With the growing popularity of digital currencies, more and more retailers are trying to find dependable payment gateways to suit their needs other than Best Apirone Alternatives.

Although Apirone provides an easy way to accept crypto payments without taking custody of them, a lot of sellers are now looking for options that have more coins, better integration, the ability to convert crypto payments into cash, and more scalable options.

Selecting the ideal alternative for Apirone for your business can ease payment processing, minimize risks, and enable your business to grow and thrive in the long run.

What Apirone?

Apirone allows individuals and businesses to accept crypto payments directly to their wallets without having to use custodial services. Apirone is a cryptocurrency payment processor working with different coins.

They have payment invoices, every instant payment is instantly notified, and there is an API integration for users. This is very beneficial to online stores, service providers, and other developers.

Apirone is also very popular due to its focus on privacy and a quick signup process. They have very low fees and unlike other processors, users do not have to custody on the processor. Customer payments go directly to the merchants crypto wallet.

Why Businesses Seek Alternatives?

Companies have various reasons for wanting to move away from Apirone. First, growing companies need more diverse cryptocurrency and fiat functions, advanced integrations, and more cryptocurrency support.

Secondly, merchants who have crypto and fiat settlement functionalities prefer automatic crypto-to-fiat integrations for reduce volatility. Thirdly, additional plugins, more reporting functionalities, and enhanced customer support have caused companies to move away from Apirone.

Finally, from a compliance perspective, having the ability to scale for high transactions and having enterprise level security are what most companies look to and move away from Apirone.

Although these reasons are analytical on the prospective Apirone alternatives, companies looking to move away from Apirone are looking to these alternatives for better costs, quicker settlements, and great overall fit for their industry/sector.

Key Point

| Platform | Best For |

|---|---|

| Blockonomics | Merchants wanting direct BTC payments without intermediaries |

| Breez | Fast, low-cost BTC Lightning payments |

| OxaPay | Businesses needing broad crypto support |

| HeroPayments | Online businesses & service providers |

| CryptAPI | Privacy-focused merchants |

| B2BinPay | Exchanges, brokers, large enterprises |

| Billbitcoins | Simple BTC acceptance for small businesses |

| SpicePay | Merchants wanting fiat settlements |

| GoUrl | Websites accepting altcoins |

| Paymento | International merchants & freelancers |

1. Blockonomics

Blockonomics is a payment processor that allows users to accept payments in the form of bitcoin (BTC) directly to their wallets without having to deal with a middleman. Blockonomics is non-custodial payment processor that does not control your funds. Blockonomics roughly charges a fee of 1% of the transaction (first transations are free) and allows users to accept USDT through BTC wallets.

Blockonomics also allows easy implementation and integration through popular WooCommerce and WordPress plugins, and is perfect for small and fast implementation e-commerce websites and freelancing services.

Avoiding risk of custodians and KYC, Blockonomics allows small privacy focused businesses the ability to accept payments with ease. Other great options include BTCPay Server, which has zero fees and allows integration through Coinbase Commerce, which has a wider range of supported coins.

Blockonomics Features

- Non-custodial payment processing: Merchants receive BTC payment directly into their designated wallets.

- Focus on privacy: Almost no KYC, hence no custodial risks.

- WooCommerce and WHMCS plugins: Straightforward onboarding with popular platforms.

- Dashboards & email notifications: Track payments and invoices.

- Support for tokens and BTC: Several tokens are supported, on top of the Bitcoin invoicing.

Blockonomics Pros & Cons

| Pros | Cons |

|---|---|

| Non-custodial — you control your own wallet | Limited to mainly Bitcoin and token receipts |

| Privacy-focused — minimal KYC | Not ideal for merchants needing fiat settlement |

| Easy plugin support (WooCommerce, WHMCS) | Fewer features than enterprise gateways |

| Simple setup for BTC payments | Doesn’t natively support Lightning |

| Transparent fees | Less support for altcoins |

2. Breez

Breez was founded around 2018 as a self-custodial Lightning Network payments provider focusing on low-cost and instant Bitcoin payments via the Lightning Network.

Unlike most multi-crypto gateways, Breez allows for the integration of instant settle, low-cost peer-to-peer Bitcoin payments via their Lightning SDK and wallet app. From there, app and POS system developers can integrate Lightning payments.

It is most useful for mobile applications, Bitcoin services, and merchants with technical expertise. Other providers for instant consumer Lightning payments include Strike and OpenNode, which is a competitor focused on seamless Lightning payments.

