offers traders guaranteed protection on negative balance in certain regions. However, the broker has a higher minimum deposit (often around $1,000) and offers leverage according to local rules.

Traders have the Swissquote proprietary trading systems and MetaTrader 4/5 options and are reported to have solid mobile trading support. This broker is also based on Switzerland and provides professional customer support, educational tools, and banking security features as usual.

Swissquote – Key Features

- Guaranteed negative balance protection under regulated entities

- Swiss FINMA regulated bank-level broker

- Supports MT4, MT5, and proprietary platforms

- Strong security and fund protection measures

- Wide range of forex and CFD instruments

- Professional research and education tools

Swissquote – Pros & Cons

| Pros | Cons |

|---|---|

| Swiss bank-level regulation | High minimum deposit |

| Strong fund security | Lower leverage limits |

| MT4, MT5 & proprietary platforms | Fees higher than average |

| Wide asset selection | Less beginner-friendly |

| Guaranteed NBP in regulated regions | Limited promotional offers |

10. Plus500

Plus500 is a well-known CFD broker with a number of regulatory licenses including FCA, ASIC, Cyprus and others. They also offer guaranteed negative balance protection and provide a user-friendly platform.In general, it takes a minimum deposit approximately $100 and offers leverage per region regulation (1:30 for retail EU/UK clients, for example).

Customer service is in-house, easily accessible, and consumer friendly on computers and mobile devices (iOS and Android). As a result of having a large number of employees, Plus500 has offices in different countries and is able to offer clients 24/7 customer service, a variety of payment options, and many different foreign exchange and CFD instruments.

Plus500 – Key Features

- Guaranteed negative balance protection for retail clients

- Regulated by FCA, CySEC, and ASIC

- Simple proprietary trading platform

- User-friendly mobile trading application

- Wide range of forex and CFD instruments

- 24/7 customer support availability

Plus500 – Pros & Cons

| Pros | Cons |

|---|---|

| Very user-friendly platform | No MT4/MT5 support |

| Guaranteed negative balance protection | CFD-only broker |

| Strong global regulation | Limited advanced tools |

| 24/7 customer support | No social or copy trading |

| Excellent mobile trading app | Limited customization |

Comparison Table of Brokers

| Broker | Regulation / Region | Minimum Deposit | Max Leverage | Platforms / Tools | Mobile App | Country Support | Customer Support | Guaranteed NBP |

|---|---|---|---|---|---|---|---|---|

| IG | FCA (UK), ASIC (AU), CFTC (US) | $0–$250 | Up to 1:200 | MT4, ProRealTime, Web Platform | Yes | Global (restricted US/JP) | 24/5 phone, chat, email | Yes |

| FP Markets | ASIC (AU), CySEC (EU) | $50–$100 | Up to 1:500 | MT4, MT5, cTrader | Yes | 100+ countries | 24/7 email, phone, chat | Yes |

| OANDA | FCA (UK), CFTC/NFA (US), ASIC | $0 | Up to 1:200 | fxTrade, MT4, WebTrader | Yes | Global | 24/5 email, phone, chat | Yes |

| FOREX.com | FCA (UK), CFTC/NFA (US), ASIC | $100 | Up to 1:200 | MT4, WebTrader, Proprietary Desktop | Yes | Global | 24/5 email, phone, chat | Yes |

| easyMarkets | CySEC, ASIC, FSA Seychelles | $25 | Up to 1:400 | Proprietary Platform, MT4 | Yes | Global (excl. US) | 24/5 phone, chat, email | Yes |

| ThinkMarkets | FCA (UK), ASIC (AU) | $50 | Up to 1:500 | ThinkTrader, MT4, MT5 | Yes | Many regions | 24/5 phone, chat, email | Yes |

| Interactive Brokers | SEC, CFTC (US), FCA (UK) | $0 | Variable | Trader Workstation, Web, Mobile | Yes | 100+ countries | Phone, secure messaging | Yes* |

| CMC Markets | FCA (UK), ASIC (AU) | $0 | Up to 1:30–1:200 | Next Generation, MT4 | Yes | Global | 24/5 multilingual | Yes |

| Swissquote | FINMA (CH) | ~$1,000 | Regional limits | Swissquote Platforms, MT4/5 | Yes | Many countries | Phone, email, chat | Yes |

| Plus500 | FCA, ASIC, CySEC | $100 | Regional limits | Proprietary Platform | Yes | Global | 24/7 email, chat | Yes |

Conclusion

Selecting a Forex broker that provides Guaranteed Negative Balance Protection (NBP) is crucial for risk management and protecting your trading funds, particularly in times of market volatility.

Strong regulatory monitoring, cutting-edge trading platforms, and dependable customer service are provided by brokers such as IG, FP Markets, OANDA, FOREX.com, easyMarkets, ThinkMarkets, Interactive Brokers,

CMC Markets, Swissquote, and Plus500, guaranteeing that traders never lose more than their deposited funds. You may trade with confidence, concentrate on strategy, and safeguard yourself from unforeseen losses by giving brokers with guaranteed NBP priority. This will make your trading experience safer and more long-lasting.

FAQ

What is Guaranteed Negative Balance Protection (NBP)?

Guaranteed Negative Balance Protection ensures that your trading account will never go below zero. If market volatility causes losses greater than your available funds, the broker absorbs the excess, so you don’t owe money beyond your deposit.

Is Guaranteed NBP available with all brokers?

No. Only brokers regulated in jurisdictions that require it (e.g., FCA, CySEC, ASIC) typically offer genuine guaranteed NBP. Always check a broker’s terms and conditions to confirm.

Does Guaranteed NBP cost extra?

Usually no. Brokers include NBP as part of their risk‑management policies, but account conditions (like spreads or minimum deposits) may vary.

Is NBP available on all account types?

Not always. Some brokers limit NBP to certain account tiers or regions. Always check account specifications before opening a live trading account.

Does NBP mean I can trade without risk?

NBP protects against negative balances, but it does not eliminate trading risk. You can still lose your deposited funds due to market movements.