Breez Features

- Bitcoin transactions through Lightning Network: Extremely rapid, very low-fee Bitcoin payment transactions.

- Wallet & self-custodial SDK: Integrated wallet with self-custodial capability and developer kit.

- Support for POS and mobility: Excellent for both in-app and on-the-go transactions.

- Flexible customizations: Open-source for custom plugins.

Breez Pros & Cons

| Pros | Cons |

|---|---|

| Lightning payments — very low fees | Supports Bitcoin only (Lightning) |

| Fast, instant settlements | Not a traditional multi-crypto gateway |

| Built-in wallet & SDK | Requires technical know-how for dev integrations |

| Great for mobile & POS use cases | Limited fiat conversion options |

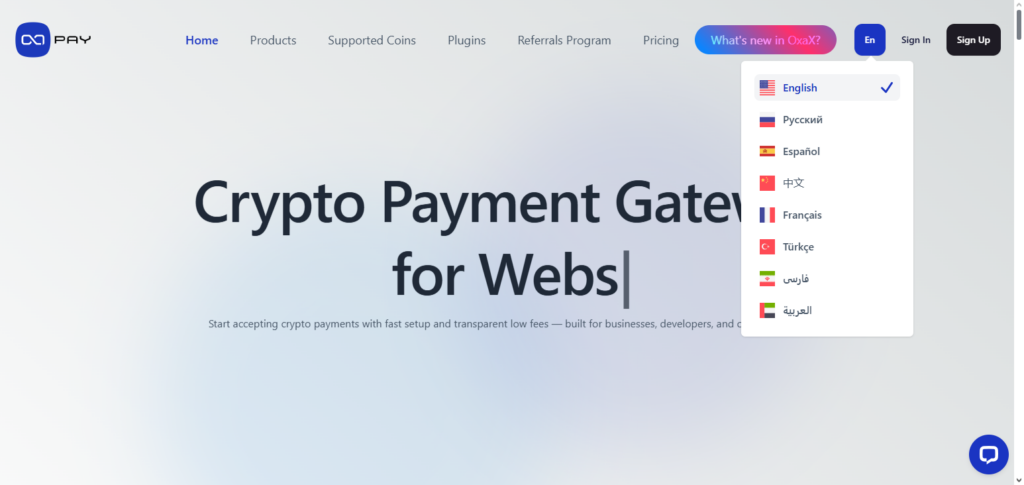

3. OxaPay

OxaPay, established in the 2020s, is a contemporary crypto payment gateway created for businesses and developers wanting a multi-faceted, API-driven platform with features like real-time invoicing, payment links, and automatic withdrawals.

It accepts several major cryptocurrencies like Bitcoin (BTC), USDT, Ethereum (ETH), BNB, and others, with fees averaging 0.4%–1.5% based on the type of service. With APIs, white-labeled tools, and access to plugins and payment links, OxaPay is ideal for eCommerce and SaaS businesses or companies with non-technical teams.

Primary customers are international digital merchants and technology startups. Competitors are NOWPayments for broad coin support and Coinbase Commerce for reputation and support for traditional currency.

OxaPay Features

- Support for multiple cryptocurrencies: BTC, ETH, USDT, BNB and many others.

- Developer API and plugins: Smooth integration for developers and e-commerce.

- Withdrawals automation: Set and forget automated payouts to wallets.

- Invoicing & payment links: Simple billing with no coding.

OxaPay Pros & Cons

| Pros | Cons |

|---|---|

| Multi-crypto support (BTC, ETH, USDT, BNB, etc.) | Fees can vary by coin and service |

| API, plugins, and payment links | Newer platform with smaller user base |

| Auto withdrawals and invoicing | Documentation can be less mature |

| Flexible tools for developers & merchants | Not as mainstream as Coinbase/BitPay |

4. Heropayments

HeroPayments (year and fee model not listed online) usually indicates a crypto payment processor that allows users to invoice and accepts payments via digital assets. These systems usually allow users to transact using BTC, ETH, and various stablecoins and offer API integration, payment buttons, and invoicing for online businesses.

End users are small to medium e-commerce, freelance and service providers users that simply want to accept crypto without having to go through lots of blockchain hoops. Other players include BitPay (enterprise) and NOWPayments (many coins). (All of this has little publicly available to analyze this payment processor).

HeroPayments Features

- Invoicing for crypto: Ability to create and send requests for those payments.

- Access through API: Programmatic handling of payments.

- Supports numerous coins: BTC, ETH, and other popular ones.

- Elaborated and user-friendly dashboard: Easy transaction management.

HeroPayments Pros & Cons

| Pros | Cons |

|---|---|

| Easy crypto invoicing tools | Public info on fees & features limited |

| API support for developers | Less known brand in crypto space |

| Accepts major cryptocurrencies | Fewer integrations than bigger gateways |

| User-friendly dashboard | May lack advanced merchant features |

5. CryptAPI

Generally speaking, CryptAPI is an API for businesses that accept different forms of cryptocurrency and have minimal KYC requirements, along with the company’s privacy-committed, crypto payment API.

Developers and privacy-friendly businesses consider service non-custodial payments, adaptable API solutions, and rapid configurations. CryptApi integrations can be carried out using easy plugins and APIs, and supported coins can be major ones along with an absence of fees, with the only ones, if any, being service fees, such as the network fees.

The best alternatives, which have a little more published information than CryptAPI, are Blockonomics, which has direct payments for wallets, and CoinPayments, which is far more accommodating for accepting different coins.

CryptAPI Features

- No KYC: You can accept crypto in a privacy-friendly way with no KYC.

- Merge transactions: Payments are straight to the wallet and non-custodial.

- Developer-friendly: An API was built to meet the demands of the most flexible developer.

- REST: Crypto payments without a fear of custodial credit, as only the merchant’s wallet is in custody.

- Custodial: payments go straight to merchant wallets.

- API first: Designed for developer flexibility.

- Multi Payment Method Support: Includes all major digital assets.

CryptAPI Pros & Cons

| Pros | Cons |

|---|---|

| Privacy-oriented, minimal KYC | Limited public documentation |

| Non-custodial crypto payments | Less feature-rich than larger competitors |

| API-centric for flexible usage | Smaller ecosystem & integrations |

| Supports multiple major coins | Community support mostly forum-based |

6. B2BinPay

B2BinPay has the support of over 350 cryptocurrencies and is an enterprise-grade crypto payment processor offering features like global fast payouts and fiat-on/off ramps. Scalable APIs help support and structure exchanges, brokers, large e-commerce, and financial platforms.

B2BinPay has competitive volume reporting fees and instant crypto-to-fiat options. Balance tracking, secure checkout and up-to-date, developer documentation give B2BinPay an advantage. Integration is enterprise-grade, as is the support.

In the payment processor of crypto domain, most ignore the industry-leading settlements made by fiat CoinsPaid. Also industry recognized is the stability of the brand, Coinbase Commerce. Customers like the options.

B2BinPay Features

- Enterprise Solution: Built for large merchants, brokers and exchanges.

- 350+ Coins: Large variety of cryptocurrencies.

- Fiat Conversion: Auto settlement to fiat if required.

- SaaS API & SDK: Flexible and scalable for developers.

B2BinPay Pros & Cons

| Pros | Cons |

|---|---|

| Enterprise-grade with 300+ coins | More complex for small merchants |

| Fiat conversion options | Fees may be higher based on services |

| Scalable API & SDK support | Better suited for businesses, not individuals |

| Strong support for exchanges | Requires technical integration team |

7. Billbitcoins

With the bitcoin-focused payment processor Billbitcoins, merchants can accept BTCs with ease. Billbitcoins, like similar payment processors, allows merchants with less complicated set ups to create BTC invoices via links and integrate with simple APIs without the need for complicated systems.

For each transaction, a small fee of about 1-1.5% is charged. Other than Bitcoin, the other cryptocurrencies accepted with Billbitcoins are very few. For small merchants and independent vendors looking for simple bitcoin payment options, it is a great choice.

Other options are Blockonomics, which is for Bitcoin payments without the need for a custodian, and GoURL, which is for altcoins. Information specific to Billbitcoins is scarce.

Billbitcoins Features

- Bitcoin Focused: Payment acceptance is only for BTC.

- API and Invoice Generation: Links for invoicing can be created programmatically.

- Light Integration: Small merchants can easily use this.

- Direct BTC Transfers: Payment immediately goes to merchant wallet.

Billbitcoins Pros & Cons

| Pros | Cons |

|---|---|

| Simple Bitcoin payment acceptance | Limited to Bitcoin mostly |

| Easy invoice link generation | Not many advanced tools (analytics, plugins) |

| Quick setup for small businesses | Limited documentation available |

| Direct BTC receipt to wallet | Few altcoin options |

8. SpicePay

Spicepay is a cryptocurrency payment system that accepts major currencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH), and provides invoicing and API tools for merchants.

There is a 1 percent fee around and the system provides crypto-to-fiat for simple settlement. The target market is e-commerce and service merchants who want fast and reliable crypto acceptance with reasonable costs.

Spicepay provides API and e-commerce plugin documentation, though it is not always available for free. Obvious competitors would be NOWPayments for lower fees and more crypto and CoinPayments for a wider variety of supported tokens.

SpicePay Features

- Multi Crypto Acceptance: BTC, ETH, LTC, BCH and others.

- API and Plugins: Web integrations tailored for stores and platforms.

- Invoicing and Checkout Pages: User-friendly billing for merchants.

- Crypto-to-Fiat: Payments can be optionally converted to fiat currency.

SpicePay Pros & Cons

| Pros | Cons |

|---|---|

| Multi-crypto support (BTC, ETH, LTC, BCH) | Fees can be moderate |

| API & plugin integrations | Not as widely adopted as top gateways |

| Merchant invoicing | Some features limited by region |

| Crypto-to-fiat options | Support may vary by crypto |

9. GoUrl

GoUrl is a cryptocurrency payment gateway that is popular for its WordPress and API plugins that enable merchants to receive Bitcoin and other altcoins in a noncustodial setup. There is no traditional account holding; payments go directly to the merchant’s wallets.

Typical fees are around 1.5%. For WordPress/WooCommerce plugins or custom API integrations, GoUrl is a great fit for small to midsize websites and sellers of digital goods. Alternatives for simple BTC acceptance include Blockonomics, and for larger multi-coin ecosystems, there is CoinPayments.

GoUrl Features

- Non Custodial Gateway: Merchant has full control over their wallet.

- Supports 100+ Cryptocurrencies: Many altcoins supported.

- Platform Ready Plugins: Compatible with WordPress and WooCommerce.

- No Bank Is Needed: You can provide a site that directly accepts cryptocurrencies.

GoUrl Pros & Cons

| Pros | Cons |

|---|---|

| Non-custodial and secure | Relatively high per-transaction fee (~1.5%) |

| Over 100 cryptocurrencies supported | Setup can be technical |

| Easy plugins (WordPress, WooCommerce) | Less fiat settlement support |

| No bank account needed | Not ideal for large enterprise |

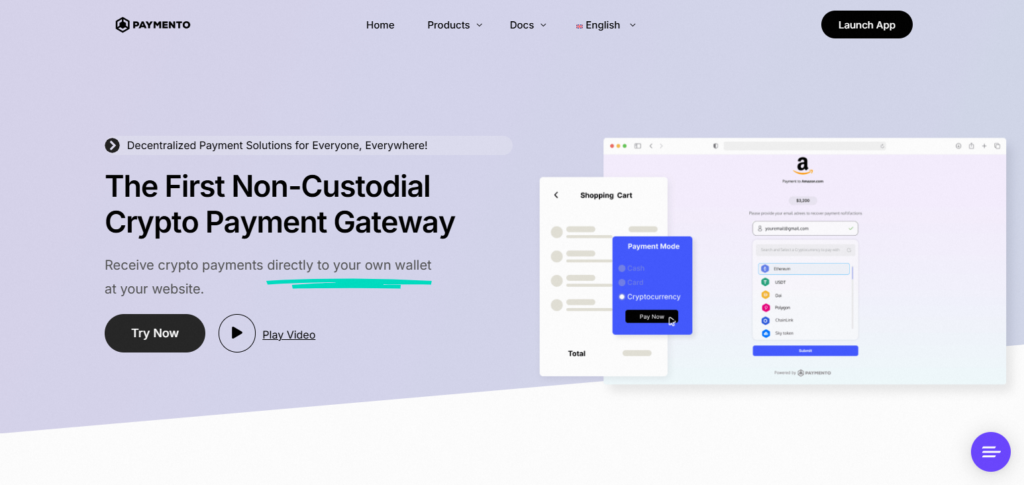

10. Paymento

Paymento is mentioned in community forums as a flexible crypto payment solution with payment links, invoicing, and a broad ability to accept varied crypto (although public detailed data is hard to find).

Such services usually provide an API, e-commerce plugins, and customizable checkout solutions to merchants worldwide, and tend to offer reasonably priced services with BTC, ETH, stablecoins, and other crypto support.

Primary intended clients are cross-border e-commerce merchants, freelancers, and professionals looking to integrate flexible solutions for accepting crypto. Best alternatives are Coinbase Commerce for fiat conversion and NOWPayments for a wider variety of coins.

Paymento Features

- Payment Links and Invoices: Flexible and easy to bill clients.

- Multi Crypto Support: BTC, ETH and many popular tokens.

- API Integration: Lets you incorporate it to apps and online stores.

- Custom Checkout Flows: Payment experience can be customized.

Paymento Pros & Cons

| Pros | Cons |

|---|---|

| Flexible payment links & API | Limited public fee transparency |

| Multi-crypto acceptance | Smaller ecosystem than Coinbase/BitPay |

| User-friendly checkout flows | Fewer plugins than some competitors |

| Good for freelancers & SMBs | Not ideal for enterprise without custom work |

Criteria for choosing Best Apirone Alternatives?

Ranges of Supported Crypto Assets. Mores the Merrier

Be on the lookout for payment processors that have volumes of different coins and tokens (BTC, ETH, stablecoins, plus the altcoins) for wider customer servicing.

Ability for Automation Transfers

Good alternatives offer seamless automation of crypto transfer to banks that currencies to fiat and settle at bank accounts.

Competitive Rates

Consider and compare the transaction, payout and other monthly setup and subscription costs. High volume merchants need low fees to sustain profit margin.

Automation of Crypto to Fiat Currencies Settlement

Providing crypto for purchase makes businesses exposed to multiple currencies and to customer demand volatility. Predictable customer revenue.

Security and Risk Management}

Strong and guarded crypto currencies that are in demand, plus, the value in the crypto wallets also have risks. Fulfilling threshold and other measures builds strong compliance that reduces regulatory risk.

User Experience

Admin and customer experience filtering of all payment management to digital payments reduces cost of payment collection and digital payment use for businesses.

Transaction Speed

When payments move faster, cash flow improves, and customer satisfaction increases. This is particularly important when there are point-of-sale or high-volume transactions.

Automation

Automated invoicing, and reporting tools, and integrations with accounting programs streamline bookkeeping and finance workflows.

Growth Potential

Look for a provider that is able to scale to meet your business’s growing needs and that can accommodate additional users, increased traffic, and more transactions. Also, with a growing business, you may need a provider that can support your company on a global scale.

Support

When there is a strong support system, established and reputable companies can provide dependable services that result in the quick resolution of problems and system failures.

Conclusion

The top Apirone alternatives in 2026 come down to whichever solution best meets your needs whether that be wider coins coverage, easiness to integrate, better security, or lower volatility risk.

Apirone may be one of the easiest options to use to accept crypto directly into your wallet, but many competitors have better features including automatic fiat conversion, enterprise-grade infrastructure, easy e-commerce plugins, and better reporting tools.

Each provider’s features and fees, the coins supported, integration options, and scalability can be compared to enable a business to choose a provider that best fits their needs and provides long-term payment strategy viability.

The right option in the ever changing crypto landscape in 2026 will sustain growth, broaden a business’s reach, and optimize payment operations.

FAQ

What is Apirone?

Apirone is a cryptocurrency payment gateway that lets businesses and individuals accept crypto payments directly into their wallets without holding funds on the platform. It supports multiple coins and provides basic integration tools for online merchants.

Why should I consider alternatives to Apirone?

Businesses may look for alternatives to gain access to broader cryptocurrency support, better integration with e-commerce platforms, automatic fiat conversion, enhanced security features, or lower fees. Some alternatives also offer advanced reporting and accounting tools that Apirone may lack.

What types of businesses benefit most from these alternatives?

Online stores, service providers, SaaS companies, and enterprises handling high payment volumes can benefit from more robust payment gateways, especially those needing advanced features like multi-platform integrations, auto-settlement, and regulatory compliance.

What criteria should I use to choose the best alternative?

Important criteria include supported assets, integration options (APIs, plugins), fees, fiat conversion support, security and compliance features, transaction speed, reporting tools, scalability, and customer support.

Do these alternatives convert crypto to fiat automatically?

Some alternatives offer automatic fiat conversion and settlement, reducing exposure to cryptocurrency price volatility. This feature is especially useful for businesses that prefer predictable revenue in local currency.

Are there alternatives suitable for small businesses?

Yes — options with simple setup, lower fees, and basic integration (e.g., plugins for common platforms) are well suited for startups and small to medium-sized enterprises.